Do I Need To Report Income Less Than 600

In other words if. Yes if you are required to file a tax return you have to report ALL income whatever the amount including self-employment income under 600.

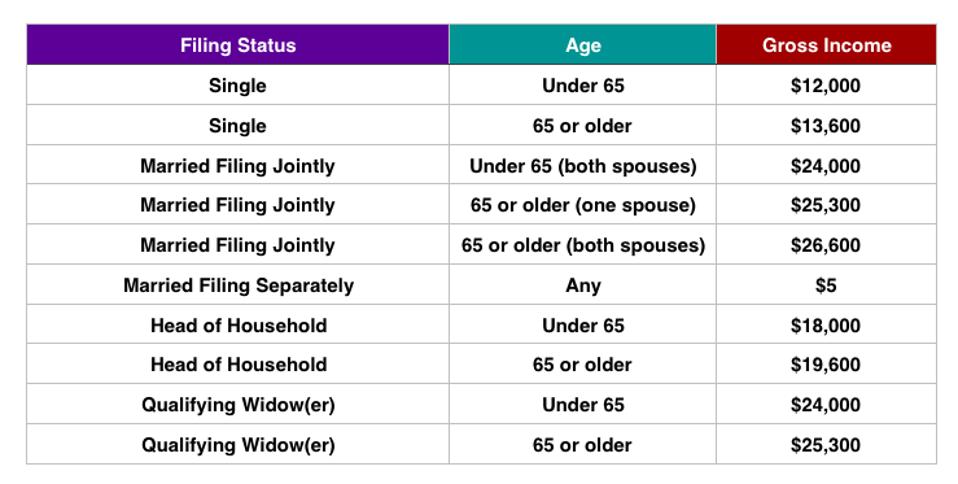

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

In this case youre required to make an effort to get the form.

Do i need to report income less than 600. When you earn money from side jobs like babysitting mowing lawns shoveling snow and tutoring t he IRS considers you self-employed even though you probably dont think of yourself that way. Beginning with Tax Year 2020 you must use Form 1099-NEC Nonemployee Compensation to report payments of nonemployee compensation NEC previously reported in box 7 on Form 1099-MISC. If youve earned less than that the paying company doesnt need to send out the form.

If those earnings are all the taxable income you had for the year you wouldnt need to file a tax return at all. The official IRS tax document that will be sent to drivers who made more than 20000 in annual payments or provided at least 200 rides andor deliveries for passengers or deliveries. Also does the same go for a holding.

Now lets consider the possibility that you earned more than 600 but still didnt get your Form 1099. Reporting Earnings Under 600 Sure it can be tempting. The official IRS tax document that only applies to driversdeliverers who received more than 600 in annual cash payments.

The employer usually must issue you a W-2 for any earnings even if you worked only one day and your income was negligible. Its included in taxable income whether a 1099-MISC was issued or not. This is a common misconception for many beginner freelancers or independent contractors that can get you into a lot of trouble with the IRS.

The 600 threshold is not related to whether you have to pay taxes. Its only that Doordash isnt required to send you a 1099 form if you made less than 600. It cuts some of your taxes.

Self-employed taxpayers and those who work as independent contractors typically report their miscellaneous income on Schedule C of IRS Form 1040. According to the law a Form 1099 should only be issued for amounts of 600 or more. If you had earnings from other g.

You are required to report and pay taxes on any income you receive. Income is income no matter the amount. Usually if you have not made the minimum income for the year you dont have to file taxes.

If he withheld any Social Security Medicare or income tax from your pay he must report. If you have other income or are filing a return regardless of your income level then yes you must claim all income. Taxpayers are required to report all income they make throughout the tax year regardless of the amount or whether they receive a form for it.

This rule is for companies and payors who hire nonemployees only. A friend of mine told me if your capital gain is less than 600 you dont have to report it but if its a loss than you should. For example a Form W-2 must be filed for each election worker who received payments of less than 600.

If the income was from self-employment or as an independent contractor received cash no taxes withheld sometimes reported on Form 1099-MISC but not required if under 600 then you need. There are a few exceptions like if you owe an early withdrawal penalty for an IRA or any other special taxes or if you earned more than 400 in self-employment income. You made payments to the payee of at least 600 during the year.

Note that the 600 is a threshold below which a payer is not required to issue a form 1099-MISC but the recipient of. If you were paid less than 600 for your services an amount that doesnt trigger a 1099-MISC youre still responsible for reporting the income. How do I report that income.

I dont have a 1099 because I made less than 600 as an independent contractor. The 600 rule often gives payees the wrong impression that they dont have to report their own 1099 earnings if they make less than 600. The taxpayer who receives the income is required to report the income regardless of the amount even if the amount is less than 600.

The reason that this gets confusing for individual taxpayers is that the threshold for required reporting from the payor is 600. Form 1099-MISC is required to be issued to independent contractors or the self-employed who have been paid 600 or more. If that was your only income and you were a Form W-2 employee then no you would not be required to file.

