What Percentage Of Income Is Unemployment Insurance

Staff performing coordinated entry asks a series of questions that help place people into these pathways. Other benefits or unearned income.

Tackling Covid 19 Unemployment Work Opportunities And Targeted Support Beat Windfall Bonuses The Heritage Foundation

Tackling Covid 19 Unemployment Work Opportunities And Targeted Support Beat Windfall Bonuses The Heritage Foundation

Part-time workers experienced an unemployment rate almost twice that of their full-time counterparts in April 245 vs.

What percentage of income is unemployment insurance. That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns. Both studies found that the majority 90 percent in the five-site study and 75 percent in New Jersey of former TANF recipients had sufficient earnings to meet the monetary requirements for unemployment insurance at some point during the first two years following their exit for work. 34 on taxable income from 13400 to 22199 for taxpayers with net income less than 22200 59 on taxable income from 37200 to.

Sources of Income During a Long-Term Spell of. Calculations refer to a single person without children whose previous in-work earnings were 67 of the average wage. If you received unemployment compensation during the year you should receive Form 1099-G which is a report of income received from a government source showing the amount you were paid.

IR-2020-185 August 18 2020 WASHINGTON With millions of Americans now receiving taxable unemployment compensation many of them for the first time the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return. 52 rows State unemployment tax is a percentage of an employees wages. Benefits in unemployment share of previous income This indicator measures the proportion of previous in-work household income maintained after 2 6 12 24 and 60 months of unemployment.

What are your current sources of income earned income. If you lost your job in 2020 and youre faced with preparing your tax return for that year its important to know which of your unemployment benefits are considered taxable income. Unemployment benefits count as income in Obamacares calculus of.

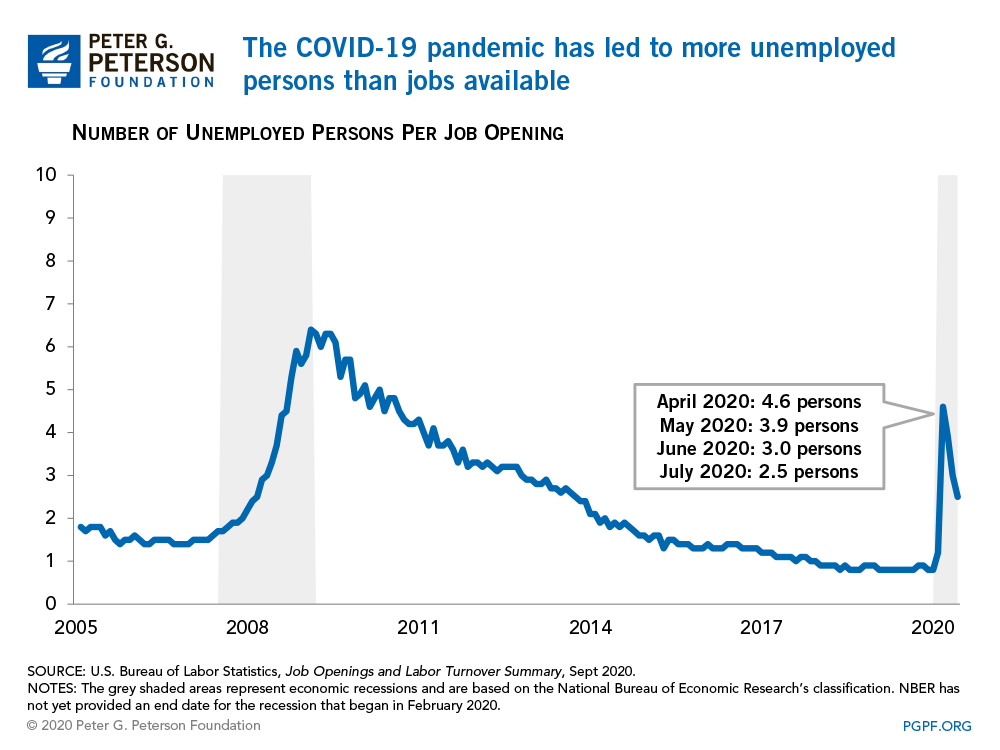

Selected Benefit Information for Regular Unemployment Insurance Programs by State 2003 6 3. This will knock the unemployment rate back up to. What skyrocketing unemployment means for health insurance.

