Can Self Employed Get Unemployment Under Cares Act

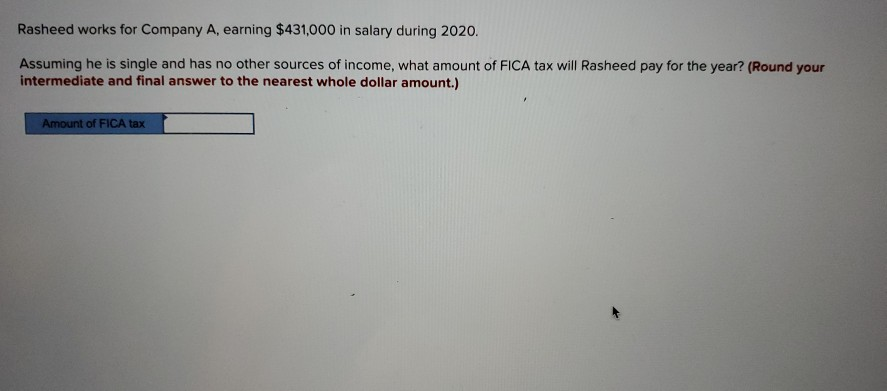

There are four main expanded unemployment benefits under the CARES Act that can aid those that are self-employed. The CARES Act allocates federal funding for states to provide an additional 600-per-week benefit called Federal Pandemic Unemployment Compensation FPUC to any individual who is receiving UI including PUA and PUEC benefits for weeks of unemployment ending on or.

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Unemployment benefits are available for Washingtonians who have lost work because of the COVID-19 crisisincluding freelancers independent contractors and other self-employed workers.

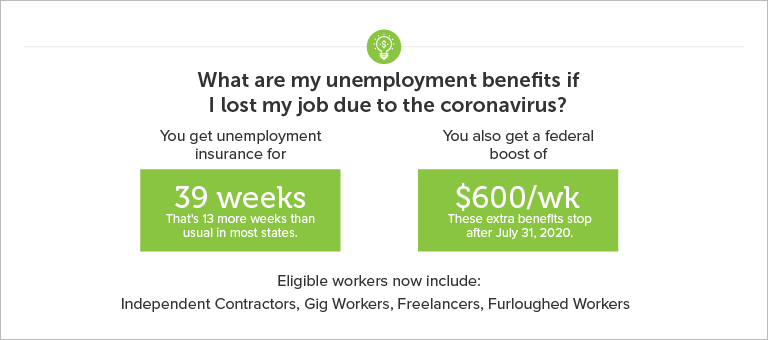

Can self employed get unemployment under cares act. The CARES Act creates a temporary Pandemic Unemployment Assistance PUA program which allows self-employed workers who are otherwise ineligible for unemployment. Are feeling the effects of forced closures and coronavirus lockdown measures small business owners and independent contractors are being hit the hardest. PUA program benefits are available for individuals who do not usually qualify for unemployment compensation and are unable to continue working as a result of COVID-19 such as self-employed workers independent contractors and gig workers.

Expanded categories of workers are eligible for unemployment benefits for the first time. Tips for Handling Joblessness. The new federal CARES Act extensions make this possible.

According to the CARES Act self-employed people affected by the COVID-19 coronavirus pandemic are eligible for Pandemic Unemployment Assistance. The CARES Act permits an individual who is self-employed an independent contractor or a gig worker to receive unemployment benefits if the individual self-certifies that he or she is able and available to work within the meaning of applicable state law and is unemployed partially unemployed or unable or unavailable to work because of one or more of the following COVID-19related reasons. Benefits are boosted by 600 over regular state benefits and can be claimed for up to 39 weeks.

Enacted last month the CARES Act expands unemployment insurance coverage and increases benefits to people whose employment status has been impacted by COVID-19. You must meet the following requirements to be eligible for MEUC. Gig Workers Self-Employed Covered Under CARES Act.

Under the CARES Act self-employed workers and independent contractors can apply for temporary unemployment benefits. The CARES Act makes state unemployment benefits available to self-employed freelance independent contractor and other gig workers unemployed or underemployed by the COVID-19 pandemic. President Trump signed into law the provisions of the CARES Act.

