New York Unemployment Tax Calculator

The day you acquire any. If you are eligible for regular unemployment insurance benefits Extended Benefits up to 20 additional weeks or Pandemic Emergency Unemployment Compensation up to 53 additional weeks an additional 600 per week will be added to your benefits for the benefit weeks ending 452020 to 7262020 and an additional 300 per week will be added to your benefits for the benefit weeks.

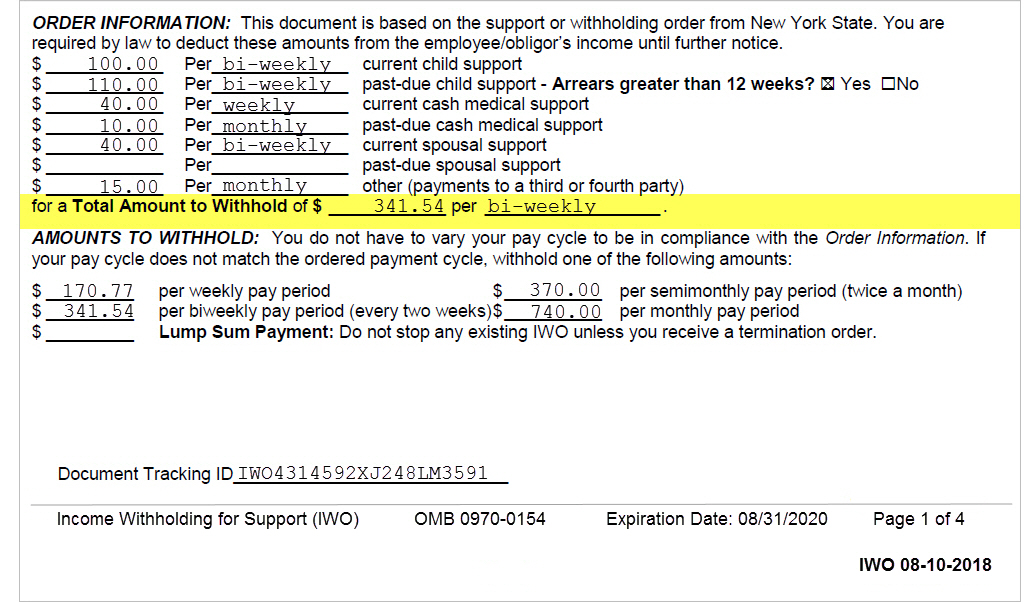

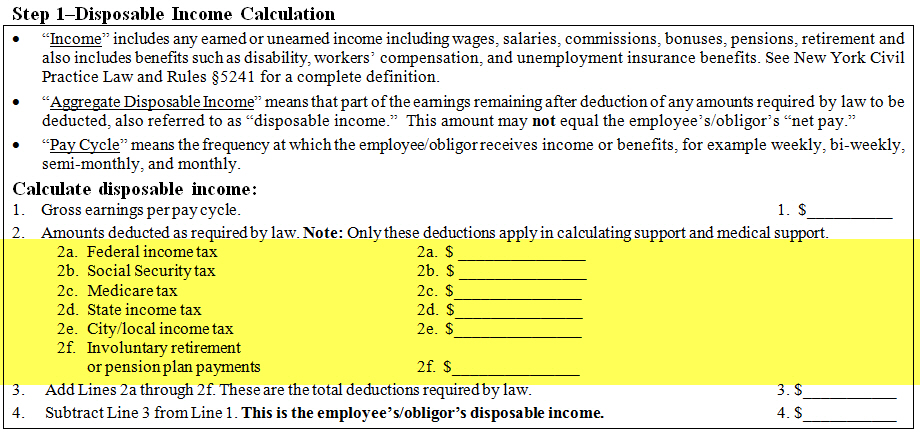

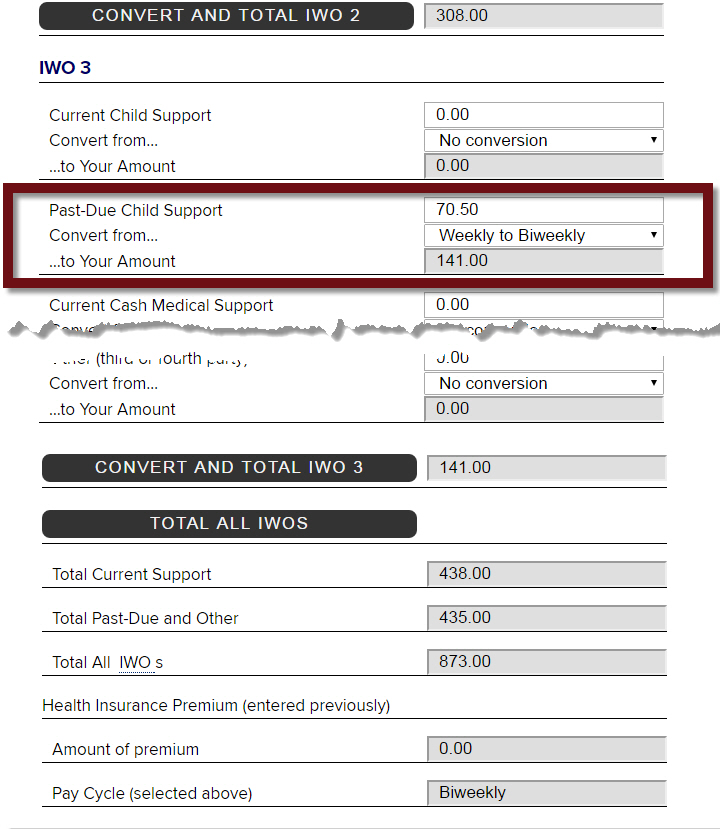

