Unemployment For Salary Workers

The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially saving workers thousands of dollars. The most common industries in Poulsbo are.

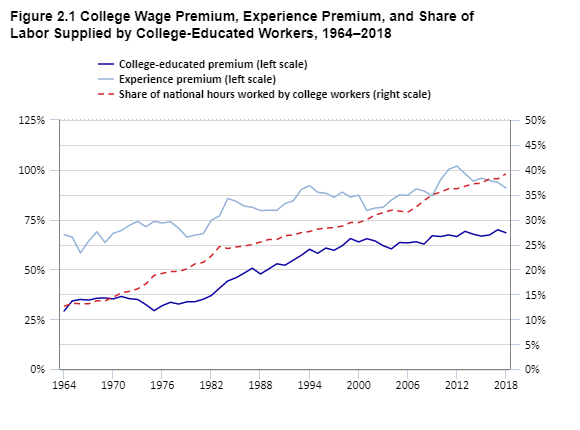

Assessing The Impact Of New Technologies On The Labor Market Key Constructs Gaps And Data Collection Strategies For The Bureau Of Labor Statistics U S Bureau Of Labor Statistics

Assessing The Impact Of New Technologies On The Labor Market Key Constructs Gaps And Data Collection Strategies For The Bureau Of Labor Statistics U S Bureau Of Labor Statistics

Paid leave may be available immediately and allow you to keep receiving a paycheck.

Unemployment for salary workers. In many states you will be compensated for half of your earnings up to a certain maximum. 561 of workers are employees of private companies which is 178 less than the rate of 661 across the. It typically takes two to four weeks to receive UC benefits.

858 of workers work in Kitsap County and 35 of all workers work at home. If you are self-employed an independent contractor or a gig worker whose employer is not required to pay payroll taxes on your wages apply for Pandemic Unemployment Assistance benefits. States calculate your weekly UI benefit amount by looking at your earnings in the past few quarters before becoming unemployed typically paying half of your regular wages up to a certain limit.

Most paid leave will provide 100 percent of your usual pay while unemployment benefits typically pay between 50 to 70 percent depending on your circumstances. The regular pre-pandemic program is funded by taxes on employers including state taxes which vary by state and the Federal Unemployment Tax Act FUTA tax. In fact a number of states wont let tax-filers exclude that.

That includes some undocumented workers. According to the Bureau of Labor Statistics the typical US worker earned about 1000 a week at the end of 2019. After significant delays Senate Democrats on Friday reached an agreement to extend unemployment benefits through Sept.

