Unemployment Not Taxable Amended Return

Were going to have to Amend the returns and wait for the IRS guidance. 1 day agoThe Internal Revenue Service is telling people not to file amended returns after the recent stimulus packages tax break on the first 10200 of unemployment benefits.

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

If you are married each spouse receiving unemployment compensation doesnt have to pay tax on.

Unemployment not taxable amended return. The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers. Also you will have State returns to fix also. The people who filed.

This tax break will be welcome news for the millions of. Even though jobless benefits count as income for tax purposes the newly-signed 19 trillion American Rescue Plan will not impose federal income. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. Anyone who received jobless benefits during 2020 may now be eligible for the earned income. While taxpayers in New York await further guidance for taxes on unemployment insurance benefits they will not be required to amend federal tax returns.

2 days ago2021 TAX FILING. The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax. The 19 trillion Covid relief bill gives a federal tax break on up to 10200 of unemployment benefits.

The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if. If you received unemployment benefits in 2020 and youve already filed your tax returns the Internal Revenue Service is saying you dont have. You might want to do more than just wait Last Updated.

It will be up to us. IRS Commissioner Charles Rettig said Thursday that recipients of unemployment benefits in 2020 should not be submitting amended federal tax returns during this filing season. The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out of.

Here are seven ways to get more money back on your 2020 tax return. Furthermore they are not going to fix it themselves and make it nontaxable. You do not need to file an amended return to claim the.

I already have my list printout with those who had unemployment and have already filed their returns. How and who has to file an Amended Return to get the 10200 IRS unemployment tax break. Normally unemployment benefits are fully taxable by the IRS and must be reported on your federal tax return.

IRS may automatically refund taxes for unemployment benefits. Amended return may be needed to get full refund on 10200 unemployment tax break IRS says Published Tue Apr 6 2021 845 AM EDT Updated Tue Apr 6. The IRS told Americans to wait to file an amended tax return if.

In a win for unemployed Americans the head of the Internal Revenue Service IRS said on Thursday that workers likely will not need to file amended tax returns to. The legislation excludes only 2020 unemployment benefits from taxes.

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

Your Tax Questions Answered Marketplace

Your Tax Questions Answered Marketplace

2020 Tax Returns Amended By Irs Software And Paper Edits Refund Checks Slashgear

2020 Tax Returns Amended By Irs Software And Paper Edits Refund Checks Slashgear

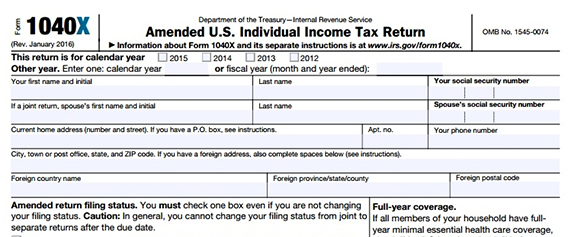

Form 1040 X Amended Returns Can Now Be E Filed Cpa Practice Advisor

Form 1040 X Amended Returns Can Now Be E Filed Cpa Practice Advisor

10 200 Unemployment Tax Break Wait To File Amended Return Irs Says

10 200 Unemployment Tax Break Wait To File Amended Return Irs Says

Correcting Mistakes After You File Amended Tax Returns

Correcting Mistakes After You File Amended Tax Returns

Can I Deduct Any Unemployment Income On My Taxes Not In Rhode Island But You Can Deduct Some On Your Federal Taxes Newport Buzz

Can I Deduct Any Unemployment Income On My Taxes Not In Rhode Island But You Can Deduct Some On Your Federal Taxes Newport Buzz

Keeping Away The Taxman Exempting Covid Unemployment Benefits Came Too Late To Avoid Irs Headaches For Millions New York Daily News

Keeping Away The Taxman Exempting Covid Unemployment Benefits Came Too Late To Avoid Irs Headaches For Millions New York Daily News

Correcting Mistakes And Submitting Amended Returns Tax Pro Center Intuit

Correcting Mistakes And Submitting Amended Returns Tax Pro Center Intuit

Income Amended Returns Department Of Taxation

Income Amended Returns Department Of Taxation

Tips For Filing Your Amended Tax Return Updated For 2018

Tips For Filing Your Amended Tax Return Updated For 2018

How To Go About Filing An Amended Tax Return E File Com

How To Go About Filing An Amended Tax Return E File Com

Irs 10 200 Unemployment Compensation Tax Break Likely Claimed Without Filing Amended Return

Irs 10 200 Unemployment Compensation Tax Break Likely Claimed Without Filing Amended Return

Cooling Breeze For The Tax Season From Hell Irs Does Not Want Amended Returns Right Away

Cooling Breeze For The Tax Season From Hell Irs Does Not Want Amended Returns Right Away

An Overview Of Amended Income Tax Returns

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Irs Will Allow Taxpayers To File Amended Returns Electronically

Irs Will Allow Taxpayers To File Amended Returns Electronically

Wondering How To Amend Your Tax Return Picnic S Blog

Wondering How To Amend Your Tax Return Picnic S Blog

Post a Comment for "Unemployment Not Taxable Amended Return"