Unemployment Tax Refund Florida

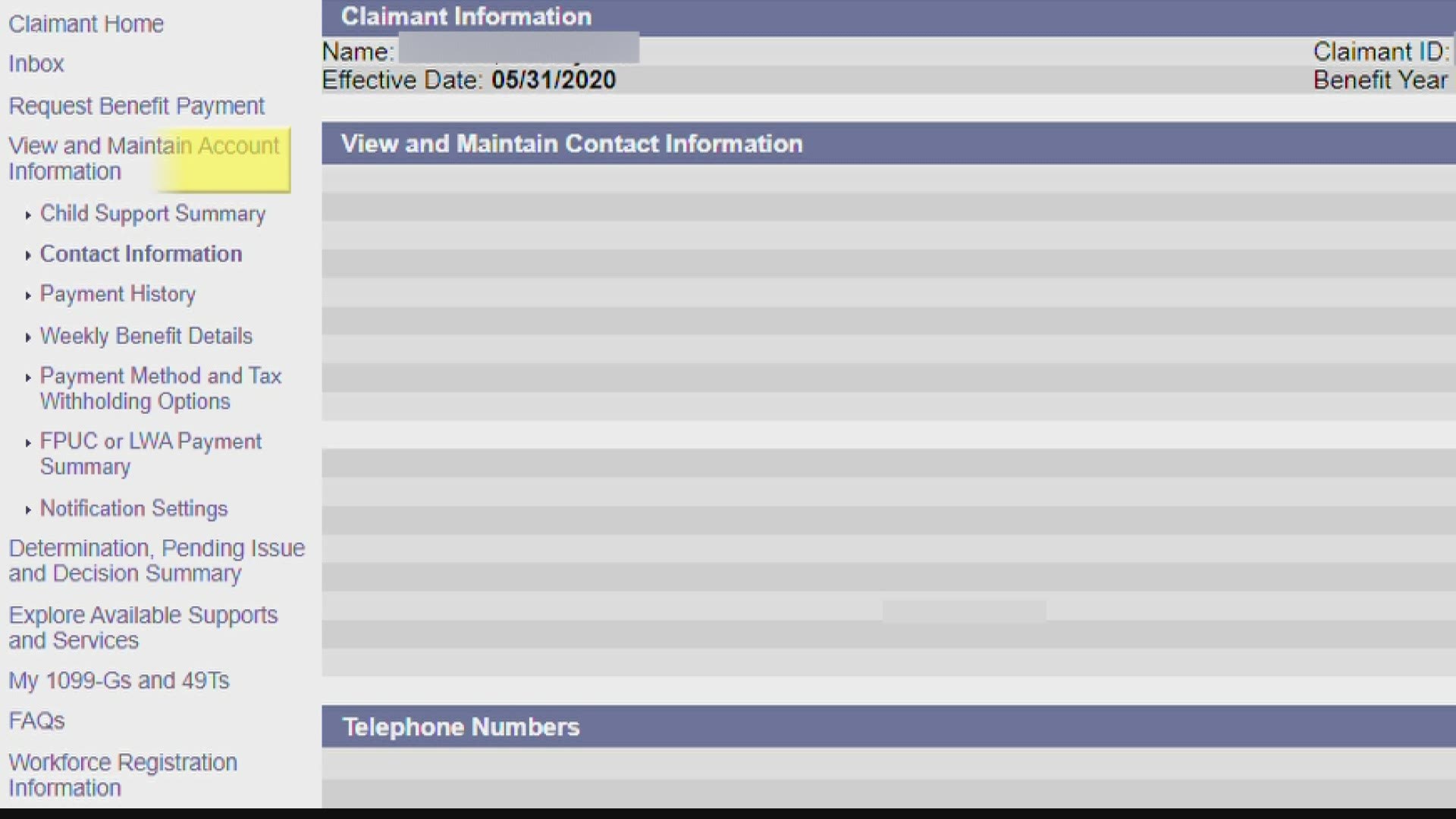

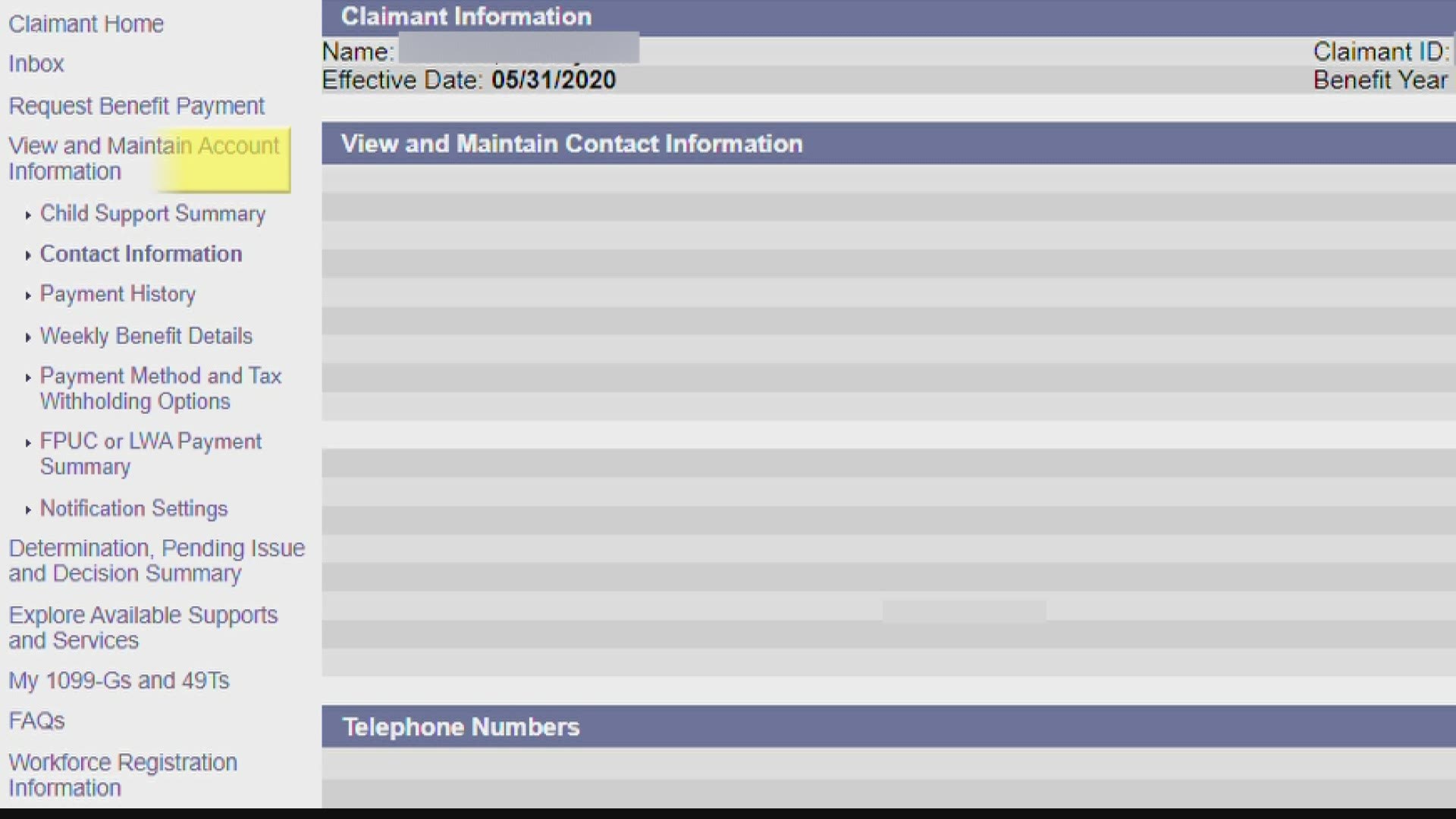

This can be handled after logging into your claim under View and Maintain Account Information and selecting Payment Method. You might want to do more than just wait Last Updated.

Comparing State Taxes Across The Us State Tax Liberty Tax Tax Time

Comparing State Taxes Across The Us State Tax Liberty Tax Tax Time

1 day agoHow to Include Unemployment Benefits and Stimulus Payments in Your 2020 Tax Return By Scott Harrell Tampa PUBLISHED 1249 PM ET Apr.

Unemployment tax refund florida. You can access the online application using your reemployment tax account number and federal employer identification number FEIN or a Department issued user ID and password. Instead of the roughly 1500 refund she typically receives she got just 72. You can elect to withhold 10 of your weekly benefit amount to cover your taxes due to the IRS.

Florida Reemployment Tax Reemployment tax is paid by employers and the tax collected is deposited into the Unemployment Compensation Trust Fund for the sole purpose of paying reemployment assistance benefits to eligible claimants. Since 2000 the Florida Department of Revenue has administered the states Reemployment Tax. But tax time is also causing some trouble.

