Unemployment Not Taxable Under New Stimulus Package

Español de Estados Unidos. The actual amount of unemployment compensation received and federal income tax withheld if any can be found on Form 1099-G Certain Government Payments issued by each states unemployment office.

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

There are several states where unemployment benefits are not taxable.

Unemployment not taxable under new stimulus package. If someone received 20000 of benefits in 2020 they will only be taxed on 9800 of it. Unemployment income exemption Stimulus. This can lead to some unpleasant tax surprises as those who have already filed their 2020 tax returns may have discovered.

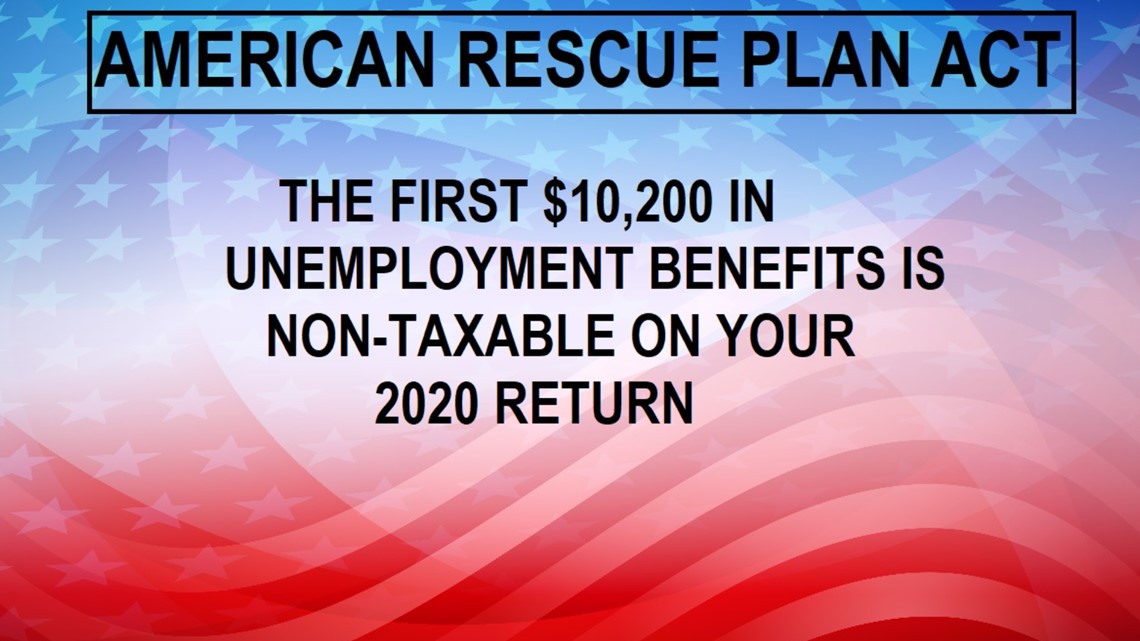

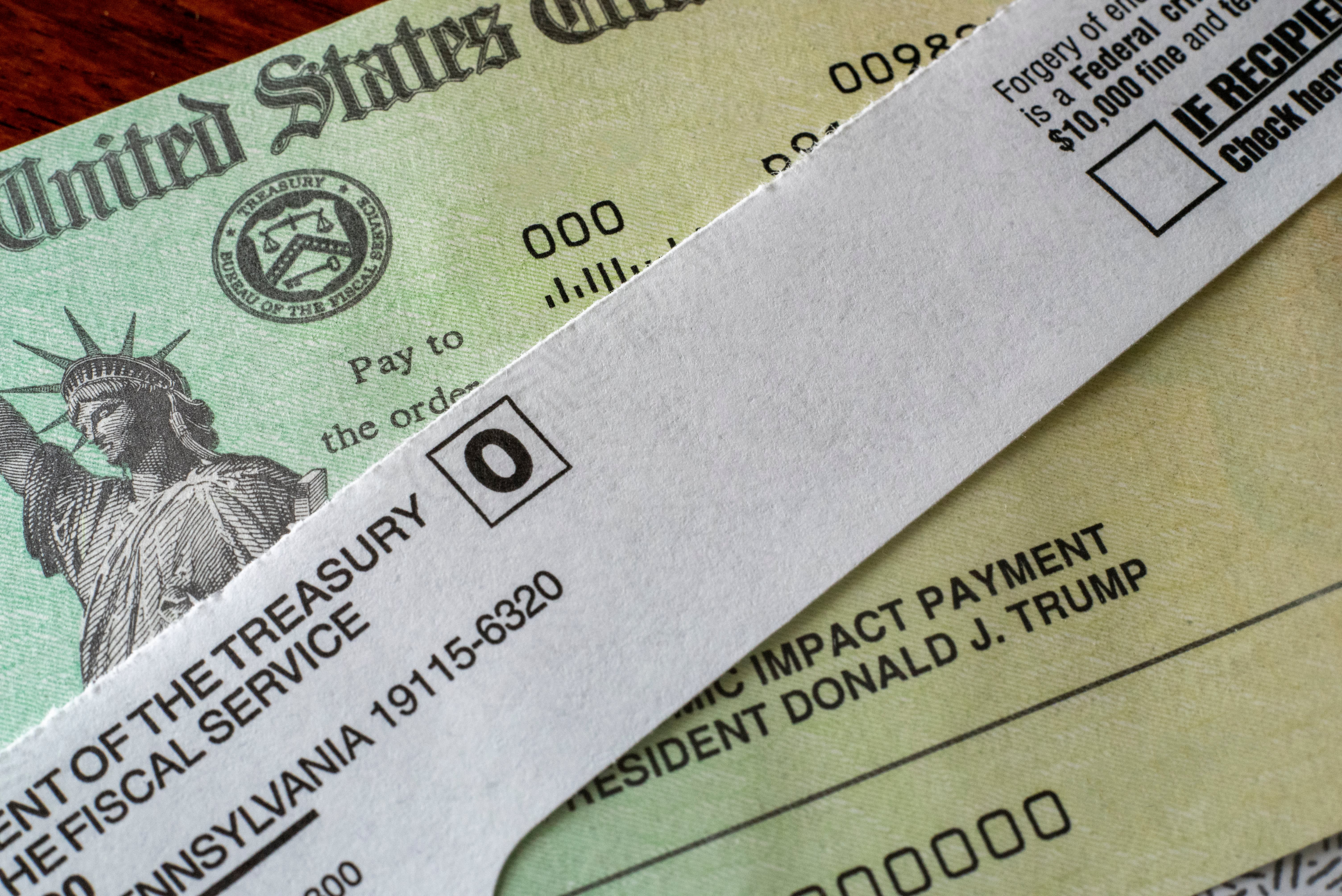

The new stimulus package called the American Rescue Plan Act of 2021 makes tax-free a big chunk of unemployment benefits people received last year. If you received unemployment benefits TurboTax is here to help you understand what all of this means and to help you get every dollar you deserve. 1 day agoMore than 70 million Americans filed for unemployment benefits last year and the IRS approved some 160 million direct payments in two stimulus packages during.

The amendment in the final stimulus bill will make the first 10200 in unemployment benefitscompensation received in 2020 non-taxable ie. Nothing has passed Congress so there has been no changes to the tax code. But the 10200 retroactive exclusion should eliminate the unemployment tax for most kiddie tax returns.

For the latest updates on coronavirus tax relief related to this page check IRSgovcoronavirus. The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially. Heres how to claim it even if youve already filed your 2020 tax return.

The latest stimulus includes a federal tax exemption for up to 10200 in unemployment benefits received in 2020. An amended return may be needed in this situation. The 19 trillion American Rescue Plan provides a 300 weekly boost extends pandemic aid until Sept.

