Unemployment Not Taxable Under Cares Act

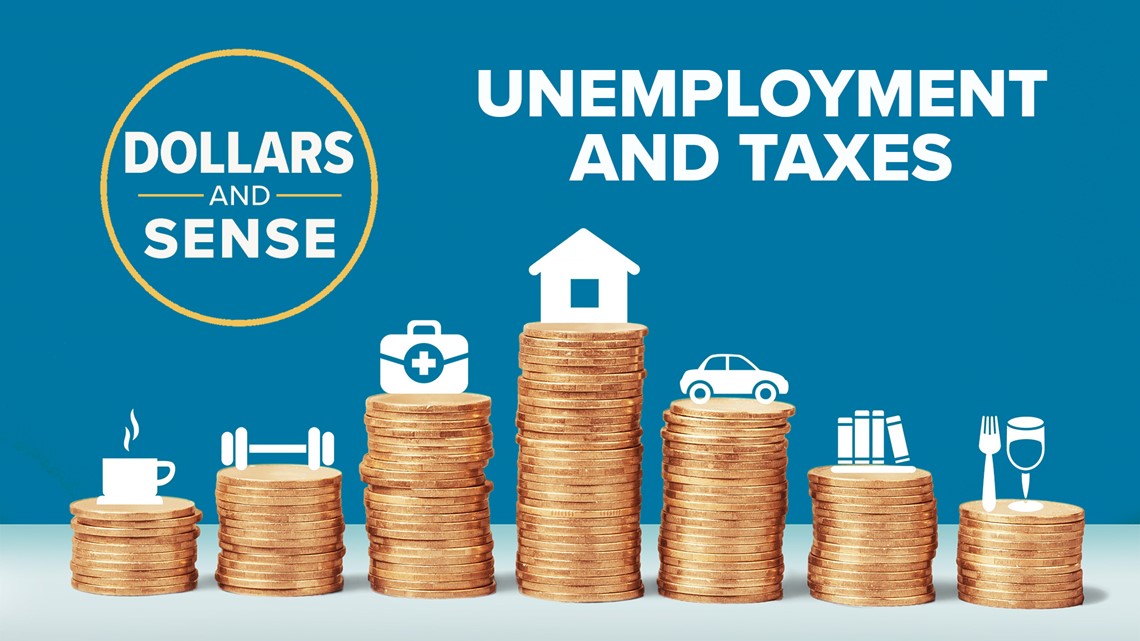

Benefits from a private fund if you voluntarily gave money to the fund and you get more money than what you gave to the fund. Federal taxes are deducted at 10 and state taxes at 6.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

