Unemployment Earned Income Questionnaire

Anyone who received jobless benefits during 2020 may now be eligible for the earned income. All applicants will be asked the same basic questions including about employment history and earnings information along with some new questions needed to determine PUA eligibility.

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

The IRS will receive a copy as well.

Unemployment earned income questionnaire. Due to emergency changes to unemployment benefits and services some information on this page is not current. If you physically cant work arent available to work or arent looking for work we will send you a questionnaire and place your benefits on hold. Generally earned income includes taxable employee compensation and net earnings from self-employment as well as certain disability payments.

The Earned Income Credit is only available if your adjusted gross income or AGI is less than the applicable maximum for the tax year. Youll receive a Form 1099-G after the end of the year reporting in Box 1 how much in the way of benefits you received. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment.

The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly or 10200 for all other. They are required by the CARES Act and claims may be audited by the US. Only individuals and couples who earned less than 150000 in adjusted gross income in 2020 are eligible for these waivers.

Answer the questions honestly. Please call UI Customer Service at 1-866-239-0843 between 8 am. Claiming the standard deduction.

Use this list of Frequently Asked Questions FAQs for answers to common unemployment insurance UI questions. If your modified adjusted gross income is less than 150000 you dont have to pay federal income tax on the first 10200 in unemployment. If you no longer qualify for PUA you may be eligible to reapply for regular unemployment benefits.

You work for someone who pays you or. Earned Income Tax Credit EIC Child tax credits. Income from Another Source Claimant - Capability - Health or Physical Condition Questionnaire 3.

Many of your questions can be answered by referring to the Handbook for Unemployed Workers. Unemployment benefits are income just like money you would have earned in a paycheck. For example if you earned 75 in a week we will deduct 50 from your weekly payment because the first 25 does not apply.

For example if you earned 5000 in your highest quarter your total wages for all four quarters must be at least 7500. For the latest FAQs and information please go to our COVID-19 page. Unemployment Income reported on a 1099-G.

Earned at least 3589 in one quarter and. Based on your responses as well as wage information reported to the EDD the EDD will determine if your claim is processed as a regular UI claim or a PUA claim. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

2021 TAX FILING. At that point see the section called Regular UI. These questions pertain only to the week that you are claiming.

Total wages for all four quarters must be at least 15 times more than the highest amount of wages paid in any single quarter. Answer questions on each page until you reach the. Taxable earned income includes.

Limited interest and dividend income reported on a 1099-INT or 1099-DIV. The first 25 or 25 percent of your income whichever is greater will not be deducted. Heres the easy part.

How and who has to file an Amended Return to get the 10200 IRS unemployment tax break. Wages salaries tips and other taxable employee. Regular UI Work Search Requirements.

Mixed Earner Unemployment Compensation MEUC - Those who earned employment and self-employment wages at least 5000 in self-employment income in the tax year prior to their regular UI application and also receive benefits through regular UI PEUC Extended Benefits or. If you earned 400 in a week we will deduct 300 from your weekly payment because the first 100 25 percent does not apply. Your benefits will stay on hold until you are determined to be eligible again based on the information you provided on your questionnaire.

Your state might still tax your unemployment benefits though so its important to set aside money for that obligation either through. The IRS says it will automatically start sending refunds to people who filed their tax returns reporting unemployment income before getting a 10200 tax break under the American Rescue Plan. A simple tax return is Form 1040 only without any additional schedules OR Form 1040 Unemployment Income.

Filing for Unemployment Benefits Filing UI Claims Guide Weekly Claims and Work Search Requirements Payment Information Additional. You own or run a business or farm. There are two ways to get earned income.

Dont see your question or answer. They are in addition to the UI weekly claim questions.

