Unemployment Insurance For Gig Workers In California

This law requires many gig companies to treat their workers like employees for the purpose of state Unemployment Insurance. California expands unemployment insurance.

Uber Lyft Could Expand New California Gig Economy Model To Other States Experts Say

Uber Lyft Could Expand New California Gig Economy Model To Other States Experts Say

Someone who was self-employed or who.

Unemployment insurance for gig workers in california. Gig workers and self-employed people arent traditionally eligible for unemployment benefits but under the CARES Act they could receive benefits through the. So-called gig workers whose work has been affected by the virus are eligible for up to 39 weeks of unemployment benefits. The 2 trillion coronavirus stimulus signed into law last week includes new unemployment benefits for self.

But the problems with gig worker unemployment insurance in the pandemic. Workers fought tirelessly to get this bill passed. WashingtonSenator Dianne Feinstein D-Calif today released the following statement on unemployment benefits for self-employed part-time and gig workers included in the coronavirus response legislation.

In November California voters passed Prop 22 with 5863 of voters in favor of the amendment to exempt app-based gig workers from California assembly bill. App-based drivers and other gig workers are considered employees and absolutely qualify for Unemployment Insurance UI in California. This includes business owners self-employed workers independent contractors and those with a limited work history who are out of business or have significantly reduced their services as a.

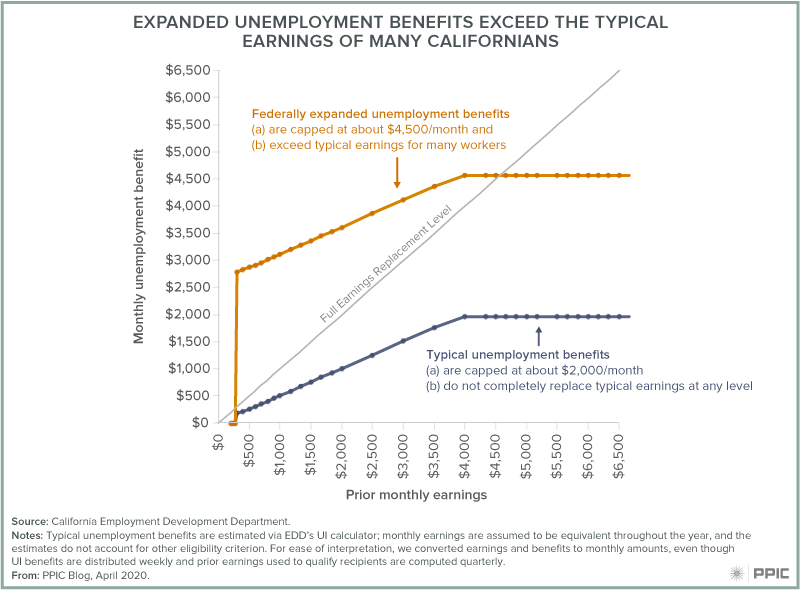

This means that companies like Uber Lyft should be paying into the Unemployment Insurance fund AND gig workers who are out of work because of COVID-19 should have access to benefits like any other worker. WashingtonSenator Dianne Feinstein D-Calif today released the following information explaining how self-employed part-time independent contractors and gig workers in California can apply for new unemployment insurance benefits including an additional 600 per week beyond usual state benefits made available through the CARES Act. To receive Unemployment Insurance UI benefit payments you must meet all eligibility requirements when filing a claim and when certifying for benefits.

New employees under gig-worker law face delays in benefits State adviser suggests ceasing debt collection to speed process Gig-economy workers in California are facing difficulties getting unemployment checks as the coronavirus pandemic slashes hours despite a new law intended to make them eligible for employee benefits. Under the Coronavirus Aid Relief and Economic Security Act or the CARES Act self-employed workers including independent contractors such as. In response last week the federal government signed a 2 trillion coronavirus stimulus response legislation the CARE Act including new unemployment benefits for self-employed part-time.

Officials in state unemployment offices. Self-Employed Part-Time and Gig Workers Can Now Apply for Unemployment Benefits In California SACRAMENTO CBS13 Self-employed part-time independent contractors and gig workers in California can apply for new unemployment insurance benefits made available through the CARES Act. California is also in the process of creating its own 1099-K form as required by Proposition 22 which passed last year.

The original CARES Act had unemployed workers either get their benefits from the state through unemployment insurance or through a federal program called PUA. Totally or partially unemployed. Because Lyft Uber have defied the law and issue 1099s for us we are considered misclassified the state and EDD see us as employees but our bosses dont.

