How To Calculate Futa Taxes Payable

Multiply the quarterly wages of your employees who are subject to FUTA tax by 0006. FUTA tax is calculated on taxable income ie.

The FUTA tax offers a credit of maximum 54 in respect of state unemployment taxes paid.

How to calculate futa taxes payable. Hector will add up the wages paid during the reporting period to employees subject to FUTA tax. In other words the payroll tax is based on employee wages but is not wit. A FUTA payment is calculated based on 08 of the first 7000 of employee wages in each tax year which is actually comprised of a 62 tax minus a 54 credit.

Thanks for your help. To calculate how much of your employees federal income tax to withhold youll need a copy of their Form W-4 as well as your employees gross pay. The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their withholding consider additional tax payments or submit a new Form W-4 to their employer.

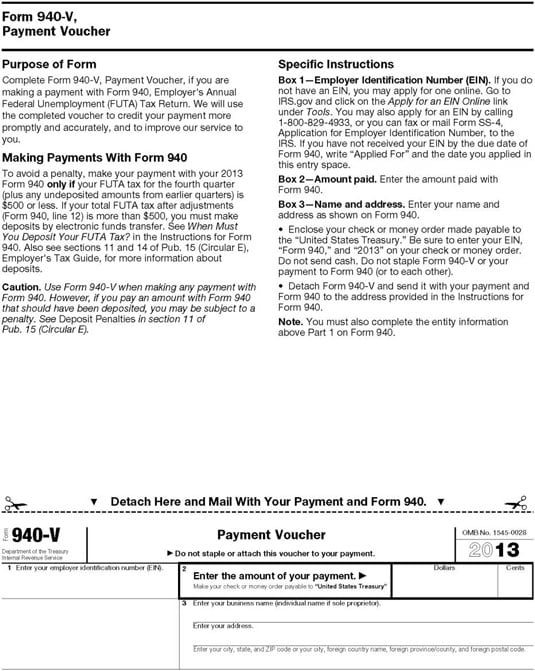

Calculate its FUTA tax liability for each payroll Set aside an amount after each payroll equal to that liability Make periodic payments to the IRS based on the amount owed and Submit an annual report on Form 940 Employers Annual Federal Unemployment FUTA Tax Return. Check with your state unemployment office to find out which payments are exempted from FUTA tax. How do I calculate FUTA tax.

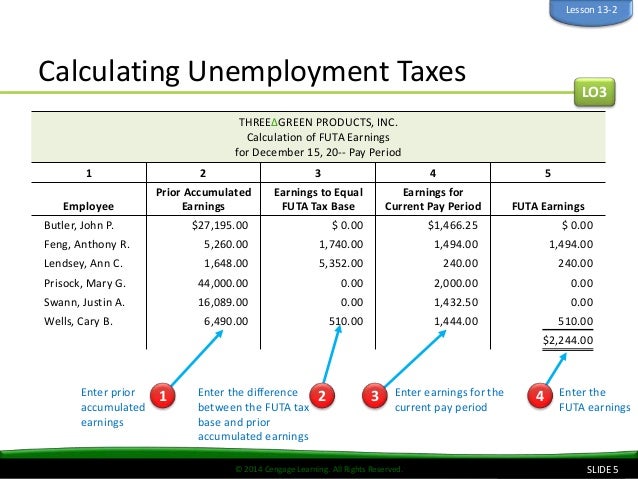

In this scenario heres how Hector will calculate his quarterly FUTA liability. Federal unemployment tax or FUTA is a payroll tax that is paid by the employer only. Heres a breakdown of how to calculate your quarterly FUTA liability in this scenario.

Continuing the example above lets say the SUTA tax rate is 54 the state unemployment tax obligation equals 756 2 7000 54. FUTA in this example would be 112 2 7000 62 - 54. In order to determine the total amount subject to the FUTA tax simply subtract the subtotal from the total amount of payments made to your employees.

To calculate this you will have to subtract your SUTA tax amount from the base FUTA tax and the result will be your net FUTA tax. FUTA tax is not deducted from an employees paycheck. 8000 x 0027 216.

The federal FUTA is the same for all employers 60 percent. Your next step is to determine the method you want to use to calculate withholding. For state FUTA taxes use the new employer rate of 27 percent on the first 8000 of income.

7000 Mary the baker 4000 Paul the cashier 5000 Daisy the manager 16000 wages earned in Q1. Now you should calculate your net FUTA tax. Calculate Totals Before Adjustments.

The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. In the example above this would result in a total taxable amount of 18500 103000-84500 18500. Thus the maximum amount of FUTA that an employer can pay per year for each employee is 56 7000 x 0008.

Employers also pay Federal Unemployment Tax Act FUTA taxes. Each of these employees earns an annual taxable income of 10000 bringing the total wages to 100000. In such a case the tax is applied to the first 7000 in wages paid to each of the employees.

