How To Get Unemployment 1099 G

It is possible you may receive more than one 1099-G form. Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online.

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

The Department of Unemployment Assistance DUA will mail you a copy of your 1099-G by Jan.

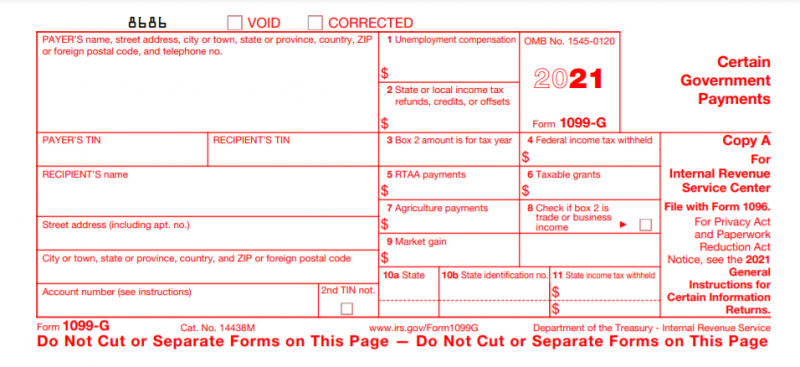

How to get unemployment 1099 g. The 1099-G is a tax form for Certain Government PaymentsESD sends 1099-G forms for two main types of benefits. Florida Department of Economic Opportunity 1099-G Request Form. For Pandemic Unemployment Assistance PUA claimants the.

You can also download your 1099-G income statement from your unemployment benefits portal. 31 of the year after you collected benefits. If you do not have an online account with NYSDOL you may call.

You can find all the information about what benefits you were paid and how much if any was withheld using Form 1099-G which you should have received from your state unemployment office by. After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. We will mail you a paper Form 1099G if you do.

1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via US. Press 2 Individual. If you received unemployment compensation during the year you should receive Form 1099-G from your states unemployment office.

Claimants may also request their 1099-G form via Tele-Serve. These forms will be mailed to the address that DES has on file for you. Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms.

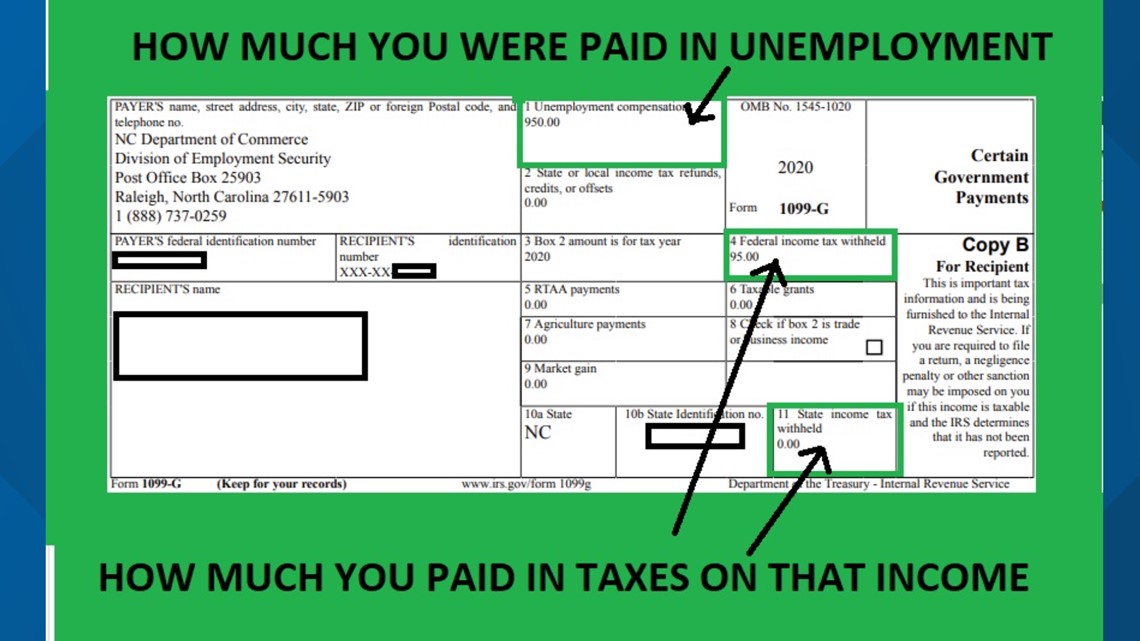

Press 2 Other questions about your 1099-G. The 1099G form reports the gross amount of unemployment compensation you have received not the net amount. If you have questions about your user name and password see our frequently asked questions for accessing online benefit services.

If you have received unemployment insurance payments last year you will need to report the total amount as found on your 1099-G on your federal taxes. Scroll until you see VEC 1099-G Tax Information. Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year.

It should show you the option to go to the 1099-G. You will need this information when you file your tax return. Once you subtract the federal and state income taxes from your 1099G amount it should match what you actually received.

Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year. PUA will be reported on a separate form from any UC including PEUC EB TRA that you may have received.

Unemployment benefits are taxable income meaning benefit payments must be reported on your federal tax return when filing taxes with the Internal Revenue Service IRS. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. You can access your Form 1099G information in your UI Online SM account.

You can opt to receive your 1099-G electronically by providing your consent through the BEACON portal or mobile app. It will not be available in your unemployment dashboard. To access this form please follow these instructions.

You will need to add the payments from all forms when. In Gov2Go click Discovery scroll all the way down to Taxes. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

Applicant Services 1099 Information The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. If youve already enrolled when you click enroll it should take you to your Profile.

RTAA benefits are also reported on a separate form. 1099-G information will also be available from the Check Claim Status tool no later than January 30. Follow the prompts to schedule a callback.

Use your 1099-G Form to File your Taxes Your unemployment payments are reported as income to the IRS. If we have your email address on file we have sent you via email the information for your 1099-G for 2020. How to Get Your 1099-G online.

Unemployment and family leave. You must update your mailing address by updating your personal information in the BEACON portal on the Maryland Unemployment Insurance for Claimants mobile app or by contacting a Claims Agent at 667-207-6520. Click Enroll in Taxes.

If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631. Your 1099-G will be sent to your mailing address on record the last week of January. Pacific time except on state holidays.

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Benefits Are Taxable Look For A 1099 G Form Abc10 Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Abc10 Com

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Florida Residents Report Problems Accessing 1099 G Form Youtube

Florida Residents Report Problems Accessing 1099 G Form Youtube

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Post a Comment for "How To Get Unemployment 1099 G"