How To Get My Unemployment 1099

A 1099-G form needs to be filled out when filing taxes if youve gotten money from IDES. We will need the nine-digit bank routing number and your personal checking or savings account number see below.

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

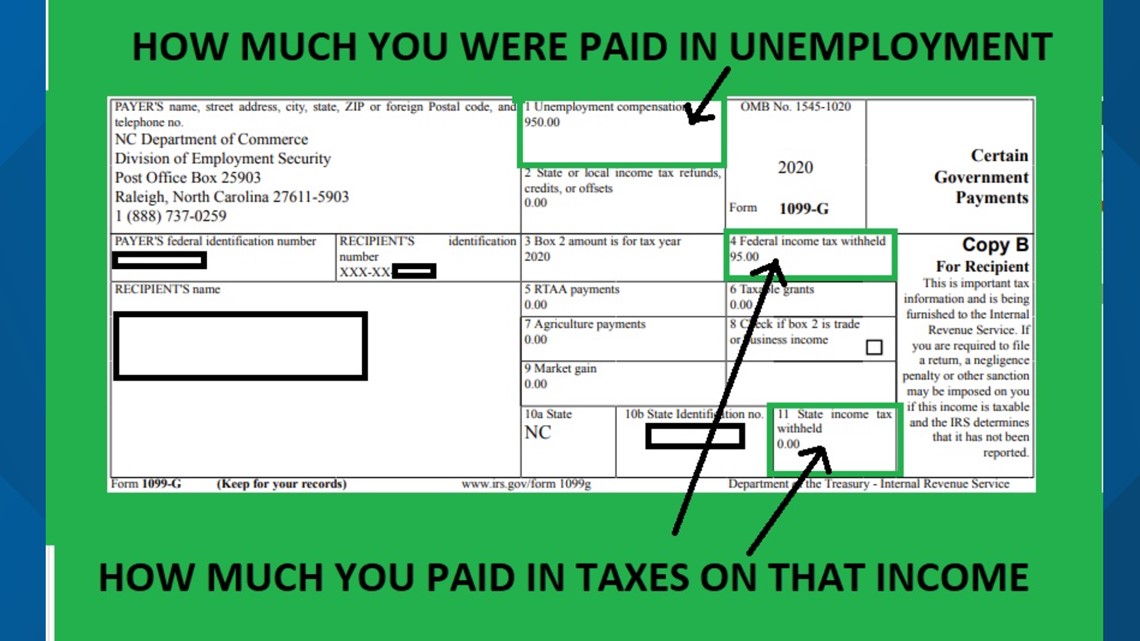

You should receive a Form 1099-G Certain Government Payments showing the amount of unemployment compensation paid to you during the year in Box 1 and any federal income tax withheld in Box 4.

How to get my unemployment 1099. After you are logged in you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment. Look for the 1099-G form youll be getting online or in the mail. Thats why 1099-G is this weeks Tax Form Tuesday document.

For example if you collected unemployment in 2018 the 1099-G should have been mailed by January 31 2019. Im on unemployment from my W-2. Where can I get my 1099-G tax form for 2020 If you want to know how to get your 1099-G information or have questions about the numbers on your form we can help.

And like other informational forms the IRS will get a copy. Unemployment is taxable income. Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax formsIf you have questions about your user name and password see our frequently asked questions for accessing online benefit services.

To enter your unemployment compensation information from Form 1099-G Certain Government Payments into the TaxAct program. Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question.

Where can I get my Form 1099-G from New Jersey. Usually if you work and want to file a tax return you need Form W-2 or Form 1099 provided by your employerIf you did not receive these forms or misplaced them you can ask your employer for a copy of these documents. But if you havent and you get one in the mail you could be a victim of unemployment fraud.

If you apply online for Unemployment Insurance benefits you can enter your direct deposit information when completing the application. From within your TaxAct return Online or Desktop click FederalOn smaller devices click in the upper left-hand corner then click Federal. 3 From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099-G section select the year you want in the NYS 1099-G drop-down menu box with an arrow and then select the Get Your NYS 1099-G buttonIf you get a file titled null after you click the 1099.

Form 1099-G looks a lot like others in the 1099 series. Yes you can still file taxes without a W-2 or 1099. The New Jersey Division of Taxation will now provide Form 1099-G information online at the divisions website.

Click Other Income in the Federal Quick QA Topics menu to expand then click Unemployment compensation. In most cases 1099-Gs for the previous year are mailed on or before January 31. View or print a copy of your current or previous year forms online.

I got paid from both W-2 and 1099 before the pandemic. In Ohio Bernie Irwin was shocked two weeks ago when she opened the mail and found a 1099-G form saying her husband had claimed 17292 in unemployment. Form 1099-G details all unemployment benefits a claimant received during the calendar year as well as.

Report the amount shown in Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF and attach this to the Form 1040. In January 2021 unemployment benefit recipients should receive a Form 1099-G Certain Government Payments from the state UI agency or department paying your unemployment benefits. Where do I get my 1099-G tax form.

Jefferson City - Missourians who received unemployment benefits in 2020 can now view print and download their 1099-G tax form online at uinteractlabormogov. Whether or not you are on unemployment doesnt disqualify you from applying for a PPP loan. The form will show the amount of unemployment compensation they received during 2020 in Box 1 and any federal income tax withheld in Box 4.

The division is no longer mailing Form 1099-G Certain Government Payments to report the amount of a New Jersey income tax refund a taxpayer received. Every person who received unemployment benefits will get Form 1099-G from their state. Unemployment and family leave.

Can I keep my unemployment there and still file for a PPP loan for my 1099. The 1099-G is a tax form for Certain Government PaymentsESD sends 1099-G forms for two main types of benefits. A loosening of eligibility rules for unemployment insurance led to a rise in fraudulent claims in 2020.

That reporting is a must since unemployment recipients will get a Form 1099-G with the government payments details. Httpsmyunemploymentwisconsingov Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms. I only have one 1099 on their website and mailed that has a total of 90200 I was getting unemployment with taxes taken out since the end of March 2020 and I have not received a 1099 for all that unemployment income.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Benefits Are Taxable Look For A 1099 G Form Cbs8 Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Cbs8 Com

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

1099 G Tax Form Causing Confusion For Some In Kentucky Wbir Com

1099 G Tax Form Causing Confusion For Some In Kentucky Wbir Com

Post a Comment for "How To Get My Unemployment 1099"