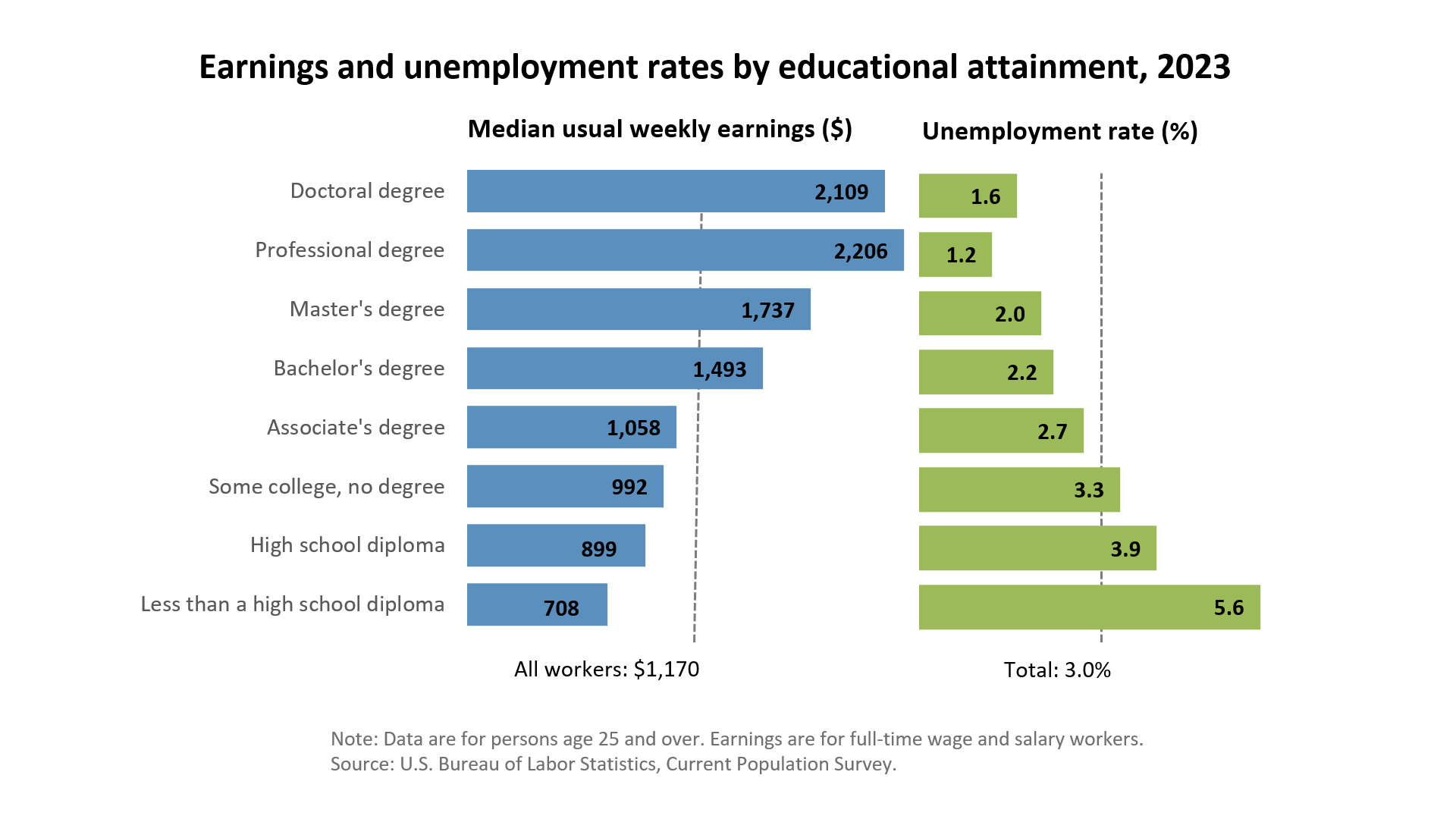

Sometimes salaried employees must accept a reduction in salary when employers are trying to save money while not reducing staff size. State benefits are typically paid for a maximum of 26 weeks. Workers with graduate degrees had the lowest unemployment rates and highest earnings.

Benefits will be reduced in increments based on your total hours of work for the week rather than on the days you work. Earlier this year both Democratic-controlled houses endorsed putting 21 billion toward workers unable to benefit from federal unemployment benefits. For example in New York you can work up to 7 days per week without losing unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment.

Despite Relief Bill Some States Wont Give Jobless Workers a Tax Break on Unemployment Benefits by Maurie Backman April 3 2021 The Ascent is reader-supported. State laws typically put a maximum percentage in place often between 70 and 80 percent of the salary the individual earned per week but plans factor other data before creating a payment plan including how much individuals earned and how long they had been at that payment level. As the chart shows workers age 25 and over who have less education than a high school diploma had the highest unemployment rate 74 percent and lowest median weekly earnings 504 in 2016 among those at all education levels.

Accommodation food services 100 of civilian employees Educational services 94 of civilian employees Construction 75 of civilian employees. If non-exempt employees experience a. If you have more than one job a W-2 payroll job for an employer and a 1099 self-employed job you have to apply for regular unemployment benefits if you earned more than 1000 or worked more than.

