What Wages Are Subject To Washington State Unemployment Taxes

For state unemployment tax purposes only the first 9000 paid to an employee by an employer during a calendar year constitutes taxable wages An employer cannot count wages paid by another employer to an employee in the calendar year toward this 9000 taxable limit unless he is a successor to the prior employer and transfer of. Prepare for a state tax bill.

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

The amount over the taxable wage base of 56500 500 in the example is considered excess wages.

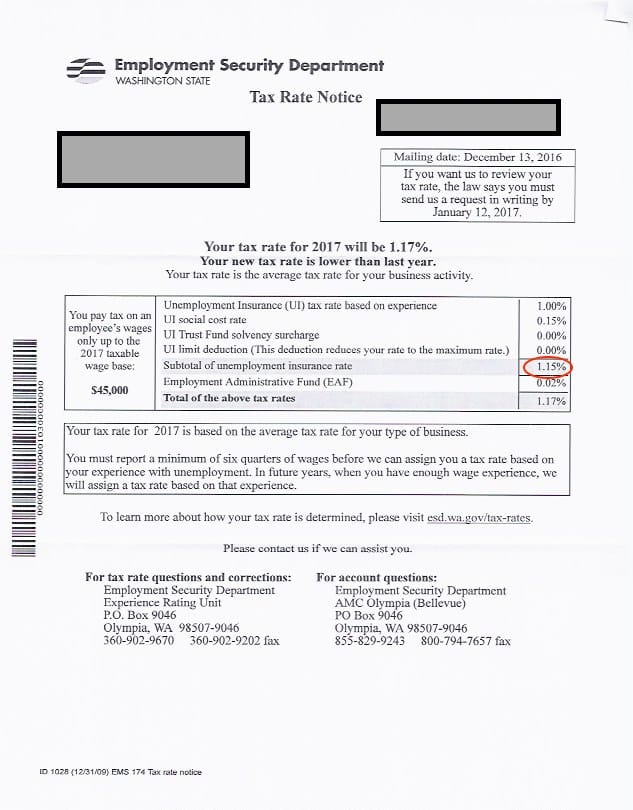

What wages are subject to washington state unemployment taxes. Employers with previous employees may be subject to a different rate. UI tax is paid on each employees wages up to a maximum annual amount. Use the tax rate provided to you by the Washington Employment Security Department.

If an employee earns more than the taxable wage base no further tax is due for that year. Again an example might help. The state UI tax rate for new employers also known as the standard beginning tax rate also is subject to change from one year to the next.

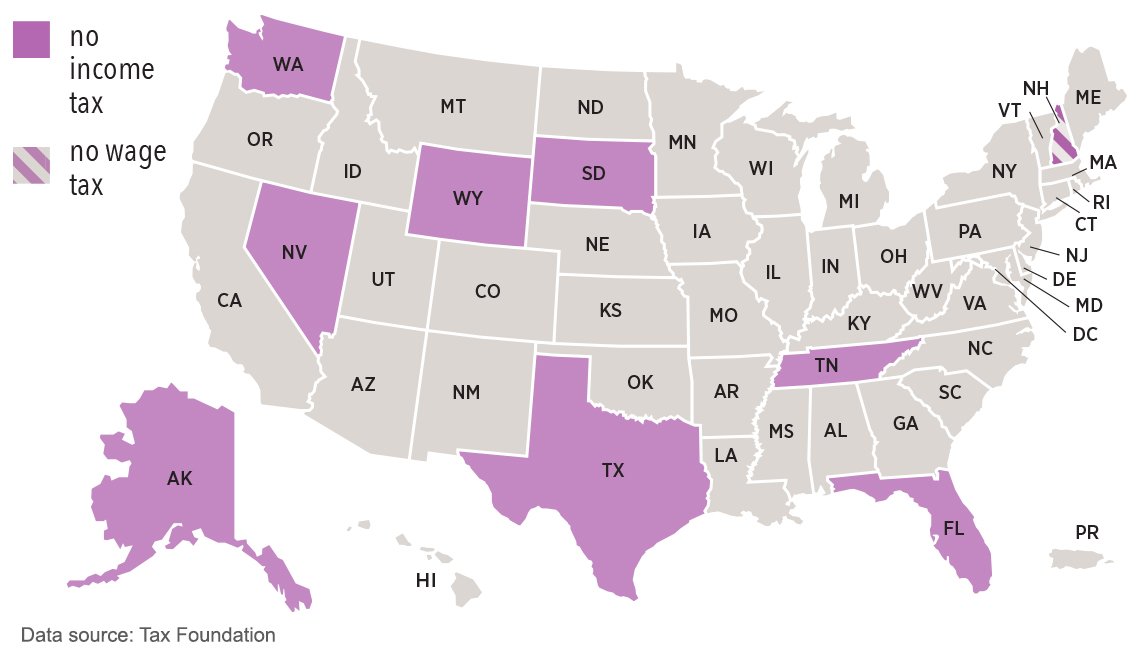

If you have employees working in Washington you likely must pay unemployment taxes on their wages in this state. You must pay your states unemployment tax rate on each employees wages until they earn above the wage base. This change will be effective 1120.

