Unemployment Taxes Standard Deduction

The American Rescue Plan waived federal tax on up to 10200 of jobless aid per person collected in 2020. The remaining 9800 would be taxable but the person would also enjoy the 12000 standard deduction and likely wouldnt owe any tax he said.

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers.

Unemployment taxes standard deduction. Even if you make 1 million in a year you still receive the standard deduction pay 10 on the first 9875 12 on the next portion on up to the top tax rate of 37 for income above 518400. People whose adjusted gross income was less than 150000 can exclude up to 10200 of unemployment benefits from taxes in 2020. For taxpayers filing form 1 NRPY qualification for the deduction is based on the total income - not just the amount that may be taxable in Massachusetts and the deduction is the smaller of 10200 or.

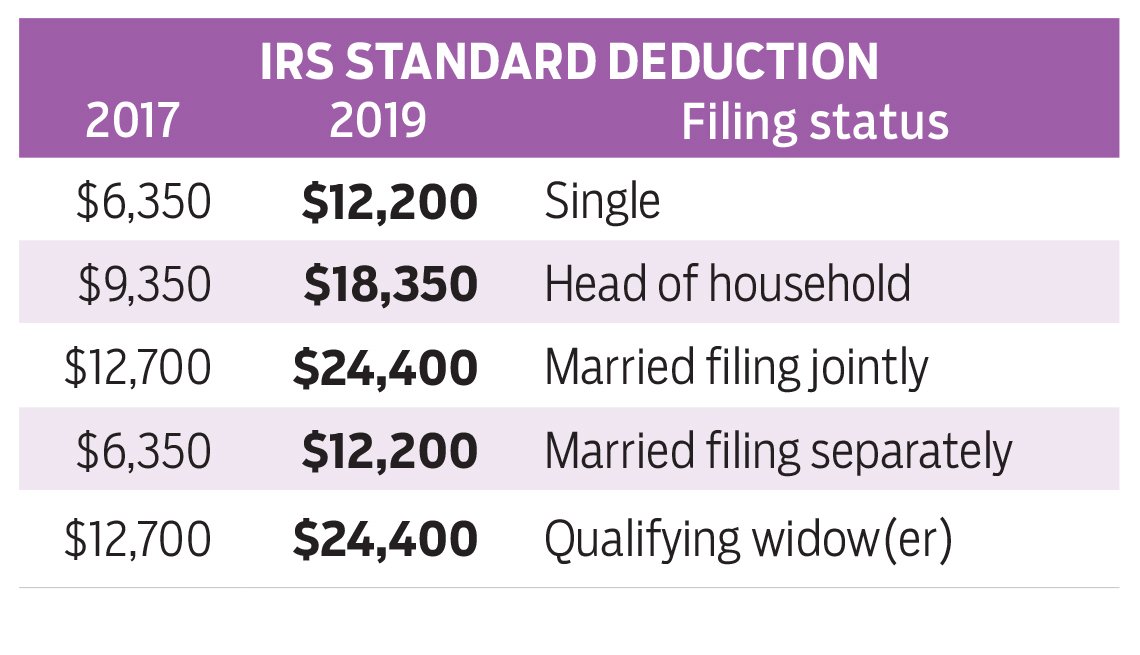

Prior to the 2018 tax year the standard deductions were about half as much. As such ODT issued guidance on April 6 related to the unemployment benefits deduction for tax year 2020. Child tax credit and credit for other dependents.

If youre unfamiliar with the standard deduction continue reading. In 2020 you can deduct up to 300 per tax return of qualified cash contributions if you take the standard deduction. For tax year 2020 what you file in early 2021 the standard deduction is 12400 for single filers and 24800 for joint filers.

You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. For 2021 this amount is up to 600 per tax return for those filing married filing jointly and 300 for other filing statuses. Massachusetts Deduction Deduction for 1 st Named individual smaller of 10200 or total unemployment compensation for that individual.

As a result your unemployment benefits may be taxed federally anywhere from 0 to 37. The legislation excludes only 2020 unemployment benefits from taxes. If two spouses both received unemployment.