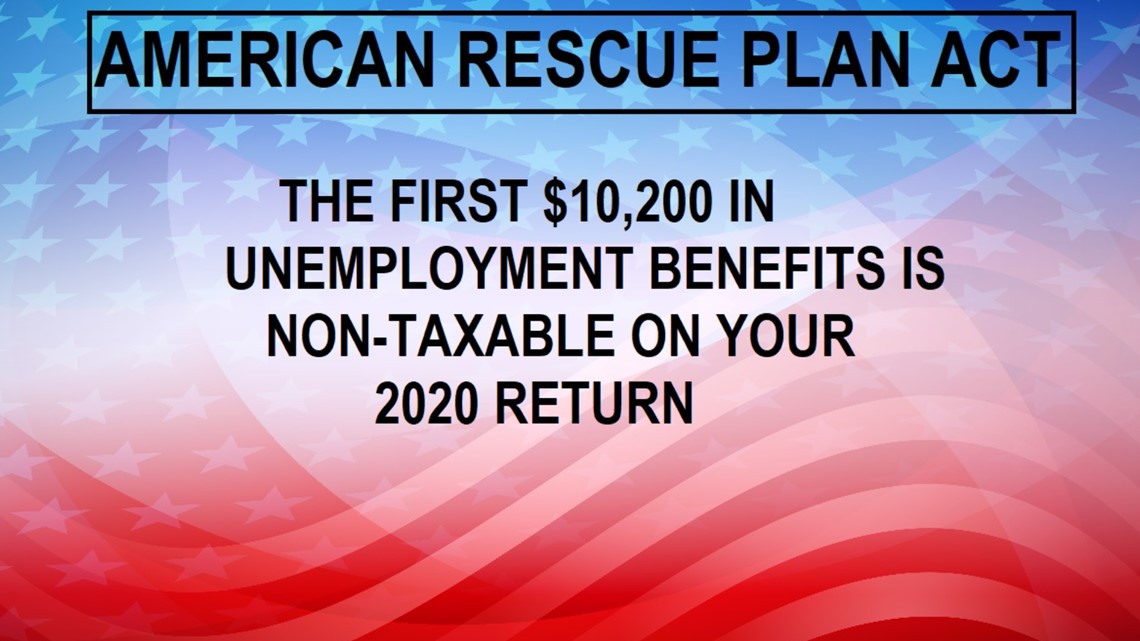

3 If you filed your taxes before the American Rescue Plan was passed you had to pay taxes on the full amount of your unemployment benefits.

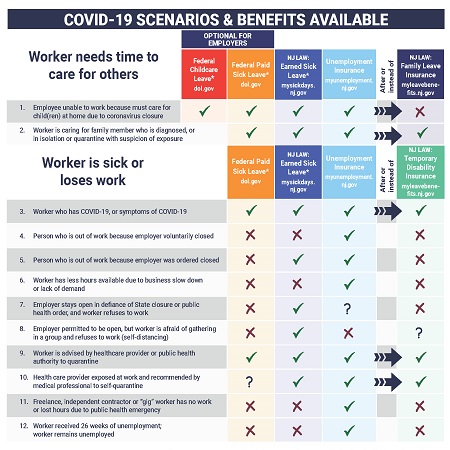

Unemployment not taxable under cares act. Unemployment Insurance UI benefits. Disability Insurance benefits received as a substitute for UI benefits. Other deductions may include court ordered or voluntary child support or repayment of an UI overpayment one-half of your 300 FPUC payment will be deducted and applied to your outstanding overpayment.

Thanks to the American Rescue Plan which was passed and signed into law in March 2021 the full amount of unemployment benefits are not taxable. But evaluating these tax impacts can be daunting. When the federal government passed the American Rescue Plan Act of 2021 in March Congress included an exemption so at least a portion of unemployment benefits from 2020 will not be federally taxed.

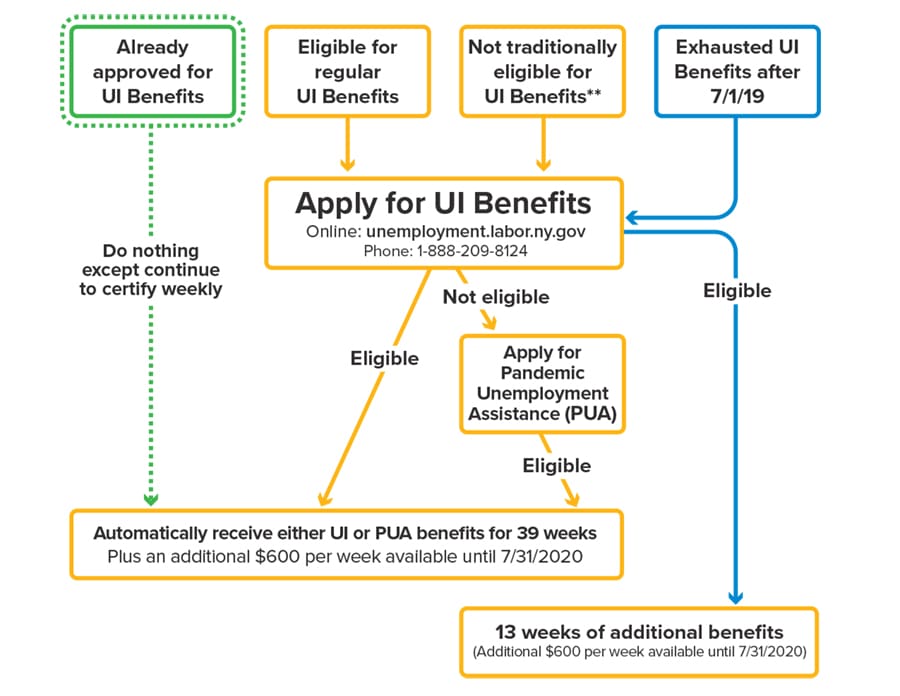

CARES ACT AND UNEMPLOYMENT QUESTIONS We Understand that this is a confusing and stressful time. According to an HR Block study of small business owners fewer than 1 in 3 28 are confident that they understand the financial andor tax. Under this law virtually all types of workers even those who otherwise would not qualify for UI benefits may receive payments for up to 39 weeks of unemployment under certain circumstances.

