Is Unemployment Insurance Taxable In Hawaii

NY unemployment insurance benefits in 2020. If your small business has employees working in Hawaii youll need to pay Hawaii unemployment insurance UI tax.

Faq Covid 19 Benefits In Hawaii Navigating Benefits National Union Of Healthcare Workers

Faq Covid 19 Benefits In Hawaii Navigating Benefits National Union Of Healthcare Workers

January 1 2020.

Is unemployment insurance taxable in hawaii. March 5 2021 A proposal to exempt unemployment compensation from state income taxes won a key approval on Thursday with the Senate Ways and Means Committee unanimously approving the measure. Liable employers must submit a tax report every quarter even if there are no paid employees that quarter andor taxes are unable to be paid. 1099-G forms are automatically generated for all individuals where an unemployment compensation payment was made.

Those who received unemployment benefits should receive a Form 1099-G. In addition the first 25000 received from an employer as severance pay unemployment compensation and the like as a result of administrative downsizing is not taxed. In Hawaii state UI tax is just one of several taxes that employers must pay.

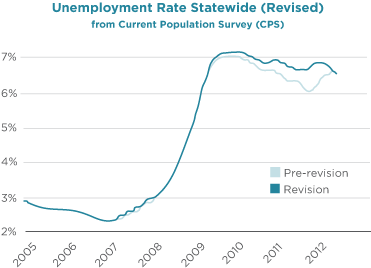

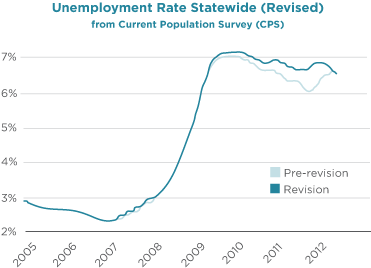

A month later it jumped to 238. The UI tax funds unemployment compensation programs for eligible employees. At the beginning of the pandemic Hawaiis unemployment rate was 24.

Tax Expectations For Web Based Platforms June 10 2020 DLIR determinations for employees of Uber Lyft Bite Squad Door Dash Rover Instacart Delivery Drivers and Grub Hub relating to Unemployment Insurance and PUA benefits are independent from DOTAX tax requirements and classifications. First-time filers may not know however. HONOLULU Hawaii HawaiiNewsNow - Hawaii businesses could see their unemployment insurance taxes triple in the spring.

State Income Tax Range. Without an exemption someone who received 10200 in unemployment compensation as part of their taxable income would be forced to pay an incremental 653 in state taxes. By the end of 2020 it was 93.

2 hours agoUnemployment benefits must be reported as gross income on your federal tax return. Tax reports are due quarterly. It will show the taxable amount paid to you in Box 1 and how much was withheld in federal and state taxes in Boxes 4 and 11.

Hawaii employers are required to file quarterly unemployment insurance tax reports on the new and interactive Employer Website. The tax base is equal to the States average annual wages of employers contributing to the unemployment trust fund and is computed at the beginning of each calendar year. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes.

If you received a 1099-G and did NOT file a claim for unemployment benefits complete the Declaration of Identity Theft form attach a copy of the 1099-G and any other documentation showing that a fraudulent claim for unemployment. In most cases if you have employees working in Hawaii you must pay unemployment taxes on their wages in this state. The impact is worse in.

Unemployment Insurance UI account numbers are issued for the purpose of reporting and paying taxes on wages paid to covered employees. The state will continue to tax unemployment benefits. Tax reports are due quarterly.

And despite the. NEW EMPLOYER REGISTRATION In most cases if you have employees working in Hawaii you must pay unemployment taxes on their wages in this state. HONOLULU Hawaii HawaiiNewsNow - Tens of thousands of Hawaii residents have turned to unemployment benefits amid the pandemic to help keep them afloat.

An individual employees wages in excess of the tax base are not taxable. The taxable portion of an employees annual wages is limited to the tax base for that calendar year. The UI number is assigned only after confirmation of the existence of taxable payroll in Hawaii.

Future hire dates are not accepted. Liable employers must submit a tax report every quarter even if there are no paid employees that quarter andor taxes are unable to be paid. Filing your quarterly wage reports online saves taxpayer dollars and results in greater accuracy when calculating taxes due.

New Yorks unemployment rate is second highest in the nation after Hawaii. The state owes the federal government approximately 700 million after it.

All About The Extended Unemployment Benefits In Hawaii

All About The Extended Unemployment Benefits In Hawaii

Hawaii S Unemployment Rate Revised Up For 2009 2011 Uhero

Hawaii S Unemployment Rate Revised Up For 2009 2011 Uhero

Http Labor Hawaii Gov Ui Files 2014 09 Ui General Information Handout Pdf

Hawaii Employers Council 2020 Ui Tax Rate Schedule And Weekly Benefit Amount Published

Hawaii Employers Council 2020 Ui Tax Rate Schedule And Weekly Benefit Amount Published

Hawaii Employers Council Dlir Unemployment Insurance Tax Rate Schedule And Weekly Benefit Amount

Hawaii Employers Council Dlir Unemployment Insurance Tax Rate Schedule And Weekly Benefit Amount

