Unemployment Taxes Covid Relief Bill

If youve already filed a return you dont need to do anything right now. The latest 19 trillion stimulus package creates a new tax break for tens of millions of workers who received unemployment benefits last year.

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

The first 10200 of unemployment benefits would be exempt from taxes for the first time to prevent surprise bills for unemployed people at the.

Unemployment taxes covid relief bill. The way the exemption works is the first 10200 of. Covid bill waives taxes on up to 20400 of unemployment benefits for married couples. The tax exemption for 10200 in unemployment benefits currently only applies to unemployment income you collected in 2020 even though the.

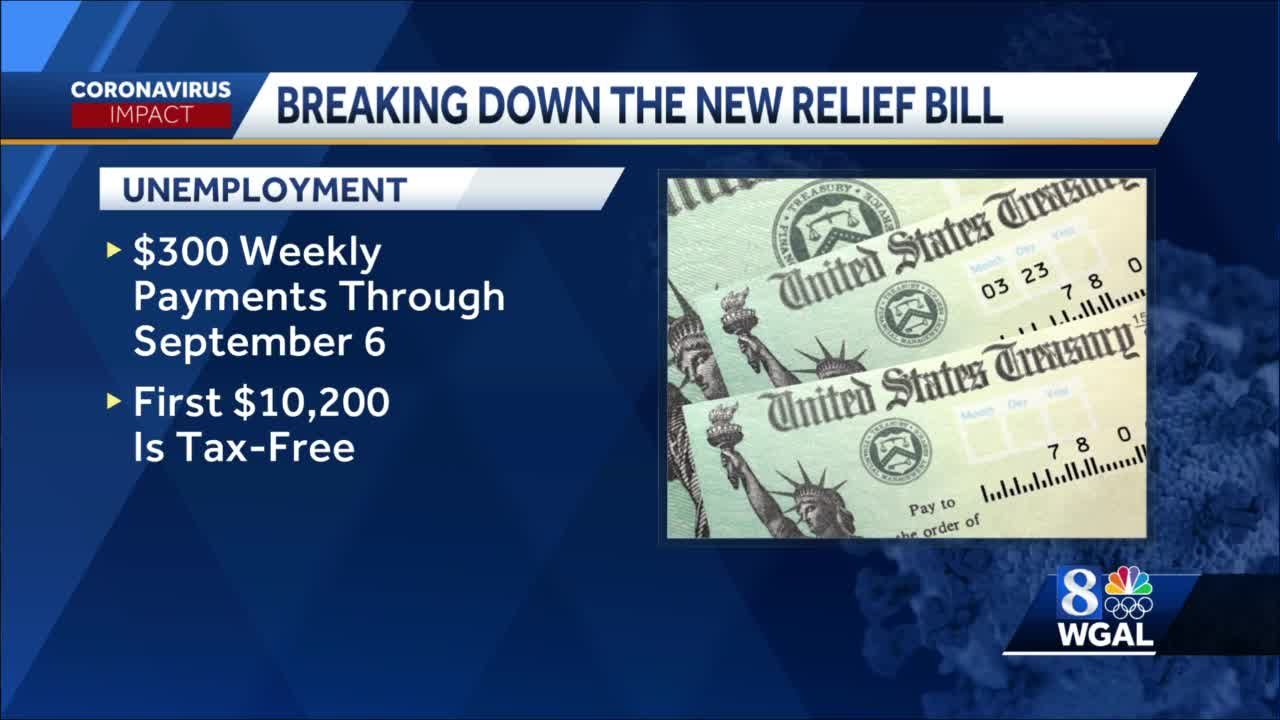

This provision in the coronavirus relief bill may ban state tax relief. 300 in additional weekly unemployment benefits including a new tax break Under the new legislation federal unemployment checks have been extended to Sept. 8 hours agoCHARLOTTE NC.

The American Rescue Plan the sweeping 19 trillion coronavirus relief bill that was signed into law in mid-March came with a host of provisions designed to. Whats inside the 19T COVID-19 bill passed by Congress. The latest version of the 19 trillion federal coronavirus relief.

The American Rescue Plan passed last month included a tax relief provision that waives taxes on up to 10200 of unemployment benefits meaning more. By KEVIN FREKING March 10 2021. The new legislation includes a 300 federal boost to weekly unemployment payments.

