Unemployment Tax Rate Hawaii

The state UI tax rate for new employers changes from one year to the next. Hawaii employers are required to file quarterly unemployment insurance tax reports on the new and interactive Employer Website.

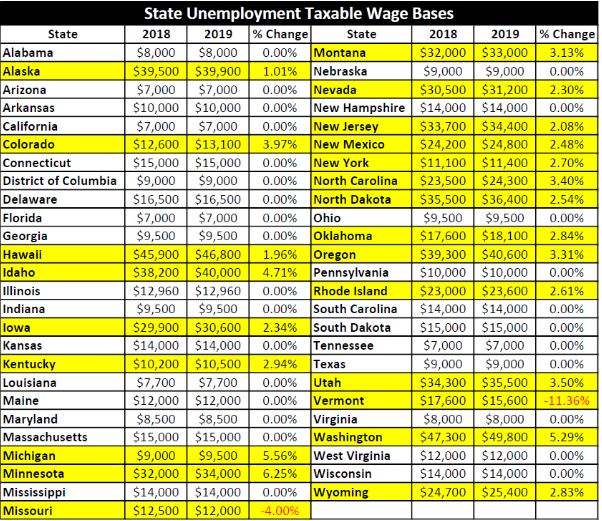

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

Hawaiis unemployment tax rates are to be revised to prevent a sharp increase for 2021 under a bill signed March 2 by Gov.

Unemployment tax rate hawaii. To be eligible for experience rating the account must have been chargeable with benefits for the 12-month period prior to the rate computations date December 31. Under the measure HB. State Announces Reduction in Unemployment Taxes for 2015Improved Rates Projected to Save Employers 50 Million HONOLULU The Hawaii State Department of Labor and Industrial Relations DLIR today announced that Unemployment Insurance contribution rates for 2015 will be reduced 22 percent on average resulting in employers paying 50 million less in taxes or 100 less per.

An excluded corporation no longer qualifies for a 54 FUTA tax credit afforded to employers covered under the Hawaii Employment Security Law. Most recently it generally has been somewhere between 30 and 46. In April the unemployment rate spiked to 238 and in just months the trust fund balance sank to near-zero as a flood of workers applied for benefits.

New York and Minnesota have top rates of 882 and 985 respectively. This rate calculator is intended solely for estimation purposes only. Employment and Training Assessment ET Rate.

Hawaiis unemployment insurance trust fund had a balance of about 500 million before March 2020. The state began borrowing from the federal government to replenish the fund in June. 1278 unemployment tax rates are to be determined with Schedule D and are to range from 02 to 58.

Federal Pandemic Unemployment Compensation FPUC The American Rescue Plan Act of 2021 ARPA extended the 300 plus-up for qualified weekly benefit payments until the week ending September 4 2021. To receive the 300 plus-up please continue to file your weekly claim certifications. MURAKAMI DIRECTOR FOR IMMEDIATE RELEASE July 16 2020 HAWAIIS UNEMPLOYMENT RATE AT 139 PERCENT IN JUNE Jobs declined by 94700 over-the-year HONOLULU The Hawaii State Department of Labor.

You will be taxed at the regular rate for any federal unemployment benefits above 10200. 45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. Starting in 2021 Proposition 208 approved by.

Employment Training Assessment Rate. IGE GOVERNOR SCOTT T. As a result the excluded corporations FUTA rate will be 62 as opposed to the covered corporate rate of8 the first 700000 for each of the 2 employees.

Still the Grassroot Institute of Hawaii anticipates that Hawaiis yearly unemployment tax on businesses is set to automatically triple in 2021 to an average of 365 or 1757 per employee up. Tax rates for experienced employers are to range from 240 to 520 for positive-rated employers and from 540 to 660 for negative-rated employers. In 2020 Schedule C which has the third-lowest range of rates out of the states eight.

You can take the tax break if you have an adjusted gross income of less than 150000. In April the unemployment rate spiked to 238 and. Over the last ten years it has fluctuated up and down.

Your actual rate will be determined in mid-March and a Contribution Rate Notice will be mailed. Hawaiis unemployment tax rates for 2021 are to be determined with the states highest unemployment tax rate schedule Schedule H. Established employers are subject to a lower or higher rate than new employers depending on an experience rating.

Hawaii for example has a top tax rate of 11. Filing your quarterly wage reports online saves taxpayer dollars and results in greater accuracy when calculating taxes due. Hawaiis Unemployment Rate at 139 in June DEPARTMENT OF LABOR AND INDUSTRIAL RELATIONS DAVID Y.

Hawaiis unemployment insurance trust fund had a balance of about 500 million before March 2020. However a lower marginal tax rate would likely apply to. Tax Expectations For Web Based Platforms June 10 2020 DLIR determinations for employees of Uber Lyft Bite Squad Door Dash Rover Instacart Delivery Drivers and Grub Hub relating to Unemployment Insurance and PUA benefits are independent from DOTAX tax requirements and classifications.

Hawaii Senate Approves Nation S Highest Income Tax Honolulu Star Advertiser

Hawaii Senate Approves Nation S Highest Income Tax Honolulu Star Advertiser

State Unemployment Tax Slated To Automatically Triple In 2021 Grassroot Institute Of Hawaii

State Unemployment Tax Slated To Automatically Triple In 2021 Grassroot Institute Of Hawaii

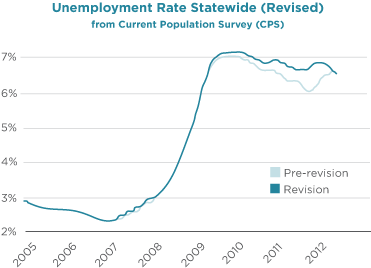

Hawaii S Unemployment Rate Revised Up For 2009 2011 Uhero

Hawaii S Unemployment Rate Revised Up For 2009 2011 Uhero

Hawaii State Unemployment Tax Rate 2017 Rating Walls

Hawaii State Unemployment Tax Rate 2017 Rating Walls

Department Of Labor And Industrial Relations State Provides Unemployment Insurance Assistance Benefits Update On Covid 19 Relief Bill Cares Act Extensions

Department Of Labor And Industrial Relations State Provides Unemployment Insurance Assistance Benefits Update On Covid 19 Relief Bill Cares Act Extensions

New Law Cuts Unemployment Insurance Tax Rates West Hawaii Today

New Law Cuts Unemployment Insurance Tax Rates West Hawaii Today

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Hawaii State Unemployment Tax Rate 2018 Rating Walls

Hawaii State Unemployment Tax Rate 2018 Rating Walls

Hawaii Governor David Ige Signs Unemployment Tax Bill Saving Employers Thousands Pacific Business News

Hawaii Governor David Ige Signs Unemployment Tax Bill Saving Employers Thousands Pacific Business News

Hawaii Employers Council 2020 Ui Tax Rate Schedule And Weekly Benefit Amount Published

Hawaii Employers Council 2020 Ui Tax Rate Schedule And Weekly Benefit Amount Published

Hawaii State Unemployment Tax Rate 2017 Rating Walls

Hawaii State Unemployment Tax Rate 2017 Rating Walls

Hawaii Governor David Ige Signs Unemployment Tax Bill Saving Employers Thousands Pacific Business News

Hawaii Governor David Ige Signs Unemployment Tax Bill Saving Employers Thousands Pacific Business News

Post a Comment for "Unemployment Tax Rate Hawaii"