The percentage of those potentially eligible at any point in time was lower between 50 to 70 percent in any given quarter of the. State laws typically put a maximum percentage in place often between 70 and 80 percent of the salary the individual earned per week but plans factor other data before creating a payment plan including how much individuals earned and how long they had been at that payment level. EMPLOYMENT INCOME AND UNEMPLOYMENT INSURANCE DURING THE PANDEMIC 3 Results Among adults ages 18 to 64 434 percent reported that they or someone in their family has lost or been laid off from a job been furloughed or had to reduce work hours or lost earnings or income from a job or business because of the pandemics impact on the economy.

Unemployment rate peaked in April 2020 to 148a level not seen since data collection began in 1948before declining to a still-high 67 in December to close out the year. The new law also freezes the unemployment insurance rate for the calendar years 2021 and 2022 slowing the annual employer UI contribution rate. Unemployment insurance programs are governed by state governments and are funded by state federal and private companies that pay employment tax.

Unemployment rate of 131 in December the second highest observed among all industries. Unemployment Insurance Benefits of Long-Term Recipients as a Percentage of Earnings in Base Month 11 4. How much will I recieve in Unemployment Insurance benefits.

Unemployment does not pay 100 percent of the wages the individual once earned. To learn more about how your benefits are calculated read below. Any unemployment compensation received must be included in your income and should be reported in the appropriate sections of your federal and state tax returns.

At the outset staff asks two questions related to employment and income. Medicaid a 109 percentage-point increase and marketplaceother Timely Analysis of Immediate Health Policy Issues Unemployment Health Insurance and the COVID-19 Recession APRIL 2020 Anuj Gangopadhyaya and Bowen Garrett Unemployment Health Insurance and the COVID-19 Recession 1 Support for this research was provided by. Ultimately the onus is on the state government to balance the checkbook so the state has to decide the benefits maximum amount duration and eligibility to receive the benefits.

The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially saving workers thousands of dollars. 129 but this gap has since effectively closed. The amount of Unemployment Insurance benefits you receive is dependent on a number of factors such as your past salary amount of severance you received from a former employer and additional sources of income.

The American Rescue Plan Act ARPA passed in March 2021 includes a provision that makes 10200 of unemployment compensation earned in 2020 tax-free for taxpayers with modified adjusted gross incomes of less.

