How To File For Unemployment If I Am Self Employed

Sign up for regular email updates about our COVID-19 response. It is best to apply for Unemployment Insurance or Pandemic Unemployment Assistance online.

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

How do I apply for unemployment benefits if Im self-employed.

How to file for unemployment if i am self employed. Self-employed workers should be able to start claiming mid-April. If you file by phone we offer translation services. However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation.

This video tutorial shows how self-employed individuals can apply for unemployment insurance benefits under the CARES Act COVID-19. The claimant must provide information and documents showing that the self-employment venture is a sideline business and that the claimant is separated from employment that constituted the individuals major source of income. Make sure to read the instructions for self-employed workers here.

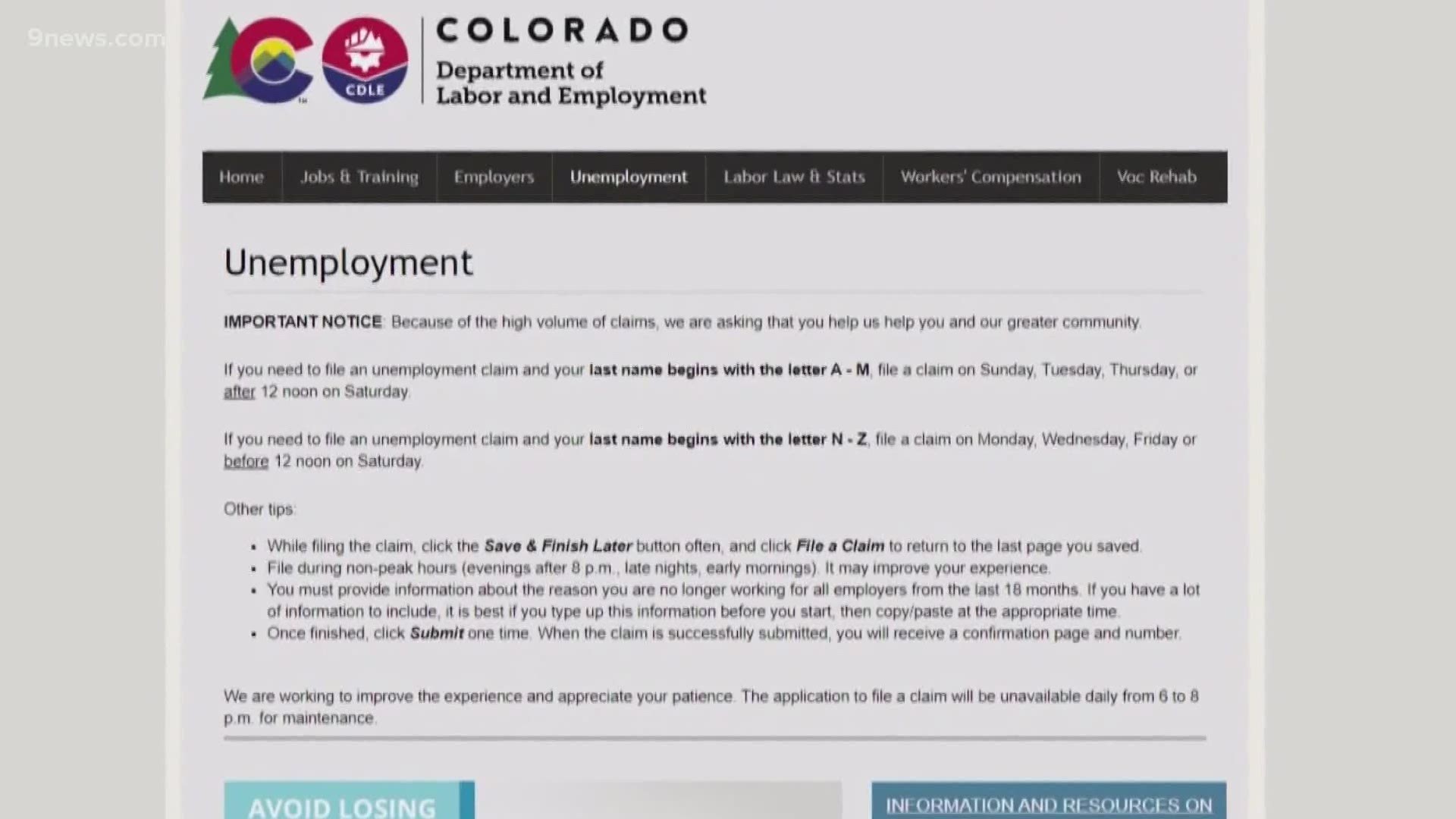

If there is a business name enter it here. Since many state unemployment offices are closed due to COVID-19 your best bet is to apply online. To receive unemployment insurance benefits you need to file a claim with the unemployment insurance program in the state that you work.

Call our Telephone Claim Center toll-free during business hours to file a claim. Yesbut its going to take a few weeks to update our systems. If youre self-employed and seeking unemployment benefits during the pandemic youll need to file a claim with your state unemployment office.

A sole proprietor is someone who owns an unincorporated business by himself or herself. As of Jan. 31 2021 you need to provide proof of prior employment including self-employment in order to receive federal unemployment benefits.

