Will Unemployment Affect My Tax Return

Workers filed for unemployment in 2020 as the COVID-19 pandemic ravaged American economy according to the IRSNow some of those workers will get money back from unemployment. The pandemic-related economic shutdown has created new questions for tax.

Irs 10 200 Unemployment Compensation Tax Break Likely Claimed Without Filing Amended Return

Irs 10 200 Unemployment Compensation Tax Break Likely Claimed Without Filing Amended Return

The Internal Revenue Service will begin refunding money to people in May who already filed their returns without claiming the new tax break on unemployment.

Will unemployment affect my tax return. Always file your tax return. If you received unemployment benefits in 2020 heres how much money you may soon get back from the IRS. You must still report your unemployment compensation on your tax return even if you dont receive a Form 1099-G for some reason.

If you live in states like California Montana New Jersey Pennsylvania and Virginia your unemployment benefits are. The IRS will in most cases pay it directly into your bank account for your 2019 tax year. Unemployment Benefits Tax Refund.

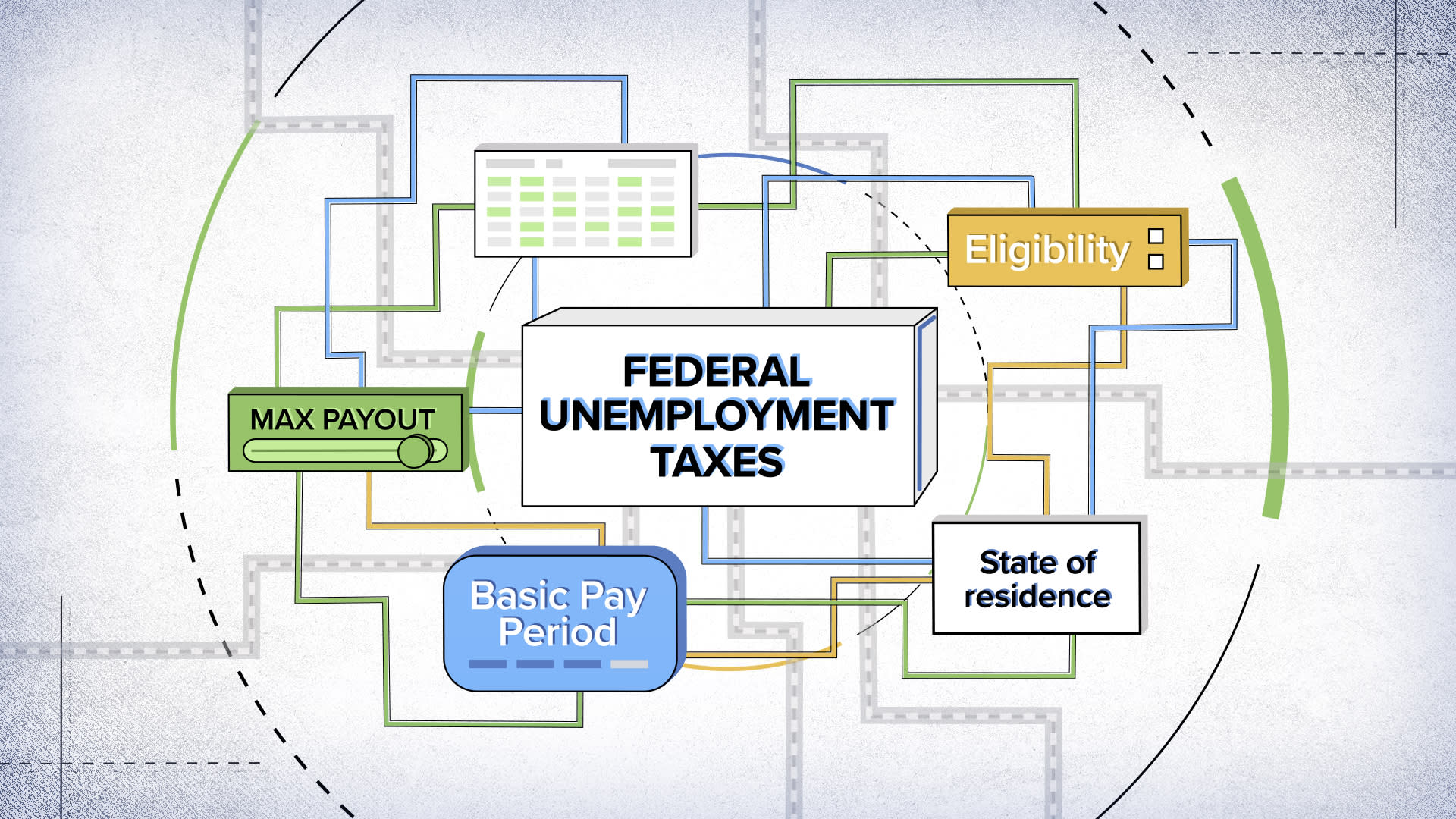

The IRS will provide taxpayers with additional guidance on those provisions that could affect their 2020 tax return including the retroactive provision that makes the first 10200 of 2020. Certain unemployment compensation debts owed to a state generally these are debts for 1 compensation paid due to fraud or 2 contributions owing to a state fund that werent paid. The unemployment benefits she received during that time also resulted in a smaller tax refund this year.