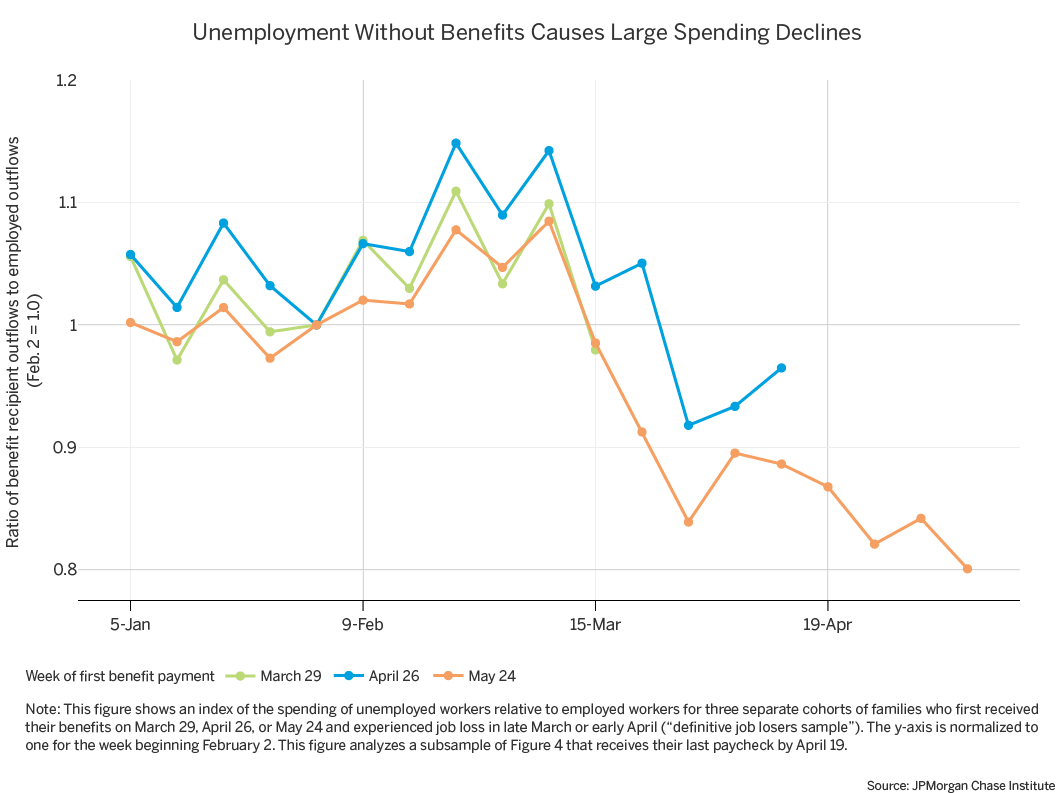

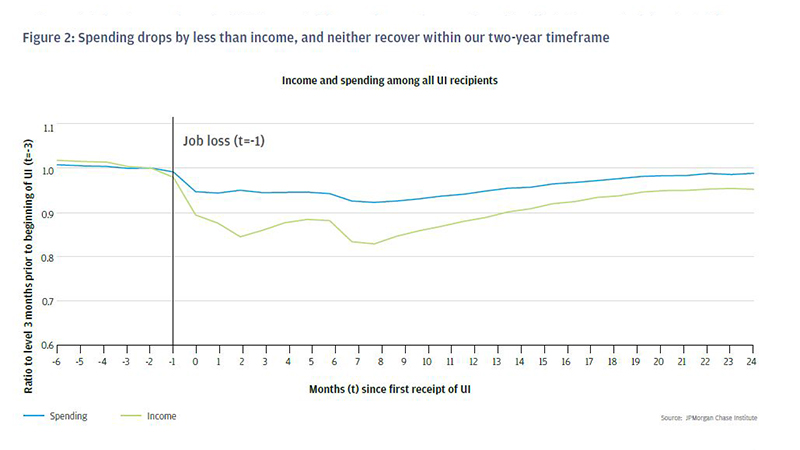

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Food Stamps And Unemployment Compensation In The Covid 19 Crisis Research Highlights Upjohn Institute

Food Stamps And Unemployment Compensation In The Covid 19 Crisis Research Highlights Upjohn Institute

The Importance Of Unemployment Benefits For Protecting Against Income Drops Equitable Growth