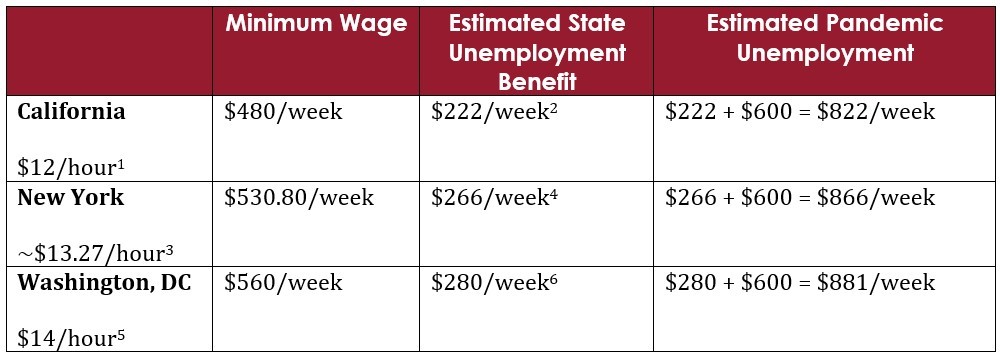

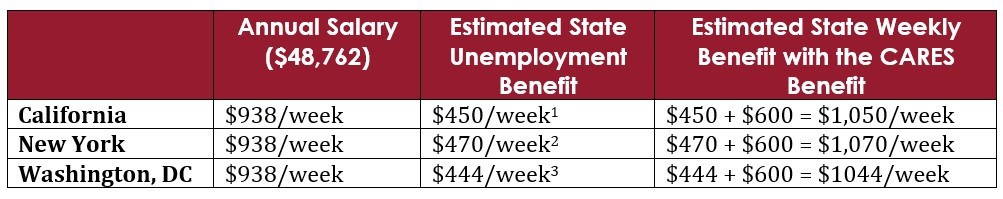

But while many jobless workers will get to enjoy that federal tax relief some states arent letting them off the hook so easily. The exemption applies to households and individuals with less than. In California for example the weekly limit for UI benefits is 450 which is taxable.

6 and pay an extra 300 a. We may earn a commission from. That means workers will not have to pay any income tax on the first 10200 in unemployment insurance benefits from 2020.

