Illinois Unemployment Tax Rate Calculator

Newly registered businesses must register with IDES within 30 days of starting up. The Illinois Department of Employment Security IDES announced today that the unemployment rate decreased -03 percentage point to 74 percent while nonfarm payrolls were up 21100 jobs in February based on preliminary data provided by the US.

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

See Schedule M Instructions.

Illinois unemployment tax rate calculator. You receive an additional 9 if you have a dependent spouse and an additional 179 per a dependent child. Employers who are subject to the Illinois Unemployment Insurance Act supply the funds IDES uses to pay benefits to the unemployed. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of.

Important Information about NAICS Credits to Employers 102015 - During routine preparation of tax rates for calendar year 2016 the Department discovered program errors that. Below is a table of the general merchandise sales tax rates for all of the counties in Illinois and the largest cities. For experience-rated employers those with three or.

Bureau of Labor Statistics BLS and released by IDES. New-employer rates are generally the greater of a standard new employer rate or the average tax rate for the new employers industry as defined by the North American Industry Classification System NAICS. Unemployment benefits in Illinois are paid by the businesses and organizations that operate within the state lines.

Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. Unemployment Taxes. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

For more information go to the Illinois State Tax Guide for Middle-Class Families. If youre a new employer your rate is 3175. Write Unemployment Exclusion across the top of Form IL-1040-X.

The base rate is 625. Usually your business receives a tax credit of up to 54 from the federal government when it pays its state unemployment tax effectively reducing the FUTA rate to. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

The provided information does not constitute financial tax or legal advice. We make no promises that the sum you receive will be equal to what the calculator illustrates. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

For more detailed information and the Illinois withholding tax amounts see. The wage base is 12960 for 2021 and rates range from 0525 to 6925. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

For the current income tax rate see Income Tax Rates. The highest combined sales tax in Illinois is 11 in the city of River Grove and Chicagos top sales tax rate is 1025. The Illinois State State Tax calculator is updated to include the latest State tax rates for 20212022 tax year and will be update to the 20222023 State Tax Tables once fully published as published by the various States.

To understand the amount to contribute to the unemployment insurance fund you must follow the. To apply for Illinois unemployment benefits click here The most recent figures for Illinois show an unemployment rate of 8. Your WBA is approximately 47 of your average weekly wage based on your two highest-earning quarters.

Railroad Unemployment and sick pay are not taxed by Illinois. The Illinois State State Tax calculator is updated to include the latest Federal tax rates for 2015-16 tax year as published by the IRS. As you know a new employer is one who has not incurred liability for state unemployment taxes within the three previous calendar years.

However most areas have additional local taxes between 1 and 475. If any amount of your Unemployment Exclusion includes railroad unemployment do not include this amount on Schedule M Line 37. This calculator uses the average weekly state benefit amount reported by the Department of Labor from January 2020 to November 2020 to calculate total unemployment compensation and.

12 rows Click here for an historical rate chart. We strive to make the calculator perfectly accurate. The Illinois Department of Employment Security distributes payments to claimants who qualify for benefits.

In Illinois the median property tax rate is 2165 per 100000 of assessed home value. 2021 IL-700-T Illinois Withholding Tax Tables Booklet effective January 1 2021 - December 31 2021. The calculator returns your estimated WBA based on your average weekly wage during the base period.

