Do You Have To Pay Taxes On The Additional $600 Unemployment

You do not have to pay Social Security and Medicare taxes on your unemployment benefits. The extra federal unemployment insurance payments are set to expire soon but some recipients may need to pay taxes on the money.

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Many will owe taxes to the federal government and their state this spring.

Do you have to pay taxes on the additional $600 unemployment. If you were laid off the state unemployment office would calculate whether youd receive benefits for the 30000 via PUA or 20000 via unemployment insurance but. Federal income tax is withheld from unemployment benefits at a flat rate of 10. Unemployment benefits are not.

Depending on how much unemployment you collect and what other sources of income you have throughout the year you may want to do this even if you have money withheld from your benefits. The 600 emergency federal unemployment benefits you may have received each week on top of your regular unemployment benefits is part of your taxable income for federal taxes and possibly for state taxes. The additional 300 per week from the 900 billion relief package is taxable.

8 Depending on the number of dependents you have this might be more or less than what an employer would have withheld from your pay. While the Paycheck Protection Program is a tax-free. But that wont last long especially for people receiving unemployment benefits and I mean that both in a time sense and a tax sense.

IR-2020-185 August 18 2020 WASHINGTON With millions of Americans now receiving taxable unemployment compensation many of them for the first time the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return. If you wind up owing more than 1000 in income taxes you may have to pay an additional underpayment penalty. Unemployment soared in 2020 because of the pandemic and because of that many people received unemployment compensation who had never done so before.

The additional 600 per week that the Coronavirus Aid Relief and Economic Security Act provides for qualifying state unemployment insurance beneficiaries is considered taxable income and it adds up fast. 9 That extra 600 is also taxable after the first 10200. More unemployment benefits than usual in 2020.

