Unemployment Tax Refund Iowa

MoreIRS tax refunds to start in May for 10200 unemployment tax break. Rates vary from 0000 to 9000 on table 1 and from 0000 to 7000 on table 8.

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Nonresidents must also file an Iowa return if they are subject to Iowa lump-sum tax or Iowa minimum tax even if Iowa-source income is less than 1000.

Unemployment tax refund iowa. Some taxpayers who claimed unemployment benefits in 2020 filed their return. If Iowa-source income is 1000 or more a nonresident isnt. 2 days ago2021 TAX FILING.

Iowa extends filing deadline. Instead of the roughly 1500 refund she typically receives she got just 72 back. State Income Tax Range.

Please check your refund status at Wheres My Refund. The majority of these refunds are issued before the. A must report the 500 as income on her 2020 federal return.

033 on up. On April 25 2020 A received a refund of 500 from the 2019 Iowa return. That bill unanimously passed and just needs the Senates approval before landing on Gov.

Will the IRS automatically refund the taxes to beneficiaries. Iowa Department of Revenue. If both spouses received unemployment benefits each of the spouses should report the benefits received as shown on the.

You might want to do more than just wait Last Updated. Wheres My Refund Use Wheres My Refund to check the status of your Iowa Income tax refund. Unemployment Insurance Tax Rate Tables.

COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable. The Department issues 825 million in individual income tax refunds per calendar year. Addresses unemployment compensation March 29 2021 Des Moines Iowa The Iowa Department of Revenue has extended the filing and payment deadline to June 1 2021 for 2020 individual income tax returns and first quarter estimated income tax payments for individuals from the April 30 2021 statutory deadline.

The anticipated time frame for refund processing is 30-45 days. People filing an original 2020 Iowa tax return should report the unemployment compensation exclusion amount on Form IA 1040 Line 14 using a code of M. Enter the amount of unemployment compensation benefits that was taxable on your federal return with the following modification.

What information do I need. This means table 1 collects the most UI tax and table 8 collects the least UI tax. In January of 2021 the Iowa Department of Revenue sends A a 1099-G showing a reportable refund of 500.

12 hours agoAmericans who collected unemployment insurance in 2020 and filed their taxes before claiming a new tax break on the benefits can expect to receive an automatic refund. MoreHow to avoid tax. March 20 2021 at 941 am.

