Is Unemployment Benefits Earned Income

Unemployment Insurance UI benefits are taxable income but do not count as earnings. This means they dont qualify towards your EITC qualifications.

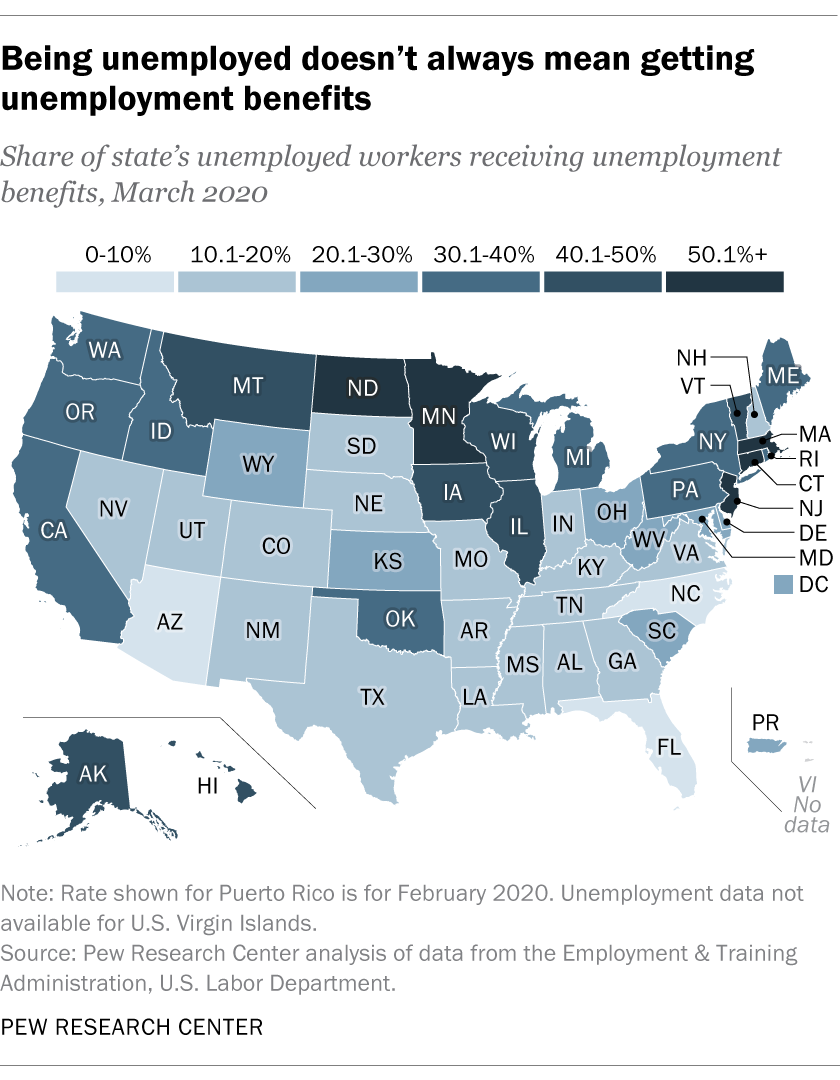

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Unemployment compensation is subject to kiddie tax.

Is unemployment benefits earned income. Unemployment income wont count as income Originally any jobless benefits that were collected in 2020 were counted for income purposes. Taxable earned income includes. That legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers.

There are two ways to get earned income. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. Unearned Income is all income that is not earned such as Social Security benefits pensions State disability payments unemployment benefits interest income dividends and cash from friends and relatives.

The law requires most employees and self-employed business owners to pay at least 90 of their tax. It includes any type of income that isnt earned income including unemployment compensation taxable social security benefits alimony some taxable scholarships and more. Unemployment benefits are income just like money you would have earned in a paycheck.

Earned Income is wages net earnings from selfemployment certain royalties honoraria and sheltered workshop payments. The IRS will receive a copy as well. That means these benefits can lower but not raise the EITC potentially leaving some.

Only income from work counts against the earnings test. Youll receive a Form 1099-G after the end of the year reporting in Box 1 how much in the way of benefits you received. The legislation excludes only 2020 unemployment benefits from taxes.

When it comes to federal income taxes the general answer is yes. You own or run a business or farm. And to help confused taxpayers the IRS plans to automatically adjust your return if you qualify for this break.

Tax exclusion Unemployment benefits are generally treated as income for tax purposes. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020. Americans who lost their jobs last year and have already filed their tax returns will have one less headache to deal with.

