Unemployment Exemption 2020 Phase Out

Dont Amend Your 2020 Tax Return Quite Yet to Claim the New Exemption The IRS is still figuring out the best way to handle to new 10200 tax exemption for. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

Irs Refund Checks For 10 200 Unemployment Tax Break Coming In May

Irs Refund Checks For 10 200 Unemployment Tax Break Coming In May

6 for 300 more per week on top of what your state pays.

Unemployment exemption 2020 phase out. To qualify individuals and married couples must have filed for unemployment and have an adjusted gross income AGI thats less than 150000 in 2020. For married couples filing jointly the first 20400 is exempt. However the final bill offers people 300 a week until Sept.

Normally you would have to pay regular taxes on any unemployment benefits youve received but the new bill gives a tax exemption to the first 10200 of unemployment. If you live in New York and received unemployment payments in 2020 youll have to pay state income taxes on all of them. The list of states not giving a tax break States get to set their own rules when it comes to state taxes.

Normally these benefits are. 6 plus an exemption of up to 10200 for last years unemployment payments. Under the new bill your family may also get far more.

Someone who received 10200 or more in unemployment benefits. The list of offenders States get to set their own rules when it comes to state taxes. Under the relief package the first 10200 received in unemployment benefits in 2020 will be tax free for people with an adjusted gross income of less than 150000.

Unlike stimulus checks and. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on. The American Rescue Plan approved by Congress and.

The 19 trillion coronavirus stimulus plan that President Biden signed into law in March known as the American Rescue Plan waives federal income. This unemployment income tax break however will apply to households with total incomes under 150000 Adjusted Gross Income AGI in 2020. 10200 Unemployment Tax Break A last minute addition to the 19 trillion stimulus package exempted the first 10200 of 2020 unemployment compensation from federal income tax.

In fact a number of states wont let tax-filers exclude that 10200 from their 2020 income. Thats down from the 400 federal bonus. In fact a number of states wont let tax-filers exclude that 10200 from their 2020 income.

For married couples the 150000 limit still applies as it is a household maximum and not a straight filing status. Under the changes in the new tax law a person who was unemployed for some or all of 2020 could potentially save thousands in taxes. The exemption applies to all unemployment benefits received in 2020 including the extra benefits provided by Congress to assist people who lost their jobs because of the pandemic.

A new provision waives federal taxes on the first 10200 of unemployment benefits you received in 2020. For example if you are single with an adjusted gross income AGI of 70000 and you received 15000 of unemployment benefits during the 2020 tax. The 19 trillion COVID-19 relief package will extend enhanced unemployment benefits until Sept.

A year and phases out at 80000. A portion of 2020 unemployment benefits are tax-exempt If you received unemployment benefits in 2020 and your AGI is less than 150000 for single and married filers you will not be required to pay income tax on the first 10200 you received for unemployment. Unemployment Tax Break.

As part of COVID relief legislation federal taxes can be waived for up to 10200 in unemployment income for the 2020 tax year provided that you made 150000 or less which is a. The 10200 exemption.

Biden Tax Plan And 2020 Year End Planning Opportunities

Biden Tax Plan And 2020 Year End Planning Opportunities

How Did The Tcja Change The Amt Tax Policy Center

How Did The Tcja Change The Amt Tax Policy Center

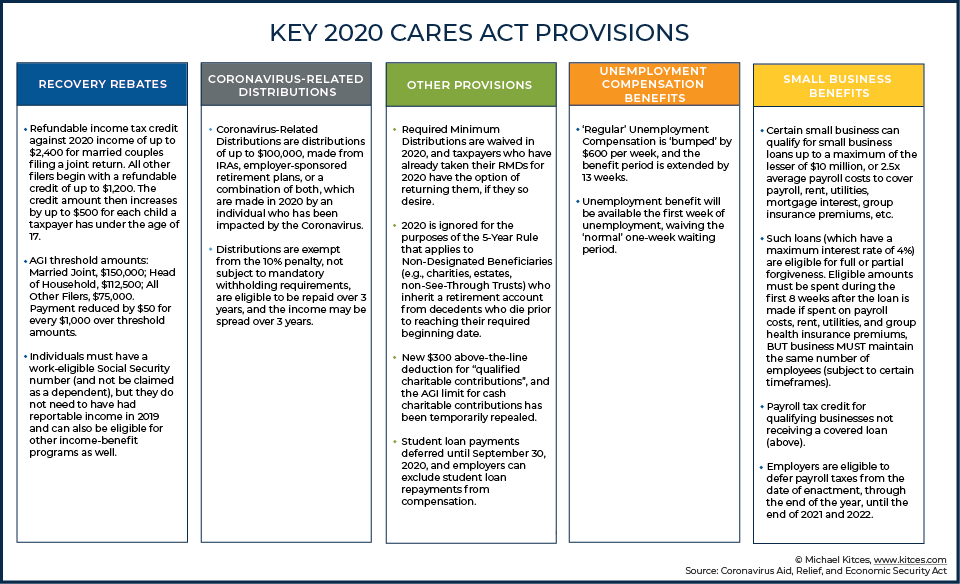

Individual Focus Coronavirus Aid Relief And Economic Security Act Cares Smith Partners Wealth Management