As part of the Continued Assistance Act CAA MEUC provides 100 in extra benefits to individuals with at least 5000 in net income from self-employment that are currently receiving an unemployment benefit from a program other than PUA. Gig workers and self-employed people arent traditionally eligible for unemployment benefits but under the CARES Act they could receive benefits through the Pandemic Unemployment. As part of the CARES Act the Pandemic Unemployment Assistance PUA program was announced.

These additional benefits are not yet available. The expansion of people who can now. The Coronavirus Aid Relief and Economic Security Act CARES Act signed into law on Friday March 27 2020 expands the scope of individuals who are eligible for unemployment benefits including those who are furloughed or otherwise unemployed as a direct result of COVID-19 including self-employed individuals independent contractors gig workers and those who have exhausted.

Expanded unemployment insurance benefits are now available to millions of Americans who are out of work for reasons related to the COVID-19 pandemic under the Coronavirus Aid Relief and Economic Security CARES Act. This program is extended until September 6 2021 and allows individuals receiving benefits to continue collected long as the individual has not reached the maximum number of weeks. Pandemic Unemployment Assistance Section 2102 Under this section covered individuals may receive unemployment assistance for 39 weeks for the rest of the year.

Pandemic Unemployment Assistance PUA provides unemployment benefits to workers who were not traditionally eligible for benefits including self-employed people. While many businesses in the US. Self-employed workers independent contractors gig economy workers and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed partially unemployed or unable or unavailable to work.

CARES Act Unemployment Benefits. This law increases the availability of unemployment insurance benefits to those that are self-employed contract workers those ineligible for state unemployment benefits or have exhausted benefits. This includes people who are not ordinarily eligible such as self-employed independent contractor and gig workers.

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Self Employed And Taxes Deductions For Health Retirement

Self Employed And Taxes Deductions For Health Retirement

Can I Get Unemployment If I M Self Employed Credit Karma

Can I Get Unemployment If I M Self Employed Credit Karma

Don T Forget Unemployment Benefits Are Ta2020 06 09 Dont Forget Unemployment Benefits Are Taxable Tax Debt Business Tax Bookkeeping Business

Don T Forget Unemployment Benefits Are Ta2020 06 09 Dont Forget Unemployment Benefits Are Taxable Tax Debt Business Tax Bookkeeping Business

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Pandemic Unemployment Assistance Pua Benefits Checklist

Pandemic Unemployment Assistance Pua Benefits Checklist

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

The 6 Secrets About Health Insurance California Only A Handful Of People Know Health Insurance C Cheap Health Insurance Health Insurance Health Care Insurance

The 6 Secrets About Health Insurance California Only A Handful Of People Know Health Insurance C Cheap Health Insurance Health Insurance Health Care Insurance

How To Apply For A Ppp Loan When Self Employed Divvy

How To Apply For A Ppp Loan When Self Employed Divvy

Taxes For Freelancers And The Self Employed In Austria Expatica

Taxes For Freelancers And The Self Employed In Austria Expatica

How To Tell If You Are Self Employed Taxact Blog

How To Tell If You Are Self Employed Taxact Blog

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

How To Find Affordable Health Insurance Krankenversicherung Gesundheitspflege Pille Nehmen

How To Find Affordable Health Insurance Krankenversicherung Gesundheitspflege Pille Nehmen

Whether Youre Self Employed Unemployed Or Covered Under An Employers Health Care Plan Finding Aff Health Insurance Cheap Health Insurance Free Health Insurance

Whether Youre Self Employed Unemployed Or Covered Under An Employers Health Care Plan Finding Aff Health Insurance Cheap Health Insurance Free Health Insurance

How To Apply For A Ppp Loan When Self Employed Divvy

How To Apply For A Ppp Loan When Self Employed Divvy

Solved Alice Is Single And Self Employed In 2020 Her Net Chegg Com

Solved Alice Is Single And Self Employed In 2020 Her Net Chegg Com

Post a Comment for "Can Self Employed Get Unemployment Under Cares Act"