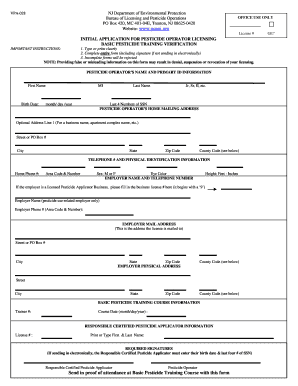

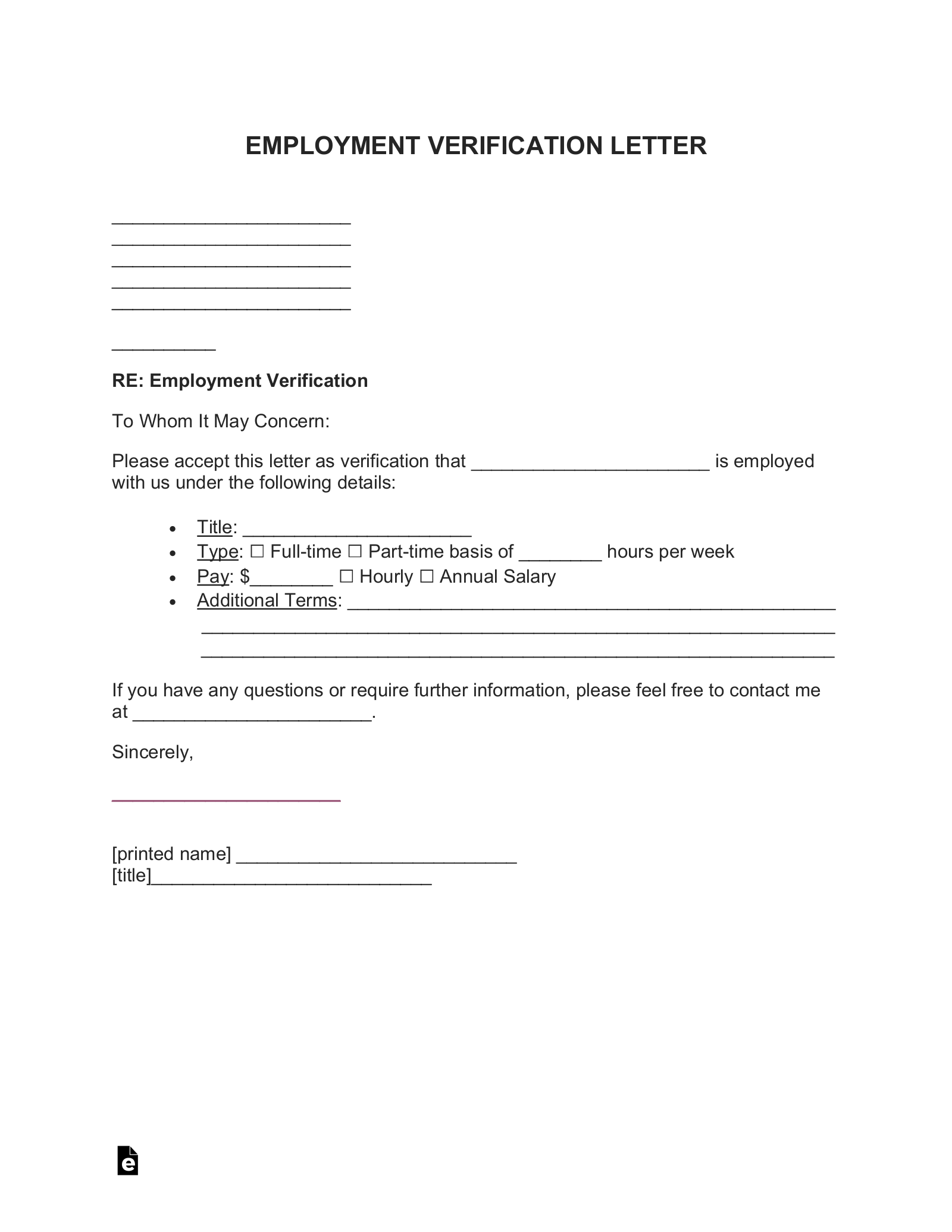

Income Verification Letter Samples Proof Of Income Letters With Verification Of Employment Loss Income Employment Letter Sample

Income Verification Letter Samples Proof Of Income Letters With Verification Of Employment Loss Income Employment Letter Sample

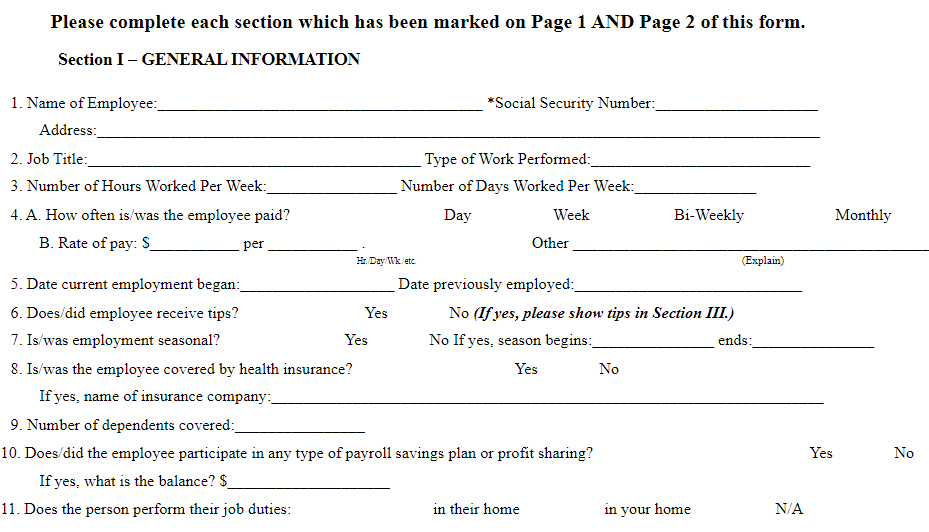

Verification Of Employment Loss Of Income Fill Online Printable Fillable Blank Pdffiller