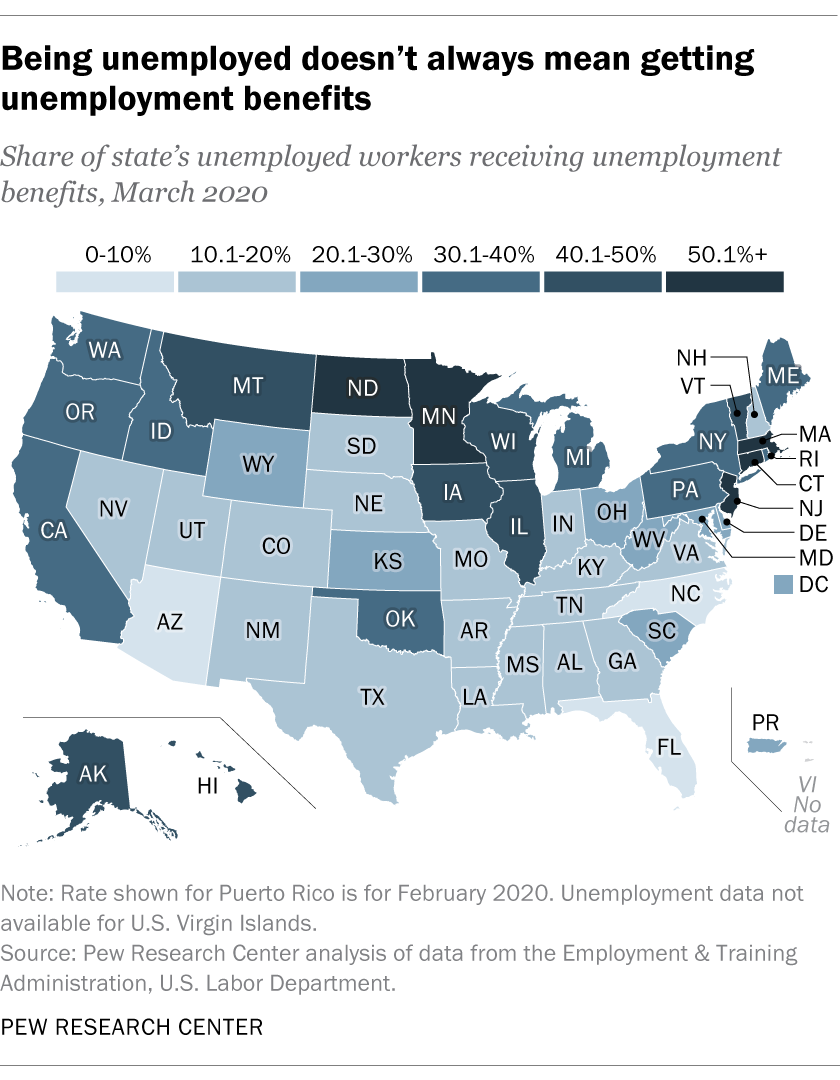

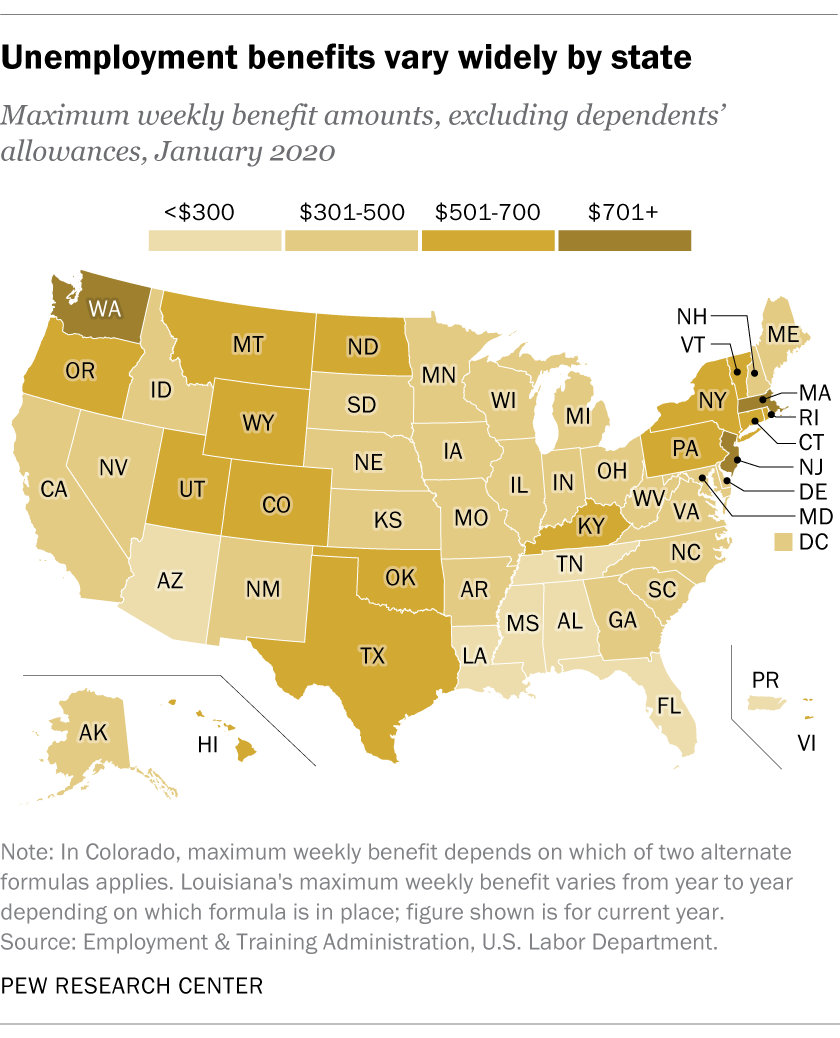

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Recovering From Job Loss The Role Of Unemployment Insurance

