Massachusetts Employer Unemployment Tax Form

The law also includes tax relief provisions for employers and employees including gross income exclusions for employers who received certain COVID-19 relief benefits and a tax. Learn the requirements which come with being an employer in Massachusetts.

Https Www Mass Gov Doc Employer Ui Online User Guide Download

State Taxes on Unemployment Benefits.

Massachusetts employer unemployment tax form. Business in Massachusetts is required to file an Employers Quarterly Report of Wages Paid Form WR-1. The American Rescue Plan a 19 trillion Covid relief bill waived. File quarterly reports of wages paid to each employee who resides or is employed in Massachusetts with the Massachusetts Department of Unemployment DUA.

They also serve as a resource for unemployed workers seeking UI benefits. The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year. CALL 617 626-5075 FOR ASSISTANCE.

Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. DUA is committed to helping you understand the Massachusetts unemployment insurance law. Topics within these pages range from obtaining workers compensation insurance to fulfilling employer obligations for state employment security taxes.

That means In Massachusetts. Massachusetts Department of Unemployment Assistance. 1099-G forms are commonly used to report certain government payments made to an individual such as state unemployment compensation.

Peggys reflected 7300 in income for unemployment benefits in 2020. Total amount of wages paid. In addition the first 25000 received from an employer as severance pay unemployment compensation and the like.

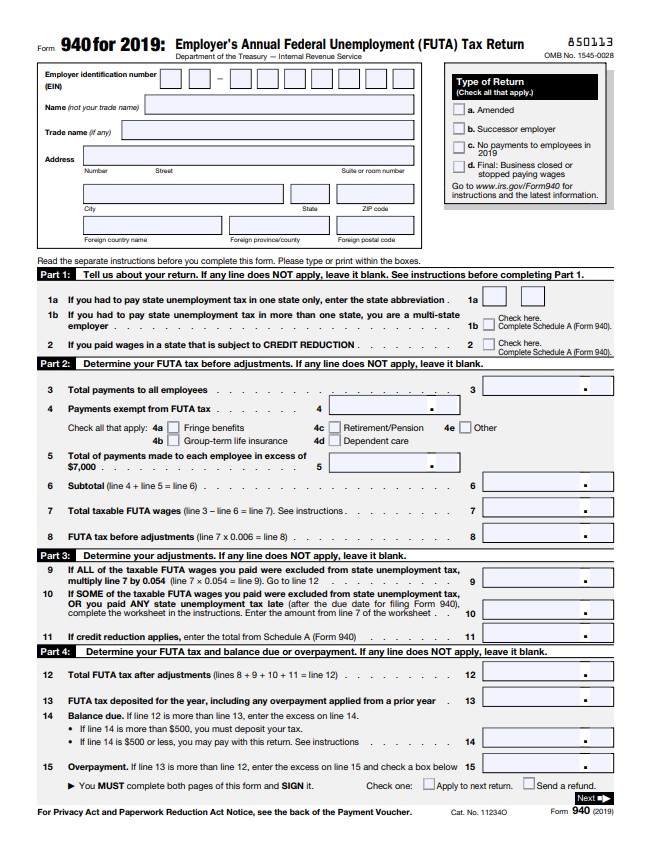

An employer is any person corporation or organization for whom an individual performs a service as an employee. The tax rate is 6 of the first 7000 of taxable income an employee earns annually. Any person or business subject to Massachusetts withholding under Massachusetts General Laws Chap-ter 62B is also subject to wage reporting requirements.

31 of the year after you collected benefits. Form WR-1 Employment Wage and Detail Report for unemployment insurance taxes is due to be filed quarterly by the end of the monthly immediately following a calendar quarter Quarter 1 is due April 30 each year Quarter 2s deadline is July 31 Quarter 3 is October 31 and Quarter 4. Form 1872 Application for Certification as a Seasonal Employer PDF 58504 KB Seasonal status precludes employers from being liable for unemployment benefits directly associated with seasonal work.

On April 1 2021 Massachusetts Governor Charlie Baker signed a new law that among other issues addresses the solvency of the Commonwealths unemployment compensation fund by imposing an excise on wages and permitting the Commonwealth to issue bonds to fund unemployment. Personal income tax withholding federal unemployment tax Fed-eral Insurance Contributions Act deductions or Railroad Retirement Online Filing Option Now Available Employers can file Form WR-1 via the Internet using WebFile for Business WFB. Division of Unemployment Assistance Status Department - 5thFloor 19 Staniford Street Boston MA 02114-2589 PLEASE TYPE OR PRINT CLEARLY IN INK.

