Unemployment For 1099 Workers In Florida

Unemployment is called Reemployment in Florida. I received a 1099 tax form from my employer and this makes me an independent contractor.

Independent Contractor Bartender Filed The New 1099 Pua Application On Tuesday And Got 600 Today Florida

Independent Contractor Bartender Filed The New 1099 Pua Application On Tuesday And Got 600 Today Florida

If you receive a 1099-MISC form reflecting nonemployee compensation you work as an independent contractor not as an employee.

Unemployment for 1099 workers in florida. This benefit is available for weeks claimed March 29 2020 July 25 2020 in addition to the funds owed under Florida law to eligible individuals. This year they fear could be the first. However the federal government created new provisions that allow 1099 earners to tap into unemployment benefits during the ongoing COVID-19 pandemic.

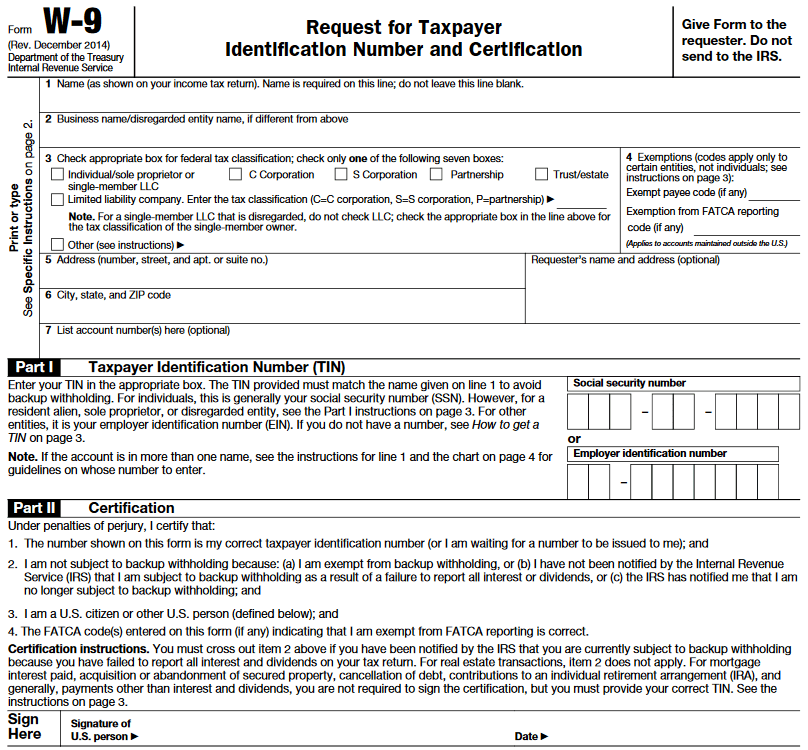

Some IDES guidance has changed. The 1099-G is the tax form the department issues in January for the purposes of filing your taxes. In order to be eligible for unemployment benefits you must actively look for work and be available for work if youre offered a suitable job.

Florida Department of Economic Opportunity 1099-G Request Form. Beginning Monday May 11 self-employed and 1099 workers impacted by COVID-19 can apply for unemployment benefits online. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

When you meet at least four points you may claim the title of contractor and enjoy the freedom of guiding your own work. This benefit expansion program called the Pandemic Unemployment Assistance PUA was created by the federal CARES Act. They are made available by January 31st for the prior tax year.

It is our understanding however that the applications. Normally self-employed and 1099 earners such as sole independent contractors freelancers gig workers and sole proprietors do not qualify for unemployment benefits. Contractors who received 1099 tax forms and self-employed workers are generally not entitled to state unemployment compensation in Florida.

Federal Pandemic Unemployment Compensation FPUC - provides an additional 600 per week to any individual eligible under Florida law for Reemployment Assistance or federal unemployment programs. Florida law provides several criteria to help determine your employment status. Florida woman works to get thousands of unemployment issues resolved A spokesperson with the DEO said The Department completed electronically processing 1099-G Tax Forms for all.

Gig workers are eligible for extra unemployment under new stimulus deal but they must clear one big hurdle first Last Updated. Claimants should review their 1099-G form available in CONNECT prior to completing this form. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

You may still qualify for UI even if you are classified as an independent contractor. 3 Oversee property tax administration involving 109. The 1099-G will detail the amount of benefits paid to you during a specific year as well as any amounts withheld and paid to the IRS.

If I am classified as an independent contractor I am not eligible for unemployment insurance UI. If your 1099 position requires you to work particular. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

Unemployment for 1099Self-Employed Workers Update. Nearly a month after President Donald Trump signed the CARES Act into law giving federal unemployment benefits to millions of gig workers contractors and. People who need assistance filing a Reemployment Assistance Claim online because of legal reasons computer illiteracy language barriers or disabilities may call.

Many people are wondering how to collect unemployment in Florida as an independent contractor NOTE. WFLA Debbie and Thom Urwin say theyve never been late filing federal income taxes. However some banks seem to be gathering information from self employed workers for the PPP Loan now asking for 1099-Misc Forms etc.

