Unemployment Taxes South Carolina

The American Rescue Plan passed last month included a tax relief provision that waives taxes on up to 10200 of unemployment benefits meaning more. For those workers that receive South Carolina unemployment benefit payments the worker must report and pay South Carolina and federal income taxes on these unemployment payments.

Pin By Elizabeth Roberts On Show Me A Sign Advertising Signs Old Signs Business Signs

Pin By Elizabeth Roberts On Show Me A Sign Advertising Signs Old Signs Business Signs

Unemployment compensation is taxable to South Carolina if it is paid by the state or received by a state resident the state Department of Revenue website notes.

Unemployment taxes south carolina. 6The Internal Revenue Service announced it will be taking steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment. Residents with 150000 in taxable income pay a marginal state tax rate of 825 percent. In South Carolina state UI tax is just one of several taxes that employers must pay.

All of the information that you have come to rely on from our agency is in this fresh clean efficient format which is also now fully compatible in mobile view. The UI tax funds unemployment compensation programs for eligible employees. The Official Web Site of the State of South Carolina.

That would translate into incremental state taxes of 841 on 10200 in unemployment. Click here if you have paid wages under covered employment or if you have an existing agent account. The American Rescue Plan a 19 trillion Covid relief bill waived.

Click here if you have paid wages under covered employment or if you have an existing employer account. After the registration is complete you will receive an Employer Account Number EAN and can begin to file wage reports and maintain your account via the online system. If youre among the 40 million Americans who received unemployment compensation in 2020 and youve already filed your taxes you could be getting a surprise refund.

South Carolina has not announced any unemployment tax relief so far. 2 days agoThere are 12 states that tax unemployment payments that have yet not followed the federal lead to extend a waiver to the first 10200 in unemployment benefits claimed in 2020 according to. To better respond we are making changes to our claimant portal nightly from 11 pm 3 am and our system will not be available.

Other important employer taxes not covered here include federal UI tax and state and federal withholding. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. Federal taxable income determines.

Welcome To South Carolina State Unemployment Insurance Tax System Employers who have paid wages in covered employment must register for an employer account. The IRS announced that it would start issuing refunds in May to taxpayers who have submitted returns but qualify for a tax break on 2020 jobless benefits. However in 13 states taxpayers wont find the revenue department so generous.

Unemployment tax creditIRS tax refunds to start in May for 10200 unemployment tax break. Please check this link to the SC Department of Revenue website for the latest information. Unemployment Tax Information.

They have announced that the Individual Income Tax due date has changed from April 15 to May 17 2021. The worker can elect to have federal and South Carolina income taxes withheld from hisher unemployment benefit payments. State Taxes on Unemployment Benefits.

Department of Employment and Workforce is excited to welcome you to the refreshed dewscgov website. Welcome To South Carolina State Unemployment Insurance Tax System Select who you are Employers. 3 on taxable income from 3070 to.

So why are the remaining states adopting the tax. If your small business has employees working in South Carolina youll need to pay South Carolina unemployment insurance UI tax. Unemployment compensation is fully taxable in South Carolina.

Under the American Rescue Plan those who received federal unemployment benefits in 2020 will receive a 10200 tax break when they file a federal income tax return this year. 17 hours agoCHARLOTTE NC. State Income Tax Range.

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

Tariffs Close Plant Element Electronics A Consumer Electronics Company In South Carolina Says It Will Be Marketing Jobs Job Training World Economic Forum

Tariffs Close Plant Element Electronics A Consumer Electronics Company In South Carolina Says It Will Be Marketing Jobs Job Training World Economic Forum

![]() Paying Your Tax Sc Department Of Employment And Workforce

Paying Your Tax Sc Department Of Employment And Workforce

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

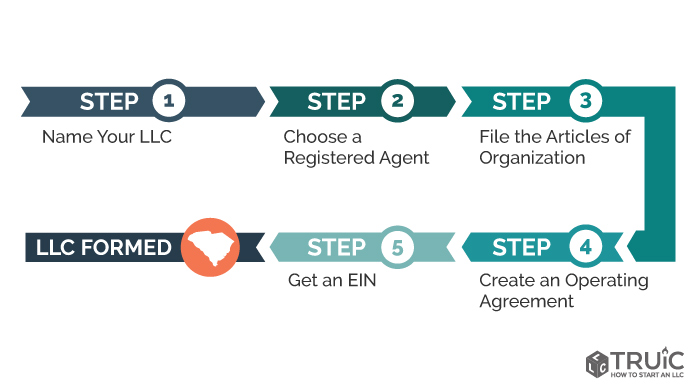

Llc In Sc How To Form An Llc In South Carolina Truic Guides

Llc In Sc How To Form An Llc In South Carolina Truic Guides

Pin On Information Visualized Infographics

Pin On Information Visualized Infographics

Rhode Island Unemployment Insurance Tax Life Insurance Quotes Term Life Insurance Quotes Home Insurance Quotes

Rhode Island Unemployment Insurance Tax Life Insurance Quotes Term Life Insurance Quotes Home Insurance Quotes

Economics Taxes Economics Notes Study Notes School Organization Notes

Economics Taxes Economics Notes Study Notes School Organization Notes

Individual Income Tax Season Opens January 27 File Online And Choose Direct Deposit

Individual Income Tax Season Opens January 27 File Online And Choose Direct Deposit

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

![]() Ui Tax Forms Sc Department Of Employment And Workforce

Ui Tax Forms Sc Department Of Employment And Workforce

2016 Sales Tax Holiday 2016 Tax Free Weekend Find States With A Tax Holiday Tax Holiday No Tax Weekend Tax Free Weekend

2016 Sales Tax Holiday 2016 Tax Free Weekend Find States With A Tax Holiday Tax Holiday No Tax Weekend Tax Free Weekend

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Peos Have Many Benefits But One Of The Biggest Lies In Their Workers Compensation Insurance Coverage Workers Compensation Insurance Company Benefits Payroll

Peos Have Many Benefits But One Of The Biggest Lies In Their Workers Compensation Insurance Coverage Workers Compensation Insurance Company Benefits Payroll

Don T Fall For It Tips To Avoid Identity Theft During Tax Season

Don T Fall For It Tips To Avoid Identity Theft During Tax Season

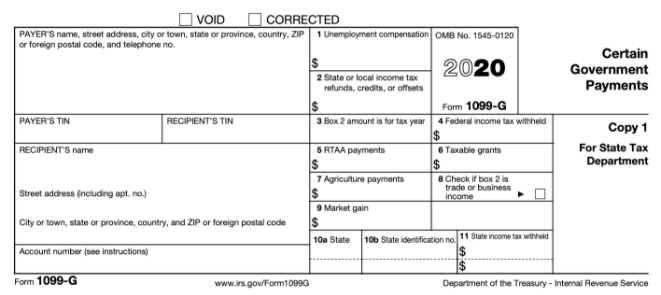

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

Post a Comment for "Unemployment Taxes South Carolina"