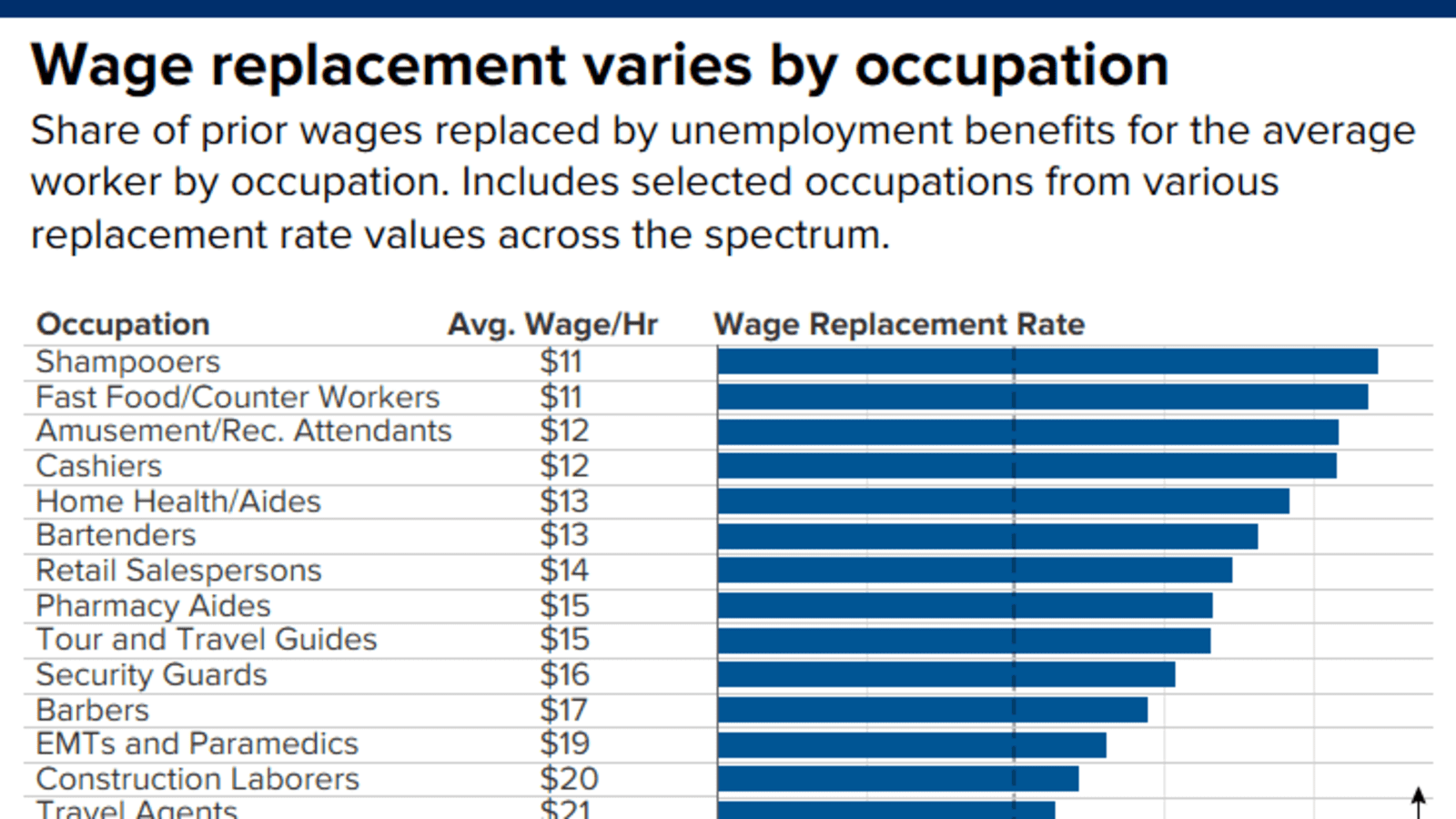

Unemployment does not pay 100 percent of the wages the individual once earned. The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker.

The Post Recession Labor Market An Incomplete Recovery Institute For Research On Labor And Employment

/UnemploymentandGDP2008-80ffa8c6bee640208888f8cc26cb38e2.jpg) Unemployment And Recession What S The Relation

