Unemployment Tax Break Earned Income Credit

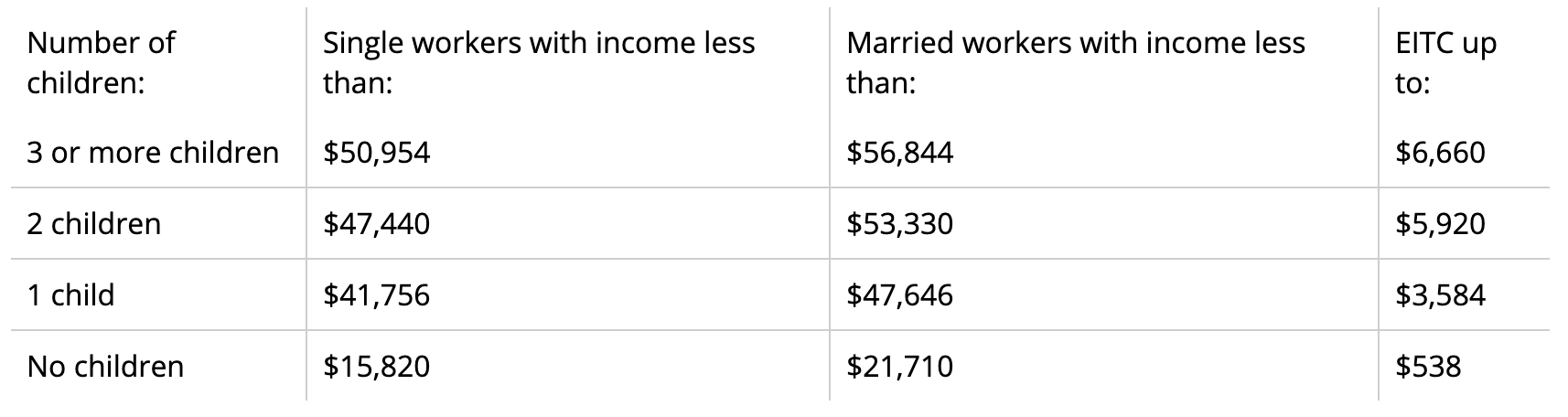

2 days agoThis tax season maximum payouts under the credit range from 538 to 6600 depending on a persons filing status income and number of children. Its possible for your earned income to be below the threshold but for your total income and therefore your AGI to be above the threshold because of the addition of unemployment compensation.

Boli Earned Income Tax Credit For Workers State Of Oregon

Boli Earned Income Tax Credit For Workers State Of Oregon

10200 Unemployment Tax Break A last minute addition to the 19 trillion stimulus package exempted the first 10200 of 2020 unemployment compensation from.

Unemployment tax break earned income credit. The earned income tax credit is a refundable tax credit available to taxpayers who received certain types of income in 2020 like wages and self-employment income. 1 day agoThe IRS promises to refund taxes that early filers paid on the first 10200 of unemployment benefits earned last year. The 19 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers.

10200 unemployment tax breakThe American bailout plan waived federal taxes on up to 10200 per person in unemployment benefits received in 2020However. On March 11 President Joe Biden signed his 19 trillion coronavirus stimulus. You must have Earned Income which we discussed above AND.

She may question that income reduction for income-based tax breaks like the Earned Income Tax Credit according to the IRS. The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if. The law waives federal income taxes on up to 10200 in unemployment insurance.