To counter that the COVID relief bill includes a tax exemption of 10200 for those with an adjusted gross income less than 150000. The latest updates to the 19 trillion federal coronavirus relief package could save millions of people from a surprise tax bill. The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits per person in 2020.

House Speaker Nancy Pelosi of Calif walks through Statuary Hall during the vote on the Democrats 19 trillion COVID-19 relief bill on Capitol Hill Wednesday March 10 2021 in Washington. AP PhotoAlex Brandon WASHINGTON AP The. The new coronavirus relief bill exempts unemployment income at the federal level.

While the federal government made the first 10200 of unemployment income tax. The Senate on Saturday passed a version of the Covid relief. Perversely because the unemployment benefits passed as part of the 2020 COVID-19 relief package were so generous those bills were expected to come in between 1000 and 2000.

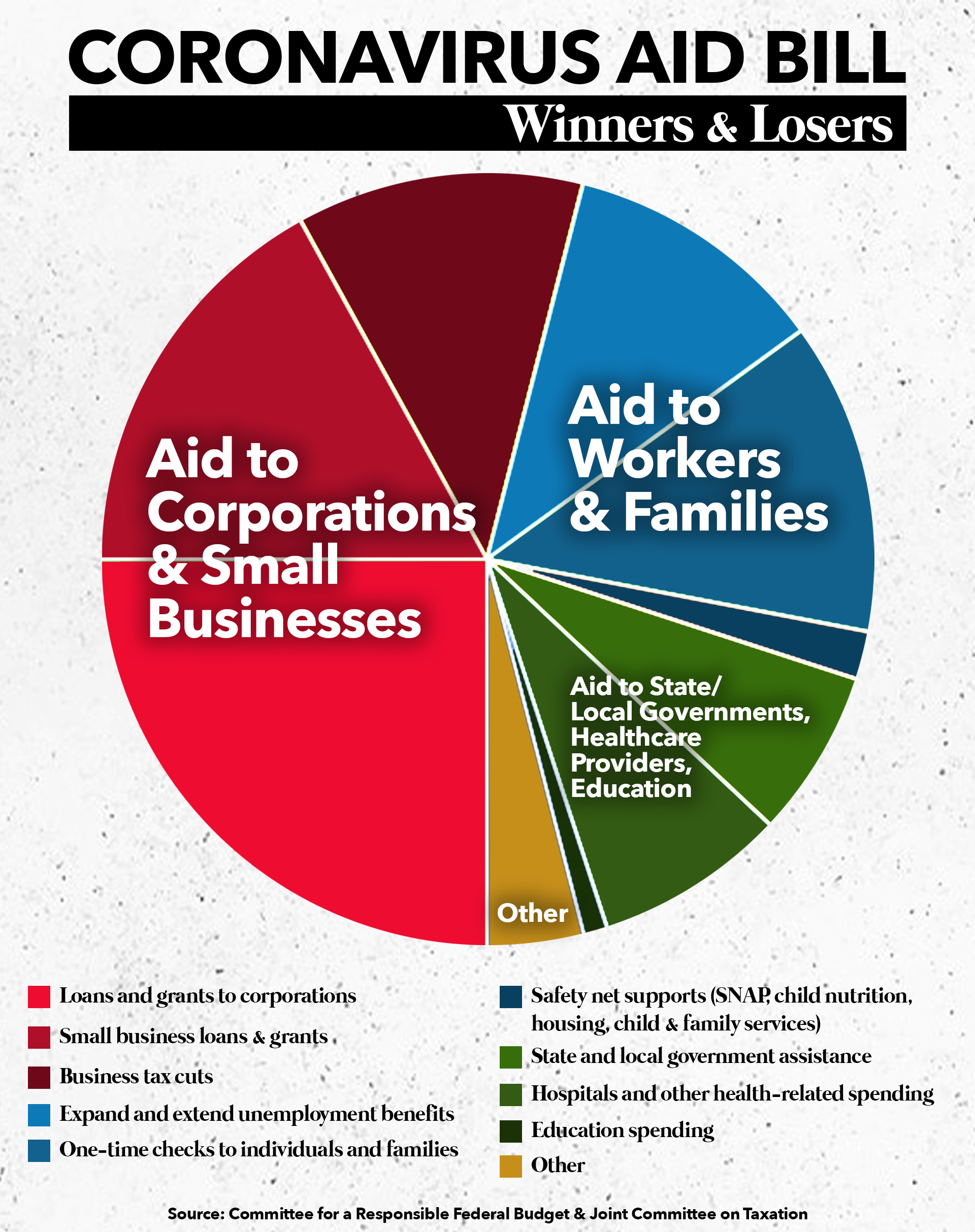

The 19 trillion Covid relief bill passed Wednesday by the House of Representatives extends unemployment benefits through Labor Day and raises them by 300 a week. The bill also makes the first 10200 of unemployment income tax-free for households with income less than 150000. One of the ways the bill does that is by relieving businesses from paying unemployment taxes on the 12 billion in benefits that were paid out from.