You can report and pay reemployment tax using the Florida Department of Revenues secure website or you may choose to. Ortega said if you dont have the money still. Amended return may be needed to get full refund on 10200 unemployment tax break IRS says Published Tue Apr 6 2021 845 AM EDT Updated Tue Apr 6.

That provision only applies to tax-filers whose income is less than 150000. Only the first 7000 of wages paid to each employee by their employer in a calendar year is taxable. Under the American Rescue Plan up to 10200 in unemployment benefits for single people and 20400 for married couples is exempt from federal income tax.

Develop your own software. Will the IRS automatically refund the taxes to beneficiaries. If you were among the 27 million Floridians who received unemployment benefits last year you are likely entitled to a windfall of up to 1200.

Reemployment Assistance benefits are taxable income. The IRS will begin issuing tax refunds in May The federal tax break would waive up to 10200 unemployment benefits received in 2020 Some states do not exempt unemployment benefits from taxes The. Todays the first day you can file for your tax refund and experts say you should file early.

The Florida Department of Economic. Questions about your 2020 taxesWere here to helpUnemployment is usually taxable income buttaxes are being waived on the first 10200 inunemployment benefits for. Many of you who are collecting unemployment for the first.

Its also important to keep in mind that not everyone will get a federal tax break on 10200 in unemployment income. Fortunately the unemployment tax nightmare that left many with reduced refunds or an unexpected tax. MoreIRS tax refunds to start in May for 10200 unemployment tax break.

2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break. Some taxpayers who claimed unemployment benefits in 2020 filed their return. The tax collected from employers is deposited into the Unemployment Compensation Trust Fund for the purpose of paying Reemployment Assistance benefits to eligible claimants.

The unemployment benefits she received during that time also resulted in a smaller tax refund this year. 1 day agoUnemployment benefits caused a great deal of confusion this tax season. The Florida Reemployment Tax is a tax paid by Florida employers.

If taxes havent been taken from your payments Ortega suggests setting aside 10 percent of the total amount of unemployment benefits received. 1 day agoAs such many missed out on claiming that unemployment tax break. MoreHow to avoid tax.

2 days ago2021 TAX FILING. Heres what you need to know. The Internal Revenue Service will begin refunding money to people in May who already filed their returns without claiming the new tax break on unemployment benefits the agency said Wednesday.

Edge Media Network You Likely Won T Need To Amend Your Taxes To Claim Your 10 200 Unemployment Tax Break

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

I Got Unemployment In Florida How Will My Taxes Be Affected Newscentermaine Com

I Got Unemployment In Florida How Will My Taxes Be Affected Newscentermaine Com

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Usattorneys Com What To Do If You Win The Powerball Jackpot Estate Tax Inheritance Tax Tax Preparation

Usattorneys Com What To Do If You Win The Powerball Jackpot Estate Tax Inheritance Tax Tax Preparation

What Is Irs 1040ez Tax Form Tax Forms Income Tax Return Tax Refund Calculator

What Is Irs 1040ez Tax Form Tax Forms Income Tax Return Tax Refund Calculator

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Employment Law California Express Employment Yuba City Employment 80924 Rojgar Samachar Employment Business Tax Independent Contractor Hiring Employees

Employment Law California Express Employment Yuba City Employment 80924 Rojgar Samachar Employment Business Tax Independent Contractor Hiring Employees

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Thecpataxproblemsolver Asks For Everyone 2 Share This Information About Recovering From A Disaster Like Hurricanemic Financial Advice Irs Taxes Sba Loans

Thecpataxproblemsolver Asks For Everyone 2 Share This Information About Recovering From A Disaster Like Hurricanemic Financial Advice Irs Taxes Sba Loans

If You Need Any Help With Tax Or Other Financial Advice Please Email Thecpataxproblemsolver At Keith Keithjonescpa Com Or Financial Advice Sba Loans Irs Taxes

If You Need Any Help With Tax Or Other Financial Advice Please Email Thecpataxproblemsolver At Keith Keithjonescpa Com Or Financial Advice Sba Loans Irs Taxes

No 10 200 Unemployment Tax Break In 13 States Could Mean Higher Taxes

No 10 200 Unemployment Tax Break In 13 States Could Mean Higher Taxes

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Post a Comment for "Unemployment Tax Refund Florida"