Unemployment And Recession What S The Relation

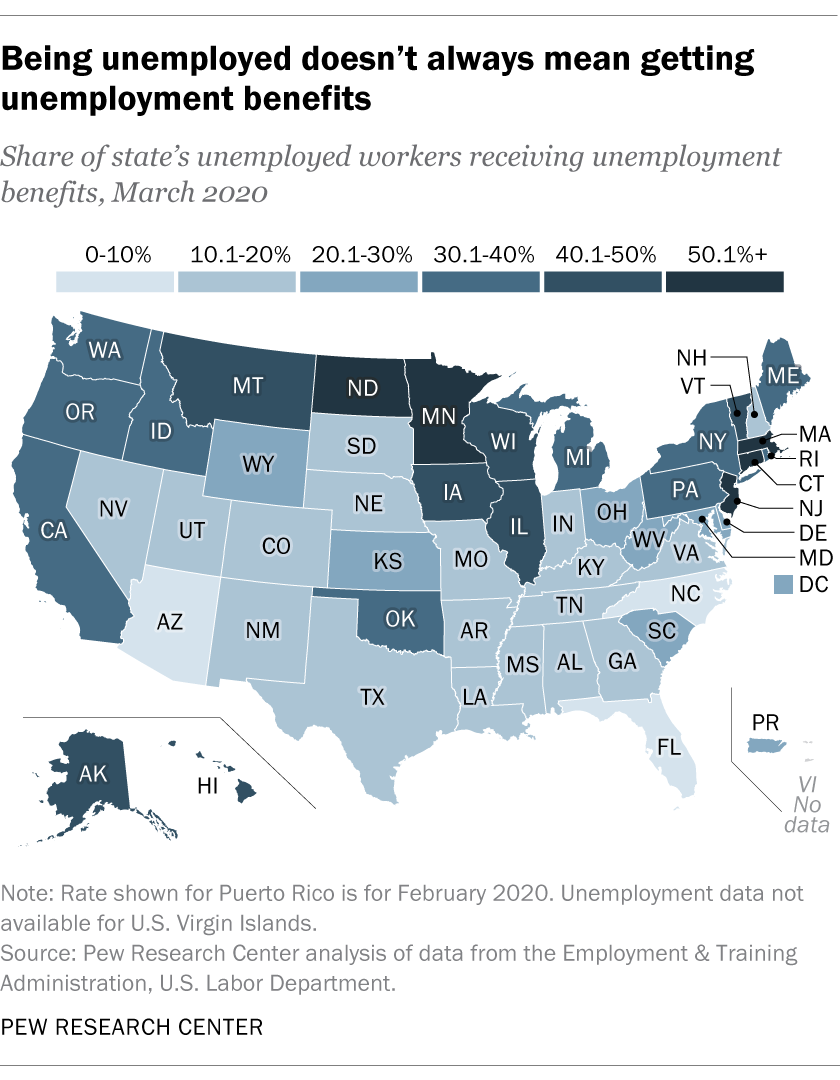

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

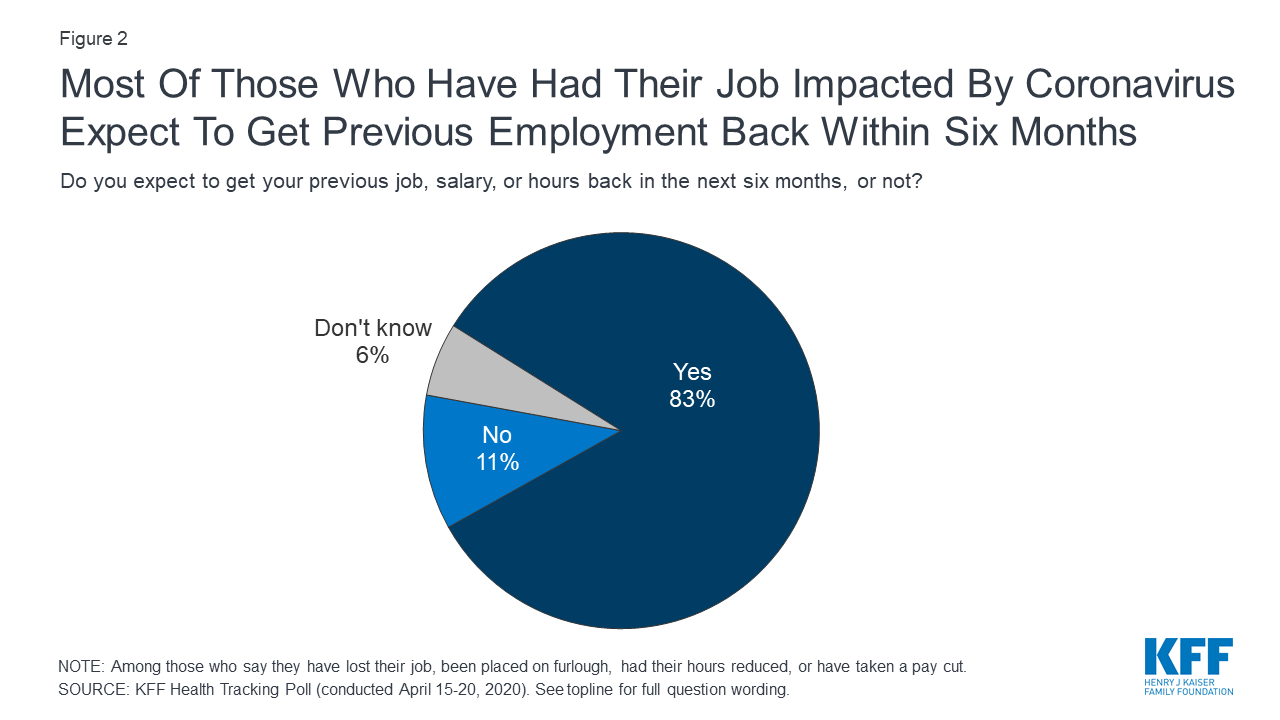

When Will The Unemployed Go Back To Work Many Laid Off Workers Expect To Get Jobs Back In The Short Term But Experts Caution About Long Term Unemployment Kff

When Will The Unemployed Go Back To Work Many Laid Off Workers Expect To Get Jobs Back In The Short Term But Experts Caution About Long Term Unemployment Kff

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

The Effect Of Covid 19 And Disease Suppression Policies On Labor Markets A Preliminary Analysis Of The Data