Individual Focus Coronavirus Aid Relief And Economic Security Act Cares Smith Partners Wealth Management

Individual Focus Coronavirus Aid Relief And Economic Security Act Cares Smith Partners Wealth Management

Individual Focus Coronavirus Aid Relief And Economic Security Act Cares Smith Partners Wealth Management

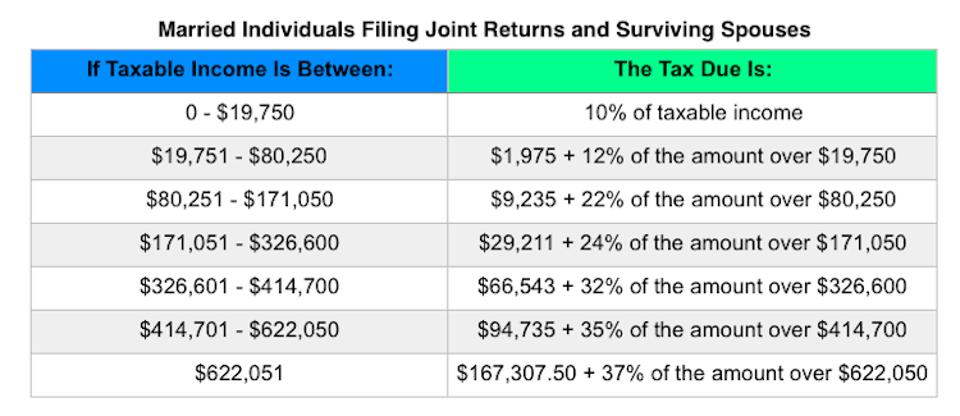

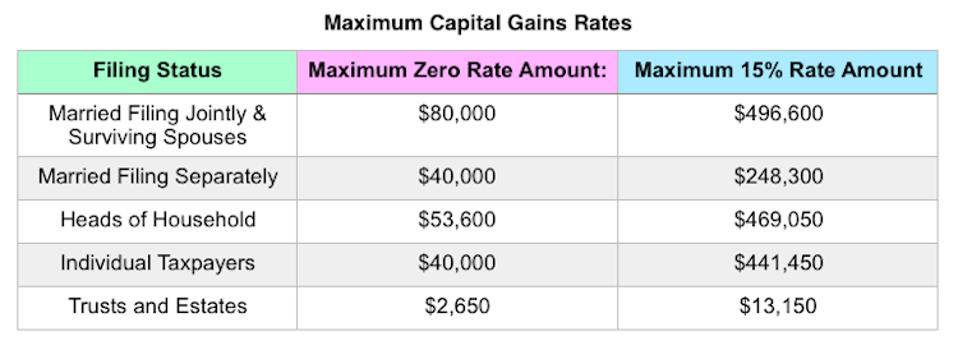

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

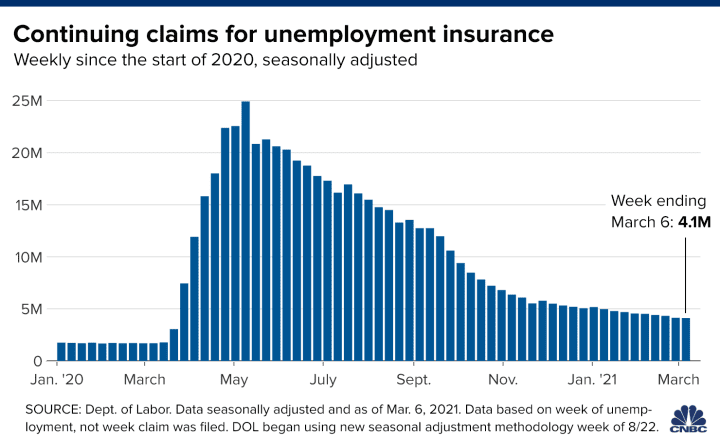

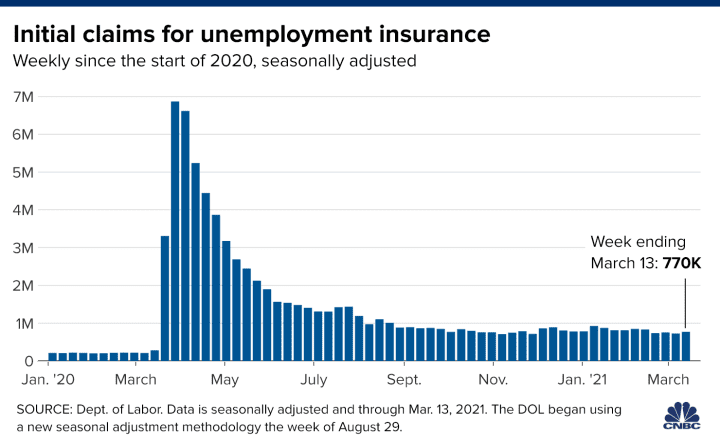

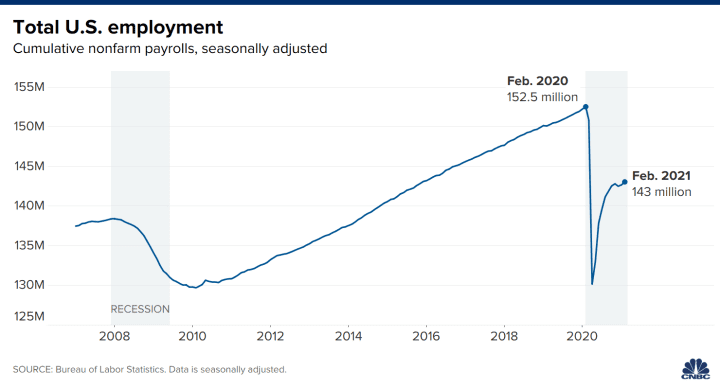

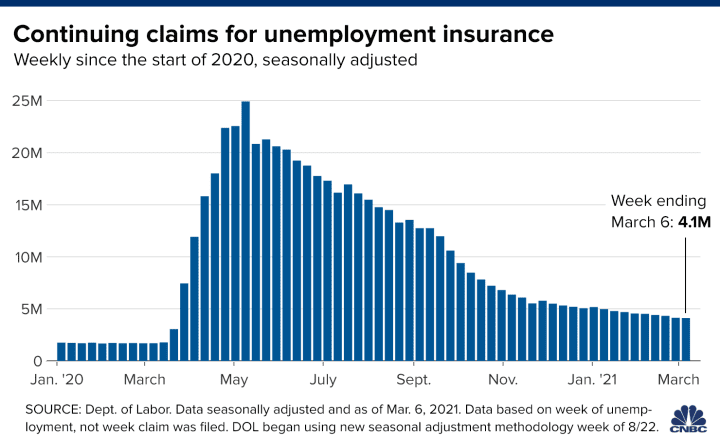

New Unemployment Benefits Stimulus Signed Into Law Nextadvisor With Time

New Unemployment Benefits Stimulus Signed Into Law Nextadvisor With Time

Workers With Disabilities Can Earn 3 34 An Hour Agency Says Law Needs Change Npr

Workers With Disabilities Can Earn 3 34 An Hour Agency Says Law Needs Change Npr