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

Payroll Software Solution For Illinois Small Business

Payroll Software Solution For Illinois Small Business

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

Pin By Eris Discordia On Economics Consumer Price Index Economics Index

Pin By Eris Discordia On Economics Consumer Price Index Economics Index

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

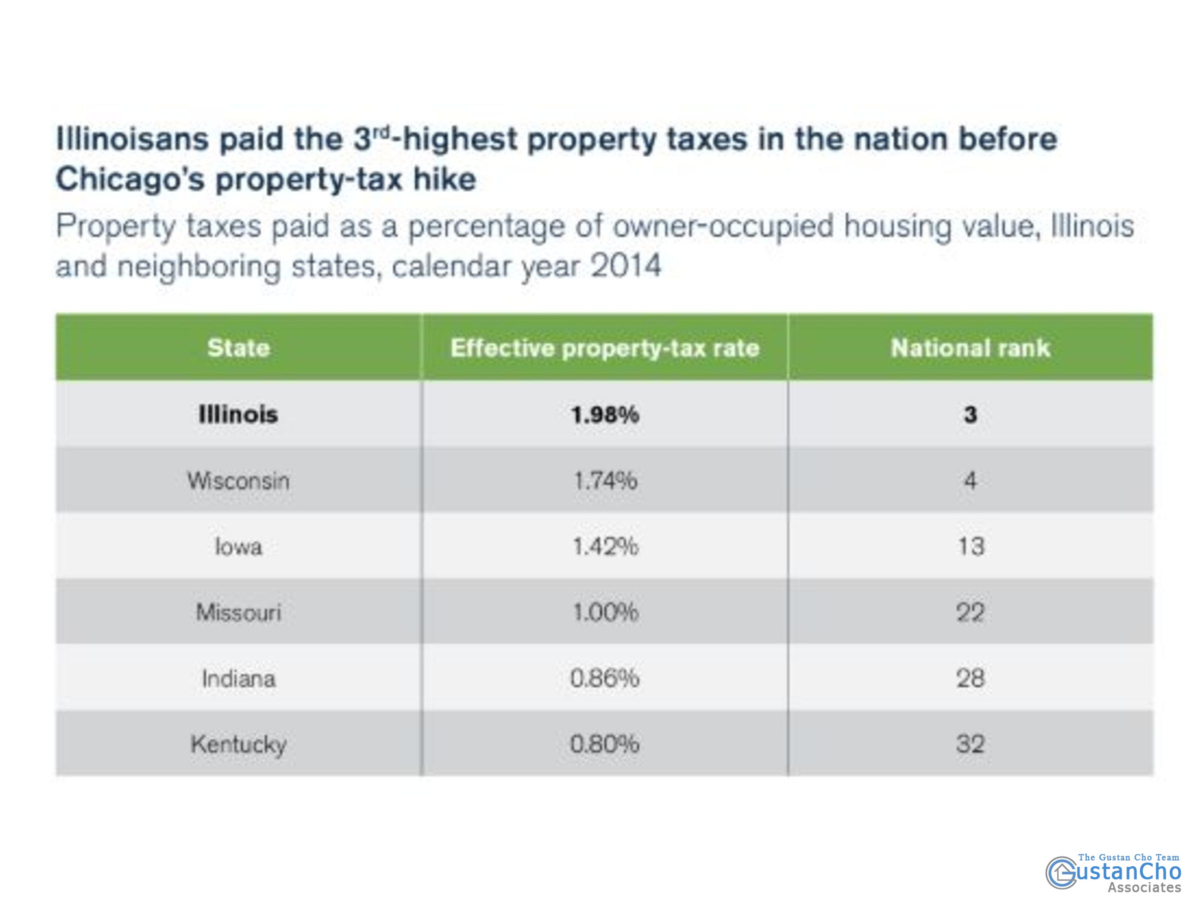

Illinois Ranked As Highest Taxed State In The Nation For Taxpayers

Illinois Ranked As Highest Taxed State In The Nation For Taxpayers

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

How Does Being On Unemployment Affect My Child Support Obligation In Pennsylvania Child Support Laws Child Support Laws Child Support Payments Child Support

How Does Being On Unemployment Affect My Child Support Obligation In Pennsylvania Child Support Laws Child Support Laws Child Support Payments Child Support

Business Owners Optimistic Following Increased Unemployment Tax Rate Wuft News

Business Owners Optimistic Following Increased Unemployment Tax Rate Wuft News

Futa Federal Unemployment Tax Act San Francisco California

Futa Federal Unemployment Tax Act San Francisco California

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

High Taxes Mean Less Revenue For Some States Personal Liberty Map Low Taxes Illinois

High Taxes Mean Less Revenue For Some States Personal Liberty Map Low Taxes Illinois

Post a Comment for "Illinois Unemployment Tax Rate Calculator"