What Income Is Subject To Kiddie Tax

If your childs interest dividends and other unearned income total more than 2200 and you dont or cant use Form 8814 to include your childs income on your. He will not have to file form 8615 Scholarships are a hybrid between earned and unearned income.

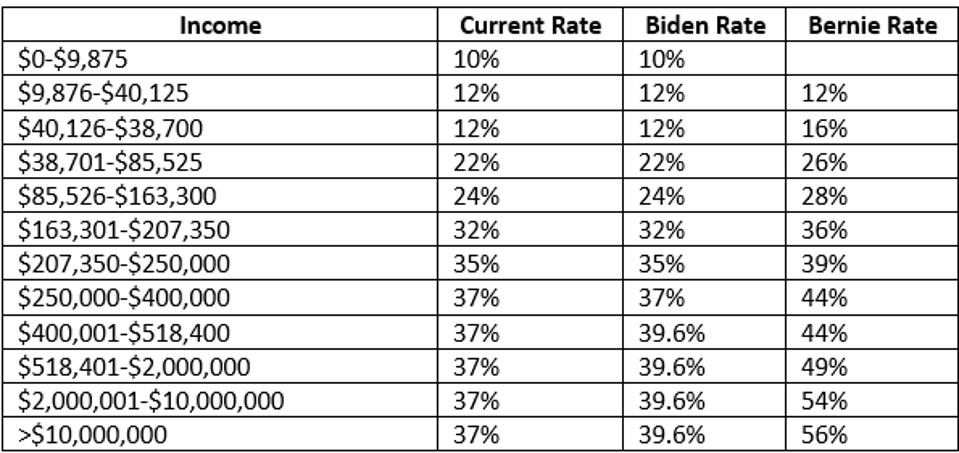

Year End Tax Planning For Biden Tax Plan

Year End Tax Planning For Biden Tax Plan

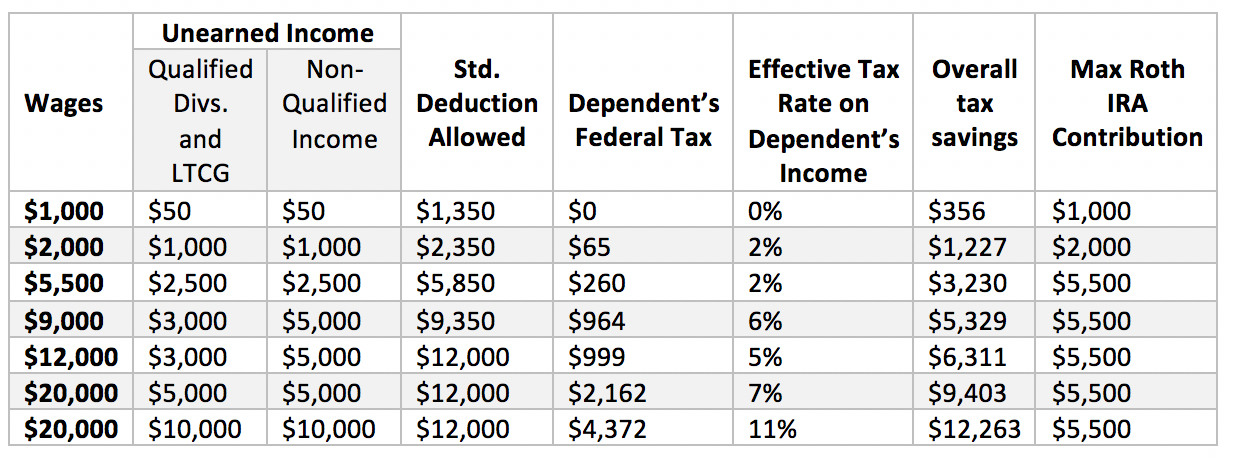

Childs Net Earned Income Childs Net Unearned Income Childs Standard Deduction Childs Taxable Income.

What income is subject to kiddie tax. 2200 for 2019 and 2020 is. However for purposes of calculating the students standard deduction the scholarship amount over 32000 is treated as earned income. The Kiddie Tax is the tax levied on the portion of your childs unearned income that exceeds 2200.

