Unemployment Va Self Employed

Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. The Virginia Unemployment Compensation Act 602-212C provides that Services performed by an individual for remuneration shall be deemed to be employment subject to this title unless the Commission determines that such individual is not an employee for purposes of the Federal Insurance Contributions Act and the Federal Unemployment Tax Act based upon application of the.

If you are self-employed you wont have to submit proof of earnings like a 1099 or tax filing at this time.

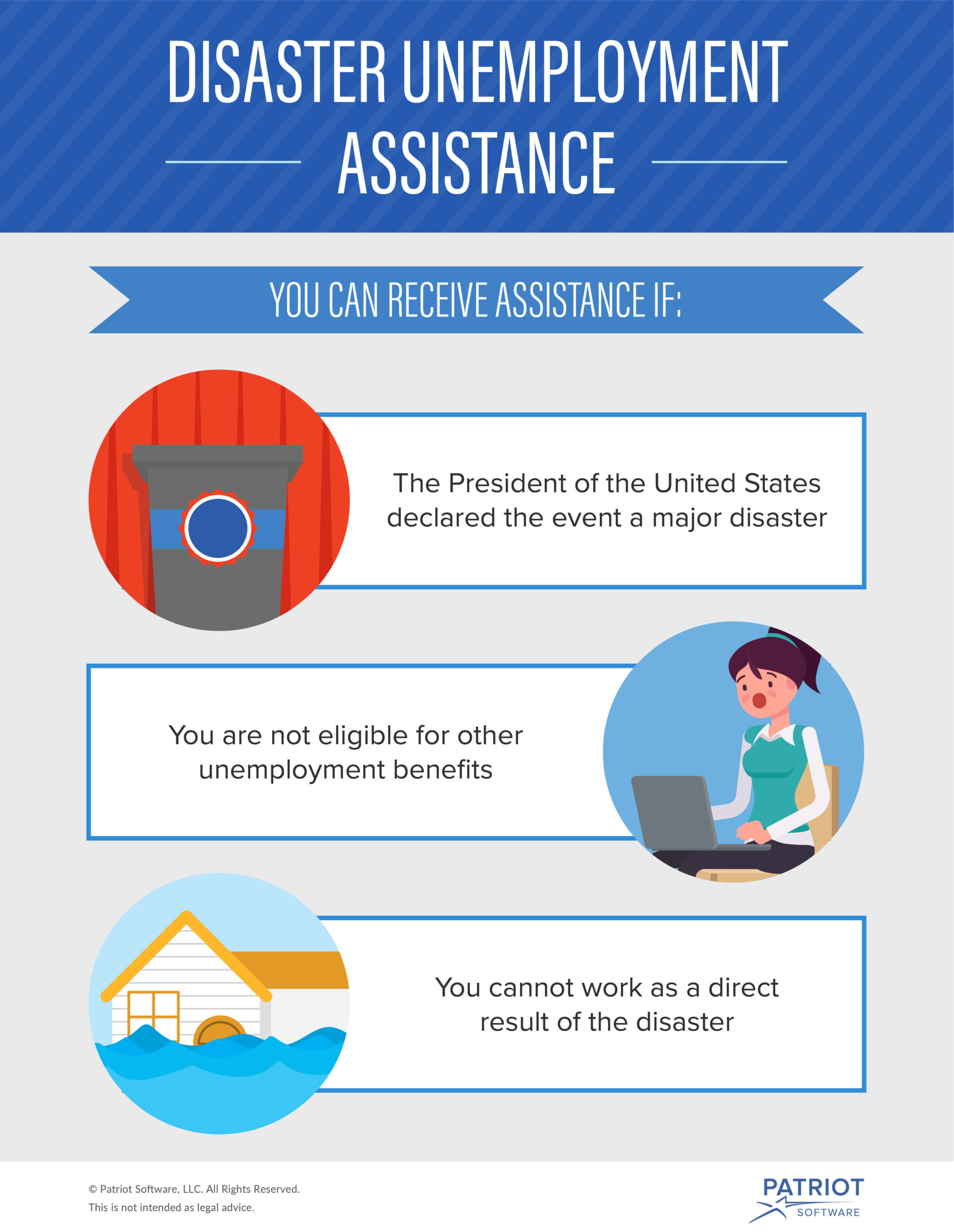

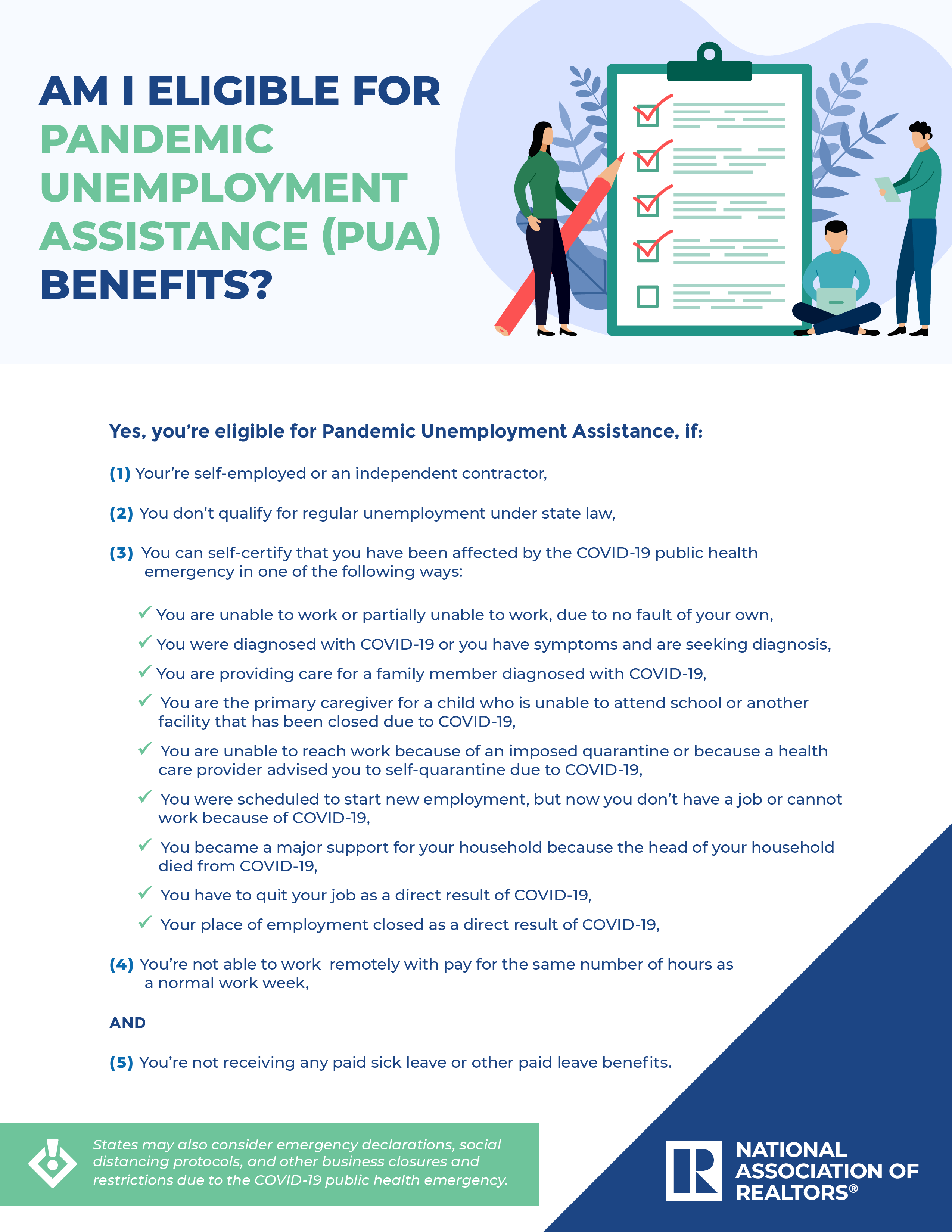

Unemployment va self employed. 11 hours agoBenefits were also expanded to include the self-employed contractors and workers who in the past havent qualified. Self-employed workers and independent contractors are typically excluded from traditional unemployment benefits but the CARES Act creates a Pandemic Unemployment Assistance program. Are my unemployment benefits taxable.

To get the maximum a person must have earned during two quarters of their base period at least 1890001. Sole proprietor and partner compensation is not reportable and they cannot pay unemployment tax on themselves. Traditionally the self-employed have not been able to receive unemployment as they do not pay the government unemployment insurance.

Benefits are paid between 12 and 26 weeks depending on your situation. Once you have filed your initial claim you must continue to file your weekly. The more you made the higher the payout.

Find out if Veteran Readiness and Employment VRE can help you start your own business. These individuals may include those who are self-employed independent contractors gig economy workers clergy and those working for religious. The information was used to fraudulently apply for Virginia unemployment.

866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. Generally unemployment benefits are taxable. If you are married and your spouse also received unemployment both of you can exclude 10200.

