New Unemployment Not Taxable

New Jersey does not tax unemployment compensation. Individuals should receive a.

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

That provision only applies to tax.

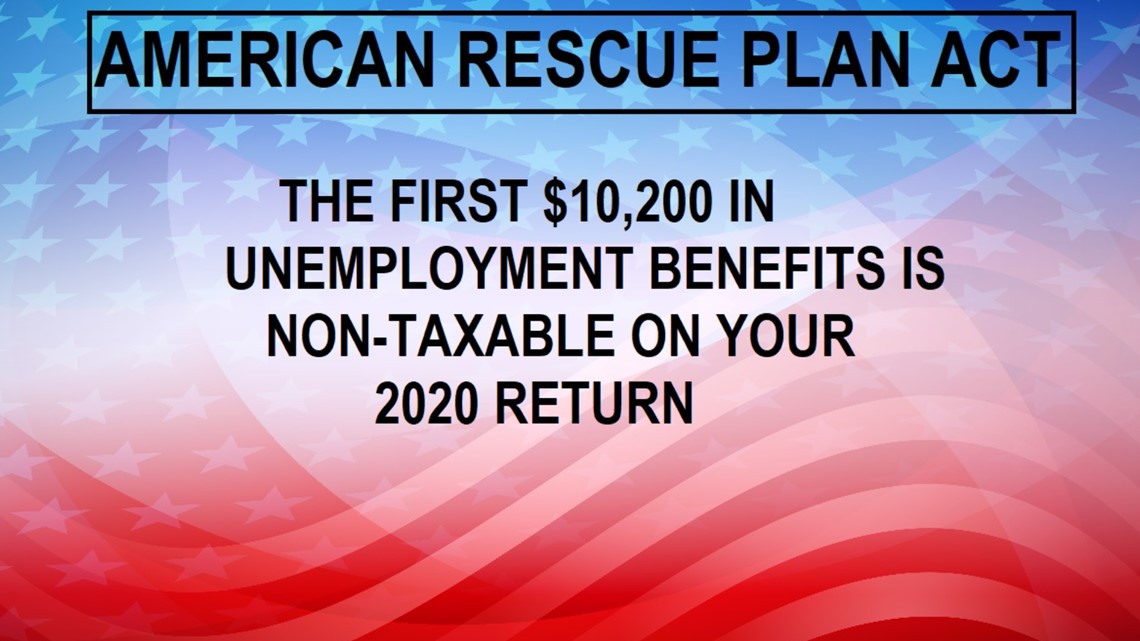

New unemployment not taxable. Households with income of less than 150000 will be able to deduct up to 10200 unemployment benefits from their 2020 income in filing their. May be required to make quarterly estimated tax payments or Can choose to have federal income tax withheld from your unemployment compensation. The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax-free.

However with the new stimulus bill up to 10200 in last years unemployment payments can be exempt from taxes if your adjusted gross. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on. Its also important to keep in mind that not everyone will get a federal tax break on 10200 in unemployment income.

The Cuomo Administration confirmed the decision Wednesday. Up to 10200 in unemployment payments is tax-free. IRS compensation announced means folks will not pay taxes on 10200 worth of unemployment benefits.

2 days agoJobless benefits are taxable income but the 19 trillion American Rescue Plan contained a provision saying the feds would not assess income tax on. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to 10200.

The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income. 2 days agoNew York State will continue to fully tax unemployment benefits despite a federal exemption on the first 10200 received by some workers who lost their jobs last year due to the pandemic. 3 If you filed your taxes before the American Rescue Plan was passed you had to pay taxes on the full amount of your unemployment benefits.

State Taxes on Unemployment Benefits. NYS Budget Director says unemployed New Yorkers still have to pay state taxes on the first 10200 in unemployment benefits collected. 14 on up to 20000 of taxable income.

Many of these may have been first-time filers and unaware that unemployment benefits are taxable income. Amounts over 10200 for each individual are still taxable. If you received unemployment compensation you.

1075 on taxable income. The empire state will still tax peoples 2020 unemployment benefits in full. If you owed money on your taxes this year due to unemployment benefits or are expecting to pay.

State Income Tax Range. If your modified AGI is 150000. Not every state taxes unemployment but now that the federal government says the first 10200 of benefits will be tax free New York is one of the few that hasnt decided whether or not its.

Thanks to the American Rescue Plan which was passed and signed into law in March 2021 the full amount of unemployment benefits are not taxable. 1 day agoWENY - Although the IRS is not taxing the first 10200 of unemployment benefits New York State is not doing the same. Refer to Form W-4V Voluntary Withholding Request and Tax Withholding.

A June 2020 survey by tax preparer Jackson Hewitt.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

File Kra Nil Returns Help The Taxman Identify All Taxpayers That Fall Below The Taxable Income Or Are Unemployed An In 2021 How To Apply Filing Taxes Income Tax Return

File Kra Nil Returns Help The Taxman Identify All Taxpayers That Fall Below The Taxable Income Or Are Unemployed An In 2021 How To Apply Filing Taxes Income Tax Return

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Taxable Or Not Taxable Video Logos Recipes Gaming Logos

Taxable Or Not Taxable Video Logos Recipes Gaming Logos

Taxable Items And Nontaxable Items Chart Income Accounting And Finance Fafsa

Taxable Items And Nontaxable Items Chart Income Accounting And Finance Fafsa

Are Unemployment Benefits Taxed Yes Claim As Income On Taxes

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Business Tax

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Post a Comment for "New Unemployment Not Taxable"