HuffPost sounded the alarm last month about the millions of Americans facing a surprise tax bill this year. The tax break isnt available to those who earned 150000 or more. While the unemployment and tax relief provisions of the bill are now law the Governor exercised his line-item veto power to send the section of the bill mandating COVID-19 emergency sick leave back to the Legislature with recommended amendments.

The American Rescue Plan -- the sweeping 19 trillion coronavirus relief bill. States are a different story.

The Covid 19 Relief Bill Improves Access To Unemployment Insurance But Further Steps Could Fill Remaining Gaps Urban Institute

The Covid 19 Relief Bill Improves Access To Unemployment Insurance But Further Steps Could Fill Remaining Gaps Urban Institute

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Unemployment 1 400 Stimulus Checks Extended Benefits Slated In House Covid Relief Deadline

Unemployment 1 400 Stimulus Checks Extended Benefits Slated In House Covid Relief Deadline

Lawmakers Urge Democratic Leaders To Waive Taxes On Jobless Benefits In Covid Relief Bill

Lawmakers Urge Democratic Leaders To Waive Taxes On Jobless Benefits In Covid Relief Bill

Faq On Stimulus Unemployment And Tax Rebates The Seattle Times

Faq On Stimulus Unemployment And Tax Rebates The Seattle Times

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

More Unemployment Money Included In New Covid 19 Relief Bill

More Unemployment Money Included In New Covid 19 Relief Bill

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

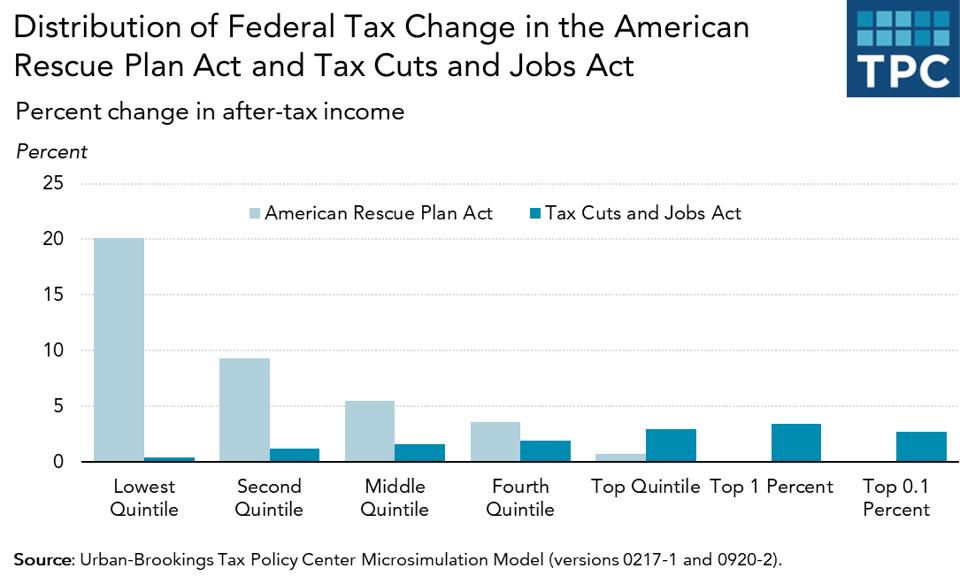

Pandemic Bill Would Cut Taxes By An Average Of 3 000 With Most Relief Going To Low And Middle Income Households

Pandemic Bill Would Cut Taxes By An Average Of 3 000 With Most Relief Going To Low And Middle Income Households