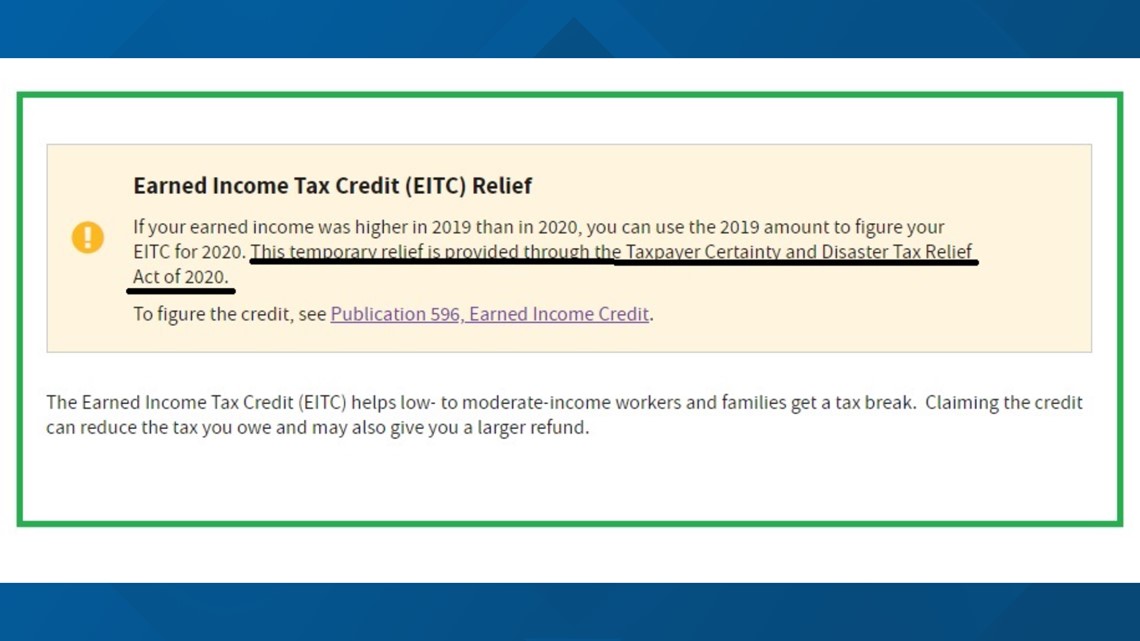

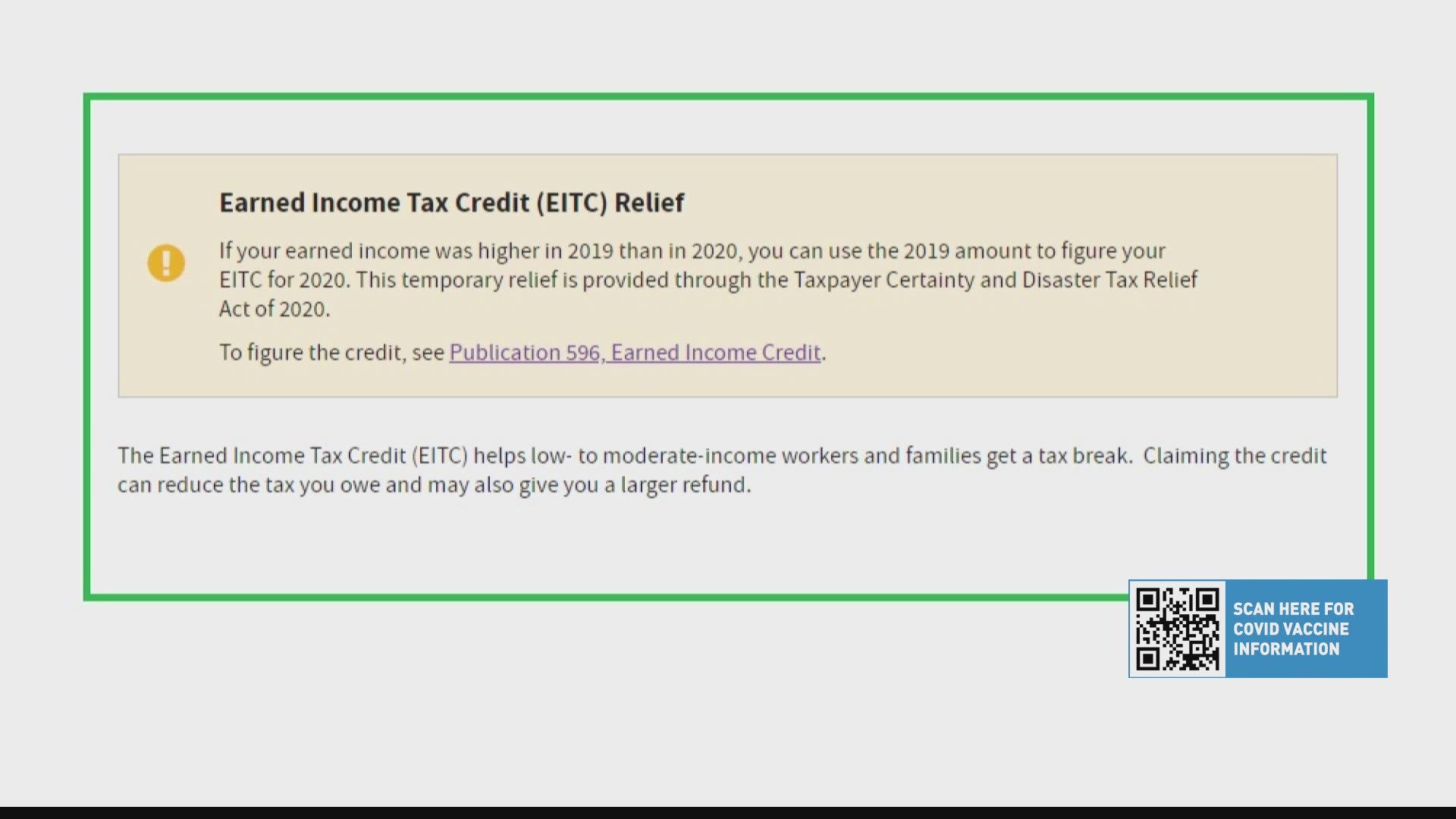

President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020. The break applies this. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. Millions of people who received unemployment benefits in 2020 are in for a pleasant surprise. Unemployed workers can waive up to 10200 in unemployment benefits received in 2020 from their taxable income.

The earned income tax. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on. The IRS will send refunds for that tax break but you may need to wait for the money.

The earned income tax credit or other tax breaks for lower income people. The recent stimulus bill includes a tax break on unemployment income. In order to be eligible for the Earned Income Credit.

If youve already filed your 2020 tax. This is because the tax break technically excludes benefits from a taxpayers income thereby reducing the income on which he pays tax. Its not a verdict said Henry Grzes senior manager of the tax practice and.

To figure the credit see Publication 596 Earned Income Credit. Your Adjusted Gross Income AGI must be below the applicable limit. For example the unemployment tax break may make some people newly eligible for the Earned Income Tax Credit.

This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020. Families who received unemployment income during 2020 should also be on the lookout for two key credits as they file their taxes.

No Family Should Be Taxed Into Poverty A Eitc Would Help Low Income Families Keep More Of What They Earn Utleg Income Tax Tax Credits Poverty

No Family Should Be Taxed Into Poverty A Eitc Would Help Low Income Families Keep More Of What They Earn Utleg Income Tax Tax Credits Poverty