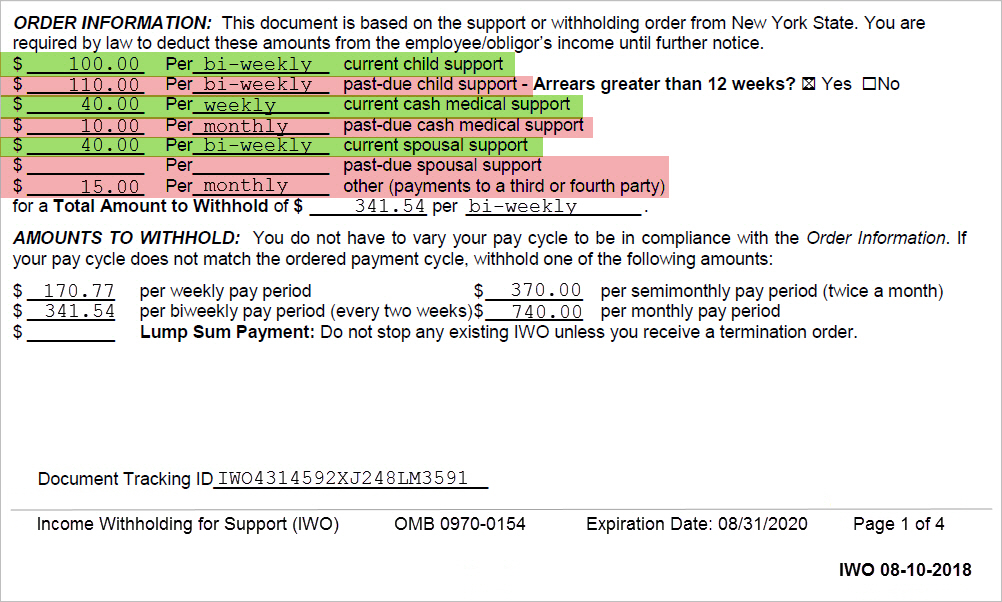

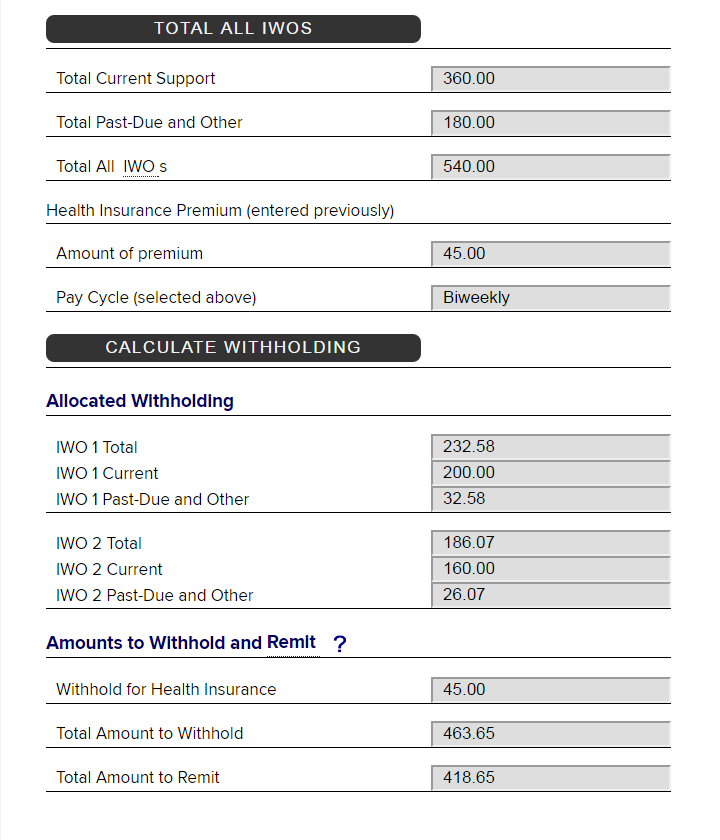

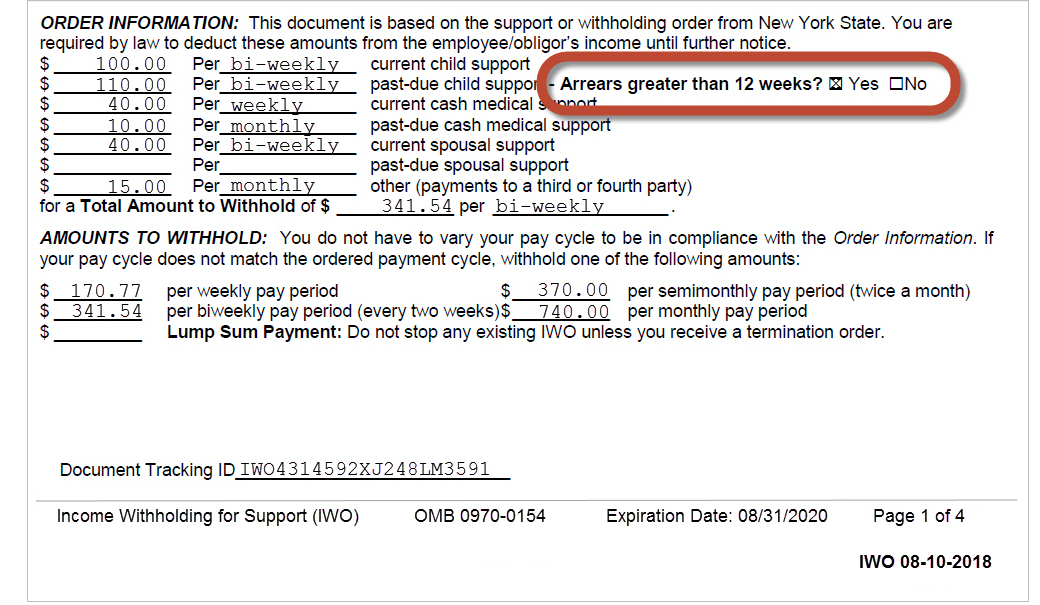

Nys Dcss Income Withholding Worksheet

Nys Dcss Income Withholding Worksheet

Use this rate to calculate line 4 on the Quarterly Combined Withholding.

New york unemployment tax calculator. The 1099 tax rate consists of two parts. This tool uses the latest information provided by the IRS including annual changes and those due to tax reform. You are subject to the MCTMT.

Usually your business receives a tax credit of up to 54 from the federal government when it pays its state unemployment tax effectively reducing the FUTA rate to. State Income Tax Range. New York Unemployment Taxes If you received a large amount of unemployment yes it is common to have a tax bill despite withholding.

You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. Gather your 2019 tax documents including 1099s business receipts bank records invoice payments and related documents to fill in the drop down sections. You receive certain types of taxable income and no tax is withheld or.

