Unemployment For Ohio 1099 Workers

Hall estimated as many as 150000 people could file for PUA benefits starting on Friday. The Ohio Department of Job and Family Services ODJFS this month is issuing 17 million 1099-G tax forms because of a federal law that requires reporting of unemployment benefits.

Petition Unemployment Relief For Independent Workers With Mixed Income Types Change Org

Petition Unemployment Relief For Independent Workers With Mixed Income Types Change Org

Report it by calling toll-free.

Unemployment for ohio 1099 workers. Ohioans who are self-employed 1099 workers or part-time can now apply for pandemic unemployment assistance The new federal program covers many. According to the US. Governor Jon Husted and Dr.

Unemployment for 1099Self-Employed Workers Update. Many Ohioans are also about to receive a 1099-G tax form in the mail stating that they received unemployment benefits in 2020 when in fact they did not. Ohio Department of Job and Family Services ONLINE.

However the federal government created new provisions that allow 1099 earners to tap into unemployment benefits during the ongoing COVID-19 pandemic. Those workers will get benefits plus an additional 600 a week through July 25. Download the Workers Guide to Unemployment Compensation available in English Somali and Spanish.

This benefit expansion program called the Pandemic Unemployment Assistance PUA was created by the federal CARES Act. Of Labor the American Rescue Plan Act expanded the number of weeks many will be able to get unemployment insurance benefits. Some IDES guidance has changed.

How long you can receive unemployment benefits will depend on your work history. Contractors dont earn benefits or have taxes. You should also collect any 1099 forms.

1 day agoHere is how it will work. Unemployment claimants will receive an Internal Revenue Service 1099 form at the end of January for the previous years benefits. Beginning Monday May 11 self-employed and 1099 workers impacted by COVID-19 can apply for unemployment benefits online.

Normally self-employed and 1099 earners such as sole independent contractors freelancers gig workers and sole proprietors do not qualify for unemployment benefits. The best documentation will likely be your 2019 tax return. SharedWork Ohio SharedWork Ohio is a voluntary layoff aversion program.

Coronavirus and Unemployment Insurance. Amy Acton MD MPH provided the following updates on Ohios response to the COVID-19 pandemic. How do I reset my unemployment PIN.

If you are a furloughed federal employee please note that there are two ways to file for unemployment compensation. If you live in Ohio and have lost your job you may be able to get cash assistance through Ohios unemployment program. COLUMBUS Ohio WSYXWTTE As the number of Ohioans whove applied for state unemployment benefits grows to more than one million 1099 or gig workers are getting a breath of air.

If youre collecting unemployment and looking for work you may have the opportunity to work on a contract basis rather than as a permanent employee. It allows workers to remain employed and employers to retain trained staff during times of reduced business activity. See the Ohio Department of Job and Family Services ODJFS unemployment tool to estimate the amount of money you could get based on your old wages.

Deferred Elective Procedures CARES Act Payments 1099 Unemployment Claims First Responder PPE Testing Partnership Prison Update Census 2020 COLUMBUS OhioOhio Governor Mike DeWine Lt. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. You can reset your PIN online or by calling the PIN reset hotline at 866 962-4064.

1099Gs are available to view and print online through our Individual Online Services. You can elect to be removed from the next years mailing by signing up for email notification. But since most people in this group of workers dont have W-2 forms youll likely have to submit more information to your state offices to document your earnings.

1 from this web page by clicking on FileAppeal Benefits from the green Unemployed Workers menu above or 2 by calling toll-free 1-877-644-6562 or TTY 1-888-642-8203 excluding holidays between 8 am. Please visit unemploymentohiogov click on the Report Identity Theft button and complete the form so that we can investigate the claim that was filed and take appropriate actionsThis can include correcting the 1099-G form that you were sent. Get Started Now PUA Application Step-by-Step Guide View FAQs.

The federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filers and part-time workers. The state reports 109369 people filed for unemployment benefits in the last week bringing the five-week total to 964556. Expanded Eligibility Resource Hub.