The Effect Of Covid 19 And Disease Suppression Policies On Labor Markets A Preliminary Analysis Of The Data

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

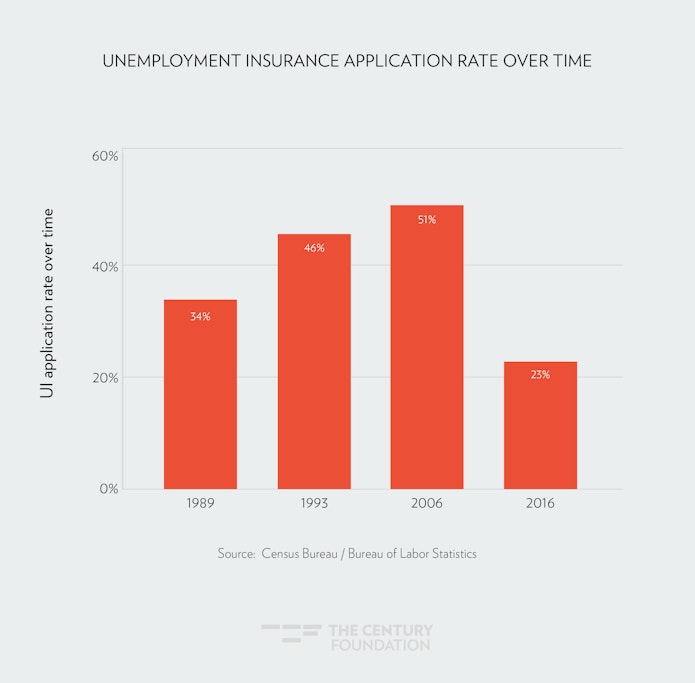

Coronavirus Bill A First Step To Badly Needed Fixes To Unemployment Insurance Ui Benefits

Coronavirus Bill A First Step To Badly Needed Fixes To Unemployment Insurance Ui Benefits

The Effect Of Covid 19 And Disease Suppression Policies On Labor Markets A Preliminary Analysis Of The Data

The Effect Of Covid 19 And Disease Suppression Policies On Labor Markets A Preliminary Analysis Of The Data

