Is Unemployment Income Taxable In Hawaii

Colorado Georgia Hawaii Idaho Kentucky Massachusetts. HONOLULU Hawaii HawaiiNewsNow - Tens of thousands of Hawaii residents have turned to unemployment benefits amid the pandemic to help keep them afloat.

Hawaii Remote Work Resources Virtual Vocations

Hawaii Remote Work Resources Virtual Vocations

Congress passed the American Rescue Plan in March 2021 which makes the first 10200 of unemployment compensation per spouse non-taxable on your federal return.

Is unemployment income taxable in hawaii. By the end of 2020 it was 93. Please see Tax Facts 2019-3 Estimated Income Tax for Individuals Tax Facts 2020-01 Estimated Income Tax for Corporations S Corporations and section 18-235-97c Hawaii Administrative Rules HAR which lays out the method for calculating the estimated tax for any given year. With this new law if your household income is less than 150000 the first 10200 of unemployment per taxpayer will be tax free on your federal tax return but any amount you receive above that will be taxed.

When it comes to federal income taxes the general answer is yes. We are actively working to update the states to account for these new federal changes. A bill exempting unemployment compensation from Hawaii income taxes passed in the state Senate but has yet to clear the state House so thats not a.

You have a few options. HAWAII INCOME TAX TREATMENT Under existing law Hawaiis income tax treatment is identical to the federal income tax treatment in most cases. Under existing law unemployment compensation is included in gross income.

This Act excludes from federal gross income a portion of the unemployment compensation received in tax year 2020 for taxpayers with adjusted gross income AGI of less than 150000. At the beginning of the pandemic Hawaiis unemployment rate was 24. The CARES Act does not provide for any special tax treatment for these.

Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020. Payments under the PUA and FPUC programs are subject to Hawaii income tax. However Hawaii cant adopt the federal exclusion of unemployment income unless they pass a new law.

Requires DOTAX to retroactively exempt and refund state income tax amounts received or withheld from unemployment compensation benefits for the period March 1 2020 to December 31 2020. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. March 25 2021 Proposed legislation that would exempt unemployment benefits from Hawaiis income tax hit a roadblock this month when President Joe.

Without an exemption someone who received 10200 in unemployment compensation as part of their taxable income would be forced to pay an incremental 653 in. Unemployment benefits are generally treated as income for tax purposes. Therefore the Economic Impact Payments and loan proceeds from the PPP and EIDL programs are not subject to Hawaii income tax.

In regards to taxes unemployment benefits are generally treated as income. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income. A month later it jumped to 238.

How do I know if my unemployment income is taxable in Hawaii. As of Monday 13 arent excluding unemployment compensation from taxes according to data from tax preparer HR Block. At this time New York State remains decoupled from the unemployment compensation income exclusion and an adjustment to income for New York is required.

RELATING TO UNEMPLOYMENT BENEFITS. First-time filers may not know however. You will be taxed at the regular rate for any federal unemployment.

If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment. Check back soon for more information. What the American Rescue Plan does is exempt the first 10200 of federal unemployment benefits from your taxable income.

Pin On Official Hawaii Unemployment Group

Pin On Official Hawaii Unemployment Group

Cost Of Living In Hawaii In 2020 The Ultimate Guide To The Price Of Paradise

Cost Of Living In Hawaii In 2020 The Ultimate Guide To The Price Of Paradise

Hawaii Emerges As Leader In Distributing Cares Act Funding To Solve Housing Issues Hawaii Solving Emergency

Hawaii Emerges As Leader In Distributing Cares Act Funding To Solve Housing Issues Hawaii Solving Emergency

Hawaii Senate Approves Nation S Highest Income Tax Honolulu Star Advertiser

Hawaii Senate Approves Nation S Highest Income Tax Honolulu Star Advertiser

Cost Of Living In Hawaii In 2020 The Ultimate Guide To The Price Of Paradise

Cost Of Living In Hawaii In 2020 The Ultimate Guide To The Price Of Paradise

Updates To Hawaii S Unemployment Programs Include Appointment System For Claimants To Talk With Staff

Updates To Hawaii S Unemployment Programs Include Appointment System For Claimants To Talk With Staff

Unemployment Insurance Instructional Video For Filing Unemployment Insurance Online

Unemployment Insurance Instructional Video For Filing Unemployment Insurance Online

How Hawaii Has Built Momentum To Become A Renewable Energy Leader Renewable Energy Solar Farm Solar Installation

How Hawaii Has Built Momentum To Become A Renewable Energy Leader Renewable Energy Solar Farm Solar Installation