For more information see JFS 08018 Important Information about Unemployment Insurance Tax Audits or call 614 466-2319. This booklet provides important information about unemployment insurance benefits in Ohio including how to apply how eligibility is determined and what must be done to receive benefit payments.

Can 1099 Employees File For Unemployment

Can 1099 Employees File For Unemployment

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

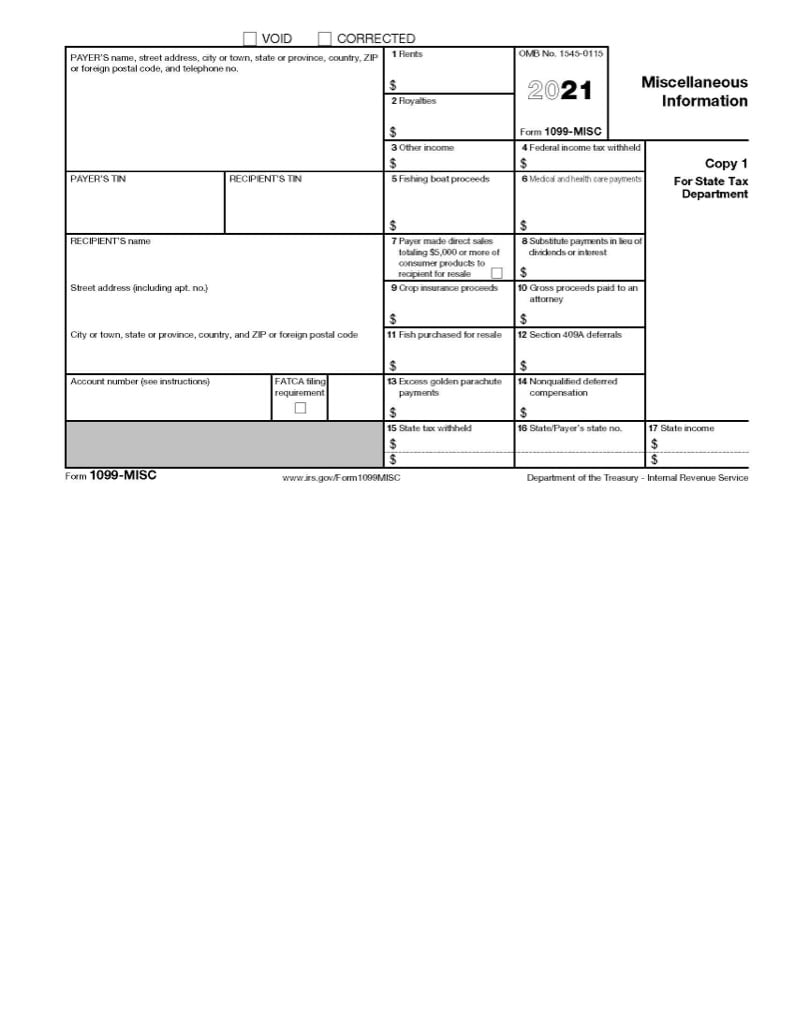

1099 Misc Form What Is It And Do You Need To File It

1099 Misc Form What Is It And Do You Need To File It

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Odjfs Adds Capacity 1099 Workers Can Begin To Line Up Next Week Wcbe 90 5 Fm

Odjfs Adds Capacity 1099 Workers Can Begin To Line Up Next Week Wcbe 90 5 Fm

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

How To Report Misclassification Of Employees Top Class Actions

How To Report Misclassification Of Employees Top Class Actions

Didn T Receive A Form 1099 Don T Ask

Didn T Receive A Form 1099 Don T Ask

1099 Workers Other Jobless Ohioans Not Previously Eligible Can Pre File For Benefits Friday The Statehouse News Bureau

1099 Workers Other Jobless Ohioans Not Previously Eligible Can Pre File For Benefits Friday The Statehouse News Bureau

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Post a Comment for "Unemployment For Ohio 1099 Workers"