You may file a claim for unemployment insurance through this Website by clicking the link below to File a new claim for unemployment benefits or through our Customer Contact Center by calling 1-866-832-2363 Monday through Friday 830am 430pm and between 9am and 1pm on Saturday closed Sunday and state holidays. As such unless they have wages from covered employment with another employer they will not have any recorded earnings on which to base a claim. However in light of the economic situation and shut-downs the federal government has changed the policy to include the self-employed freelancers and gig-workers.

Important Information Concerning the CARES Act and Unemployment Insurance UI The CARES Act includes a provision of temporary benefits for individuals who are not eligible for regulartraditional unemployment insurance. The additional 600-per-week Federal Pandemic Unemployment Compensation program ends on July 31 2020 though the date can vary by state. Freelancers self-employed workers now eligible for unemployment benefits in Virginia Under the CARES Act self-employed workers and independent contractors.

Weekly unemployment benefits in Virginia range from 60 to 378 per week and are based on your wages. The American Rescue Plan signed into law on March 11 2021 includes a provision that makes the first 10200 of unemployment nontaxable for each taxpayer who made less than 150000 in 2020. The CARES Act allows states to pay unemployment benefits to self-employed people for up to 39 weeks.

Virginia Relay call 711 or 800-828-1120. Box 26441 Richmond VA 23261-6441. VRE Self-Employment track If youre a service member or Veteran with a service-connected disability and employment barrier who has the strong desire skills and drive to run a successful business you may be interested in the Self-Employment track.

According to the VEC these payments.

How To Get Food Stamps Or Snap Benefits When Self Employed Toughnickel

How To Get Food Stamps Or Snap Benefits When Self Employed Toughnickel

Chart Where People Are Self Employed Around The World Statista

Unemployed Contractors Self Employed Virginians Can Now File Weekly Claims Through Gov2go App Youtube

Unemployed Contractors Self Employed Virginians Can Now File Weekly Claims Through Gov2go App Youtube

How To File For Unemployment Benefits If You Re Self Employed Youtube

How To File For Unemployment Benefits If You Re Self Employed Youtube

Self Employed Unemployment Insurance Can Business Owners File

Self Employed Unemployment Insurance Can Business Owners File

Nc Unemployment Self Employed Workers Contractors Can Apply For Pandemic Unemployment Assistance Benefits Friday Abc11 Raleigh Durham

Nc Unemployment Self Employed Workers Contractors Can Apply For Pandemic Unemployment Assistance Benefits Friday Abc11 Raleigh Durham

Employment Posters California Employment Related Securities Return Temporary Employment Agencies Bolton Contract Template Caregiver Caregiver Resources

Employment Posters California Employment Related Securities Return Temporary Employment Agencies Bolton Contract Template Caregiver Caregiver Resources

Fha Loan For Self Employed In 2021 Fha Lenders

Fha Loan For Self Employed In 2021 Fha Lenders

Is Owning An Llc Considered Self Employment In 2021 The Blueprint

Is Owning An Llc Considered Self Employment In 2021 The Blueprint

The Top 10 Best Self Employed Jobs Smartasset

The Top 10 Best Self Employed Jobs Smartasset

Career Transition Ivmf Hiring Veterans Veteran Jobs Job Fair

Career Transition Ivmf Hiring Veterans Veteran Jobs Job Fair

Schedule C Income Mortgagemark Com

Schedule C Income Mortgagemark Com

Proof Of Income Self Employed Check More At Https Nationalgriefawarenessday Com 43454 Proof Of Income Self Empl Statement Template Lettering Letter Templates

Proof Of Income Self Employed Check More At Https Nationalgriefawarenessday Com 43454 Proof Of Income Self Empl Statement Template Lettering Letter Templates

Mortgage Loan Options For Self Employed Buyers

Mortgage Loan Options For Self Employed Buyers

Stimulus 2020 Unemployment Insurance For Self Employed Individuals Turbotax Tax Tips Videos

Stimulus 2020 Unemployment Insurance For Self Employed Individuals Turbotax Tax Tips Videos

City Of Providence Pvd Self Employment Program City Of Providence Self Employment Employment Self

City Of Providence Pvd Self Employment Program City Of Providence Self Employment Employment Self

Pandemic Unemployment Assistance Pua Benefits Checklist

Pandemic Unemployment Assistance Pua Benefits Checklist

6 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor

6 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor

Self Employed And Taxes Deductions For Health Retirement

Self Employed And Taxes Deductions For Health Retirement

Post a Comment for "Unemployment Va Self Employed"