10 That extra 600 is also taxable after the first 10200. 12400 for single filers and married couples filing separately 18650 for heads of household. My advice would be to know yourself Madison says.

The Tax Cuts and Jobs Act passed in 2017 increased the standard deduction meaning many low- to middle-income taxpayers receiving UI may end up owing little or no federal taxes. The guidance provides several tax filing scenarios but many OSCPA members have asked about taxpayers who previously filed federal and Ohio tax returns and are waiting for IRS to issue a refund based on the unemployment benefits deduction. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

Any income above those levels will fall into one of the. 1 day agoIn 2017 Congress made a landmark change by nearly doubling the standard deduction and the percentage of tax filers using it rose to 87 in 2019 from 68 two years before according to IRS. You would exclude the first 10200 and pay tax only on the remaining 2000.

Go beyond taxes to build a comprehensive financial plan. Unemployment benefits are included along with your other income such as wages salaries and bank interest For tax year 2020 the first 10200 of unemployment income are tax free for taxpayers with an AGI of less than 150000. For example if you received 8000 in regular state unemployment benefits and 4200 in 600 Federal Pandemic Unemployment Compensation weekly payments you would have a total of 12200 in benefits.

On April 1 2021 Governor Baker signed legislation which allows taxpayers with household income up to 200 of the federal poverty level to deduct up to 10200 of unemployment compensation from taxable income on their Massachusetts tax return. It provided an additional 600 per week in unemployment compensation per recipient through July 2020. The standard deduction for 2020 was 12400 for singles 24800 for married couples and 18650 for those filing as head of household.

If you are married each spouse receiving unemployment compensation doesnt have to pay tax on. The deduction may be claimed by each eligible individual for tax years 2020 and 2021. The 19 trillion Covid relief measure limits that break to.

For the 2020 tax year the standard deduction amounts are. If its less than the standard deduction for your filing status you might not need to file a tax returnand youre not on the hook for paying taxes on unemployment income.

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

2021 Taxes A Comprehensive Guide To Filing Money

2021 Taxes A Comprehensive Guide To Filing Money

Tax Q A Can I Deduct Property Tax Without Itemizing

Tax Q A Can I Deduct Property Tax Without Itemizing

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Federal Income Tax Bracket Tables And Standard Deduction Changes Aving To Invest

Federal Income Tax Bracket Tables And Standard Deduction Changes Aving To Invest

Asked And Answered Filing Taxes While On Unemployment

Asked And Answered Filing Taxes While On Unemployment

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Give To Charity But Don T Count On A Tax Deduction

Give To Charity But Don T Count On A Tax Deduction

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

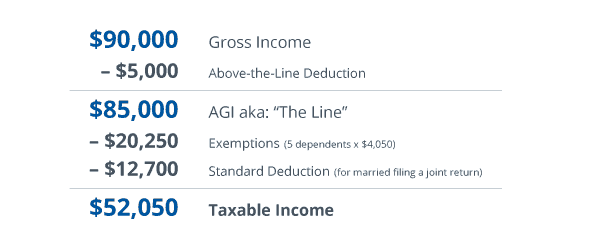

Standard Deduction Tax Exemption And Deduction Taxact Blog

Standard Deduction Tax Exemption And Deduction Taxact Blog

Standard Vs Itemized Deductions

Standard Vs Itemized Deductions

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Five Ways The Covid 19 Pandemic Could Affect Your Taxes This Year

Five Ways The Covid 19 Pandemic Could Affect Your Taxes This Year

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Solved Re Claim Of Right With Standard Deduction

Solved Re Claim Of Right With Standard Deduction

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

2013 Tax Rates And Brackets Standard Deduction And Personal Exemptions Updated In Federal Irs Tax Table Aving To Invest

2013 Tax Rates And Brackets Standard Deduction And Personal Exemptions Updated In Federal Irs Tax Table Aving To Invest

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Post a Comment for "Unemployment Taxes Standard Deduction"