Therefore if an employee submits a federal Form W-4 to you for tax year 2020 or later and they do not file Form IT-2104 you may. 14 on up to 20000 of taxable income. 32421 - New York State is currently decoupled from the federal American Rescue Plan Act of 2021.

On the first 11800 each employee earns New York employers also pay unemployment insurance of between 0525 and 7825. As a New York for-profit employer you become liable for state UI taxes at either of the following times. Estimated tax is the method used to pay tax on income when no taxor not enough taxis withheld.

However Democrats voted against the proposal. New Yorks income tax rates range from 4 to 882. If youre a new employer youll pay a flat rate of 3125.

The first day of the calendar quarter in which you pay remuneration wages of 300 or more or. Learn more about your NY. Wage Reporting and Unemployment Insurance Report NYS 45.

This Act excludes from federal gross income a portion of the unemployment compensation received in tax year 2020 for taxpayers with adjusted gross income AGI of less than 150000. 1075 on taxable income. State Taxes on Unemployment Benefits.

Rules for Unemployment Insurance Tax Liability. This calculator uses the average weekly state benefit amount reported by the Department of Labor from January 2020 to November 2020 to calculate total unemployment compensation and. The Center Square New York state Senate Republicans offered Wednesday an amendment that would have eliminated the income tax liability on a portion of unemployment benefits residents received last year.

For heads of household the threshold is 1616450 and for married people filing jointly it is 2155350. New Jersey does not tax unemployment compensation. Use this Self-Employment Tax Calculator to estimate your tax bill or refund.

Certain churches and non-profits are exempt from this payment. The top tax rate is one of the highest in the country though only individual taxpayers whose taxable income exceeds 1077550 pay that rate. New York has yet to adopt the federal governments exemption on the first 10200 in unemployment payments forcing many New Yorkers still.

Most states only withhold 10 for federal tax which wont be enough if you are in a higher tax bracket and many people forego having any state tax withheld. Less than 0 The Unemployment Insurance contribution rate is the normal rate PLUS the subsidiary rate. The exemption for the 2019 tax year is 574 million which means that any.

124 for social security tax and 29 for Medicare. New York Estate Tax. Unemployment Insurance New York Codes Rules and Regulations Electronic Interpretation Service The Interpretation Service Index is a compilation of rules based on Appeal Board.

For tax years 2020 or later withholding allowances are no longer reported on federal Form W-4. However due to differences in federal and New York State tax law this may result in the wrong amount of tax withheld. You may be required to make estimated tax payments to New York State if.

New Yorks estate tax is based on a graduated rate scale with tax rates increasing from 5 to 16 as the value of the estate grows. The biggest reason why filing a 1099-MISC can catch people off guard is because of the 153 self-employment tax. For 2021 the new employer normal contribution rate is 34.

The self-employment tax applies evenly to everyone regardless of your income bracket. ALBANY NY NEWS10 Not every state taxes unemployment but now that the federal government says the first 10200 of benefits will be tax free New York is.

