Can I Get My 1099 Online From Unemployment

You can also download your 1099-G income statement from your unemployment benefits portal. The amount showing in your account is your bi-weekly benefit amount minus the state and federal withholding that you opted to have withheld.

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Unemployment is taxable income.

Can i get my 1099 online from unemployment. Claimants who received PUA benefits will have a separate 1099-G tax form than those claimants who received Unemployment Insurance UI Pandemic Emergency Unemployment Compensation PEUC and Extended Benefits EB. For example if you collected unemployment in 2018 the 1099-G should have been mailed by January 31 2019. Follow the prompts to schedule a callback.

If its convenient consider stopping by the state unemployment office. I didnt receive the amount reflected on my 1099. I paid some of the money back.

1099-G income tax statements for 2020 are available online. 1099-Gs were mailed during the week of January 25th. These forms are available online from the NC.

1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via US. PUA will be reported on a separate form from any UC including PEUC EB TRA that you may have received. While on your states website copy the contact information so you can contact the office directly if necessary.

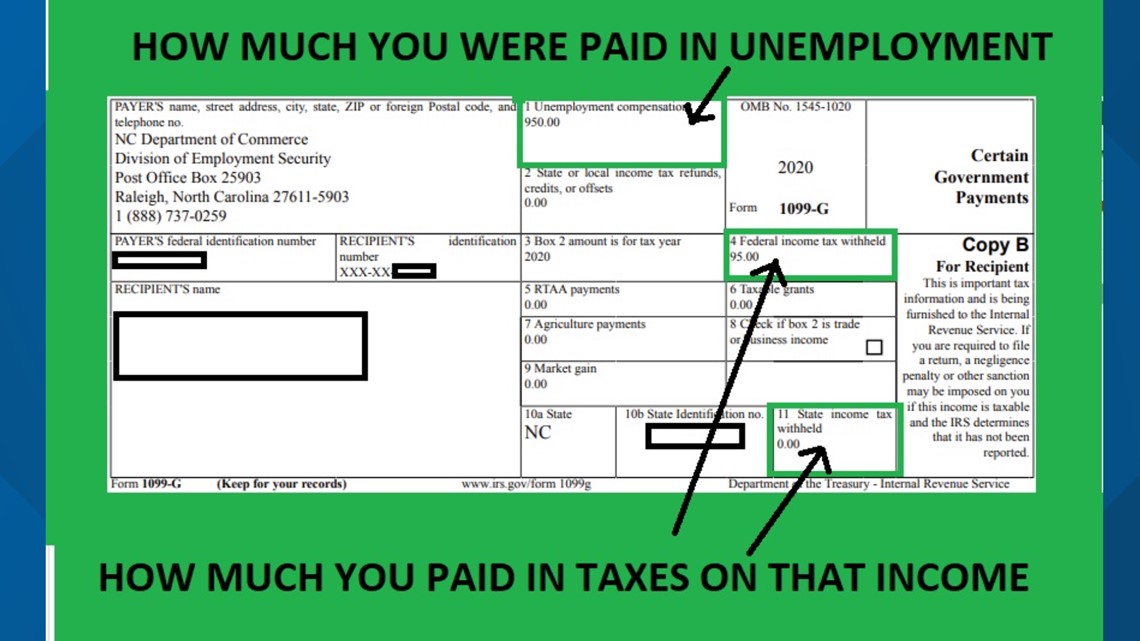

Unemployment benefits including Federal Pandemic Unemployment Compensation FPUC Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Lost Wages Assistance LWA and Extended. State and federal taxes were withheld - Answered by a verified Tax Professional. If you received unemployment your tax statement is called form 1099-G not form W-2.

If you received unemployment compensation during the year you should receive Form 1099-G from your states unemployment office. I havent recieved a 1099g form from unemployment office sp i can file my taxes. If you do not have an online account with NYSDOL you may call.

The most common use of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year. For additional questions please review our 1099-G frequently asked questions here. Press 2 Individual.

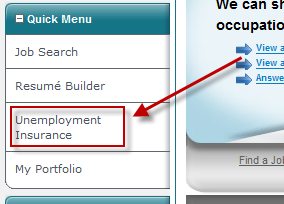

Once logged in to the New Mexico Workforce Connection Online System you can log in to the UI Tax Claims System by clicking on Unemployment Insurance on the left-hand side of the screen under the Quick Menu After logging in to the UI Tax Claims System you can view your 1099-G by clicking on View Correspondence on the menu on the left-hand side of the screen. For Pandemic Unemployment Assistance PUA claimants the forms will also be available online in the PUA portal. What if my 1099-G statement is wrong.

Please note that your 1099-G reflects the total amount paid to you in 2020 regardless of the week that payment represents. We use cookies to give you the best possible experience on our website. 1099-Gs are only issued to the individual to whom benefits were paid.

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. If you have moved since filing for UI benefits your 1099-G will NOT be forwarded by the United States Postal Service. It is possible you may receive more than one 1099-G form.

Meaning if you were paid in 2020 for weeks of unemployment benefits from 2019 those will appear on your 1099-G for 2020. The form will be mailed to the address we have on file for you. You can check your payment history on your claim for the exact amount processed for each week on UI PUA or PEUC.

To access this form please follow these instructions. IDES mailed paper copies of the 1099-G form in January to all claimants who opted NOT to receive their form electronically. You can log into CONNECT and click on My 1099G49T to view and print the forms.

This can be handled after logging into your claim under View and Maintain Account Information and selecting Payment Method and Tax Withholding Options. I received unemployment insurance then it was determined I was overpaid. Remember even if you were unemployed you still have to file income taxes.

If you cant download your 1099-G online or you have technical issues with it contact your states Department of Revenue. Both FPUC and LWA are taxable and will be included on your 1099G. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application.

You can opt to receive your 1099-G electronically by providing your consent through the BEACON portal or mobile app. You must update your mailing address by updating your personal information in the BEACON portal on the Maryland Unemployment Insurance for Claimants mobile app or by contacting a Claims Agent at 667-207-6520. In most cases 1099-Gs for the previous year are mailed on or before January 31.

Why does the 1099G not show the money I paid back. You can find your calendar year payments by clicking on the claim and reviewing the payment details. If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631.

How to Get Your 1099-G online. Some states only issue the form by mail so youll have to request it and wait for it to arrive if you never received a copy. The Delaware Division of Unemployment Insurance cannot update your mailing address for this 1099 cycle.

Look for the 1099-G form youll be getting online or in the mail.

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

New Mexico Department Of Workforce Solutions Unemployment Unemployment For An Individual Unemployment Tax Forms 1099

New Mexico Department Of Workforce Solutions Unemployment Unemployment For An Individual Unemployment Tax Forms 1099

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Unemployment Benefits Are Taxable Look For A 1099 G Form Abc10 Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Abc10 Com

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Post a Comment for "Can I Get My 1099 Online From Unemployment"