The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable. However receiving unemployment benefits. It includes a tax break on up to 10200 of unemployment benefits earned in 2020.

In addition the formerly widespread practice of states deducting money from unemployment benefits if a recipient also received Social Security has been all but eliminated nationwide. Wages salaries tips and other taxable employee. As the name implies to be eligible for the Earned Income Credit you must earn income such as through employment.

You work for someone who pays you or. Generally earned income includes taxable employee compensation and net earnings from self-employment as well as certain disability payments. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on.

You need to receive wages during the year to qualify for this credit. While unemployment benefits can get taxed they dont count towards your earned income. Unearned income is not limited to investment income such as dividends and interest.

Income tax is a pay-as-you-earn system. 1 day agoThe US.

Do I Qualify For Earned Income Credit While On Unemployment Turbotax Tax Tips Videos

Do I Qualify For Earned Income Credit While On Unemployment Turbotax Tax Tips Videos

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

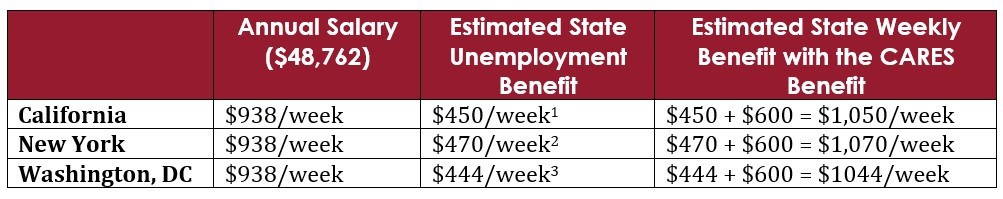

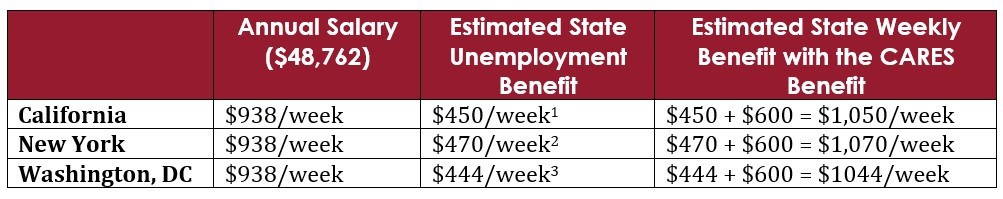

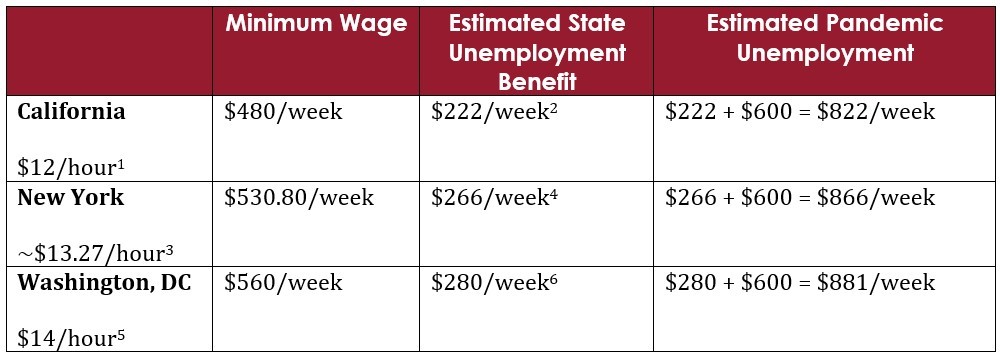

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

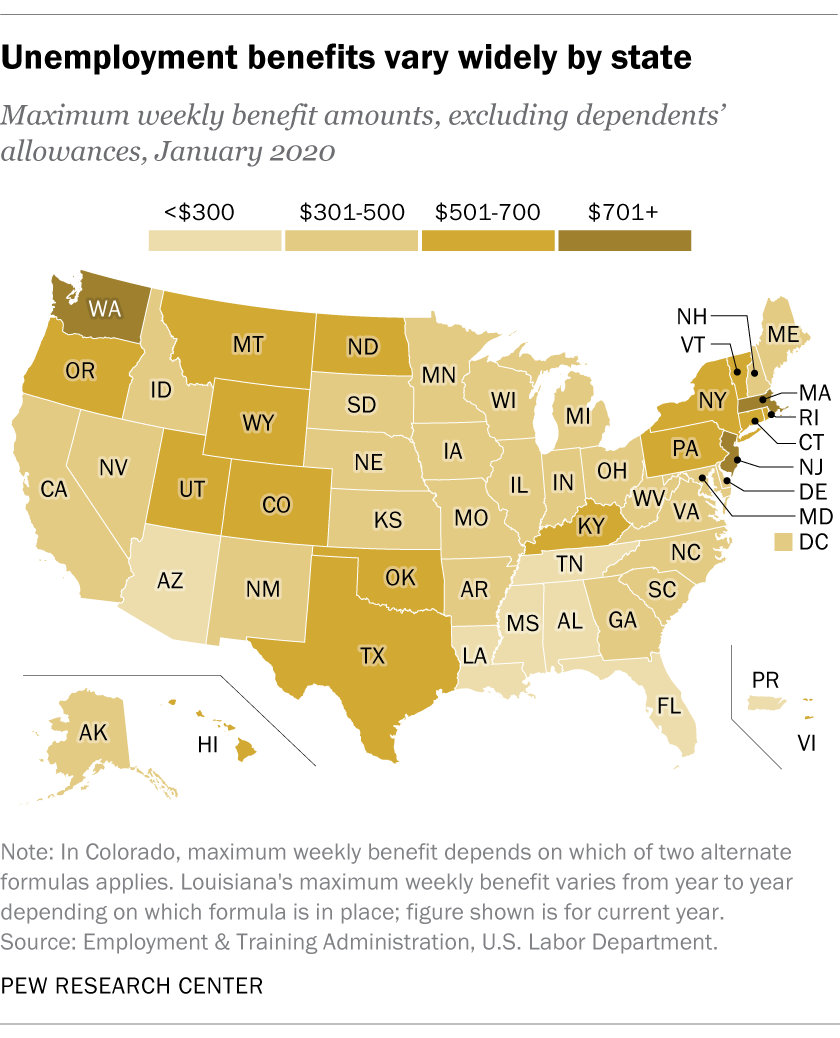

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Are Your Unemployment Benefits Taxable

Are Your Unemployment Benefits Taxable

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Top 3 Tax Tips For Unemployment Benefits

Top 3 Tax Tips For Unemployment Benefits

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

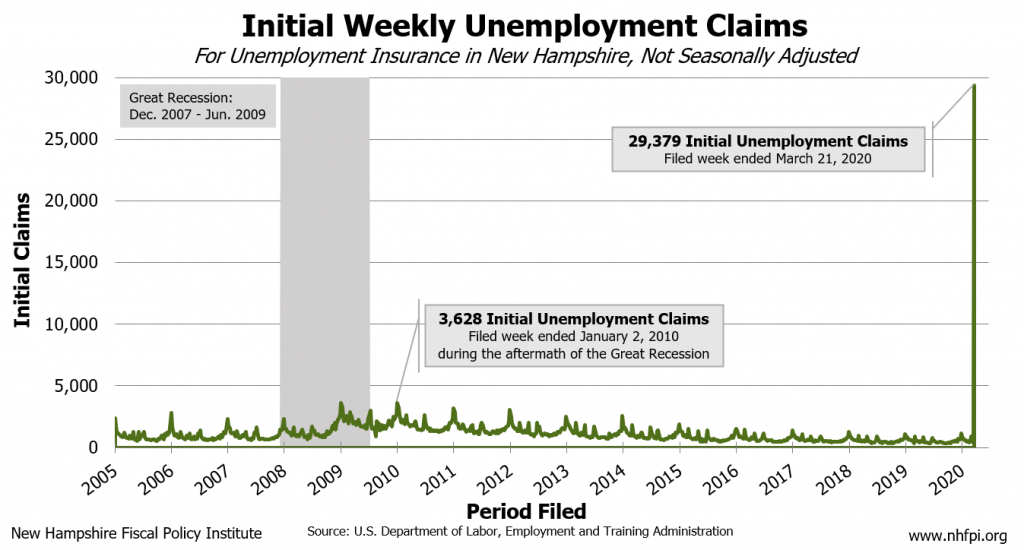

Unemployment Benefits And Temporary Income Supplements Provide Financial Support During The Covid 19 Crisis New Hampshire Fiscal Policy Institute

Unemployment Benefits And Temporary Income Supplements Provide Financial Support During The Covid 19 Crisis New Hampshire Fiscal Policy Institute

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Post a Comment for "Is Unemployment Benefits Earned Income"