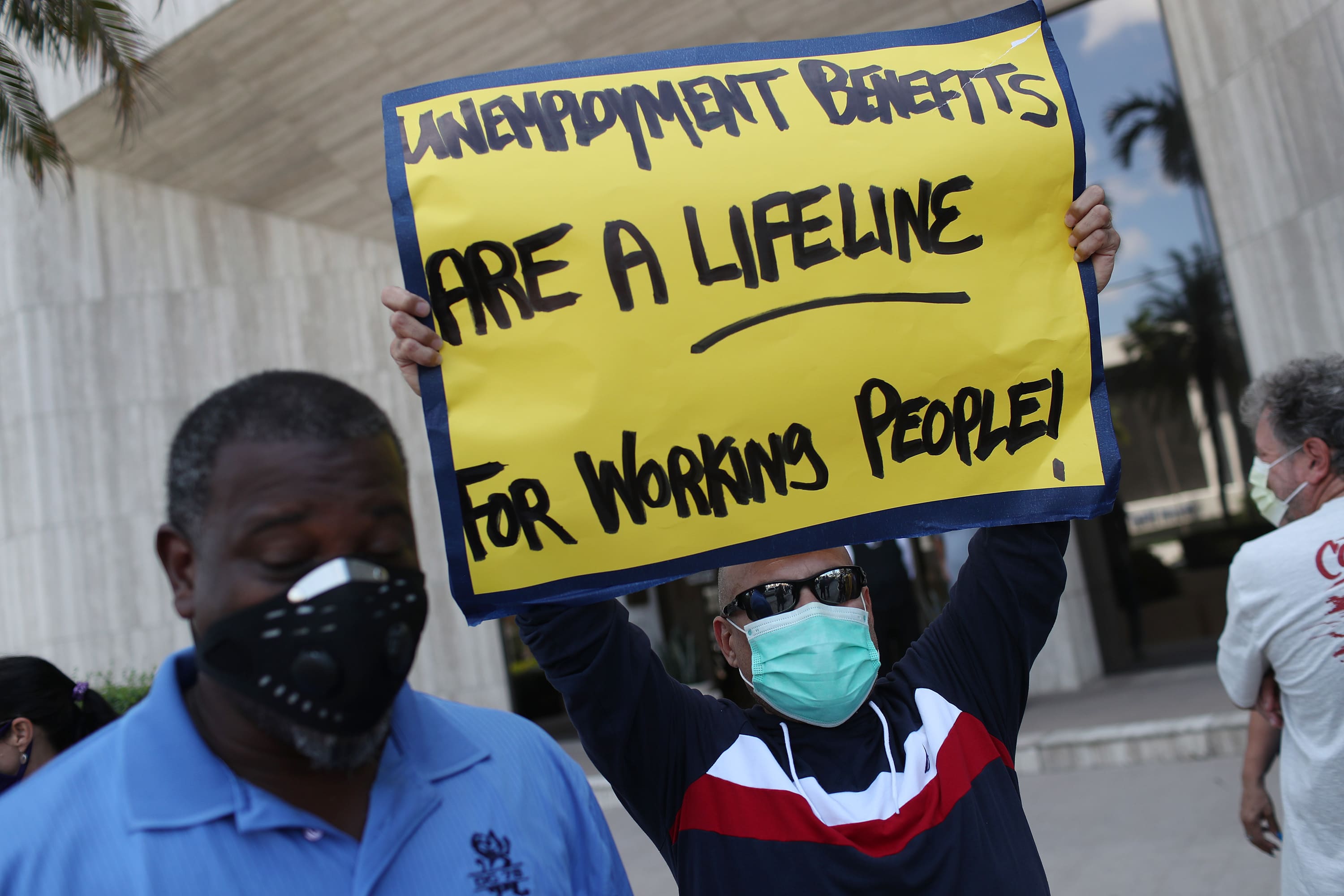

It provided an additional 600 per week in unemployment compensation per recipient through July 2020. More than 33 million American workers are currently collecting unemployment benefits as a result of the coronavirus -induced lockdown throughout the nation. You may not owe as much in federal and state income taxes on your 2020 unemployment compensation as you would have in previous years.

So keep in mind. Unemployment benefits are considered compensation just like income from a job. For example the extra 600 alone adds up to 9600 in income if you collect this additional benefit for a 16-week period.

Weve known that the NJ. You can use Form W-4V Voluntary Withholding Request to have taxes withheld from your benefits. Families also received an additional 600 in weekly benefits up to the end of July 2020 thanks to the CARES Act.

Giving beneficiaries an additional 600 per week. The extra 600 in weekly payments works out to 8400 in taxable income if you received the benefit for 14 weeks and remember this money is offered on top of traditional un. The good news.

Under the CARES Act the federal government is paying eligible unemployed people an extra 600 a week until July 31. Department of Labor hasnt been giving workers the opportunity to have federal taxes withheld from their 600 expanded federal unemployment payments. You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10.

Yes the extra 600 that the unemployed can receive as part of the expanded federal benefits is taxed by the federal government. Oscar Gonzalez March 6 2021 814 am.