IF I had a job that i made LESS THAN 600 DO I HAVE TO claim that. If you work for someone as an employee the 600 rule doesnt apply. You are not required to file if your total SE self-employment income is less than 600 and that is all the income you have to report.

While it is true that companies paying independent or self-employed contractors are not required to supply them with a 1099-NEC for jobs less than 600 this has no bearing on whether you report this income to the IRS. According to the IRS it is a widespread misconception that wages under 600 arent taxed or do not have to be reported. If an election workers compensation is subject to withholding of FICA tax reporting is required by Section 6051 a regardless of the amount of compensation.

Contractor Vs Employee Risks And Rewards Infographic Via Wunderland Group Employee Infographic Independent Contractor Contractors

Contractor Vs Employee Risks And Rewards Infographic Via Wunderland Group Employee Infographic Independent Contractor Contractors

Do I Need To File A Tax Return 1040 Com Filing Taxes Tax Guide Social Security Benefits

Do I Need To File A Tax Return 1040 Com Filing Taxes Tax Guide Social Security Benefits

Transition From An Employee To 1099 Contractor Process Printing Business Cards Employer Identification Number Irs Forms

Transition From An Employee To 1099 Contractor Process Printing Business Cards Employer Identification Number Irs Forms

Do You Need To File A Tax Return In 2016 Tax Return Filing Taxes Married Filing Separately

Do You Need To File A Tax Return In 2016 Tax Return Filing Taxes Married Filing Separately

What Is A 1099 Misc And How Does It Work The Korean Accountant What Is A 1099 Business Content Does It Work

What Is A 1099 Misc And How Does It Work The Korean Accountant What Is A 1099 Business Content Does It Work

What Is The Fair Credit Reporting Act Know Your Rights Credit Repair Fair Credit Check Credit Score

What Is The Fair Credit Reporting Act Know Your Rights Credit Repair Fair Credit Check Credit Score

Want To Get Rid Of Your Credit Card Debt Fast And Save The Option That Best Suits You Depends On Your O Paying Off Credit Cards Credit Score Credit Cards Debt

Want To Get Rid Of Your Credit Card Debt Fast And Save The Option That Best Suits You Depends On Your O Paying Off Credit Cards Credit Score Credit Cards Debt

Taxes For Freelancers For All The Visual Learners Out There This Board Is For You We Ve Condensed Complicated Tax Topics Diy Taxes Tax Guide Filing Taxes

Taxes For Freelancers For All The Visual Learners Out There This Board Is For You We Ve Condensed Complicated Tax Topics Diy Taxes Tax Guide Filing Taxes

15 Challenges To Save To Save Between 600 To 13780 In Less Than A Year Eagle Millionaire Money Saving Strategies Need Money Money Saving Mom

15 Challenges To Save To Save Between 600 To 13780 In Less Than A Year Eagle Millionaire Money Saving Strategies Need Money Money Saving Mom

Tax Myth I Don T Report Income Under 600 Business Tax Small Business Tax Income

Tax Myth I Don T Report Income Under 600 Business Tax Small Business Tax Income

Credit Repair Mastery Class Credit Repair Waco Tx The Easy Section 609 Credit Repair Secret Pdf Annual Credit Report Credit Repair Credit Repair Business

Credit Repair Mastery Class Credit Repair Waco Tx The Easy Section 609 Credit Repair Secret Pdf Annual Credit Report Credit Repair Credit Repair Business

Get A Free Copy Of Your Credit Report And Identify What S Impacting Your Purchasing Power Learn How You Can Fix Credit Repair Credit Score Check Credit Score

Get A Free Copy Of Your Credit Report And Identify What S Impacting Your Purchasing Power Learn How You Can Fix Credit Repair Credit Score Check Credit Score

Do You Have To File A 1099 Under 600

Do You Have To File A 1099 Under 600

Do You Have To File A 1099 Under 600

Do You Have To File A 1099 Under 600

1099 Tax Return Contractors Small Business Freelancer Bookkeeping Business Business Tax Small Business Bookkeeping

1099 Tax Return Contractors Small Business Freelancer Bookkeeping Business Business Tax Small Business Bookkeeping

Filing An Eu Flight Delay Claim Was Easier Than I Thought Travel Fun Travel Tips Budgeting Money

Filing An Eu Flight Delay Claim Was Easier Than I Thought Travel Fun Travel Tips Budgeting Money

How Do I Include Irs 1099 Information Return Income On My Tax Return Tax Return Income Tax Return 1099 Tax Form

How Do I Include Irs 1099 Information Return Income On My Tax Return Tax Return Income Tax Return 1099 Tax Form

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

How Much Money Do You Have To Make To File Taxes 2015 Tax Return Fotografcilik

How Much Money Do You Have To Make To File Taxes 2015 Tax Return Fotografcilik

Post a Comment for "Do I Need To Report Income Less Than 600"