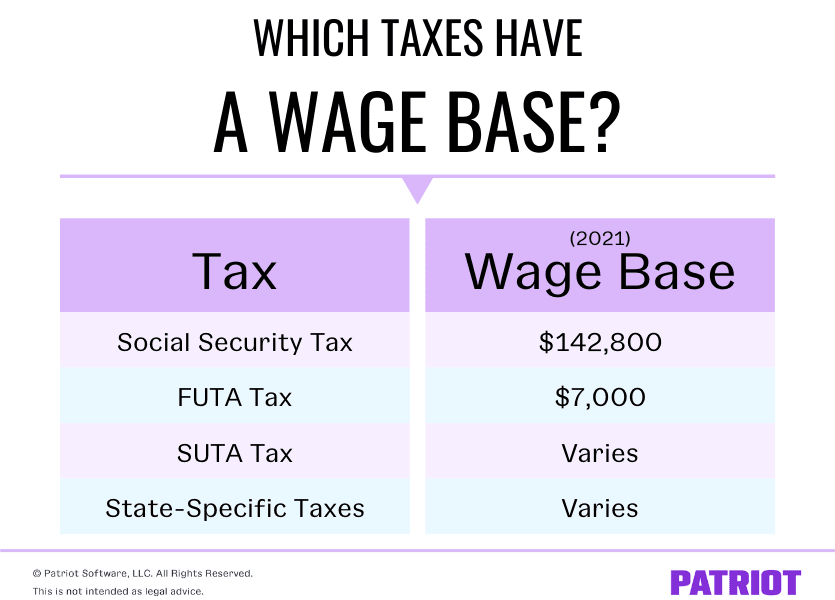

Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from. Tax reports or tax and wage reports are due quarterly. Most states set a higher taxable wage base for SUTA than the 7000 FUTA tax wage base.

This applies to the first 56500 of wages for each employee. For example Washingtons taxable wage base is 56500 for 2021. The amount each employee was paid for working whether paid as a fixed salary hourly pay or overtime.

Liable employers must submit a tax report every quarter even if there are no paid employees that quarter andor taxes are unable to be paid. Some of the factors are the salary you pay the corporate officer your corporations state tax rate and the total difference in wages among all employees excluding corporate officers between the federal taxable wage base 7000 as of November 2013 and the state taxable wage base 41300 for 2014. 2 days agoIR-2021-81 April 8 2021 WASHINGTON The Internal Revenue Service reminds eligible residents of the US.

Territories that if they receive unemployment compensation payments that are otherwise subject to US. If your payroll reaches 1000 in any quarter you must report wages for the entire year. You pay unemployment taxes on your employees gross wages up to the taxable wage base.

When an employee receives PFL benefits the payments come from the state. If you hire someone to perform domestic services in a private home college club fraternity or sorority you do not report until you pay wages of 1000 or more per quarter. However PFL benefits are not subject to Social Security and Medicare taxes or federal unemployment FUTA tax.

Based on the last response from the state we are changing tax rule -800023 for Illness Leave Wages so that those wages are NOT subject to WA State Unemployment. Employers SUTA Experience Rate The initial SUTA rate assigned to an employer may be increased or decreased by the state over a period of time depending on the amount of benefits paid out of the state fund on behalf of the employers terminated employees. The maximum gross pay subject to SUTA tax is generally the first 7000 of gross pay paid to each employee.

In recent years it has exceeded 42000. The state unemployment tax that District of Columbia employers pay to the Department of Employment Services DOES on the first 9000 of wages paid to each employee finances the unemployment benefits that unemployed District workers receive. If you got unemployment income last year and your state isnt offering a tax break on your first 10200 of benefits you may need to gear up for a tax bill when you.

In Washington new employers will pay 115 percent of the average state unemployment SUI tax rate for all businesses in their respective industries with the minimum rate being 100 as set by federal law. This differs from the definition used in other places like by the federal government. SUTA is paid on wages and other compensation up to a maximum per employee during each calendar year the taxable wage base is 56500 for 2021.

In all 50 states employers pay the same 6 rate for each and every worker but the federal government may change the rate in future years. Income tax for 2020 following legislation that was passed. Excess wages are reported for unemployment-insurance benefits purposes but are subtracted from the employees total wages so they do not pay taxes on the amount above the taxable wage base 56500 in 2021.

Income tax they may be eligible to exclude up to 10200 per person of unemployment compensation from US. In general employers must pay 6 of gross wages up to a cap of 7000 per worker in order to fund federal unemployment taxes FUTA for each employee. When paid vacation or holidays earnings are reportable.

Tips reported by the employee. That amount known as the taxable wage base increases slightly every year in Washington.

Setting Up Washington Payroll In Xero Skepsis Technologies

Setting Up Washington Payroll In Xero Skepsis Technologies

Washington Paycheck Calculator Smartasset

Washington Paycheck Calculator Smartasset

Do I Need To File A Tax Return Forbes Advisor

Do I Need To File A Tax Return Forbes Advisor

Setting Up Washington Payroll In Xero Skepsis Technologies

Setting Up Washington Payroll In Xero Skepsis Technologies

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Understanding Your Pay Statement Office Of Human Resources

Understanding Your Pay Statement Office Of Human Resources

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax 2021 Tax Rates And Information

What Is A Wage Base Definition Taxes With Wage Bases More

What Is A Wage Base Definition Taxes With Wage Bases More

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

What Are Employee And Employer Payroll Taxes Ask Gusto

What Are Employee And Employer Payroll Taxes Ask Gusto

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Washington Paycheck Calculator Smartasset

Washington Paycheck Calculator Smartasset

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Post a Comment for "What Wages Are Subject To Washington State Unemployment Taxes"