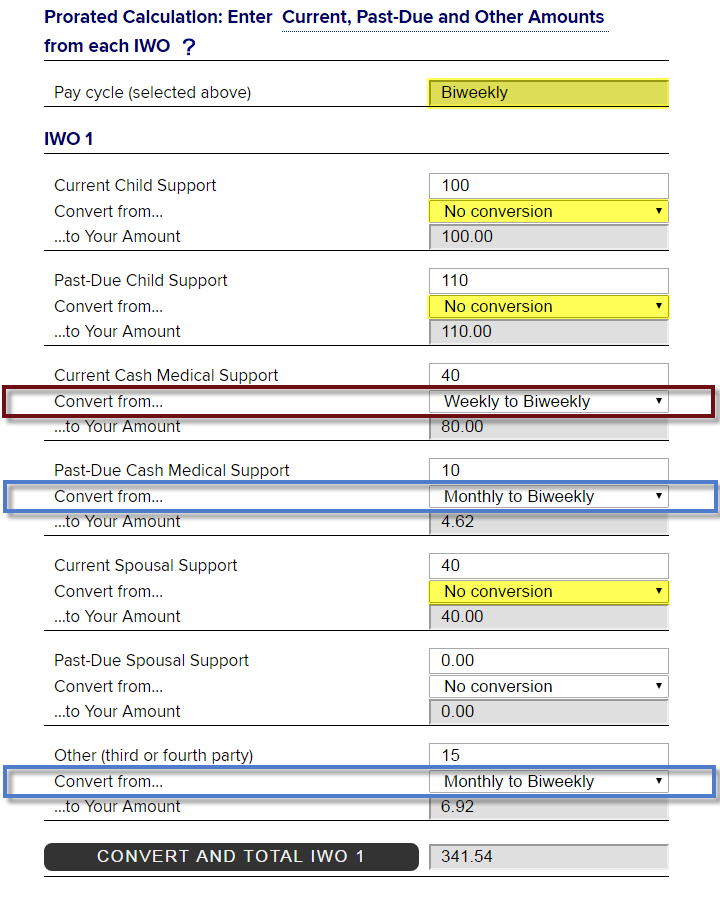

Nys Dcss Income Withholding Worksheet

Nys Dcss Income Withholding Worksheet

Nys Dcss Income Withholding Worksheet

Nys Dcss Income Withholding Worksheet

Unemployment Insurance Rate Information Department Of Labor

Unemployment Insurance Rate Information Department Of Labor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Nys Dcss Income Withholding Worksheet

Nys Dcss Income Withholding Worksheet

New York Paycheck Calculator Smartasset

New York Paycheck Calculator Smartasset

Nys Dcss Income Withholding Worksheet

Nys Dcss Income Withholding Worksheet

New York Paycheck Calculator Smartasset

New York Paycheck Calculator Smartasset

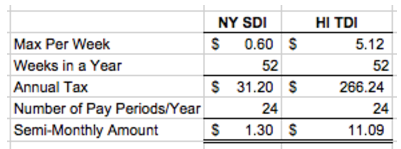

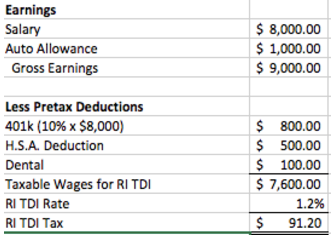

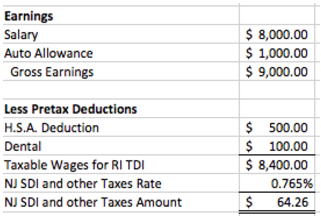

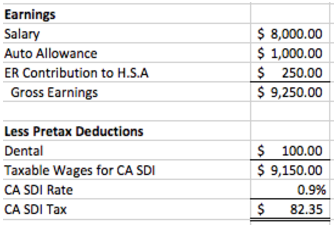

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Nys Dcss Income Withholding Worksheet

Nys Dcss Income Withholding Worksheet

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

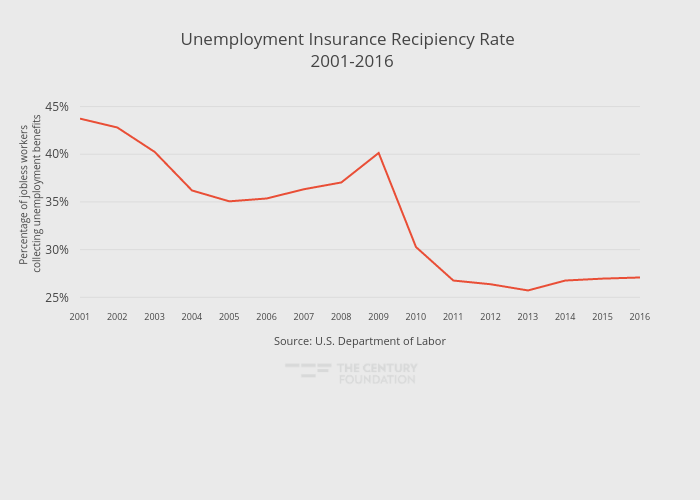

Unemployment Trust Fund Recovery Is Helping Employers Not Workers

Unemployment Trust Fund Recovery Is Helping Employers Not Workers

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Nys Dcss Income Withholding Worksheet

Nys Dcss Income Withholding Worksheet

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How Are State Disability Insurance Sdi Payroll Taxes Calculated

What Are Employee And Employer Payroll Taxes Ask Gusto

What Are Employee And Employer Payroll Taxes Ask Gusto

Post a Comment for "New York Unemployment Tax Calculator"