The tax on unearned income of children known as the kiddie tax applies when the child has unearned income of more than 2200 for 2020 and all the following apply. Children who are subject to the kiddie tax. The income is reported on Form 8814.

Any salary or wages the child earns is. A kiddie tax as it is better known is imposed on a childs investment income above an exemption amount which was 2100 in 2018 and is 2200 in 2019. As you said that did not happen with 3800 of income so the Kiddie Tax applies.

It is not earned income for other purposes. The kiddie tax is tax on a childs unearned income. Yes Eloise will be subject to the kiddie tax because of her unemployment compensation.

The so-called kiddie tax is designed to prevent parents or other relatives from shifting investment income to a child in a lower tax bracket. A non-dependent may still be required to pay Kiddie Tax. At the end of the tax year the child was.

Since its enactment as part of the Tax Reform Act of 1986 the kiddie tax rules traditionally tied the tax on a childs unearned income to the tax rates of the child. Yes I have been told 30000 is a lot but university housing is extremely expensive I was always told I would pay some tax on my scholarship and I withheld for unemployment but upon entering my info to TurboTax I was made aware of the Kiddie Tax. The first 1100 of a childs unearned income is tax-free and the next 1100 is subject to the childs tax rate.

He will not be subject to the kiddie tax. Because the scholarship exceeds 32000 the student will have unearned income for the amount received in excess of 32000 that is subject to the kiddie tax. The portion of taxable income that consists of net unearned income and that exceeds the unearned income threshold 2100 for 2018.

If the childs unearned income exceeds 2200 then he or she is subject to the kiddie tax says Michael Trank a. Children who only had earned income from a job or self-employment dont make enough money to be required to file or are filing jointly with their spouses are. My total unearned income as far as I know would be 36000.

The tax law allows parents of children younger than 19 or younger than 24 and a full-time student with income between 1050 and 10500 consisting only of interest and dividends including capital gains distributions to elect to include the childs income on their return. Interest dividends capital gains rent and royalties. The kiddie tax includes unearned income a child receives.

How much is the kiddie tax. The Kiddie Tax is not based on being a dependent but on the rules that you have pointed out. I only have 700 in earned income.

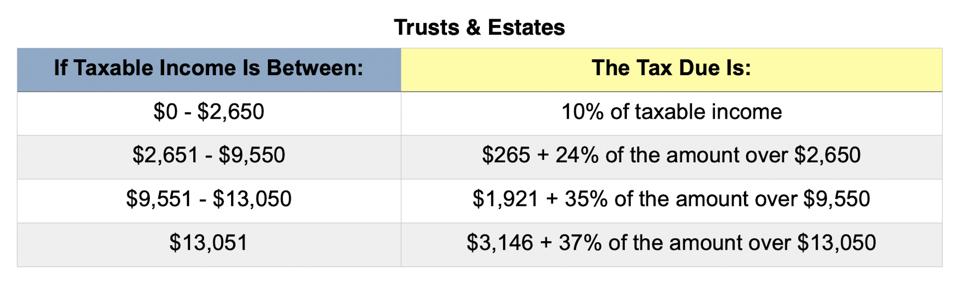

It means that if your child has unearned income more than 2200 some of it will be taxed at estate and trust tax rates for tax years 2018 and 2019 or at the parents highest marginal tax rate beginning in 2020. To calculate the Kiddie Tax first determine the childs taxable income. It is earned income for purposes of the 12400 filing requirement and the dependent standard deduction calculation earned income 350 and the kiddie tax.

The Kiddie Tax applies unless the child provides over 12 of their support with EARNED income. 5 rows A child who turns 20 or 24 by the end of the tax year is not subject to the kiddie tax. This higher tax rate will apply to unearned income including investments and unemployment compensation but normal income tax rates will apply to income earned from.

A child who receives unemployment compensation may be subject to the kiddie tax and as a result may pay substantially higher tax than an adult receiving the same compensation. Kiddie tax rules apply to unearned income that belongs to a child.