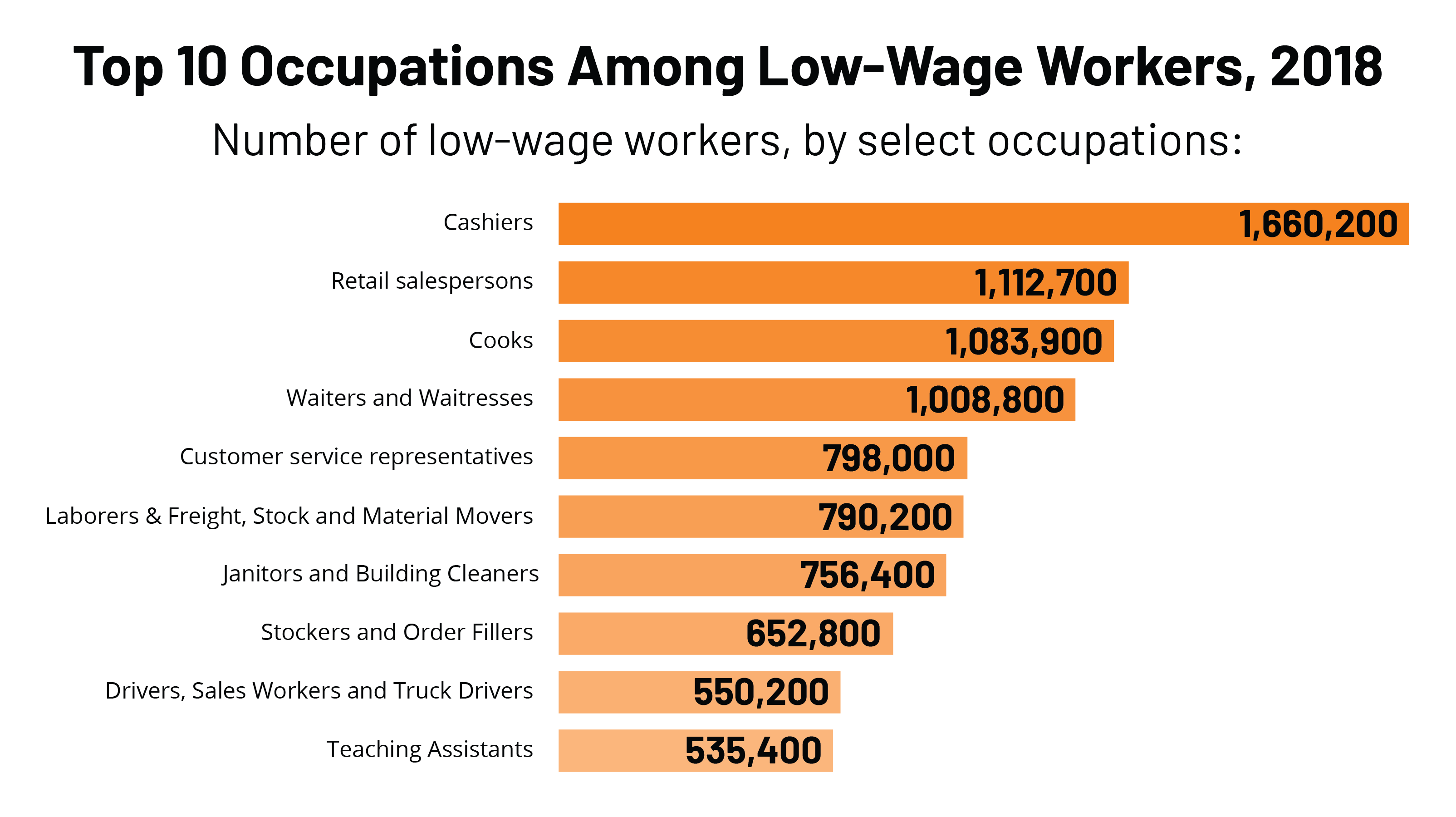

Double Jeopardy Low Wage Workers At Risk For Health And Financial Implications Of Covid 19 Kff

Double Jeopardy Low Wage Workers At Risk For Health And Financial Implications Of Covid 19 Kff

Unemployment Rates And Earnings By Educational Attainment U S Bureau Of Labor Statistics

Unemployment Rates And Earnings By Educational Attainment U S Bureau Of Labor Statistics

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

U S Unemployment Rate By Industry And Class Of Worker February 2021 Statista

U S Unemployment Rate By Industry And Class Of Worker February 2021 Statista

Essential Workers Comprise About Half Of All Workers In Low Paid Occupations They Deserve A 15 Minimum Wage

Essential Workers Comprise About Half Of All Workers In Low Paid Occupations They Deserve A 15 Minimum Wage

Post a Comment for "Unemployment For Salary Workers"