Verification Of Employment Loss Of Income Fill Online Printable Fillable Blank Pdffiller

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Free Employment Income Verification Letter Pdf Word Eforms

Free Employment Income Verification Letter Pdf Word Eforms

How To Show Loss Of Income During Verification Of Employment

How To Show Loss Of Income During Verification Of Employment

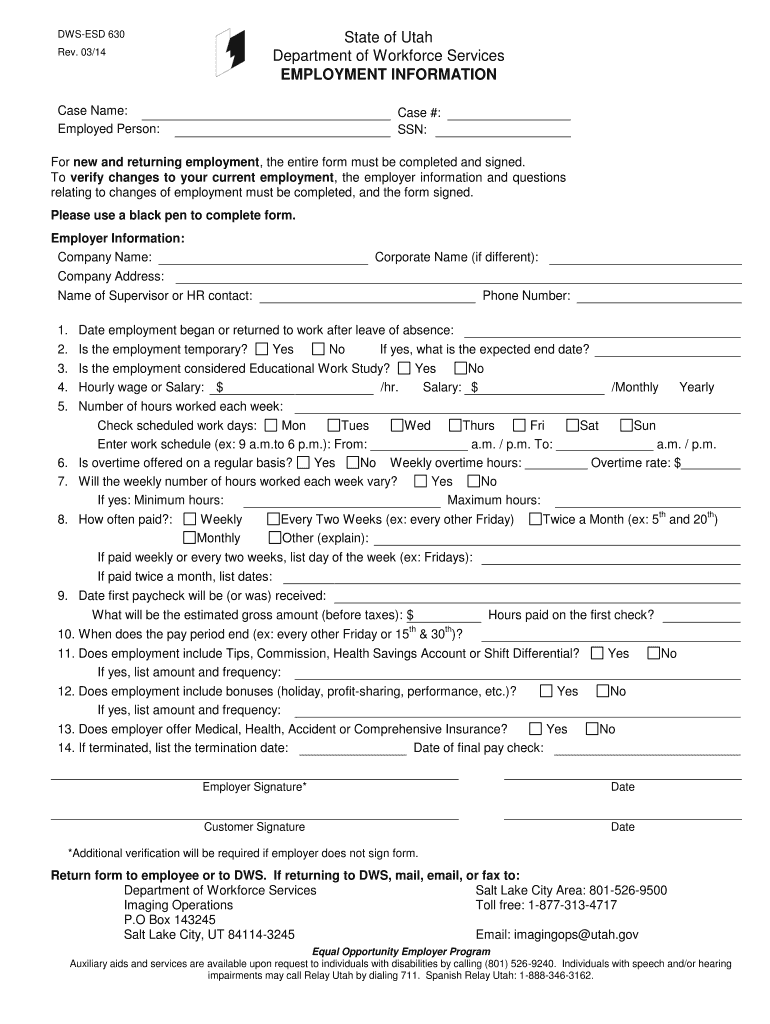

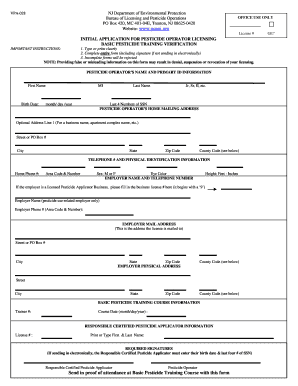

630 Employment Form Fill Online Printable Fillable Blank Pdffiller

630 Employment Form Fill Online Printable Fillable Blank Pdffiller

Hmis Earned Income Verification Form Page 1 Line 17qq Com

Hmis Earned Income Verification Form Page 1 Line 17qq Com

How To Complete Part 6 On The Form I 864 Sponsor S Employment And Income Sound Immigration

How To Complete Part 6 On The Form I 864 Sponsor S Employment And Income Sound Immigration