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

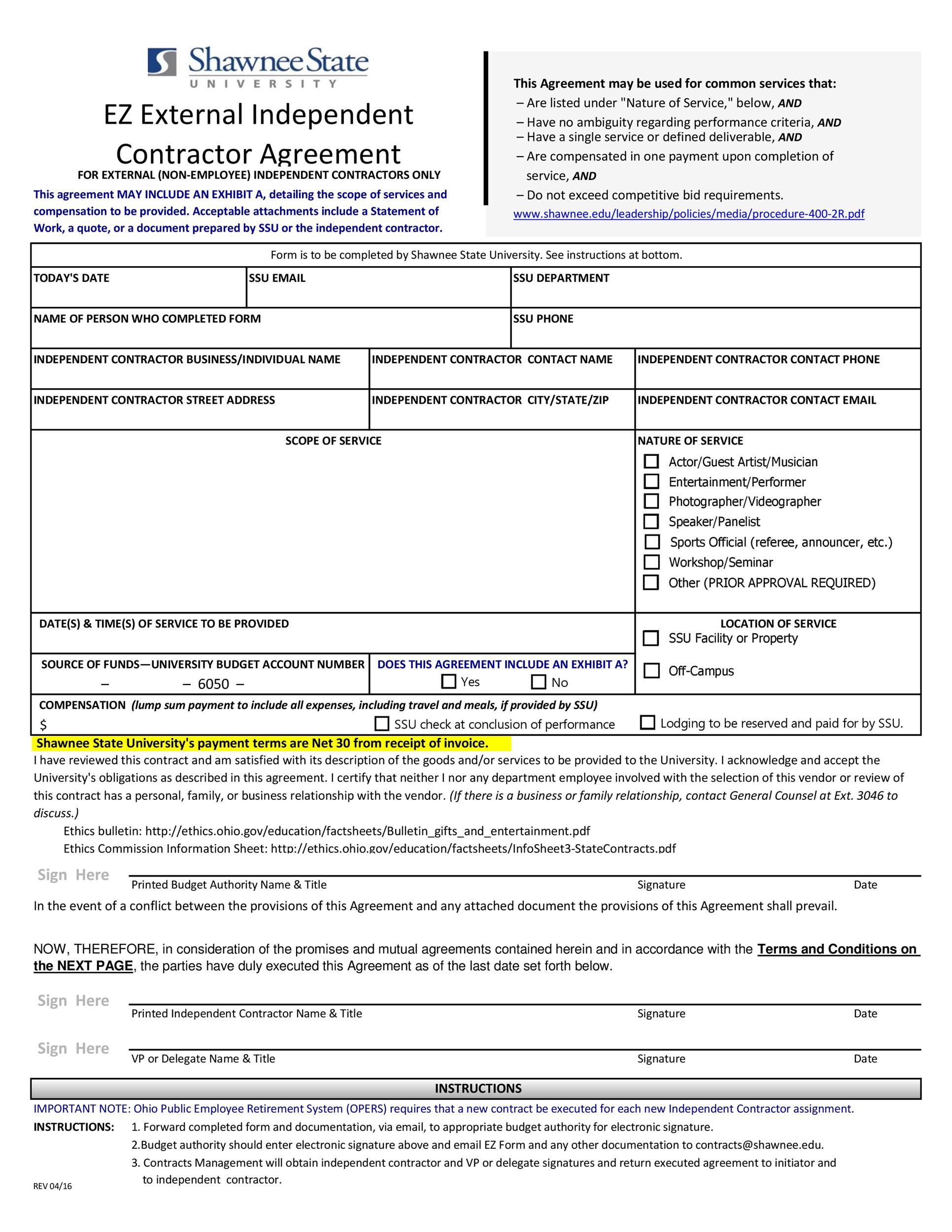

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

By 2020 50 Of Americans Are Expected To Be Independent Contractors Freelancers Alexander S Blog

By 2020 50 Of Americans Are Expected To Be Independent Contractors Freelancers Alexander S Blog

What Is A 1099 Employee The Definitive Guide To 1099 Status Supermoney

What Is A 1099 Employee The Definitive Guide To 1099 Status Supermoney

Filing For Unemployment When Self Employed Or An Independent Contractor In Florida Unbehagen Advisors

Filing For Unemployment When Self Employed Or An Independent Contractor In Florida Unbehagen Advisors

How To Manage 1099 Sales Reps Independent Contractors

How To Manage 1099 Sales Reps Independent Contractors

Unemployed Workers Struggle To Download 1099 G Form From Fdeo S Website

Unemployed Workers Struggle To Download 1099 G Form From Fdeo S Website

Free Florida Independent Contractor Agreement Word Pdf Eforms

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Agreement Templates Pdf Word Eforms

Sc Dew Announces 3 Programs To Expand Unemployment Benefits Wpde

Sc Dew Announces 3 Programs To Expand Unemployment Benefits Wpde

Wrongful Termination For 1099 Independent Contractors Workers Compensation Attorney

Wrongful Termination For 1099 Independent Contractors Workers Compensation Attorney

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Petition Unemployment Relief For Independent Workers With Mixed Income Types Change Org

Petition Unemployment Relief For Independent Workers With Mixed Income Types Change Org

What Does A Pay Stub Look Like For An Independent Contractor Quora

Sc Dew Announces 3 Programs To Expand Unemployment Benefits Wpde

Sc Dew Announces 3 Programs To Expand Unemployment Benefits Wpde

Why You Need To Understand The Difference Between Independent Contractor Self Employed And Employee Nurse Practitioners In Business

Why You Need To Understand The Difference Between Independent Contractor Self Employed And Employee Nurse Practitioners In Business

What Is A 1099 Employee And Should You Hire Them Employers Resource

What Is A 1099 Employee And Should You Hire Them Employers Resource

How To Report Misclassification Of Employees Top Class Actions

How To Report Misclassification Of Employees Top Class Actions

Can 1099 Employees File For Unemployment

Can 1099 Employees File For Unemployment

Post a Comment for "Unemployment For 1099 Workers In Florida"