How To Calculate Federal Unemployment Tax Rate 2019

The maximum amount of taxable wages per employee per calendar year is set by statute and is currently 9000. Pay FUTA unemployment taxes which is 6 of the first 7000 of each employees taxable income.

.jpg?sfvrsn=b82e8f1f_2) Employer Tax Rates Employers Kdol

Employer Tax Rates Employers Kdol

FUTA tax rate.

How to calculate federal unemployment tax rate 2019. The 7000 is often referred to as the federal or FUTA wage base. We strive to make the calculator perfectly accurate. The provided information does not constitute financial tax or legal advice.

Your business will generally be able to claim the maximum 54 credit if it can satisfy both of the eligibility requirements below. 7000 x 0060 420 420 x 10 employees 4200 The company doesnt have to pay the full federal amount because it can take up to a 54 percent credit for state taxes paid 7000 x 0054 378. If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the construction industry in which case the 2017 rate is 62 the 2018 rate is 60 the 2019 rate is 59.

For paying unemployment taxes. Employers may access their current rates through e-Services for Business select View your Payroll Tax Rates under More Online Services Refer to How to Determine Taxable Wages for additional information on determining the taxable wages to be used in the calculation. The tax applies to the first 7000 you paid to each employee as wages during the year.

Your state wage base may be different based on the respective states rules. To use EAMS or EAMS for Single Filers you will need to be sure to set up your online account in advance. For Federal 940 Certification purposes the State Experience Rate indicated on the Notice of UI Tax Rate is the State Experience Rate as defined on the federal form 940.

If youre eligible for the maximum credit it means your remaining tax rate will only be 06. The current newly subject employer rate for employers in the non-construction industry is 242 according to UI Tax Rate Schedule E in effect for 2019 and 2020. Unemployment taxes in Washington are calculated using a formula that is written into state law.

In 2019 the Virgin Islands received. This estimator only supports a federal unemployment tax rate of 06. Appealing Your UI Tax Rate.

How Income Taxes Are Calculated First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. The federal government applies a standard 6 FUTA tax rate across industries and it does not change based on how many former employees file for unemployment benefits. Minimum Tax Rate for 2020 is 031 percent.

There are two components of the state unemployment tax. View federal tax rate schedules and get resources to learn more about how tax brackets work. Maximum Tax Rate for 2020 is 631 percent.

Employers who do not agree with an unemployment tax rate computation may file an appeal. This rate is subject to change any time the rate schedule changes. The FUTA tax rate for 2019which is expected to remain the same in 2020is 6 on the first 7000 in wages that you paid to an employee during the calendar year.

If state unemployment taxes dont apply such as in the case of exempt corporate officers the federal unemployment tax rate is 6 rather than 06 of the first 7000 of compensation per year. Be filed within 30 days of the rate notice. To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate.

Use Employer Account Management Services EAMS or EAMS for Single Filers to file your tax reports or tax and wage reports online. UI and EAF tax rates provided to you by Employment Security Dept. After the first 7000 in annual wages you dont have to pay federal unemployment taxes.

Based on your annual taxable income and filing status your tax bracket determines your federal tax rate. FUTA taxes come with a huge caveat that you will want to know about. You pay unemployment tax on the first 9000 that each employee earns during the calendar year.

The average taxable payroll is the average of up to three fiscal. The state where your business files taxes is not a credit reduction state. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

You may use either EAMS or ePay to pay your taxes. Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan. The maximum FUTA credit is 54.

The FUTA tax rate is 60. The first component of the tax rate is the experience-based tax which is based on the amount of unemployment benefits paid to former. The 54 tax credit is reduced if the businesss state or territory fails to repay the federal government for money borrowed to pay unemployment benefits.

Your company paid its state unemployment taxes on time and in full. Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2020-2021 federal income taxes. Newly subject employers in the construction industry North American Industrial Classification System code 23 pay at a rate consistent with the average rate.