21 Printable Income Verification Letter For Self Employed Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

21 Printable Income Verification Letter For Self Employed Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Form 8615 Tax For Certain Children With Unearned Income

Form 8615 Tax For Certain Children With Unearned Income

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

How To Show Loss Of Income During Verification Of Employment

How To Show Loss Of Income During Verification Of Employment

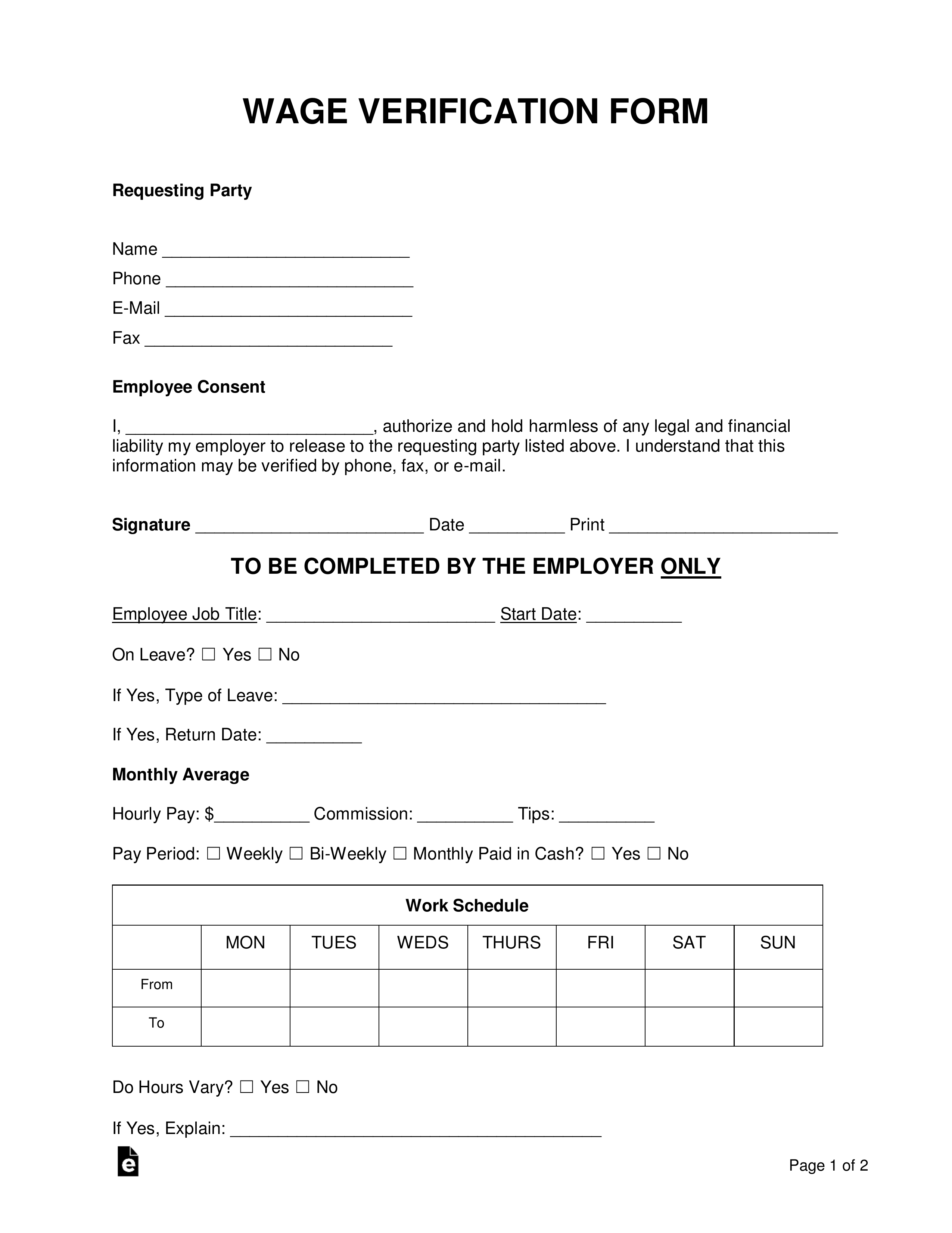

Free Wage Verification Form Pdf Word Eforms

Free Wage Verification Form Pdf Word Eforms

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

How Does Peachcare Verify Income Fill Online Printable Fillable Blank Pdffiller

How Does Peachcare Verify Income Fill Online Printable Fillable Blank Pdffiller

Self Employment Income Verification Form Fill Online Printable Fillable Blank Pdffiller

Self Employment Income Verification Form Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "Unemployment Earned Income Questionnaire"