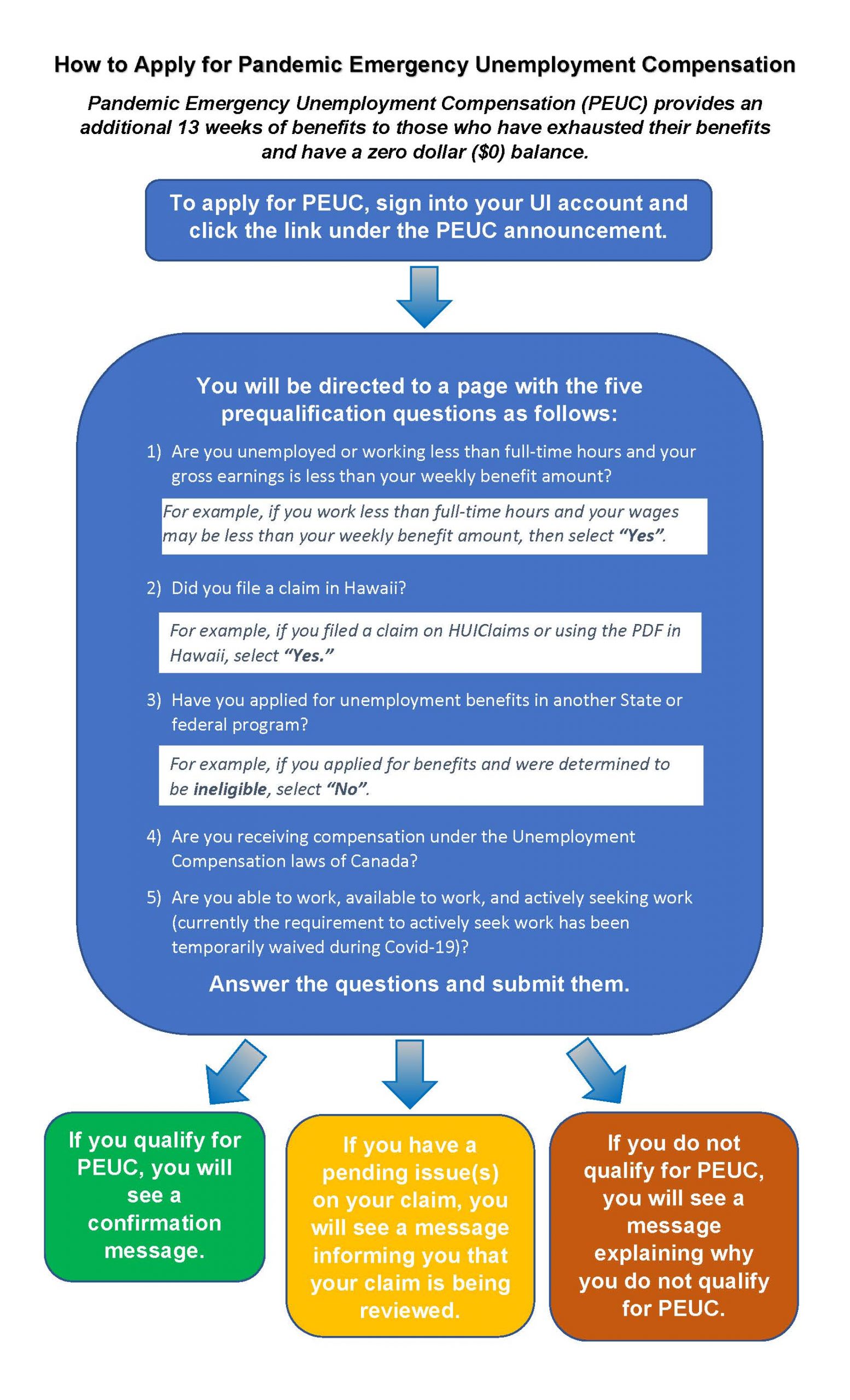

Hawaii Employers Council How To Apply For An Additional 13 Weeks Of Unemployment

Hawaii Employers Council How To Apply For An Additional 13 Weeks Of Unemployment

State Unemployment Tax Slated To Automatically Triple In 2021 Grassroot Institute Of Hawaii

State Unemployment Tax Slated To Automatically Triple In 2021 Grassroot Institute Of Hawaii

Hawaii State Unemployment Tax Rate 2017 Rating Walls

Hawaii State Unemployment Tax Rate 2017 Rating Walls

Hawaii Tax And Labor Law Summary Care Com Homepay

Hawaii Tax And Labor Law Summary Care Com Homepay

Unemployment Insurance Employer Frequently Asked Questions

Unemployment Insurance Employer Frequently Asked Questions

Hirenet Hawaii Ui Claimants Registration For Work Search And Online Resume In Hirenet

Hirenet Hawaii Ui Claimants Registration For Work Search And Online Resume In Hirenet

Https Labor Hawaii Gov Wdc Files 2018 12 Ui Benefits Handbook Uc 266 Pdf

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

Https Labor Hawaii Gov Wp Content Uploads 2020 04 How To Create A Ui Account Pdf

![]() Employer S Guide To The Coronavirus

Employer S Guide To The Coronavirus

Https Labor Hawaii Gov Wdc Files 2018 12 Ui Information Sheet For Ex Service Persons Ucx Pdf

The State Pua System Says You Are Renting Honolulu Hawaii Eminetra

The State Pua System Says You Are Renting Honolulu Hawaii Eminetra

Post a Comment for "Is Unemployment Insurance Taxable In Hawaii"