What You Need To Know About The Earned Income Tax Credit In 2021 Forbes Advisor

What You Need To Know About The Earned Income Tax Credit In 2021 Forbes Advisor

Earned Income Tax Credit Eitc Qualification And Income Threshold Limits Tax Credits Income Tax Income

Earned Income Tax Credit Eitc Qualification And Income Threshold Limits Tax Credits Income Tax Income

Unemployed In 2020 But Need The Eic Use Your 2019 Earned Income

Unemployed In 2020 But Need The Eic Use Your 2019 Earned Income

Get A Bigger Refund With The Earned Income Tax Credit Eitc 11alive Com

Get A Bigger Refund With The Earned Income Tax Credit Eitc 11alive Com

Https Crsreports Congress Gov Product Pdf R R43805

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Is The Earned Income Credit A Refundable Tax Credit

What Is Irs 1040ez Tax Form Tax Forms Income Tax Return Tax Refund Calculator

What Is Irs 1040ez Tax Form Tax Forms Income Tax Return Tax Refund Calculator

Do I Qualify For Earned Income Credit While On Unemployment Turbotax Tax Tips Videos

Do I Qualify For Earned Income Credit While On Unemployment Turbotax Tax Tips Videos

Get A Bigger Refund With The Earned Income Tax Credit Eitc 11alive Com

Get A Bigger Refund With The Earned Income Tax Credit Eitc 11alive Com

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Earned Income Tax Credit Things To Know Credit Karma Tax

Earned Income Tax Credit Things To Know Credit Karma Tax

Eic Frequently Asked Questions Eic

Earned Income Tax Credit Course Module 14 Youtube

Earned Income Tax Credit Course Module 14 Youtube

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Post a Comment for "Unemployment Tax Break Earned Income Credit"