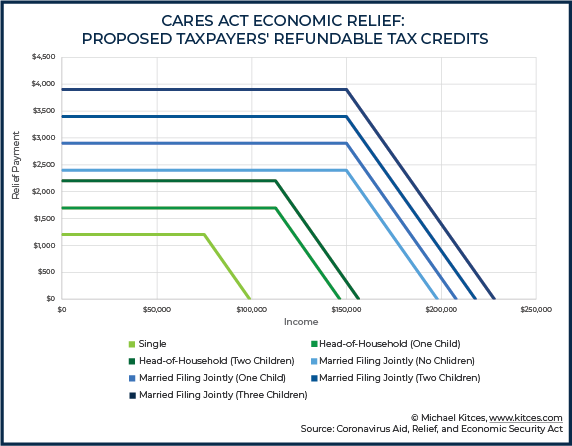

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

10 200 Jobless Tax Break How To Cut Income Below The 150 000 Limit

10 200 Jobless Tax Break How To Cut Income Below The 150 000 Limit

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Arpa Unemployment Partially Excluded From Income For Some Taxpayers

Arpa Unemployment Partially Excluded From Income For Some Taxpayers

10 200 Jobless Tax Break How To Cut Income Below The 150 000 Limit

10 200 Jobless Tax Break How To Cut Income Below The 150 000 Limit

Cares Act Of 2020 Summary Shakespeare Wealth Management Llc

Cares Act Of 2020 Summary Shakespeare Wealth Management Llc

10 200 Jobless Tax Break How To Cut Income Below The 150 000 Limit

10 200 Jobless Tax Break How To Cut Income Below The 150 000 Limit

Post a Comment for "Unemployment Exemption 2020 Phase Out"