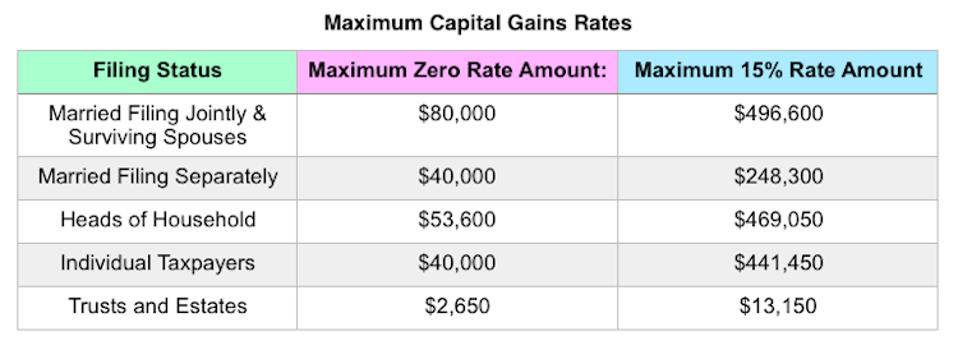

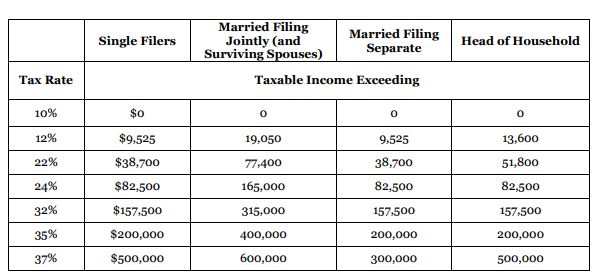

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Taxes From A To Z 2019 K Is For Kiddie Tax

Taxes From A To Z 2019 K Is For Kiddie Tax

Tax Rules For Children Moran Wealth Management

Tax Rules For Children Moran Wealth Management

The Kiddie Tax Is Now Easier To Calculate But More Expensive For Some Children Marketwatch

The Kiddie Tax Is Now Easier To Calculate But More Expensive For Some Children Marketwatch

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Tax Cuts And Jobs Act Makes Sweeping Changes To Estate Gift Gst And Income Tax Lexology

Tax Cuts And Jobs Act Makes Sweeping Changes To Estate Gift Gst And Income Tax Lexology

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Does A Dependent Child Have To File A 2020 Federal Tax Return

Does A Dependent Child Have To File A 2020 Federal Tax Return

The Mystockoptions Blog Tax Planning

4 Ways The Kiddie Tax Can Work For You And Your Family The Colony Group

4 Ways The Kiddie Tax Can Work For You And Your Family The Colony Group

First World Problems And The Kiddie Tax Penobscot Financial Advisors

First World Problems And The Kiddie Tax Penobscot Financial Advisors

The Kiddie Tax Hurts Families More Than Ever

The Kiddie Tax Hurts Families More Than Ever

What Is The Kiddie Tax And Who Pays It Credit Karma Tax

What Is The Kiddie Tax And Who Pays It Credit Karma Tax

Kiddie Tax On Unearned Income H R Block

Kiddie Tax On Unearned Income H R Block

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

Gaming Revenues Distributed To Indian Tribe Members Aren T Earned Income In Chief Counsel Advice The Irs Held That F Federal Income Tax Tax Rules Income Tax

Gaming Revenues Distributed To Indian Tribe Members Aren T Earned Income In Chief Counsel Advice The Irs Held That F Federal Income Tax Tax Rules Income Tax

2020 Year End Tax Planning For Individuals

The Kiddie Tax Changes Again Putnam Investments

The Kiddie Tax Changes Again Putnam Investments

J K Lasser S Your Income Tax 2020 For Preparing Your 2019 Tax Return By J K Lasser Institute Paperback Barnes Noble

Post a Comment for "What Income Is Subject To Kiddie Tax"