What The 600 Unemployment Benefit Means In Your State Marketplace

What The 600 Unemployment Benefit Means In Your State Marketplace

Millions Can Get Extra 600 In Unemployment Benefits Retroactively

Millions Can Get Extra 600 In Unemployment Benefits Retroactively

Unemployment Payments 600 Are They Exempt From Tax As Com

Unemployment Payments 600 Are They Exempt From Tax As Com

600 A Week Unemployment Benefits Unlikely To Be Extended

600 A Week Unemployment Benefits Unlikely To Be Extended

600 Unemployment Benefits Are About To End Hitting Households And The Economy Coronavirus Updates Npr

600 Unemployment Benefits Are About To End Hitting Households And The Economy Coronavirus Updates Npr

How 600 Benefits For Jobless People Helped Rescue The American Economy

Dwd Starts Issuing Extra 600 To Eligible Unemployment Recipients

Dwd Starts Issuing Extra 600 To Eligible Unemployment Recipients

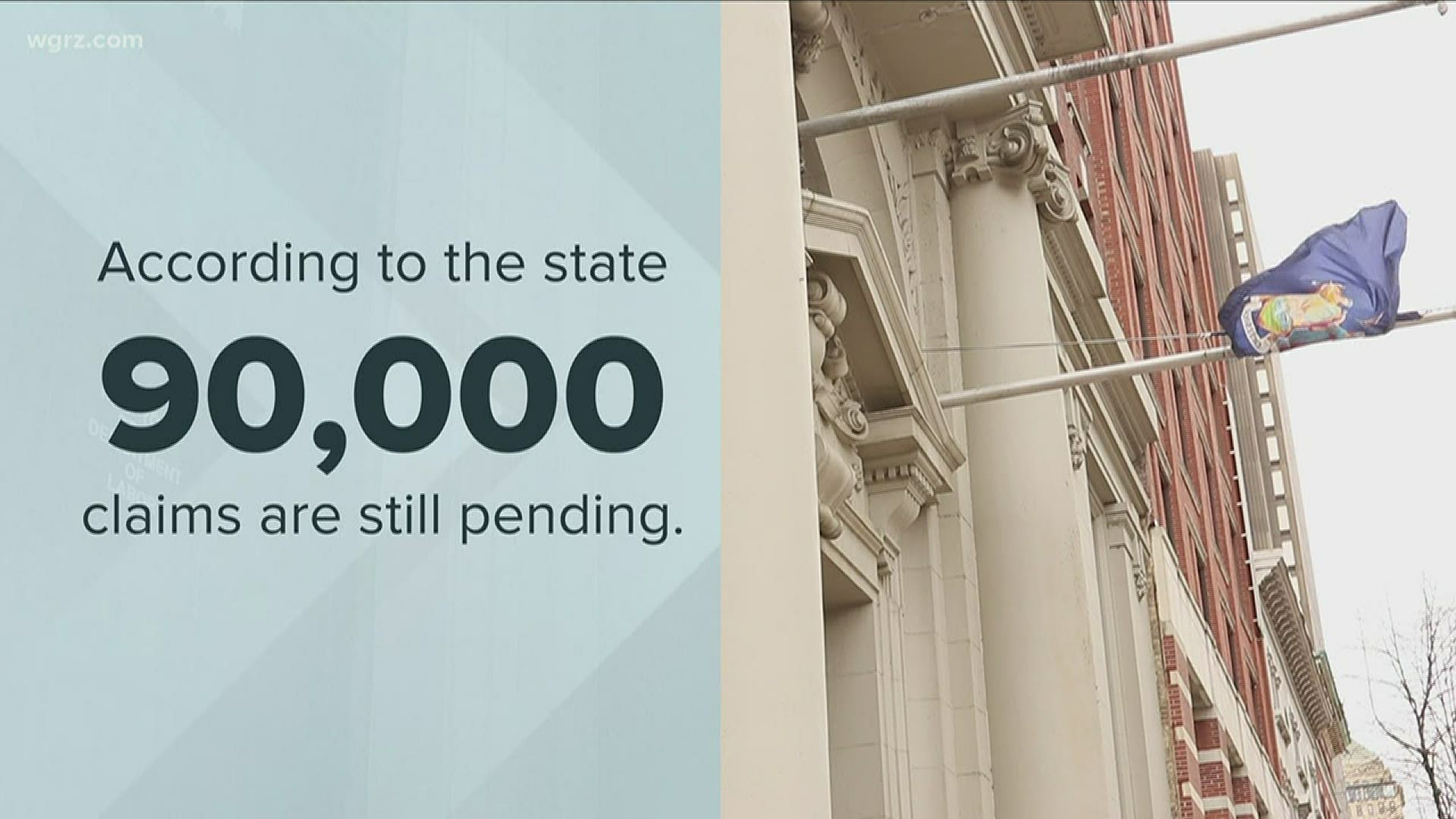

Questions Remain About Mystery 600 Unemployment Payments Wgrz Com

Questions Remain About Mystery 600 Unemployment Payments Wgrz Com

State Expect Extra 600 In Unemployment Payments By April 17 Wral Com

State Expect Extra 600 In Unemployment Payments By April 17 Wral Com

Extra 600 Unemployment Benefits Will Start Flowing As Early As This Week For A Lucky Few Coronavirus Fox5vegas Com

Extra 600 Unemployment Benefits Will Start Flowing As Early As This Week For A Lucky Few Coronavirus Fox5vegas Com

Yes Your Extra 600 In Unemployment Is Taxable Income

Yes Your Extra 600 In Unemployment Is Taxable Income

Is The 600 Unemployment Benefit Taxable Njmoneyhelp Com

Is The 600 Unemployment Benefit Taxable Njmoneyhelp Com

Extra 600 Unemployment Benefits Will Start Flowing As Early As This Week For A Lucky Few Coronavirus Fox5vegas Com

Extra 600 Unemployment Benefits Will Start Flowing As Early As This Week For A Lucky Few Coronavirus Fox5vegas Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Expiring 600 Unemployment Benefits Are Essential For Some Workers

Expiring 600 Unemployment Benefits Are Essential For Some Workers

Post a Comment for "Do You Have To Pay Taxes On The Additional $600 Unemployment"