Unemployment Insurance Tax Exemption

Charlie Baker signs Massachusetts unemployment insurance bill that includes tax benefit for forgiven PPP loans. The tax exemption for 10200 in unemployment benefits currently only applies to unemployment income you collected in 2020 even though the.

Unemployment Benefits 2020 How To Claim The New Tax Reduction As Com

Unemployment Benefits 2020 How To Claim The New Tax Reduction As Com

Unemployment compensation includes amounts received under the laws of the United States or of a state such as.

Unemployment insurance tax exemption. The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially saving workers thousands of dollars. To use EAMS or EAMS for Single Filers you will need to be sure to set up your online account in advance. The Democratic lawmakers who wrote the letter are sponsors of a bill that would exempt the first 10200 in unemployment insurance UI received last year from federal income taxes and.

When the federal government passed the American Rescue Plan Act of 2021 in March Congress included an exemption so at least a portion of unemployment benefits from 2020 will not be federally taxed. The IRS provided guidance on how to use the tax exemption for unemployment insurance on your taxes. As part of that compromise Democrats added language to the bill that would provide a tax waiver on up to 10200 of unemployment insurance benefits for.

UI payments are currently subject to federal and state income taxation. For paying unemployment taxes. Use Employer Account Management Services EAMS or EAMS for Single Filers to file your tax reports or tax and wage reports online.

If you employ one or more persons Unemployment Insurance coverage is required. -- If you live in New York and received unemployment payments in 2020 youll have to pay state income taxes on all of them. For filing tax reports or tax and wage reports online.

The RELIEF Act provides a State Income Tax Exemption for Unemployment Insurance UI Benefits for qualifying filers. They also included a. 2 days agoSyracuse NY.

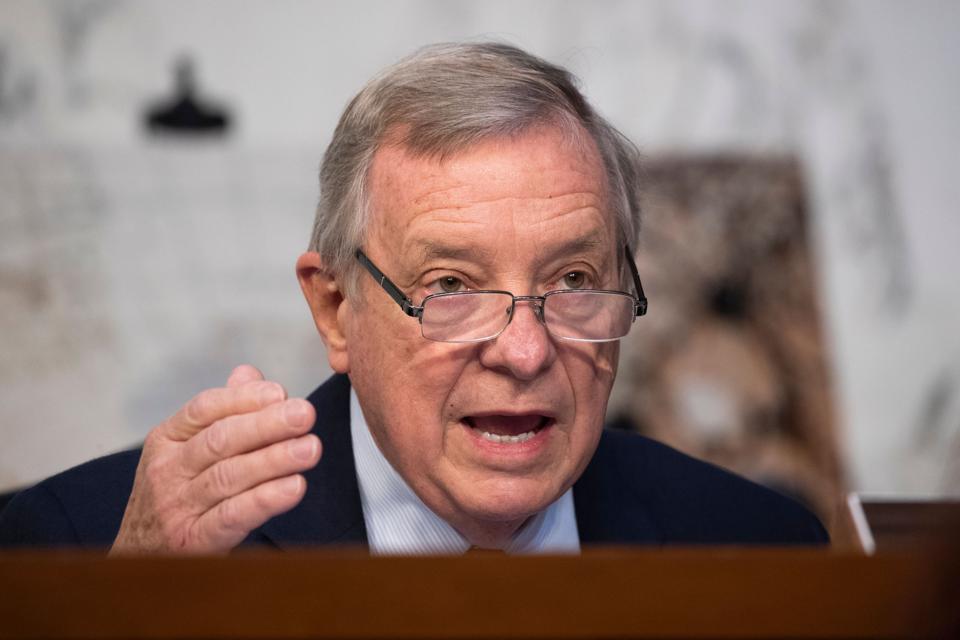

The 10200 amount is the same tax exemption in the American Rescue Plan Act of 2021 signed on March 11 Adkins added. Updated Apr 01 2021. MICHELLE STODDART ABC NEWS NEW YORK As Americans file their tax returns for 2020 a year riddled with job insecurity millions who relied on unemployment insurance during the pandemic will find that up to 10200 of those benefits will be exempt from taxes.

The plan lets tax filers who received benefits exempt the first 10200 of. New York will continue to apply state income tax to 2020 unemployment benefits in full despite the federal government exempting the first 10200. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on.

The tax treatment of unemployment benefits you receive depends on the type of program paying the benefits. State unemployment insurance benefits. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

You may use either EAMS or ePay to pay your taxes. As Americans file their tax returns for 2020 -- a year riddled with job insecurity -- millions who relied on unemployment insurance during the pandemic will find that up to 10200 of those benefits will be exempt from taxes. Officers of for-profit corporations who provide services in Washington are automatically exempt from Unemployment Insurance unless the employer specifically requests coverage.

People whose adjusted gross income was less than 150000 can exclude up to 10200 of unemployment benefits from taxes in 2020. The tax break is part of the American Rescue Plan President Joe Bidens 19 trillion relief package that also. Senate Democrats agreed to lower additional unemployment aid to 300 per week from 400 but extended the payments through Sept.

Unemployment Payments 600 Are They Exempt From Tax As Com

Unemployment Payments 600 Are They Exempt From Tax As Com

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

Supplemental Unemployment Benefit Plans A Tool For Employers Responding To The Covid 19 Crisis

Supplemental Unemployment Benefit Plans A Tool For Employers Responding To The Covid 19 Crisis

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Bill To Exempt State Taxes On Unemployment Benefits One Step From Governor S Signature Talk Business Politics

Bill To Exempt State Taxes On Unemployment Benefits One Step From Governor S Signature Talk Business Politics

State Unemployment Insurance Tax Exemption For 501 C 3 S Explained 501 C Agencies Trust

State Unemployment Insurance Tax Exemption For 501 C 3 S Explained 501 C Agencies Trust

Keeping Away The Taxman Exempting Covid Unemployment Benefits Came Too Late To Avoid Irs Headaches For Millions New York Daily News

Keeping Away The Taxman Exempting Covid Unemployment Benefits Came Too Late To Avoid Irs Headaches For Millions New York Daily News

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

2020 Unemployment Benefits Will Be A Factor When Your Taxes Are Due

2020 Unemployment Benefits Will Be A Factor When Your Taxes Are Due

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Tax Waiver For Unemployment Benefits Leads To Questions Kake

Tax Waiver For Unemployment Benefits Leads To Questions Kake

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Https Esdorchardstorage Blob Core Windows Net Esdwa Default Esdwagov Employer Taxes Esd Exempt Professions Chart Pdf

State Unemployment Insurance Tax Exemption For 501 C 3 S Explained 501 C Agencies Trust

State Unemployment Insurance Tax Exemption For 501 C 3 S Explained 501 C Agencies Trust

Https Www Irs Gov Pub Irs News Ir 09 029 Pdf

Post a Comment for "Unemployment Insurance Tax Exemption"