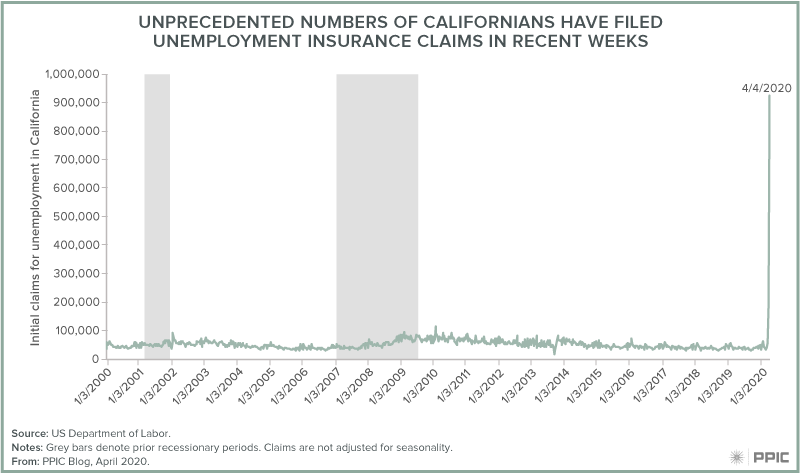

The novel coronavirus pandemic has caused an historic surge of 10 million unemployment claims across the country in just the last two weeks. California began accepting applications for assistance on Tuesday. But the money wont arrive quickly.

Requirements to File a Claim When filing for UI benefits you must have earned enough wages during the base period to establish a claim and be. Pandemic Unemployment Assistance PUA is part of the federal assistance that helps unemployed Californians who are not usually eligible for regular Unemployment Insurance UI benefits. Self-employed part-time and gig workers eligible.

Through the programs Phase 1 gig workerscontractorsself-employed are eligible to receive 167 per week if they have been. Many of the hundreds of thousands of California gig workers and independent contractors wont have to repay part of their unemployment aid under a provision in the new COVID-19 stimulus package. Self-employed part-time gig workers can now receive benefits.

Ab5 Is Law In California Now What Now What Economy California

Ab5 Is Law In California Now What Now What Economy California

Pin On Official California Unemployment Group

Pin On Official California Unemployment Group

Here S Where We Stand Today Virginian Pilot The Virginian Unemployment

Here S Where We Stand Today Virginian Pilot The Virginian Unemployment

6 Ways Uber And Lyft Drivers Can Get Free Money Right Now Lyft Driver Irs Website Lyft

6 Ways Uber And Lyft Drivers Can Get Free Money Right Now Lyft Driver Irs Website Lyft

Ab5 Is Law In California Now What Now What Economy California

Ab5 Is Law In California Now What Now What Economy California

Alternatives To Driving For Uber Or Lyft Uber Driving Lyft Uber

Alternatives To Driving For Uber Or Lyft Uber Driving Lyft Uber

How Ab5 Affects Gig Rivals One Gets More Business One Exits California In 2020 Job Fair Temporary Jobs Blue Collar Worker

How Ab5 Affects Gig Rivals One Gets More Business One Exits California In 2020 Job Fair Temporary Jobs Blue Collar Worker

California Gig Workers Could Have To Pay Back Thousands In Unemployment Insurance Wlos

California Gig Workers Could Have To Pay Back Thousands In Unemployment Insurance Wlos

California Expands Unemployment Insurance Self Employed Part Time And Gig Workers Eligible Coronavirus Resources Coastalview Com

California Expands Unemployment Insurance Self Employed Part Time And Gig Workers Eligible Coronavirus Resources Coastalview Com

Gig Workers In California Can Apply For Unemployment Youtube

Gig Workers In California Can Apply For Unemployment Youtube

These 10 Charities Will Benefit Californians In 2021 Benefit Charity This Or That Questions

These 10 Charities Will Benefit Californians In 2021 Benefit Charity This Or That Questions

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Rideshare Rodeo Podcast 15 Lyft Driver Attacked Then Arrested Wearing Masks Interview With Rideshare Movie Lyft Driver Rideshare Lyft

Rideshare Rodeo Podcast 15 Lyft Driver Attacked Then Arrested Wearing Masks Interview With Rideshare Movie Lyft Driver Rideshare Lyft

Illinois Gig Workers Pua Benefits On Monday But Will System Handle It Gigs Virtual Call Center Illinois

Illinois Gig Workers Pua Benefits On Monday But Will System Handle It Gigs Virtual Call Center Illinois

Post a Comment for "Unemployment Insurance For Gig Workers In California"