How Do I Get My 1099 G From Unemployment

1099-G information will also be available from the Check Claim Status tool no later than January 30. It will also be mailed to the mailing address the Department has on.

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631.

How do i get my 1099 g from unemployment. Reprints for 1099-G forms for the current tax year can be requested starting Feb 2. To request a new 1099-G to be mailed to you log into httpswwwgetkansasbenefitsgov and click REQUEST 1099-G REPRINT. It will not be available in your unemployment dashboard.

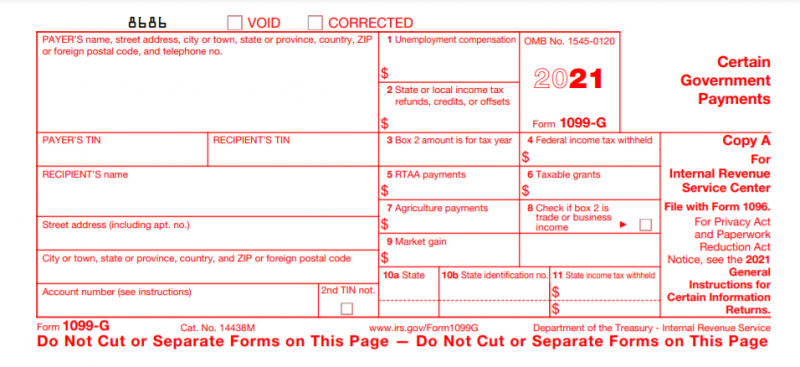

I havent recieved a 1099g form from unemployment office sp i can file my taxes. Form 1099G is now available in Uplink for the most recent tax year. The most common uses of the 1099-G is to report unemployment compensation and state or local income tax refunds you received that year.

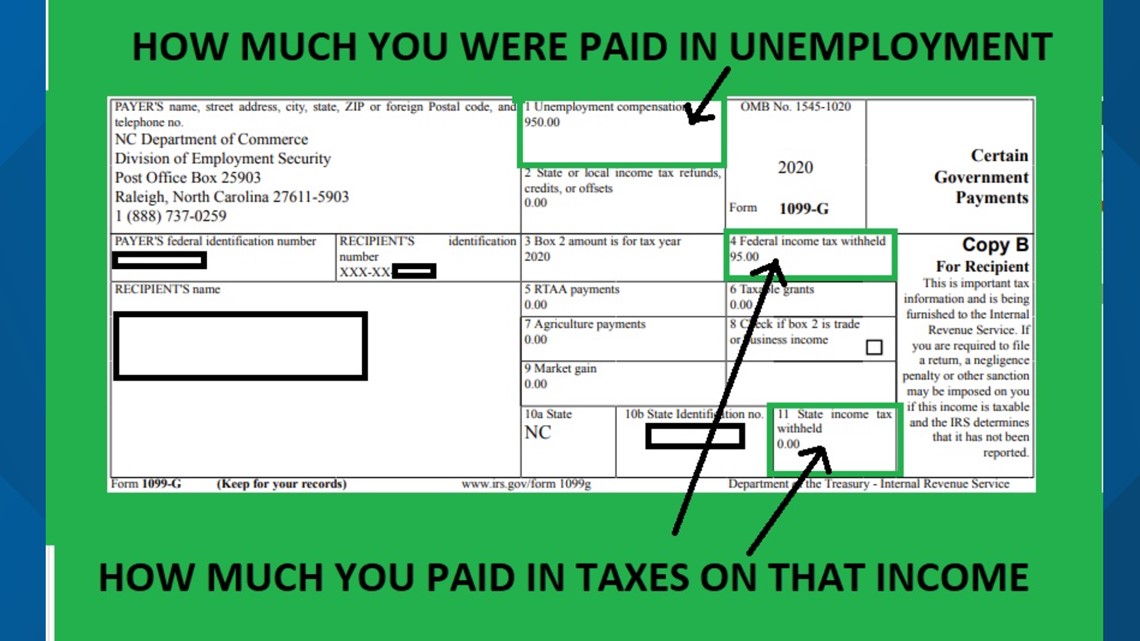

I have total amount paid out i have totalof taxes taken out but dont know how much was federal and how much was state. Your 1099-G Form should be available in your CONNCET inbox no later than January 31. Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms.

Call your local unemployment office to request a copy of your 1099-G by mail or fax. Log on to Unemployment Benefits Services. When you do youll see an option to view my 1099-G.

Claimants may also request their 1099-G form via Tele-Serve. Unemployment benefits are taxable income meaning benefit payments must be reported on your federal tax return when filing taxes with the Internal Revenue Service IRS. The Internet is available 24 hours a day 7 days a week in English and Spanish.

By January 31 all 1099-Gs will be mailed out to individuals who had claimed Unemployment Insurance UI benefits in the previous calendar year. You may update your withholding choice anytime through the Online Claim System. Where to find your 1099G info Your 1099G tax form will be mailed to you by Jan.

If you received unemployment benefits in 2020 contact your state unemployment benefits office for a duplicate or check their website for a download option. Press 2 Other questions about your 1099-G. Your local office will be able to send a replacement copy in the mail.

The 1099-G tax form is commonly used to report unemployment compensation. Follow the prompts to schedule a callback. Your 1099-G will be sent to your mailing address on record the last week of January.

Similarly if you were paid for 2020 weeks in 2021 those will not be on your 1099-G for 2020 they will appear on your 1099-G for 2021. How long have you been unemployed. We mailed you a paper Form 1099G if you have opted into paper mailing or are a telephone filer.

State and federal taxes were withheld from unemployment. You can also download your 1099-G income statement from your unemployment benefits portal. Is thete anyway that turbo tax could help me.

The example we have shows the person paid federal taxes on their benefits but not the state. 31 there is a chance your copy was lost in transit. How do I get a new copy of my 1099-G Form.

Press 2 Individual. Select the link View IRS 1099-G Information and 3. If you have questions about your user name and password see our frequently asked questions for accessing online benefit services.

To view your. You can also print additional copies if needed. For additional questions please review our 1099-G frequently asked questions here.

Instructions for the form can be found on the IRS website. In addition to receiving a hard copy in the mail in January you will be able to log into the UI Tax Claims System and view your 1099G. This means theyll probably owe the state a.

This can be handled after logging into your claim under View and Maintain Account Information and selecting Payment Method and Tax Withholding Options You can log into CONNECT and click on My 1099G49T to view and print the forms. Viewing your IRS 1099-G information over the Internet is fast easy and secure. If we have your email address on file we have sent you via email the information for your 1099-G for 2020.

You can access your Form 1099G information on your Correspondence page in Uplink account. If you havent received your 1099-G copy in the mail by Jan. When you apply for unemployment insurance benefits you can choose to have 10 of your weekly benefit amount withheld for federal income taxes andor 6 for state income taxes.

Then you will be able to file a complete and accurate tax return.

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Unemployment Benefits Are Taxable Look For A 1099 G Form Cbs8 Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Cbs8 Com

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 G Tax Form Causing Confusion For Some In Kentucky Wbir Com

1099 G Tax Form Causing Confusion For Some In Kentucky Wbir Com

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

1 0 9 9 U N E M P L O Y M E N T T A X F O R M Zonealarm Results

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Florida Residents Report Problems Accessing 1099 G Form Youtube

Florida Residents Report Problems Accessing 1099 G Form Youtube

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Post a Comment for "How Do I Get My 1099 G From Unemployment"