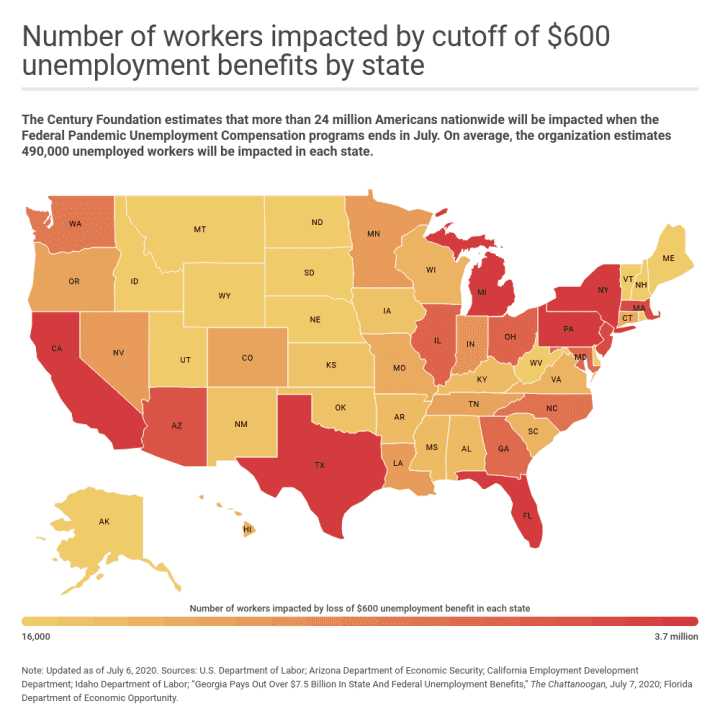

Even though jobless benefits count as income for tax purposes the newly-signed 19 trillion American Rescue Plan will not impose federal income. Normally unemployment benefits are fully taxable by the IRS and must be reported on your federal tax return. 23 million US.

WASHINGTON If you took unemployment during the pandemic you might be in for a surprise as you file your taxes. The break applies this tax. This tax break will be welcome.

Some states waive income taxes on unemployment checks. April 5 2021 1118 AM. While unemployment benefits are taxable they arent considered earned income.

Unemployment benefits are generally taxable. Says it expects to premiere some 2022 movies exclusively in theatres signaling confidence in a box office comeback. Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes.

Effect on Other Tax Benefits Taxable unemployment benefits include the extra 600 per week that was provided by the federal government in response to the coronavirus pandemic accountant Chip Capelli of Provincetown Massachusetts told The Balance. For those who received unemployment benefits last year and have already filed their 2020 tax return the IRS emphasizes they should not file an amended return at this time until the IRS issues. Instead of the roughly 1500 refund she typically receives she got just 72 back.

Under normal circumstances receiving unemployment would result in a reduction of both credits when you file your. If you have been made unemployed you should still file your tax return. Ortega said if you dont have the money still.

There is an incentive to do this as you may fall into a lower tax band and therefore qualify for a tax refund on payments made in the last 12 months or so. President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020. If you are receiving unemployment benefits check with your state about voluntary withholding to help.

You can contact the agency with which you have a debt to determine if your debt was submitted for a tax. If taxes havent been taken from your payments Ortega suggests setting aside 10 percent of the total amount of unemployment benefits received.

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How Does Being On Unemployment Affect My Child Support Obligation In Pennsylvania Child Support Laws Child Support Laws Child Support Payments Child Support

How Does Being On Unemployment Affect My Child Support Obligation In Pennsylvania Child Support Laws Child Support Laws Child Support Payments Child Support

What Are The Highlights Of The New Stimulus Package How To Get Money Student Loan Interest Business Assistance

What Are The Highlights Of The New Stimulus Package How To Get Money Student Loan Interest Business Assistance

How Unemployment Affects Your Taxes Taxact Blog

How Unemployment Affects Your Taxes Taxact Blog

How The Tax Law Might Affect You Interactive Data Visualization Infographic

How The Tax Law Might Affect You Interactive Data Visualization Infographic

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

How Eliminating Certain Tax Deductions Will Affect Income Groups Tax Deductions Income Family Income

How Eliminating Certain Tax Deductions Will Affect Income Groups Tax Deductions Income Family Income

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

How Unemployment Stimulus Payments Will Affect Your Taxes Abc10 Com

How Unemployment Stimulus Payments Will Affect Your Taxes Abc10 Com

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

How Unemployment Can Affect Your Tax Return

How Unemployment Can Affect Your Tax Return

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

See How The Democratic Candidates Tax Plans Would Affect You Tax Services Income Tax Return Tax Deductions

See How The Democratic Candidates Tax Plans Would Affect You Tax Services Income Tax Return Tax Deductions

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

How Unemployment And Stimulus Checks Affect Your Tax Return Khqa

How Unemployment And Stimulus Checks Affect Your Tax Return Khqa

Post a Comment for "Will Unemployment Affect My Tax Return"