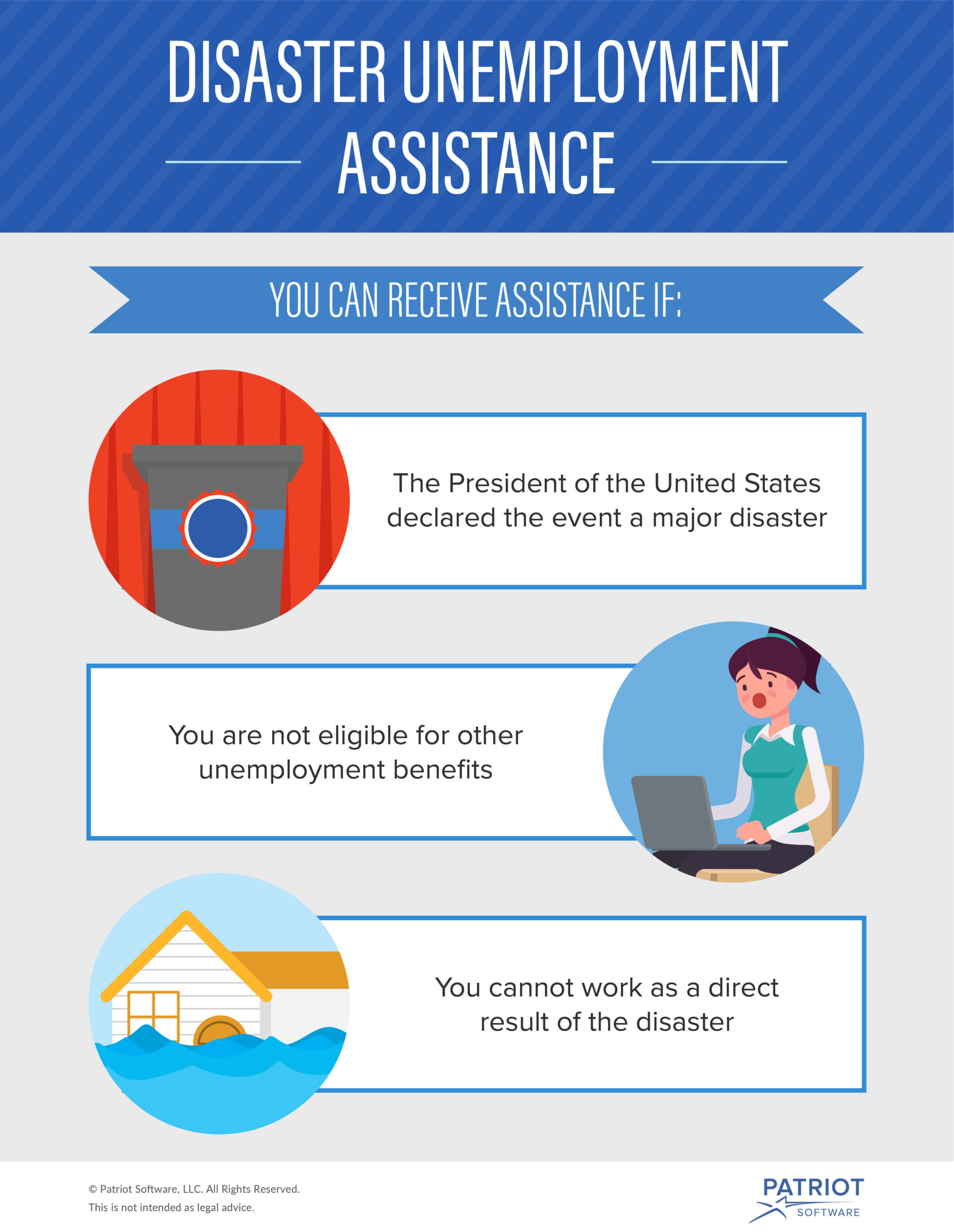

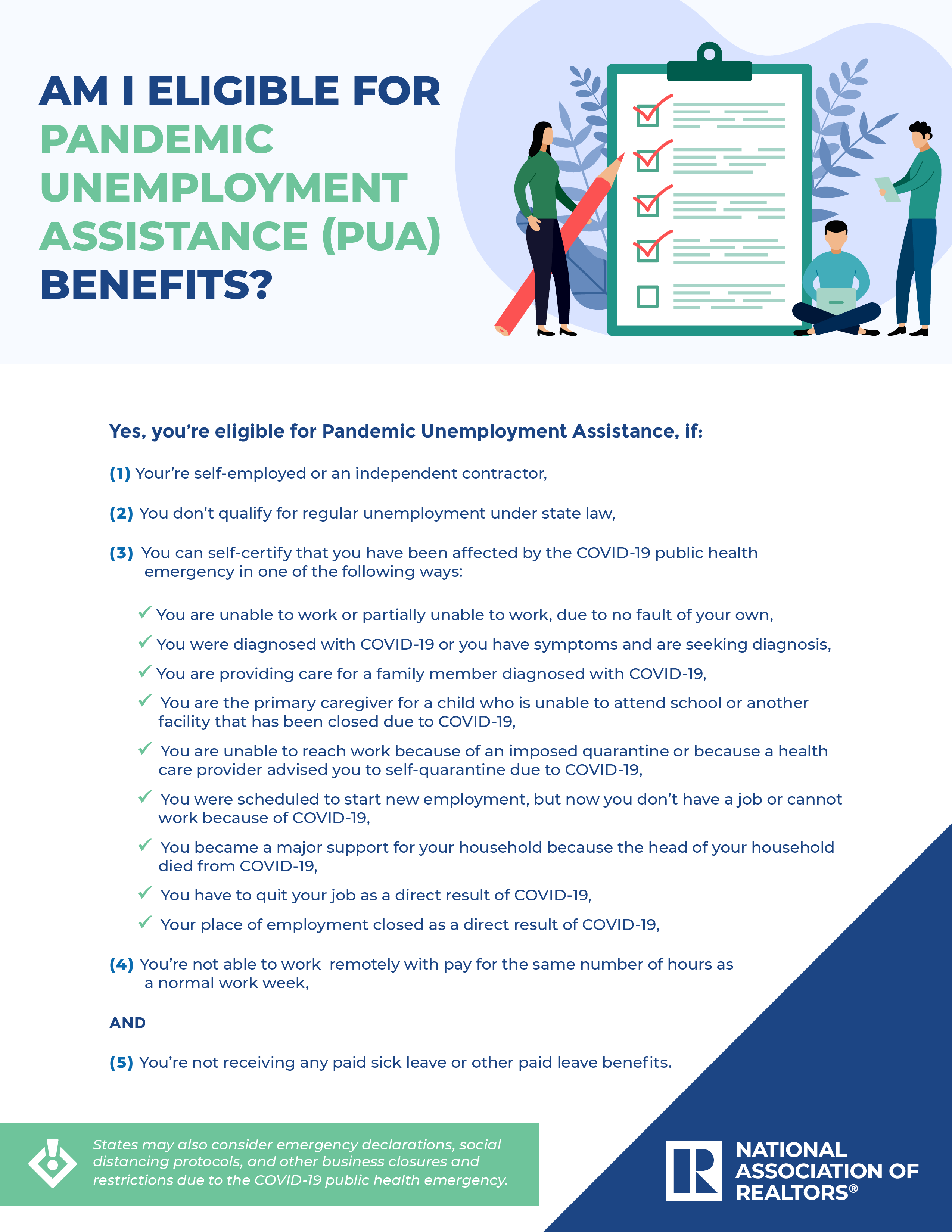

The new federal Pandemic Unemployment Assistance PUA program is designed for people who have lost work due to the crisis who cant access traditional unemployment benefits like independent contractors. Youll typically file in the state where you worked. Unfortunately many states unemployment websites are crashing due to the sudden influx of inquiries so keep trying.

Depending on the state you may be able to file a claim online by phone or in person. Monday through Friday 8 am to 730 pm. Keeping documentation about your previous income and wages as a freelancer independent contractor or self-employed worker is important and will help you when filing for unemployment.

Self-employed workers should be able to start claiming mid-April. Non-traditional applicants who are eligible will qualify for a base weekly benefit amount of 207 plus the additional 600 Federal Pandemic Unemployment Compensation FPUC payment per week. You must not be eligible for unemployment benefits in any state including self-employed workers independent workers gig workers Your claim is invalid due to self-employment your employer is exempt for example a church or you have insufficient work history.