The legislation only would affect a federal tax return. The tax treatment of unemployment benefits you receive depends on the type of program. Kiddie Tax and Unemployment States Taxation of Unemployment With the passage of the CARES Act stimulus package early in 2020 the federal government began supplementing the normal state weekly unemployment benefits by adding 600 per week through the end of July 2020.

Ordinarily unemployment benefits are treated as taxable income that recipients must report on their federal and state income tax returns. The recently passed third stimulus relief package known as the American Rescue Plan expands federal unemployment benefits and provides tax free unemployment benefits. If you received unemployment benefits you probably have an bigger tax refund coming your way.

This was added as a compromise to appease factions of the Democratic party who wanted more support for those receiving unemployment benefits coverage while keeping the incentive to return to work. 10200 Of Unemployment Compensation Exempted From Federal Taxes Late in stimulus package negotiations lawmakers included a provision in the 19 trillion American Rescue Plan that exempted the. 6 and offers a new tax waiver on the first 10200 of.

Those receiving unemployment benefits will not need to pay federal income taxes on the first 10200 as long their 2020 adjusted gross income was less than 150000. The various states that tax unemployment compensation would have to make changes to their own tax codes and only if they so desire. Unemployment benefits are considered taxable income but the new law provides a tax break.

The American Rescue Plan Act signed in 3112021 makes the first 10200 of unemployment payments per taxpayer free of federal taxation for households with an annual income under 150000. TurboTax nor any other tax preparation software company can do anything until. Update in stimulus package unemployment not taxable will you notify me when your program is updated so i can amend.

USA Today reports under the latest stimulus package you will not be not taxed on the first. Were reviewing the tax provisions of the American Rescue Plan Act of 2021 signed into law on March 11 2021. The way the exemption works is the first 10200 of unemployment insurance will not be taxable.