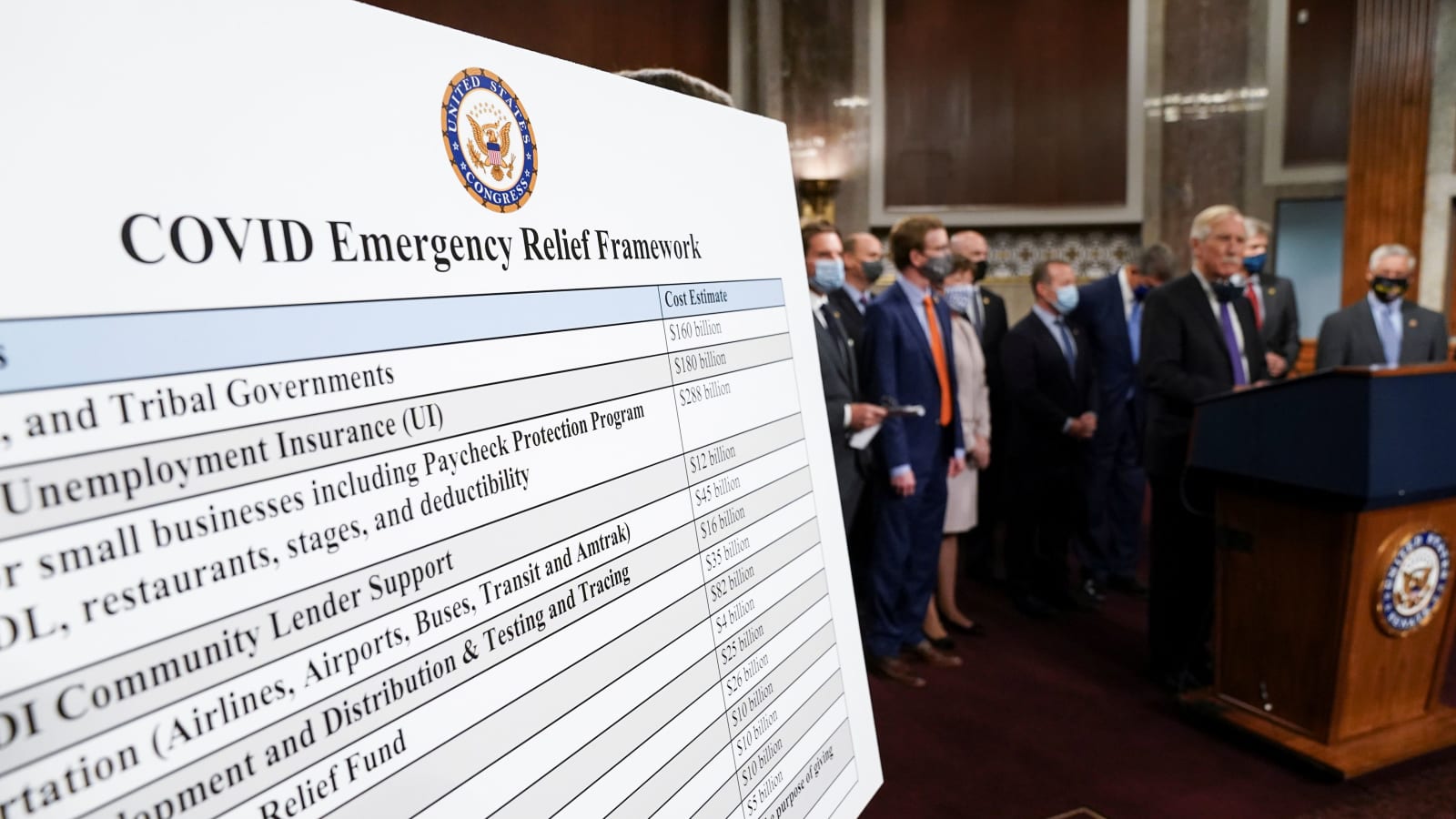

Coronavirus Bulletin Resources For Leading During The Crisis Ways And Means Republicans

Coronavirus Bulletin Resources For Leading During The Crisis Ways And Means Republicans