Inside was a 1099-G tax form from the State of Massachusetts. Wages earned in a seasonally certified occupation will not be used to establish an unemployment claim if all the criteria are met. Employers can also use WFB to submit returns make payments and manage their tax accounts online.

Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. To set up your account you must register online at the DUAs UI Online website also known as the QUEST system. The Department of Unemployment Assistance DUA will mail you a copy of your 1099-G by Jan.

The second amendment would extend a 40-per-employee tax credit to employers. As an employer you will need to establish a Massachusetts UI tax account with the states Department of Unemployment Assistance DUA. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

Employers fund the UI program. Charlie Baker signs Massachusetts unemployment insurance bill that includes tax benefit for forgiven PPP loans. Based on tax schedules businesses in Rhode Island can expect to see a 14 increase in UI taxes for 2021 according to the states Department of Labor and Training.

Provide each employee a Form W-2 Wage and Tax Statement by January 31 or within 30 days if employment ends before the end of the year. For purposes of authentication using your Password is considered the same as using your signature. The Department of Unemployment Assistance DUA manages the UI program.

EMPLOYER STATUS REPORT Complete And Return This Form Within 10 days To. Note that you can claim a tax credit of up to 54 for paying your Massachusetts state unemployment taxes in full and on time each quarter which means that youll effectively be paying only 06 on your FUTA tax. Employers who have their wage reporting returns Form WR-1.

It definitely pays to save 90 on your tax bill. The W-2 should show. You will need this information when you file your tax return.

Employer Login To access Employer account information enter your User ID and Password. Alabama does not tax unemployment benefits. Your account number should be.

2019 2021 Ma Dua Form 1750 Fill Online Printable Fillable Blank Pdffiller

2019 2021 Ma Dua Form 1750 Fill Online Printable Fillable Blank Pdffiller

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Futa Taxes Form 940 Instructions

Futa Taxes Form 940 Instructions

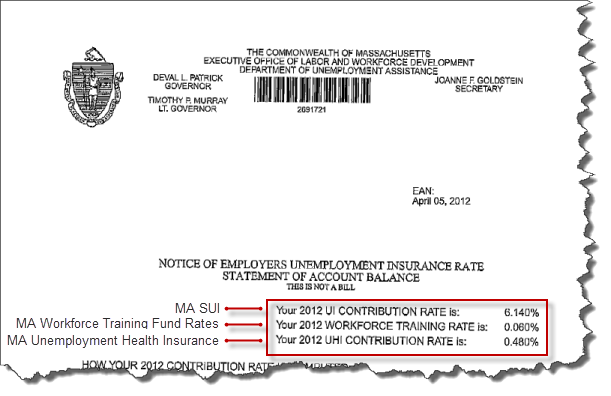

If You Own A Business That S A Massachusetts Employer Don T Miss This New Urgent Online Deadline 12 14 09

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Https Www Mass Gov Doc Financing Unemployment Insurance Options For Non Profit Or Governmental Employers Download

Https Www Publicpartnerships Com Media Nrobth1o Employer Informational Packet Pdf

Fill Free Fillable Forms Commonwealth Of Massachusetts

Fill Free Fillable Forms Commonwealth Of Massachusetts

Https Www Mass Gov Doc Employer Ui Online User Guide Download

Payroll Software Solution For Massachusetts Small Business

Payroll Software Solution For Massachusetts Small Business

Ssa Poms Rm 01103 044 Form 940 Employer S Annual Federal Unemployment Futa Tax Return Original 03 10 2003

Ssa Poms Rm 01103 044 Form 940 Employer S Annual Federal Unemployment Futa Tax Return Original 03 10 2003

If You Own A Business That S A Massachusetts Employer Don T Miss This New Urgent Online Deadline 12 14 09

If You Own A Business That S A Massachusetts Employer Don T Miss This New Urgent Online Deadline 12 14 09

If You Own A Business That S A Massachusetts Employer Don T Miss This New Urgent Online Deadline 12 14 09

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

2018 2021 Form Ma 0590 A Fill Online Printable Fillable Blank Pdffiller

2018 2021 Form Ma 0590 A Fill Online Printable Fillable Blank Pdffiller

Https Www Publicpartnerships Com Media Nrobth1o Employer Informational Packet Pdf

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Post a Comment for "Massachusetts Employer Unemployment Tax Form"