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Labor Organizations And Unemployment Insurance A Virtuous Circle Supporting U S Workers Voices And Reducing Disparities In Benefits Equitable Growth

Labor Organizations And Unemployment Insurance A Virtuous Circle Supporting U S Workers Voices And Reducing Disparities In Benefits Equitable Growth

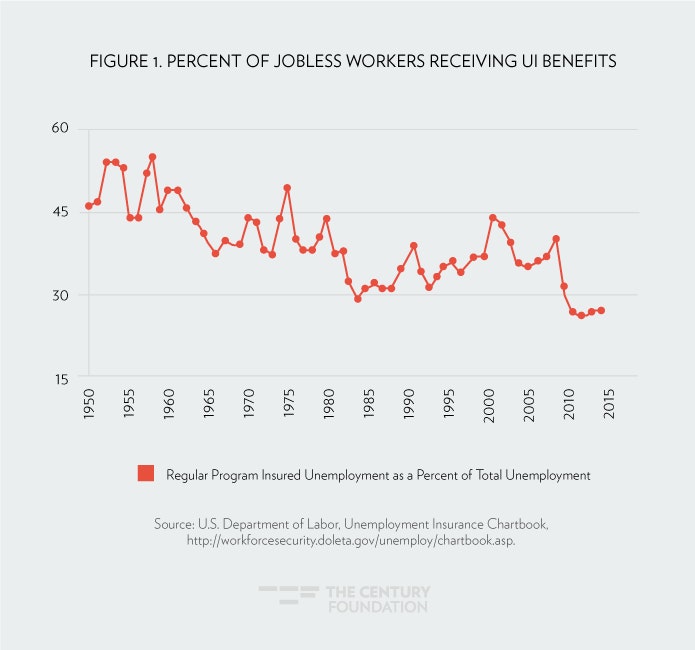

Speeding The Recovery Of Unemployment Insurance

Speeding The Recovery Of Unemployment Insurance

Recovering From Job Loss The Role Of Unemployment Insurance

Recovering From Job Loss The Role Of Unemployment Insurance

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Usda Ers Unemployment Insurance And Usda S Supplemental Nutrition Assistance Program Together Cushioned The Great Recession

Usda Ers Unemployment Insurance And Usda S Supplemental Nutrition Assistance Program Together Cushioned The Great Recession

Recovering From Job Loss The Role Of Unemployment Insurance

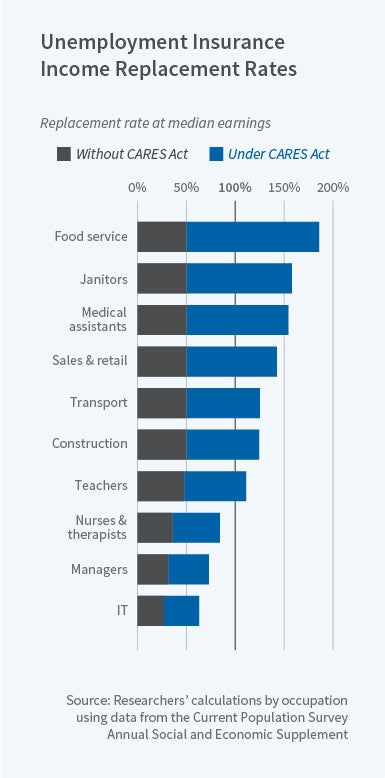

Unemployment Benefit Replacement Rates During The Pandemic Nber

Unemployment Benefit Replacement Rates During The Pandemic Nber

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Recovering From Job Loss The Role Of Unemployment Insurance

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

How Are Safety Net Programs Like Unemployment Insurance Snap And Medicaid Helping The Response To The Coronavirus Pandemic

How Are Safety Net Programs Like Unemployment Insurance Snap And Medicaid Helping The Response To The Coronavirus Pandemic

Recovering From Job Loss The Role Of Unemployment Insurance

Post a Comment for "What Percentage Of Income Is Unemployment Insurance"