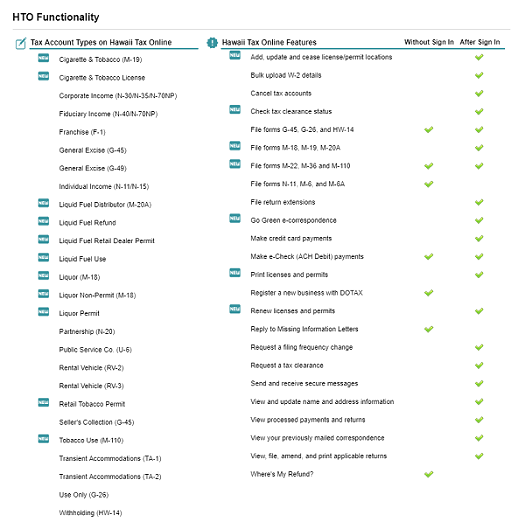

What S New To Hawaii Tax Online Department Of Taxation

What S New To Hawaii Tax Online Department Of Taxation

Should You Vote Yes Or No On Property Tax Measure Hawaii Business Magazine

Should You Vote Yes Or No On Property Tax Measure Hawaii Business Magazine

All About The Extended Unemployment Benefits In Hawaii

All About The Extended Unemployment Benefits In Hawaii

Safe Travels Fails To Lure Many Travelers From Japan To Hawaii Safe Travel Japan Hawaii

Safe Travels Fails To Lure Many Travelers From Japan To Hawaii Safe Travel Japan Hawaii

State Unemployment Tax Slated To Automatically Triple In 2021 Grassroot Institute Of Hawaii

State Unemployment Tax Slated To Automatically Triple In 2021 Grassroot Institute Of Hawaii

Department Of Labor And Industrial Relations State Provides Unemployment Insurance Assistance Benefits Update On Covid 19 Relief Bill Cares Act Extensions

Department Of Labor And Industrial Relations State Provides Unemployment Insurance Assistance Benefits Update On Covid 19 Relief Bill Cares Act Extensions