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

300 Bonus Unemployment Checks How Many Are Left What You Should Know Cnet

300 Bonus Unemployment Checks How Many Are Left What You Should Know Cnet

Unemployment Recipients May Be Surprised Come April 15 Memphis Local Sports Business Food News Daily Memphian

Most Unemployment Benefits No Longer Taxable Income Tom Copeland S Taking Care Of Business

Most Unemployment Benefits No Longer Taxable Income Tom Copeland S Taking Care Of Business

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

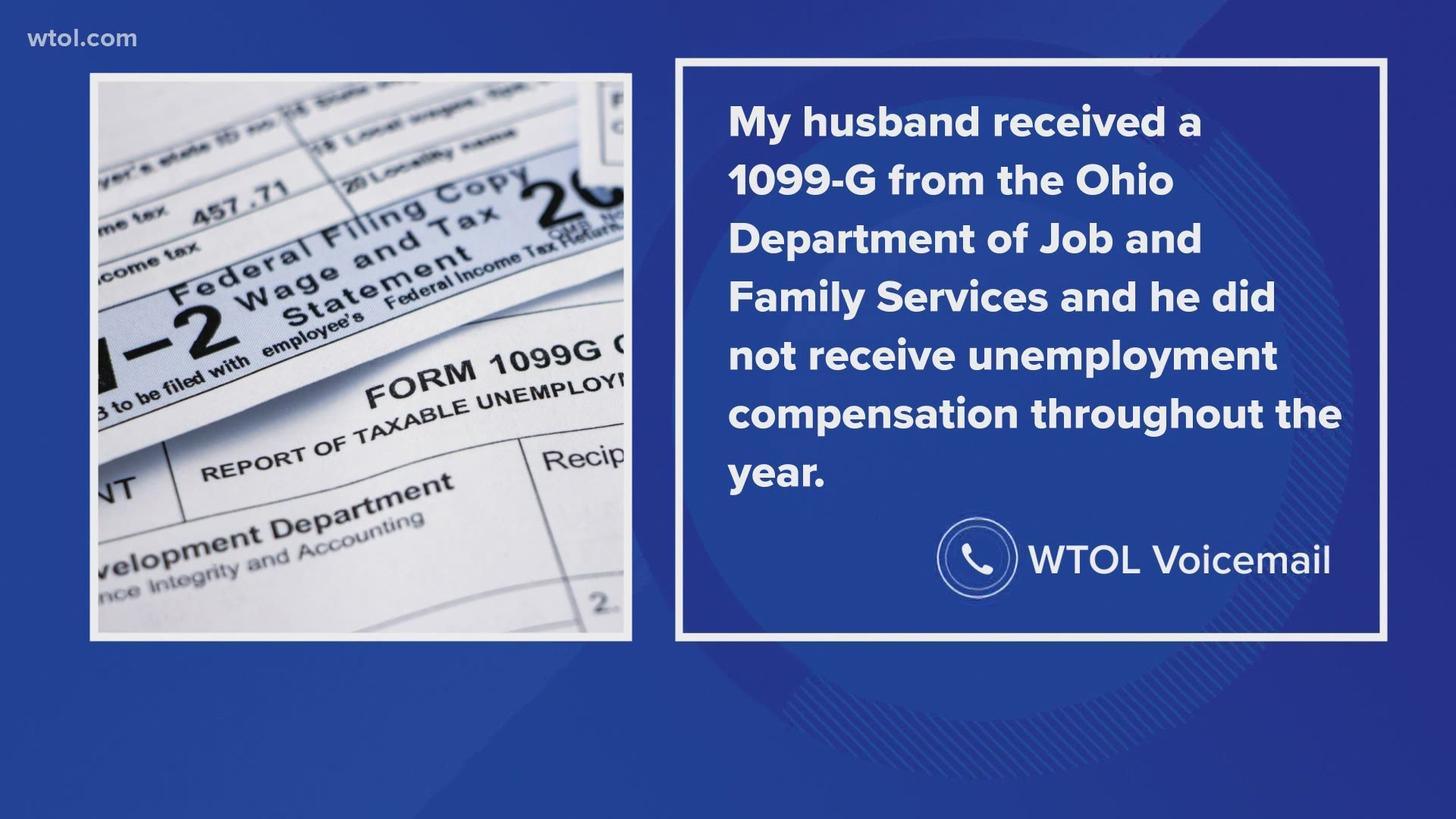

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Everything You Need To Know About The New Coronavirus Stimulus Checks

Everything You Need To Know About The New Coronavirus Stimulus Checks

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

How Do I Apply For Unemployment And Cash In On Supermaker

How Do I Apply For Unemployment And Cash In On Supermaker

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

House Stimulus Package Proposal Pares Federal Unemployment Benefits By 1 600 Keeps Income Thresholds For Full 1 400 Stimulus Check

House Stimulus Package Proposal Pares Federal Unemployment Benefits By 1 600 Keeps Income Thresholds For Full 1 400 Stimulus Check

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

Post a Comment for "Unemployment Not Taxable Under New Stimulus Package"