The Coronavirus Relief Bill Every Benefit For Small Businesses Bench Accounting

The Coronavirus Relief Bill Every Benefit For Small Businesses Bench Accounting

Iowa Rep Cindy Axne Introduces Covid Unemployment Tax Relief Bill Kgan

Iowa Rep Cindy Axne Introduces Covid Unemployment Tax Relief Bill Kgan

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

The Next Covid Bill May Forgo 1 200 Checks What Else Is On The Table

The Next Covid Bill May Forgo 1 200 Checks What Else Is On The Table

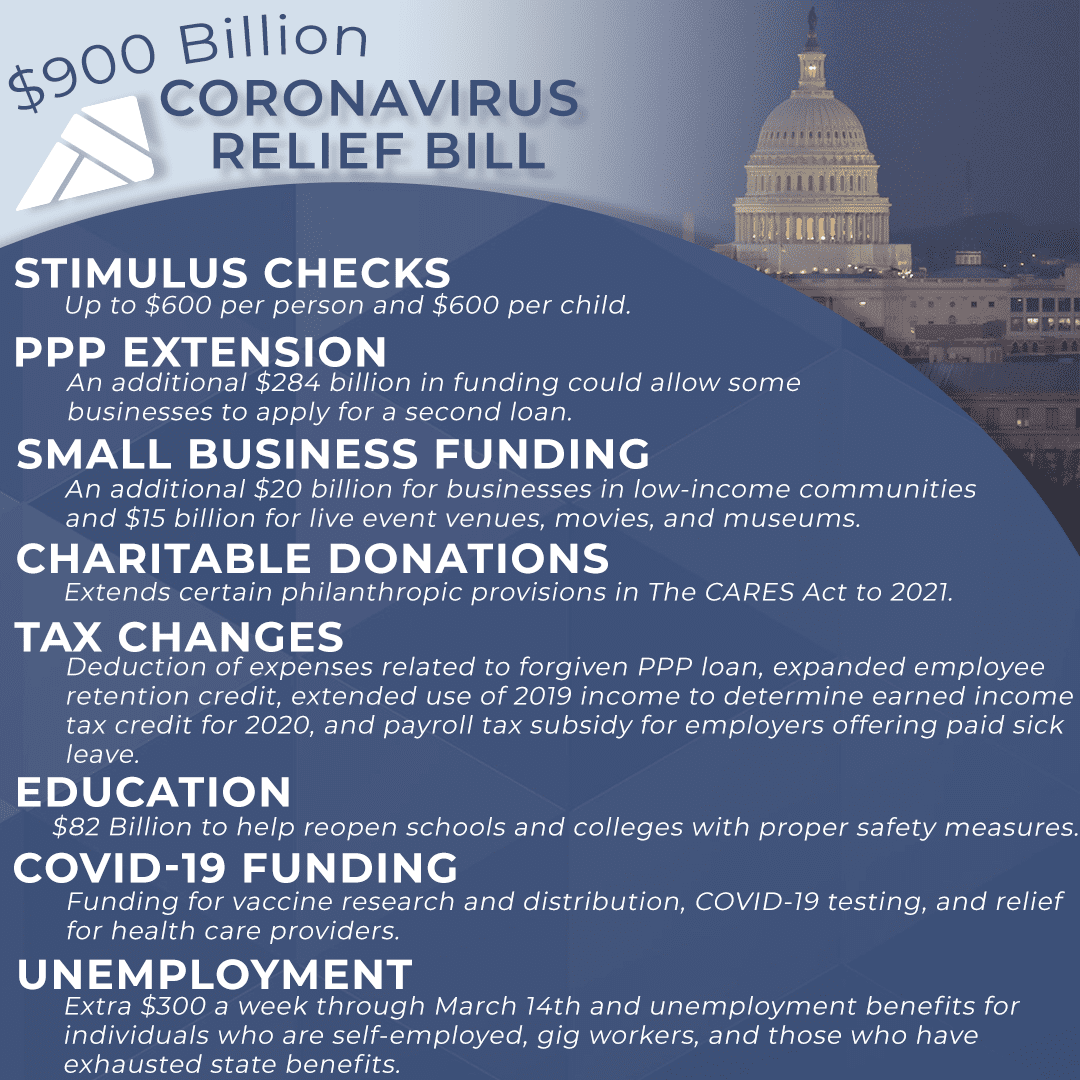

New 900 Billion Covid 19 Relief Bill Alloy Silverstein

New 900 Billion Covid 19 Relief Bill Alloy Silverstein

Cares Act Supplemental Unemployment Insurance Blue Co Llc

Cares Act Supplemental Unemployment Insurance Blue Co Llc

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Cares Act Provisions For Financial Advisors And Their Clients

Cares Act Provisions For Financial Advisors And Their Clients

Post a Comment for "Unemployment Taxes Covid Relief Bill"