Due to an influx of calls to our offices phone lines are often busy or have long hold times. States own contributing the remaining 25 100 of the benefit payment using state budgets or the emergency funding received under the CARES Act. As taxable income these payments must be reported on your federal tax return but they are exempt from California state income tax.

We want to make sure your questions are answered as quickly and easily as possible. However the state contribution is not mandatory and is at the discretion of the states governor. Unemployment benefits are taxable income and they generally count as income when determining eligibility for public assistance programs.

Unemployment benefits are taxable income. Now that its tax time business owners who took advantage of these programs will want to know how the CARES Act relief affects their taxes. Funding for this expires December 31 2020.

Up to 10200 in unemployment payments is tax-free. Please read through these frequently asked questions if you are confused. Total taxable compensation includes.

This income is reported to the IRS. Are unemployment benefits taxable and do they count as income. With the CARES Act youll receive federal unemployment dollars on top of the base amount that youd normally receive from the state.

Further states can count existing unemployment benefits paid to claimants against their 100. People whose adjusted gross income was less than 150000 can exclude up to 10200 of unemployment benefits from taxes in 2020. The CARES Act also provides funding for states to waive any waiting week requirements for UI benefits during the COVID-19 pandemic and to provide an additional 600 per week to all individuals receiving.

The CARES Act provides federal funding for an additional 13 weeks for those who need it. Mixed Earners Unemployment Compensation MEUC. Unemployment checks count as taxable income but some states didnt withhold federal taxes according to a report from The Century Foundation.

Federal Pandemic Unemployment Compensation provided under the Coronavirus Aid Relief and Economic Security CARES Act of 2020. Unemployment benefits Under the CARES Act eligible Americans who are out of work entirely or underemployed because of reasons related to coronavirus can receive an additional 600 a. Expanded unemployment insurance benefits are now available to millions of Americans who are out of work for reasons related to the COVID-19 pandemic under the Coronavirus Aid Relief and Economic Security CARES Act.

Unemployment assistance under the Airline Deregulation Act of 1978 Program. Unemployment Compensation in the CARES Act Section 2102 of the CARES Act provides individuals who are not already eligible for state and federal unemployment programsbut would be able to work in the absence of the coronavirus outbreaka set amount of. The federal Coronavirus Aid Relief and Economic Security Act CARES ACT and the Consolidated Appropriations Act 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and provide assistance to taxpayers and businesses affected by COVID-19.

The 10200 exemption amount is intended to cover 17 weeks of the extra 600 federal unemployment benefit that was passed as part of the Cares Act. To further complicate things while state unemployment offices are supposed to offer standard 10 federal tax withholding not all states offered. This includes people who are not ordinarily eligible such as self-employed independent contractor and gig workers.

Unemployment Benefits And The Cares Act Bench Accounting

Unemployment Benefits And The Cares Act Bench Accounting

Cares Act What You Need To Know Neighborhood Trust Financial Partners

Cares Act What You Need To Know Neighborhood Trust Financial Partners

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

Https Wdr Doleta Gov Directives Attach Uipl Uipl 14 20 Pdf

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Unemployment Benefits And The Cares Act Bench Accounting

Unemployment Benefits And The Cares Act Bench Accounting

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Top 3 Tax Tips For Unemployment Benefits

Top 3 Tax Tips For Unemployment Benefits

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Cares Act Income Support And Unemployment Compensation Effect On Eligibility For Medicaid Chip And Aca Premium Tax Credit Everycrsreport Com

Cares Act Income Support And Unemployment Compensation Effect On Eligibility For Medicaid Chip And Aca Premium Tax Credit Everycrsreport Com

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Post a Comment for "Unemployment Not Taxable Under Cares Act"