Telephone filing hours are as follows. But if you live in one state and work in one or more other states your home states unemployment agency should be able to guide you on how to file. If you are self-employed enter your business name if one exists or your name in the Employer Name field.

If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file. Experts also stressed that self-employed people who have been denied unemployment in the past should reapply. Back to Benefit Eligibility.

Otherwise enter your own name. Download this checklist for information you need to apply for regular unemployment benefits. Download the COVID-19 unemployment guide then apply for regular unemployment benefits even though you likely dont qualify for themThis step is required before you can apply for the benefits for self-employed.

You must apply for UI first and be rejected before you can apply for PUA. Self-employed contract and gig workers must submit their 2019 IRS 1040 Schedule C F or SE prior to December 26 2020 by fax or mail. If you have multiple employers make sure you are answering.

Can independent contractors or self-employed get benefits.

File My Initial Claim Nh Unemployment Benefits

File My Initial Claim Nh Unemployment Benefits

Self Employed Unemployment Insurance Can Business Owners File

Self Employed Unemployment Insurance Can Business Owners File

Here S What The Nc Unemployment Office Says It S Doing To Deal With The Spike In Benefits Claims Due To Covid 19 Abc11 Raleigh Durham

Here S What The Nc Unemployment Office Says It S Doing To Deal With The Spike In Benefits Claims Due To Covid 19 Abc11 Raleigh Durham

Applying For Benefits Sc Department Of Employment And Workforce

Applying For Benefits Sc Department Of Employment And Workforce

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Dwd Awaiting More Guidance To Roll Out Unemployment Benefit Changes

Dwd Awaiting More Guidance To Roll Out Unemployment Benefit Changes

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

Https Www Louisianaworks Net Hire Admin Gsipub Htmlarea Uploads Pandemic Unemployment Assistance Pua Portal Claimants Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Pandemic Unemployment Assistance Pua Benefits Checklist

Pandemic Unemployment Assistance Pua Benefits Checklist

Here S How Colorado Self Employed Can Apply For Unemployment 9news Com

Here S How Colorado Self Employed Can Apply For Unemployment 9news Com

Self Employed How To Claim 600 Week Unemployment Youtube

Self Employed How To Claim 600 Week Unemployment Youtube

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Extended Unemployment Benefits Set To End This Week

Extended Unemployment Benefits Set To End This Week

Post a Comment for "How To File For Unemployment If I Am Self Employed"