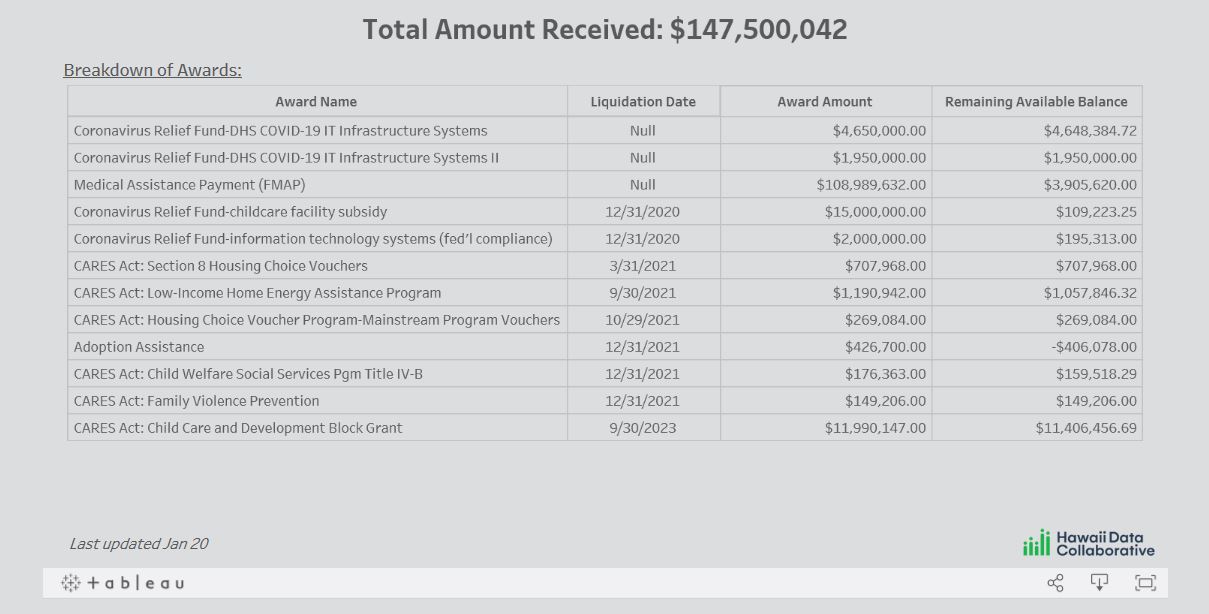

Department Of Human Services Dhs Public Information Amid Covid 19

Department Of Human Services Dhs Public Information Amid Covid 19

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

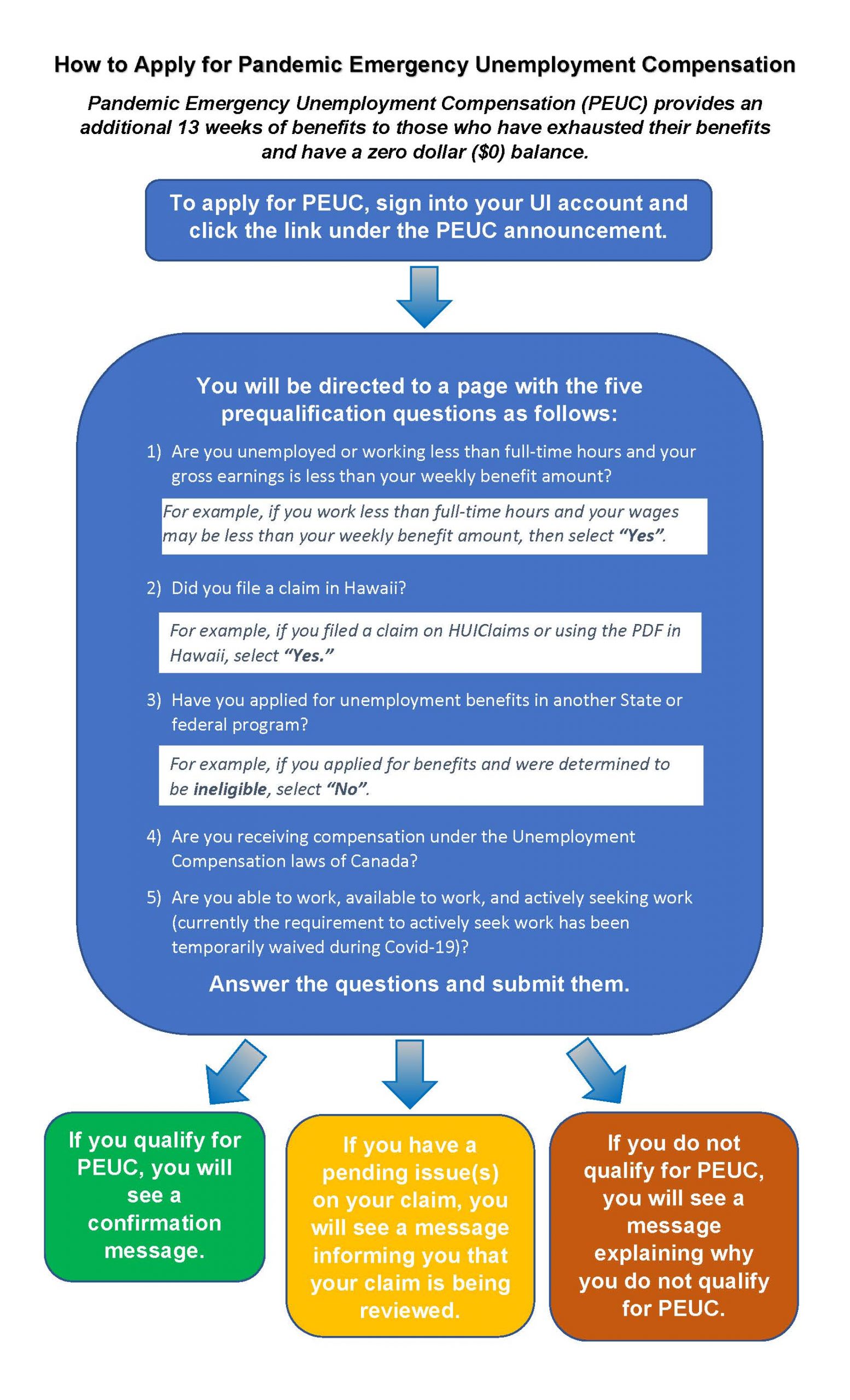

Hawaii Employers Council How To Apply For An Additional 13 Weeks Of Unemployment

Hawaii Employers Council How To Apply For An Additional 13 Weeks Of Unemployment

Hawaii Lawmakers Considering Nation S Highest Income Tax Fox 5 San Diego

Hawaii Lawmakers Considering Nation S Highest Income Tax Fox 5 San Diego

Post a Comment for "Is Unemployment Income Taxable In Hawaii"