Start date is January assume 125500 bimonthly payment. Add up the wages paid during the reporting period to your employees who are subject to FUTA tax. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

This figure assumes youre. Employee 3 has 37100 in eligible FUTA wages but. I need formula to calculate FUTA tax 008 of gross salary on first 7000 -- thus when it gets to 5600 no more tax is deducted.

The federal government uses the revenue to cover the administrative cost of state unemployment benefit programs. Unemployment Compensation Subject to Income Tax and Withholding. For more information about estimated tax payments or additional tax payments visit payment options at IRSgovpayments.

Most employers have two options the wage bracket method and the percentage method. Heres how you calculate the FUTA tax for this company. The first 7000 per employee per annum.

Therefore the companys annual FUTA tax will be 006 x 7000 x 10 4200.

Futa 2020 What Are Futa Taxes And How To Calculate Them Nav

Futa 2020 What Are Futa Taxes And How To Calculate Them Nav

Calculation Of Taxable Earnings And Employer Payroll Taxes And Preparation Of Journal Entry Selected Information From The Payroll Register Of Howard S Cutlery For The Week Ended October 7 20 Is Presented Below

Calculation Of Taxable Earnings And Employer Payroll Taxes And Preparation Of Journal Entry Selected Information From The Payroll Register Of Howard S Cutlery For The Week Ended October 7 20 Is Presented Below

Futa Tax Learn How To Calculate The Federal Futa Tax

Futa Tax Learn How To Calculate The Federal Futa Tax

Solved Calculation Of Taxable Earnings And Employer Payroll Taxes And Preparation Of Journal Entry 1 Calculate The Amount Of Taxable Earnings For Course Hero

What Is Futa Tax Rate Due Dates More

What Is Futa Tax Rate Due Dates More

Solved 1 Calculate The Employer S Payroll Taxes Expense Chegg Com

Solved 1 Calculate The Employer S Payroll Taxes Expense Chegg Com

Federal Unemployment Insurance Taxes California Employers Paying More Advocacy California Chamber Of Commerce

How To Calculate Unemployment Tax Futa Dummies

How To Calculate Unemployment Tax Futa Dummies

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

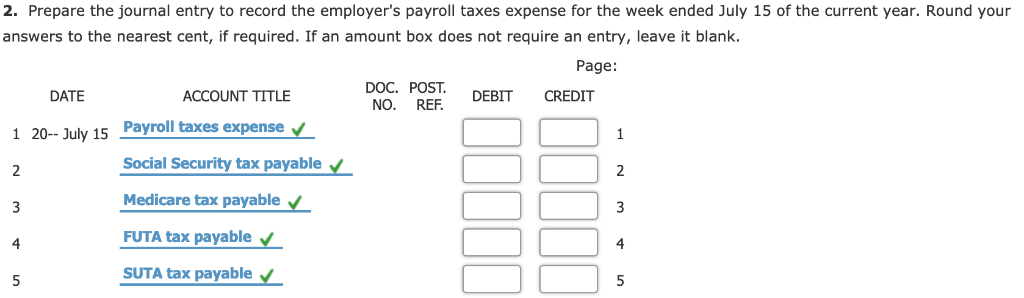

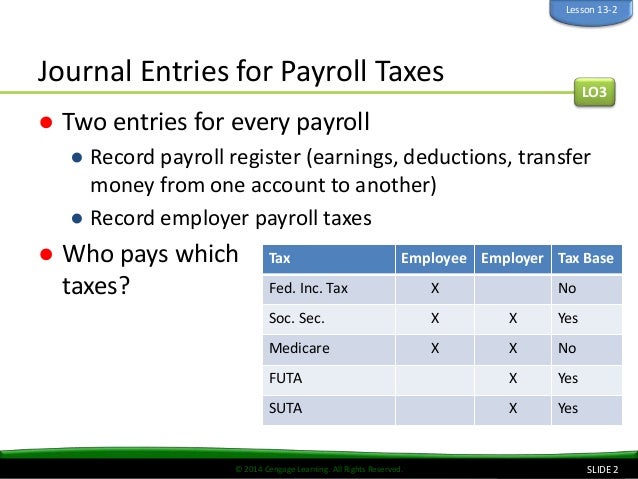

Journalizing Employer Payroll Taxes

Journalizing Employer Payroll Taxes

Journalizing Employer Payroll Taxes

Journalizing Employer Payroll Taxes

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube

What Is The Futa Tax 2021 Tax Rates And Info Onpay

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

How To Calculate Unemployment Tax Futa Dummies

How To Calculate Unemployment Tax Futa Dummies

Post a Comment for "How To Calculate Futa Taxes Payable"