Can I Get My W2 From Unemployment Online

Yes but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return. Fortunately many people can get their W2 online and they can simply import it into their tax returns.

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

This form does not include unemployment compensation.

Can i get my w2 from unemployment online. Various companies provide it online even the military Walmart and McDonalds. Employers have until January 31 to mail W-2s to their employees. Todays the first day you can file for your tax refund and experts say you should file early.

If you received unemployment compensation in 2020 including any income taxes withheld visit the New York State Department of Labors website for Form 1099-G. The W-2 forms typically get there by the end of January but there is a way to get a free copy of your W2 online faster than in the. But tax time is also causing some trouble.

You have to get it yourself. New York State and the IRS recommend you contact your employer to request your W-2. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am.

You can get a wage and income transcript containing the Federal tax information your employer reported to the Social Security Administration SSA by visiting our Get Transcript page. Your local unemployment office may be able to supply these numbers by phone if you cant access the form online. 1099-G Fraud If you received a 1099-G form and did not file a UI claim yourself or your employer did not file one on your behalf you may be the victim of UI fraud.

Call your local unemployment office to request a copy of your 1099-G by mail or fax. To view and print your current or. Starting in January every year companies mail out W2s to their employees by January 31st the due date set by the IRS.

The Tax Department issues New York State Form 1099-G. The W2 online distribution process has been simplified and automated by third-party companies. Filing taxes is much easier when you have all the forms you need in front of you.

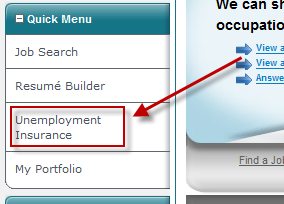

You should wait until mid-February to receive your W-2 before requesting a copy from your employer. If you received unemployment compensation you. Usually you need to go to the states unemployment web site to get it and print it out.

Using the Search feature in the upper right corner of the screen enter unemployment compensation and perform the search. Any unemployment benefits you collected box 2 Any unemployment benefits you repaid in calendar year 2020 box 3 If you received a 1099G form and you did not file for or collect unemployment benefits please report this to us immediately this may mean you are a victim of identity theftWe will investigate if we find you are a victim of ID theft we will reissue the 1099G as soon as possible. Then click on the Jump to link which is the first item in the search results.

Many states now offer online access to 1099-G forms which is a big help when its time to file but you never received the form. Then you will be able to file a complete and accurate tax return. NOTE that pursuant to the IRS webpage the following now applies to your federal taxes.

Although some states will enable you to download your unemployment W2 form and the 1099-G form that is also required you should be aware that downloading the necessary documentation online isnt always possibleDepending on how advanced your states online infrastructure is youll either receive a private message with the forms you need to fill in or there will be a section on the website. Unemployment benefits including Federal Pandemic Unemployment Compensation FPUC Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Lost Wages Assistance LWA and Extended Benefits EB are taxable income. If you received unemployment benefits.

You can access your Form 1099G information in your UI Online SM account. We will mail you a paper Form 1099G if you. Can choose to have federal income tax withheld from your unemployment compensation.

You get a 1099G and no TurboTax cannot get it for you. If you received unemployment your tax statement is called form 1099-G not form W-2. If you havent received your 1099-G copy in the mail by Jan.

This is also the number for our collections unit. Incomplete or inaccurate information on your return may cause a delay in processing. 31 there is a chance your copy was lost in transit.

If there is a problem with your PIN you can also access your form by selecting IRS Form 1099-G for UI Payments then enter other credentials. On the Unemployment and Paid Family Leave screen answer Yes and click Continue. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment.

Refer to Form W-4V Voluntary Withholding Request and Tax Withholding. Iaf44 You do not get a W-2 for unemployment benefits. To enter it on your tax return go to FederalWages IncomeUnemployment Government benefits on Form 1099G.

May be required to make quarterly estimated tax payments or. Many of you who are collecting unemployment for the first. Pacific time except on state holidays.

Select option 5 for questions about 1099-G forms. How to Pay Taxes for Unemployment Compensation. Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year.

Your local office will be able to send a replacement copy in the mail.

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

New Mexico Department Of Workforce Solutions Unemployment Unemployment For An Individual Unemployment Tax Forms 1099

New Mexico Department Of Workforce Solutions Unemployment Unemployment For An Individual Unemployment Tax Forms 1099

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Ky Unemployment W2 Forms Vincegray2014

Ky Unemployment W2 Forms Vincegray2014

Ky Unemployment W2 Forms Vincegray2014

Ky Unemployment W2 Forms Vincegray2014

Ky Unemployment W2 Forms Vincegray2014

Ky Unemployment W2 Forms Vincegray2014

Missouri Unemployment W2 Forms Vincegray2014

Missouri Unemployment W2 Forms Vincegray2014

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Out Of Work In Ri Due To Covid 19 Here S What You Re Eligible For Wpri Com

Out Of Work In Ri Due To Covid 19 Here S What You Re Eligible For Wpri Com

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Indiana Unemployment W2 Forms Vincegray2014

Indiana Unemployment W2 Forms Vincegray2014

Unemployment Guides Archives Fileunemployment Org

Unemployment Guides Archives Fileunemployment Org

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Ky Unemployment W2 Forms Vincegray2014

Ky Unemployment W2 Forms Vincegray2014

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Post a Comment for "Can I Get My W2 From Unemployment Online"