Unemployed Health Insurance Deduction

Coinsurance is the portion of the bill youre responsible for. 1 Employees can claim medical expenses as deductions too including health insurance premiums.

Are Health Insurance Premiums Tax Deductible

Are Health Insurance Premiums Tax Deductible

This includes dental and long-term care coverage.

Unemployed health insurance deduction. Health Insurance premium deduction while unemployed Yes you can claim your COBRA premiums under Medical Expenses. Having health insurance can help lower the financial stress of unemployment. If youre self-employed and not eligible for an employer-sponsored health plan through a spouses job you may be eligible to write-off your health insurance premiums on your taxes.

If you qualify this deduction will reduce your adjusted gross income AGI. However you cant write off more in health insurance premiums than you earned. Although finding affordable coverage becomes a challenge when you dont have a job but options do exist.

Amounts you paid with after-tax funds Medical expenses that are more than 75 of your adjusted gross income AGI for 2018. If your insurance is through your employer you can only deduct these. I paid for private health insurance while unemployed.

Self-employed people who qualify are allowed to deduct 100 of their health insurance premiums including dental and long-term care coverage for themselves their spouses and their dependents. One of the many perks of being self-employed is that you can deduct what you spend on health insurance premiums above the line on the first page of your tax return. If you paid the premiums for a policy you obtained yourself your health insurance premium is deductible when they are out-of-pocket costs.

Senate Democrats agreed to lower additional unemployment aid to 300 per week from 400 but extended the payments through Sept. This insurance can also cover your children up to age 27 26 or younger as of the end of a tax year whether they are your dependents or not. However you are correct about the 10 limitation.

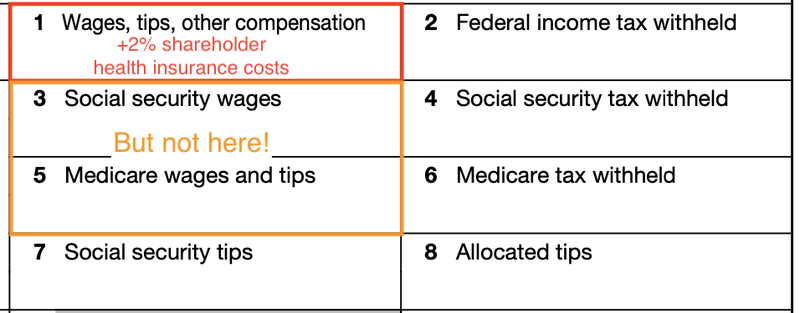

You can only deduct the amount that is over 10 of your income. Also while you can deduct 100 of health and dental insurance premiums the amount of long-term care insurance premiums you can deduct. This is where the corporation deducts the premiums essentially as additional salaries and wages paid Peterson said.

Any paid premiums that you dont deduct as self-employed health insurance can be claimed as an itemized deduction on Schedule A. Health Insurance Assistance for the Unemployed - TurboTax Tax Tips Videos. Health coverage options if youre unemployed If youre unemployed you may be able to get an affordable health insurance plan through the Marketplace with savings based on your income and household size.

In a nutshell the self-employed health insurance deduction allows eligible self-employed folks to deduct up to 100 of health dental and long-term care insurance premiums for themselves and for their spouses dependents and non-dependent children under age 27. Its important to understand however that this is not a business deduction. Other taxpayers can deduct the cost of health insurance as an itemized deduction only if their overall medical and dental expenses exceed 75 of their adjusted gross incomes in 2020.

If youre self-employed your health insurance premiums may be tax deductible. Peterson said self-employed people that arent considered an S Corporation can deduct health insurance premiums as an adjustment to your gross income. The medical expense deduction has to meet a rather large threshold before it can affect your return.

They also included a. The self-employed health insurance deduction applies to health insurance premiums for yourself your spouse and your dependents. Youd then be able to deduct 900month in health insurance premiums under the self-employed health insurance deduction for a total of 10800 for the year since thats what you ultimately ended up paying out-of-pocket for your health insurance coverage.

Health insurance premiums that you paid for can be counted as a medical expense--go to FederalDeductions and CreditsMedicalMedical Expenses. It is a special personal deduction for the self-employed. Self-employed persons can deduct health insurance above the line on their 2020 Schedule 1 which also eliminates the hassle and limitations of itemizing.

The lower-priced plans have deductibles as high as 8150 and coinsurance as high as 50. S-corp shareholders have to put their premiums on their W-2 Forms. You may also qualify for free or low-cost coverage through Medicaid or the Childrens Health Insurance Program CHIP.

Find Affordable Health Insurance And Compare Quotes

Find Affordable Health Insurance And Compare Quotes

Wow I Had No Idea All The Benefits Usaa Offers Like Usaa Health Insurance Plans And How Affordable Health Insurance Health Insurance Best Health Insurance

Wow I Had No Idea All The Benefits Usaa Offers Like Usaa Health Insurance Plans And How Affordable Health Insurance Health Insurance Best Health Insurance

History Of Healthcare In America Health Care Hr Infographic American Healthcare

History Of Healthcare In America Health Care Hr Infographic American Healthcare

Self Employed Health Insurance Deductions H R Block

Self Employed Health Insurance Deductions H R Block

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

The Benefits Of Using An Insurance Broker Morning Business Chat Extra Morning Business Chat Insurance Broker Insurance Marketing Business Insurance

The Benefits Of Using An Insurance Broker Morning Business Chat Extra Morning Business Chat Insurance Broker Insurance Marketing Business Insurance

Health Insurance Application Process

Health Insurance Application Process

A Beginner S Guide To S Corp Health Insurance The Blueprint

A Beginner S Guide To S Corp Health Insurance The Blueprint

How Laid Off And Furloughed Employees Can Keep Their Health Coverage Third Way

How Laid Off And Furloughed Employees Can Keep Their Health Coverage Third Way

What Is The Self Employed Health Insurance Deduction Ask Gusto

What Is The Self Employed Health Insurance Deduction Ask Gusto

Affordable Health Insurance Quotes Tips For Finding Affordable Health Insurance Quotes In 2020 Affordable Health Insurance Health Insurance Quote Affordable Health

Affordable Health Insurance Quotes Tips For Finding Affordable Health Insurance Quotes In 2020 Affordable Health Insurance Health Insurance Quote Affordable Health

How To Save Big Money On Your Health Insurance Expenses Couple Money Individual Health Insurance Health Insurance Cost Health Insurance

How To Save Big Money On Your Health Insurance Expenses Couple Money Individual Health Insurance Health Insurance Cost Health Insurance

The Master List Of Small Business Tax Write Offs For 2020 Owllytics Small Business Tax Small Business Tax Deductions Business Tax

The Master List Of Small Business Tax Write Offs For 2020 Owllytics Small Business Tax Small Business Tax Deductions Business Tax

Medical Crowdfunding How Effective Is It Really Centsai Crowdfunding Personal Finance Lessons How To Raise Money

Medical Crowdfunding How Effective Is It Really Centsai Crowdfunding Personal Finance Lessons How To Raise Money

How Can I Avoid An Obamacare Tax Penalty In 2019 Ehealth Insurance

How Can I Avoid An Obamacare Tax Penalty In 2019 Ehealth Insurance

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Business Tax

Lgi Health Insurance Page Health Insurance Insurance Health

Lgi Health Insurance Page Health Insurance Insurance Health

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Post a Comment for "Unemployed Health Insurance Deduction"