You can claim a tax credit of up to 54 for the state unemployment tax you pay as long as you pay in full and on time. Each year the ratio is calculated by adding the taxes paid in and subtracting the benefit payments charges from the accumulated reserve and then dividing by the employers average taxable payroll. Its an easy way to save a whopping 90 so make sure you take advantage.

We do not have independent authority to adjust the rates. For filing tax reports or tax and wage reports online. Your taxable wages are the sum of the wages you pay up to 9000 per employee per year.

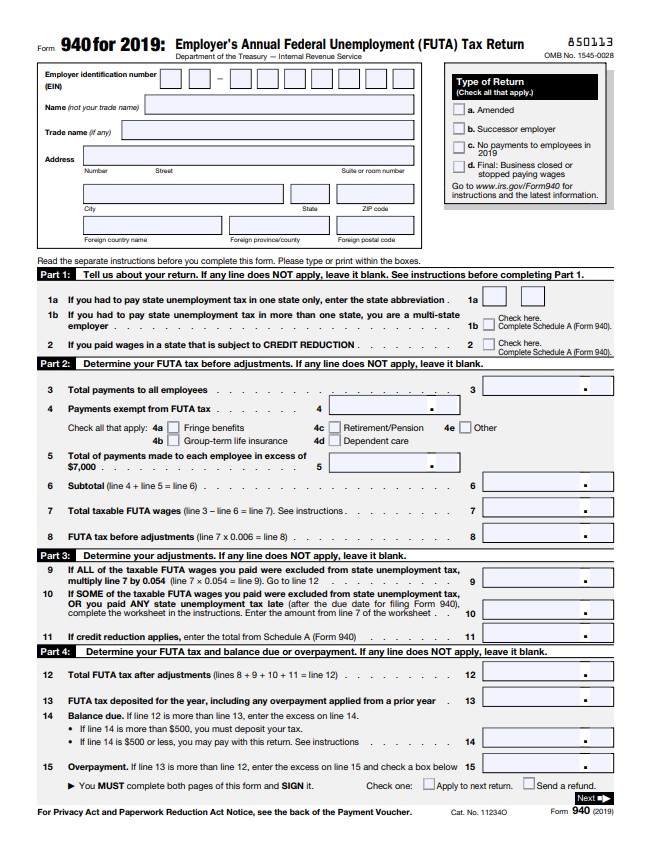

How To Fill Out Irs Form 940 Futa Tax Return Youtube

How To Fill Out Irs Form 940 Futa Tax Return Youtube

What Is Futa Tax Rate Due Dates More

What Is Futa Tax Rate Due Dates More

What Is The Futa Tax 2021 Tax Rates And Info Onpay

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Unemployment Tax Futa Dummies

How To Calculate Unemployment Tax Futa Dummies

Futa Federal Unemployment Tax Act San Francisco California

Futa Federal Unemployment Tax Act San Francisco California

Futa Tax Learn How To Calculate The Federal Futa Tax

Futa Tax Learn How To Calculate The Federal Futa Tax

Form 940 Who Needs To File How To File And More

Form 940 Who Needs To File How To File And More

Are Employers Responsible For Paying Unemployment Taxes

Are Employers Responsible For Paying Unemployment Taxes

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube

Futa 2020 What Are Futa Taxes And How To Calculate Them Nav

Futa 2020 What Are Futa Taxes And How To Calculate Them Nav

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa Taxes Form 940 Instructions

Futa Taxes Form 940 Instructions

How To Calculate Federal Unemployment Tax Futa In 2021 The Blueprint

How To Calculate Federal Unemployment Tax Futa In 2021 The Blueprint

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax 2021 Tax Rates And Information

What Is The Federal Unemployment Tax Rate In 2020

What Is The Federal Unemployment Tax Rate In 2020

Post a Comment for "How To Calculate Federal Unemployment Tax Rate 2019"