Do I Have To Pay Taxes On Unemployment In Massachusetts

That provision only applies to tax-filers whose income is less than 150000. Unemployment compensation has its own line Line 7 on Schedule 1.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Residents who received unemployment benefits wont be taxed on the first 10200 if they live below 200 of the federal poverty level.

Do i have to pay taxes on unemployment in massachusetts. State Taxes on Unemployment Benefits. To do this you may. Nonresidents are subject to Massachusetts income tax on unemployment compensation that is related to previous employment in Massachusetts.

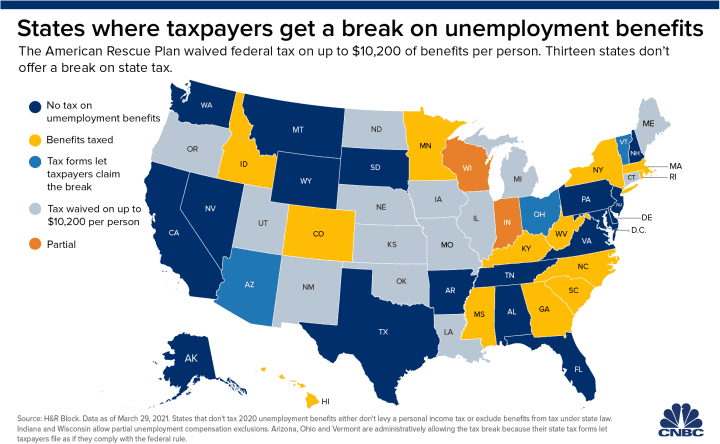

Its also important to keep in mind that not everyone will get a federal tax break on 10200 in unemployment income. It depends on your total family size including dependents. Colorado Georgia Hawaii Idaho Kentucky Massachusetts Minnesota Mississippi North Carolina New York Rhode Island South Carolina and West Virginia.

Call the TeleCert line at 617 626-6338. 8 Depending on the number of dependents you have this might be more or less than what an employer would have withheld from your pay. Per the State of Massachusetts taxpayers with household income not more than 200 of the federal poverty level may deduct up to 10200 of unemployment benefits from their taxable income on their 2020 and 2021 tax returns for each eligible individualI have attached the income limits below.

If you want taxes withheld from your weekly benefit payments you must tell us this when you file your claim. Its also important to keep in mind that not everyone will get a federal tax break on 10200 in unemployment income. Massachusetts how do taxes for back pay work.

Massachusetts taxes unemployment benefits including any amount received in 2020 that is exempt for federal income tax. The IRS and most states consider unemployment payments as taxable income which means that you have to pay tax on these payments and report them on your return. Enjoy the windfall but dont forget the tax man.

The UI tax funds unemployment compensation programs for eligible employees. Now Im facing a huge tax bill but I dont regret it. Part-year residents are subject to Massachusetts income tax on unemployment received while a Massachusetts resident whether related to employment inside or outside of Massachusetts.

Some of those states may still decide to adopt the tax break before the May 17 tax filing deadline. Your 1099-G will have the information youll need to transfer to your tax return. Fill out the tax withholding section of UI Online.

Without an exemption someone who received 10200 in unemployment compensation as part of their taxable income would be forced to pay an incremental 653 in state taxes. I received unemployment in 2020 and didnt have any tax withheld because I needed all the cash. Your unemployment benefits are taxable.

Youll have to pay taxes on the remaining amount if you received more than 10200 in unemployment compensation. Federal income tax is withheld from unemployment benefits at a flat rate of 10. Colorado Georgia Hawaii Idaho Kentucky Massachusetts.

That provision only applies to tax-filers whose income is less than 150000. The current tax-withholding rates are. Due to the part of the bill that makes up to 10200 in unemployment income from 2020 tax free.

The federally funded 300 weekly payments like state unemployment insurance benefits are normally taxable at the federal level. The 13 states that are still taxing federal unemployment benefits are. With this new law if your household income is less than 150000 the first 10200 of unemployment per taxpayer will be tax free on your federal tax return but any amount you receive above that will be taxed.

Early this year you probably received a Form 1099-G which told you the amount of UI benefits you received in 2020 and how much was withheld for taxes. You can use Form W-4V Voluntary Withholding Request to have taxes withheld from your benefits. The bill was just signed into law we have no idea what the process is going to be.

In Massachusetts state UI tax is just one of several taxes that employers must pay. As of Monday 13 arent excluding unemployment compensation from taxes according to data from tax preparer HR Block. There are taxes on unemployment benefits Those who did not elect to have taxes withheld will now be responsible for paying federal and state taxes directly.

If your small business has employees working in Massachusetts youll need to pay Massachusetts unemployment insurance UI tax.

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

Fillable Cms 1500 Form Fillable Cms 1500 Form Address Label Template Letter Example Label Templates

Fillable Cms 1500 Form Fillable Cms 1500 Form Address Label Template Letter Example Label Templates

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

How Does Your State Structure Its Individual Income Tax Brackets Like The Federal Income Tax 33 States And Th Income Tax Brackets Tax Lawyer Legal Marketing

How Does Your State Structure Its Individual Income Tax Brackets Like The Federal Income Tax 33 States And Th Income Tax Brackets Tax Lawyer Legal Marketing

5 Must Know Tax Tips The Happier Homemaker Tax Checklist Tax Time Diy Taxes

5 Must Know Tax Tips The Happier Homemaker Tax Checklist Tax Time Diy Taxes

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

File A Claim For Unemployment Insurance Rhode Island Dept Of Labor And Training Income Support Insurance Benefits Employment Service

File A Claim For Unemployment Insurance Rhode Island Dept Of Labor And Training Income Support Insurance Benefits Employment Service

Citylab Bloomberg Geography Federal Income Tax Economy

Citylab Bloomberg Geography Federal Income Tax Economy

Last Minute Tax Guide And Infographic For Sole Proprietors Tax Guide Filing Taxes Sole Proprietor

Last Minute Tax Guide And Infographic For Sole Proprietors Tax Guide Filing Taxes Sole Proprietor

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Where Your State Gets Its Money Fivethirtyeight Http J Mp 1hyejnz States State Tax How To Get

Where Your State Gets Its Money Fivethirtyeight Http J Mp 1hyejnz States State Tax How To Get

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

U S National Debt Clock Real Time National Debt Debt Real Time

U S National Debt Clock Real Time National Debt Debt Real Time

Want A Business Loan Pay Attention To These Five Areas Business Loans Loan Financial Institutions

Want A Business Loan Pay Attention To These Five Areas Business Loans Loan Financial Institutions

U S National Debt Clock In Real Time National Debt Debt Real Time

U S National Debt Clock In Real Time National Debt Debt Real Time

Post a Comment for "Do I Have To Pay Taxes On Unemployment In Massachusetts"