Unemployment Not Taxable Bill

14 on up to 20000 of taxable income. The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly or 10200 for all other.

The American Rescue Plan Act of 2021 has saved the tax season for millions of Americans who received unemployment benefits in 2020.

Unemployment not taxable bill. The way the exemption works is the first 10200 of unemployment insurance will not be taxable. Oregonians who paid taxes on unemployment benefits do not need to file amended returns. Cindy Axne D-Iowa introduced a bill on Tuesday that would waive taxes on the first 10200 in unemployment benefits that individuals received last year.

1075 on taxable income. The American Rescue Plan a 19 trillion Covid relief bill waived federal tax on up to 10200 of jobless benefits per person. 2 days agoA lot of families got a shock when they learned their unemployment benefits were taxable but the new stimulus bill passed recently corrects some concerns.

The legislation excludes only 2020 unemployment benefits from taxes. As Americans file their tax returns for 2020 -- a year riddled with job insecurity -- millions who relied on unemployment insurance during the pandemic will find that up to 10200 of those benefits will be exempt from taxes. Unemployed workers can waive up to 10200 in unemployment benefits received in 2020 from their taxable income.

State Taxes on Unemployment Benefits. Up to 10200 in unemployment payments is tax-free. The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers.

New Jersey does not tax unemployment compensation. 10200 tax break President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in. The law provides 19 trillion of tax and financial relief to businesses and individuals and includes a.

Thanks to the American Rescue Plan which was passed and signed into law in March 2021 the full amount of unemployment benefits are not taxable. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. The proposed bill would waive federal income taxes on the first 10200 of unemployment benefits that Americans received in 2020.

8 hours agoMost people on unemployment last year didnt have state income taxes taken out potentially leaving them with a bill when those taxes come. 3 If you filed your taxes before the American Rescue Plan was passed you had to pay taxes on the full amount of your unemployment benefits. President Biden signed the American Rescue Plan into law on Thursday March 11 2021.

If you are married each spouse receiving unemployment compensation doesnt have to pay tax on. Dick Durbin D-Ill and Rep. If someone received 20000 of benefits in 2020 they will only be taxed on 9800 of it.

State Income Tax Range. If you got unemployment income last year and your state isnt offering a tax break on your first 10200 of benefits you may need to gear up for a tax bill when you file your state income taxes. The State of Oregon and Internal Revenue Service will automatically adjust the tax returns of individuals and families who filed their 2020 returns before the passage of the federal governments most recent coronavirus relief bill and are now owed refunds from income taxes they paid on jobless benefits.

The remaining states partially or fully exclude benefits from tax. The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially. If youve already filed your 2020 tax.

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Business Tax

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Taxes On Unemployment Checks May Surprise Some

Taxes On Unemployment Checks May Surprise Some

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Are Unemployment Benefits Taxed Yes Claim As Income On Taxes

Refunds On Taxed Unemployment Benefits Will Come Later Marketplace

Refunds On Taxed Unemployment Benefits Will Come Later Marketplace

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

Payroll Tax How It Will Affect Every Business Payroll Taxes Payroll Check And Balance

Payroll Tax How It Will Affect Every Business Payroll Taxes Payroll Check And Balance

Weekly Waterfall Evergreen Financial Tips For Students Families And Seniors Ovlg Financial Tips Paying Taxes Financial

Weekly Waterfall Evergreen Financial Tips For Students Families And Seniors Ovlg Financial Tips Paying Taxes Financial

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

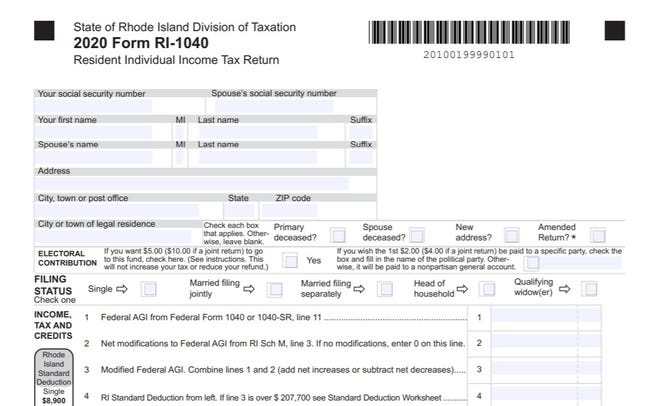

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

2020 Unemployment Benefits Will Be A Factor When Your Taxes Are Due

2020 Unemployment Benefits Will Be A Factor When Your Taxes Are Due

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Post a Comment for "Unemployment Not Taxable Bill"