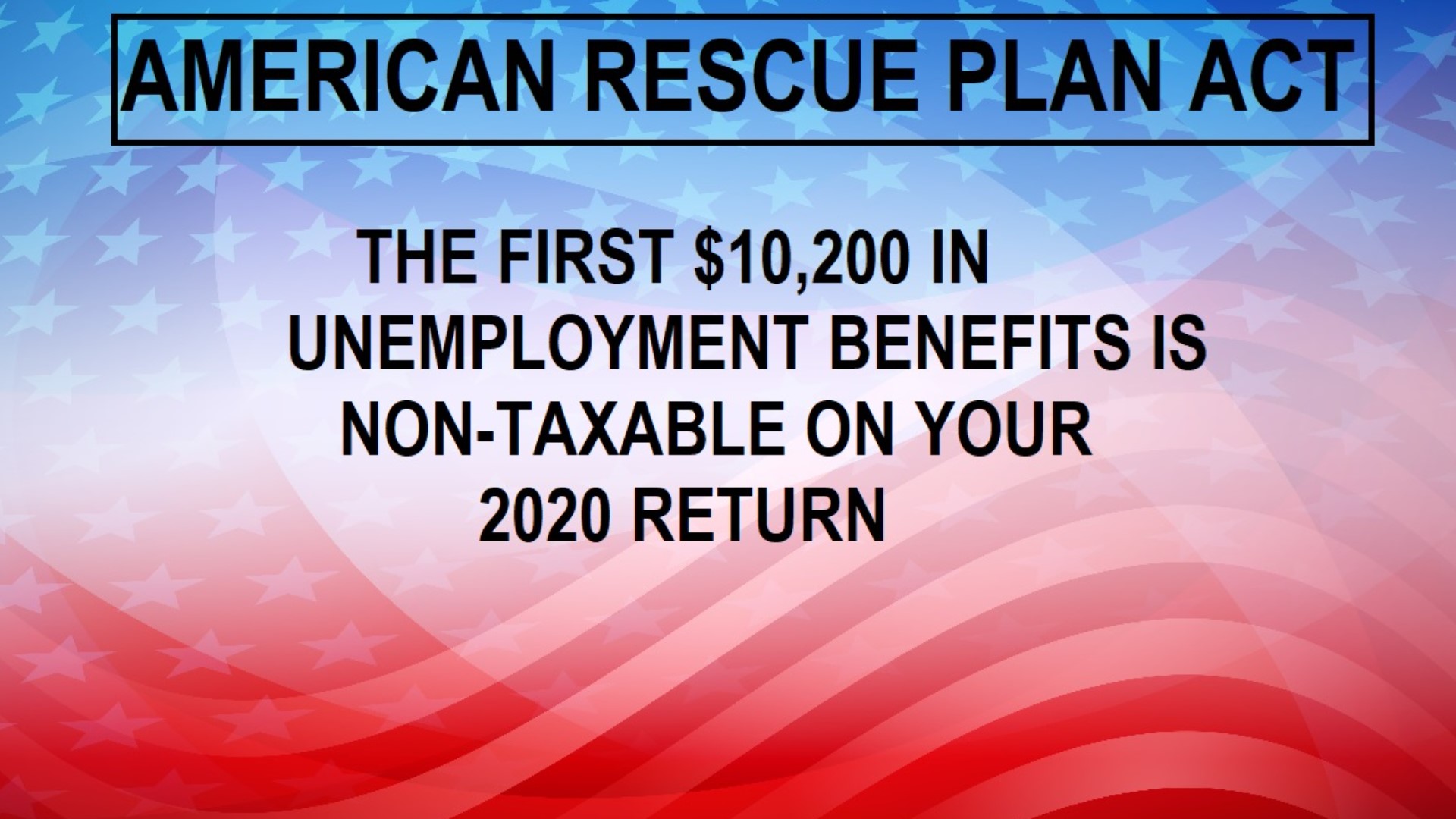

1 day agoAs such many missed out on claiming that unemployment tax break. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. The Iowa law stipulates that UI taxes may be collected from employers under eight different tax rate tables and each tax rate table has 21 rate brackets or ranks.

What does funnel week mean in the Iowa Legislature. The Iowa House passed their own COVID relief package already. Income from pass-through entities such as partnerships and S-corporations.

Heres what you need to know. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American. The unemployment benefits she received during that time also resulted in a smaller tax refund this year.

Social Security Number SSN Tax Year Refund. All Forms and Publications Forms for Individuals Forms for Employers Iowa Workforce Development Administration Documents Labor Market Information Documents. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break.

Do not include unemployment compensation and sickness insurance benefits paid by the Railroad Retirement Board. TaxWatch What to do if you already filed taxes but want to claim the 10200 unemployment tax break Last Updated. The now Senate File 364 exempts pandemic-related grants and unemployment benefits from state income tax.

Federal Unemployment Tax Act most private employers covered by the Iowa UI Program are subject to the Federal Unemployment Tax Act FUTA you can receive a maximum credit equal to 54 percent against this tax if you are participating in a state UI program that meets federal requirements.

When Are Taxes Due Weareiowa Com

When Are Taxes Due Weareiowa Com

Technology Quantum Internet Transfers Data At Lightening Speed In 2021 Digital Science Quantum Engineering Challenge

Technology Quantum Internet Transfers Data At Lightening Speed In 2021 Digital Science Quantum Engineering Challenge

Get Answers About Stimulus Payments And Taxes Kare11 Com

Get Answers About Stimulus Payments And Taxes Kare11 Com

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Supporting Small Business Employees In A Top Companies World Lmar2018 Employee Perks Good Employee Family Medical

Supporting Small Business Employees In A Top Companies World Lmar2018 Employee Perks Good Employee Family Medical

What Do South Koreans See As The Biggest Barrier To Peace North Korea Threat Korea

What Do South Koreans See As The Biggest Barrier To Peace North Korea Threat Korea

How To File Taxes For Free In 2021

2020 Taxes Everything You Need To Know About Filing This Year

2020 Taxes Everything You Need To Know About Filing This Year

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

How Eliminating Certain Tax Deductions Will Affect Income Groups Tax Deductions Income Family Income

How Eliminating Certain Tax Deductions Will Affect Income Groups Tax Deductions Income Family Income

Taxes 2021 Tax Filing Season Delayed Until February Irs Says Abc11 Raleigh Durham

Taxes 2021 Tax Filing Season Delayed Until February Irs Says Abc11 Raleigh Durham

Mpower Financing Review Student Millennial Personal Finance Student Loans

Mpower Financing Review Student Millennial Personal Finance Student Loans

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

Irs Will Automatically Send Refunds For Unemployment Tax Breaks

Irs Will Automatically Send Refunds For Unemployment Tax Breaks

Here Are The Barbershop Salon Rules For Reopening In Florida On Monday Orlando Sentinel Barber Shop Salons Cosmetology License

Here Are The Barbershop Salon Rules For Reopening In Florida On Monday Orlando Sentinel Barber Shop Salons Cosmetology License

Make Sure You Don T Pay Taxes On These Unemployment Benefits Weareiowa Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Weareiowa Com

Post a Comment for "Unemployment Tax Refund Iowa"