Are Unemployment Benefits Taxable In Hawaii

This is not. The form includes the amount of benefits paid and other information to meet Federal State and personal income tax needs for the tax year.

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

The impact is worse in.

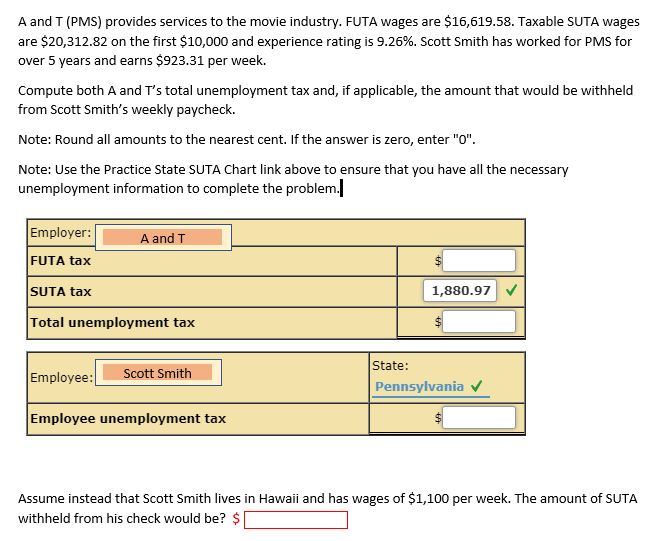

Are unemployment benefits taxable in hawaii. As of Monday 13 arent excluding unemployment compensation from taxes according to data from tax preparer HR Block. Your unemployment benefit is not free money it is fully taxed. 1099-G forms are automatically generated for all individuals where an unemployment compensation payment was made.

Keep in mind that UI is a benefit. GENERAL EXCISE TAX TREATMENT Under existing law unemployment compensation paid to employees and the receipt of. You can take the tax break if you have an adjusted gross.

You will be taxed at the regular rate for. Form 1099-G for calendar year 2020 is scheduled for mailing on or about January 27 2021 to all who received unemployment insurance and pandemic unemployment insurance benefits in 2020. PPP loans are subject to Hawaii income tax.

How do I know if my unemployment income is taxable in Hawaii. If your small business has employees working in Hawaii youll need to pay Hawaii unemployment insurance UI tax. Tax Expectations For Web Based Platforms June 10 2020 DLIR determinations for employees of Uber Lyft Bite Squad Door Dash Rover Instacart Delivery Drivers and Grub Hub relating to Unemployment Insurance and PUA benefits are independent from DOTAX tax requirements and classifications.

Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from. You have a few options. Congress passed the American Rescue Plan in March 2021 which makes the first 10200 of unemployment compensation per spouse non-taxable on your federal return.

An individual employees wages in excess of the tax base are not taxable. What the American Rescue Plan does is exempt the first 10200 of federal unemployment benefits from your taxable income. Calendar Year 2021 2020 2019 2018 2017 2016 Contribution Rate Schedule D C C C C C Taxable Wage Base per employee 47400 48100 46800 45900 44000 42200 Tax Rate for New Employers 300 240 240 240 240 240 Maximum Tax Rate 580 560 560 560 560 560 Employment and Training Assessment ET Rate 001.

HONOLULU Hawaii HawaiiNewsNow - Tens of thousands of Hawaii residents have turned to unemployment benefits amid the pandemic to help keep them afloat. The UI tax funds unemployment compensation programs for eligible employees. If you received a 1099-G and did NOT file a claim for unemployment benefits complete the Declaration of Identity Theft form attach a copy of the 1099-G and any other documentation showing that a fraudulent claim for unemployment.

However Hawaii cant adopt the federal exclusion of unemployment income unless they pass a new law. You will be taxed at the regular rate for any federal unemployment benefits above 10200. However the Department of Taxation intends to recommend to the Hawaii State Legislature that Hawaii conform to the federal treatment of PPP loan forgiveness.

Individuals receiving the assistance will be subject to Hawaii income tax as if the tenant paid rent and the mortgagor made the payment in the ordinary course of business. What the American Rescue Plan does is exempt the first 10200 of federal unemployment benefits from your taxable income. Without an exemption someone who received 10200 in unemployment compensation as part of their taxable income would be forced to pay an incremental 653 in state taxes.

The 1099-G information will be available for viewing on or. Colorado Georgia Hawaii Idaho Kentucky Massachusetts. In Hawaii state UI tax is just one of several taxes that employers must pay.

The website I linked to above has the following message. Im trying to file my tax return for 2020 part of which I was unemployed and receiving PUA benefits and I never received a form 1099-G from the state. Form 1099-G for unemployment benefits.

The Hawaii State UI Division tax withholding ID is WH-093-185-7408-01. The government treats unemployment benefits as wages. First-time filers may not know however.

New York will continue to apply state income tax to 2020 unemployment benefits in full despite the federal government exempting the first 10200. In regards to taxes unemployment benefits are generally treated as income. The tax base is equal to the States average annual wages of employers contributing to the unemployment trust fund and is computed at the beginning of each calendar year.

GENERAL EXCISE TAX TREATMENT Under existing law unemployment compensation paid to employees and the receipt of loan.

A And T Pms Provides Services To The Movie Indus Chegg Com

A And T Pms Provides Services To The Movie Indus Chegg Com

2020 Taxes Everything You Need To Know About Filing This Year Honolulu Hawaii News Sports Amp Weather Kitv Channel 4

2020 Taxes Everything You Need To Know About Filing This Year Honolulu Hawaii News Sports Amp Weather Kitv Channel 4

Https Labor Hawaii Gov Wdc Files 2018 12 Ui Benefits Handbook Uc 266 Pdf

![]() Employer S Guide To The Coronavirus

Employer S Guide To The Coronavirus

Hirenet Hawaii Ui Claimants Registration For Work Search And Online Resume In Hirenet

Hirenet Hawaii Ui Claimants Registration For Work Search And Online Resume In Hirenet

All About The Extended Unemployment Benefits In Hawaii

All About The Extended Unemployment Benefits In Hawaii

Https Labor Hawaii Gov Wdc Files 2018 12 Ui Information Sheet For Ex Service Persons Ucx Pdf

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

Top 3 Tax Tips For Unemployment Benefits

Top 3 Tax Tips For Unemployment Benefits

Hawaii Employers Council Dlir Unemployment Insurance Tax Rate Schedule And Weekly Benefit Amount

Hawaii Employers Council Dlir Unemployment Insurance Tax Rate Schedule And Weekly Benefit Amount

How Unemployment Can Affect Your Tax Return

How Unemployment Can Affect Your Tax Return

Hawaii Unemployment Benefit Questions Fileunemployment Org

Hawaii Unemployment Benefit Questions Fileunemployment Org

Https Www Capitol Hawaii Gov Committeefiles Special Scovid Instructions 20for 20filing 20unemployment 20insurance 20online Pdf

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

Should You Vote Yes Or No On Property Tax Measure Hawaii Business Magazine

Hawaii Employers Council 2020 Ui Tax Rate Schedule And Weekly Benefit Amount Published

Hawaii Employers Council 2020 Ui Tax Rate Schedule And Weekly Benefit Amount Published

Department Of Labor And Industrial Relations Covid 19 Post Filing Information

Department Of Labor And Industrial Relations Covid 19 Post Filing Information

State Unemployment Tax Slated To Automatically Triple In 2021 Grassroot Institute Of Hawaii

State Unemployment Tax Slated To Automatically Triple In 2021 Grassroot Institute Of Hawaii

Post a Comment for "Are Unemployment Benefits Taxable In Hawaii"