Suta Tax Rate 2021 Oklahoma

Because of the balance of the Trust Fund Tax Table F will apply to employers unemployment insurance tax rate for 2021. The 7000 is often referred to as the federal or FUTA wage base.

Https Www Ok Gov Tax Documents 2021whtables Pdf

Oklahoma State Personal Income Tax Rates and Thresholds in 2021.

Suta tax rate 2021 oklahoma. FUTA tax rate. The state UI tax rate for new employers known as the standard beginning tax rate also changes from one year to the next. Each state has its own SUTA tax.

1 2021 the wage base is to be 24000 for 2021 up from 18700 in 2020 the spokeswoman told Bloomberg Tax in an email. This allows rates to return to 2020 levels providing relief to all experience-rated employers. The rate for new employers will be 23.

Single filers will pay the top rate after earning 7200 in taxable income per year. For 2021 Conditional Factor D is to be in effect and. 012 00012 for 1st quarter.

Additionally HB 413 will decrease the 2021 unemployment taxable wage base from 11100 to 10800. The state sales tax rate in Oklahoma is 4500. See SUI Taxable Wages.

Oklahoma Employment Security Commission. The annual total SUI tax rate is based on a range of rates. An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes.

1 day agoThe solvency fund assessment one of several factors used to calculate a business owners unemployment insurance contribution rate jumped from 058 to 923 for 2021. UI tax is paid on each employees wages up to a maximum annual amount. Special payroll tax offset.

2021 rate changes are not impacted by employers unemployment charges related to the pandemic. Tax rates range from 05 to 50. The range of tax rates for contributory employers in 2021 will be between 22 to 135 which is the Table F tax rate schedule.

With local taxes the total sales tax rate is between 4500 and 11500. 20 rows 2021 STATE WAGE BASES Updated 122320 2020 STATE WAGE BASES 2019 STATE. With local taxes the total sales tax rate is between 4500 and 11500.

Payroll greater than 500000. The maximum amount of taxable wages per employee per calendar year is set by statute and is currently 9000. Over the last decade it has ranged from around 13000 to around 20000.

The tax applies to the first 7000 you paid to each employee as wages during the year. Here is a list of the non-construction new employer tax. 52 rows SUTA Tax Rates and Wage Base Limit.

The FUTA tax rate is 60. The good news is that only the state charges income tax so theres no need to worry about local taxes. Payroll less than 500000.

Oklahomas unemployment-taxable wage base and unemployment tax rates are to increase for 2021 a spokeswoman for the state Employment Security Commission said Sept. 405 557-7100 Telecommunications Device for the Deaf TDD. The new-employer tax rate will remain at 270 for 2021.

009 00009 for 2nd quarter. Due to this change tax rates will range from 030 to 900. 009 00009 for 3rd quarter.

Wage Base and Tax Rates. The Oklahoma anti-SUTA dumping law mirrors the federal SUTA Dumping Prevention Act. The taxable wage base for 2021 is 43800.

Conversely low unemployment can produce lower tax rates. High rates of unemployment in the state can produce higher tax rates in subsequent years. The wage base for SUI is 24000.

Oklahoma has recent rate changes Thu Apr 01 2021. 52 rows SUI tax rate by state. To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate.

The Oklahoma Employment Security Commission has confirmed that unemployment tax rates and taxable wage limits for calendar year 2021 will increase. PO Box 52003 Oklahoma City OK 73152-2003. Your state wage base may be different based on the respective states rules.

Oklahoma State Unemployment Insurance SUI Oklahoma has a State Unemployment Insurance SUI which ranges from 03 to 75. New effective final rates for 2021 will range from03 to no higher than 75. Under state law employers that knowingly attempt to manipulate businesses to get a lower tax rate are liable for serious penalties.

Taxable wage base. At the beginning of the year you will receive a Determination of Unemployment Tax Rate UC-603 UC-603 Sample 345 KB PDF advising you of your tax rate for the that calendar year. Effective January 1 2021 Oklahomas experienced-employer unemployment tax rates are to be determined with Conditional Factor D causing rates to range from 030 to 750.

009 00009 for 4th quarter. That amount known as the taxable wage base goes up or down every year in Oklahoma. 405 525-1500 Administrative Offices.

In The Know Archives Oklahoma Policy Institute

In The Know Archives Oklahoma Policy Institute

See The Redesigned Unemployment Website To File Claims Average Wait Times Down To 15 To 30 Minutes Business News Tulsaworld Com

See The Redesigned Unemployment Website To File Claims Average Wait Times Down To 15 To 30 Minutes Business News Tulsaworld Com

Oklahoma Reinstating 1 Week Waiting Period Work Search Requirement For Unemployment Public Radio Tulsa

Oklahoma Reinstating 1 Week Waiting Period Work Search Requirement For Unemployment Public Radio Tulsa

Oklahoma Raising Unemployment Taxes For 2021 Public Radio Tulsa

Oklahoma Raising Unemployment Taxes For 2021 Public Radio Tulsa

In The Know Archives Oklahoma Policy Institute

In The Know Archives Oklahoma Policy Institute

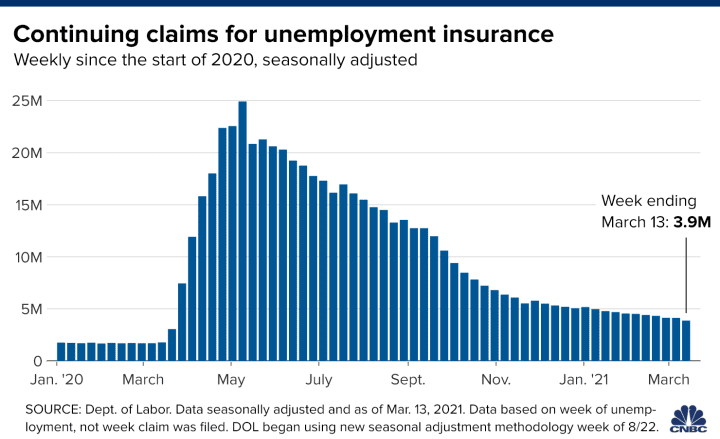

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Oklahoma Unemployment Rate Continues To Decline Remains In Top Ten Oklahoma Department Of Commerce

Oklahoma Unemployment Rate Continues To Decline Remains In Top Ten Oklahoma Department Of Commerce

Employer Faqs About Unemployment Insurance Coronavirus Covid 19 Oklahoma Department Of Commerce

Employer Faqs About Unemployment Insurance Coronavirus Covid 19 Oklahoma Department Of Commerce

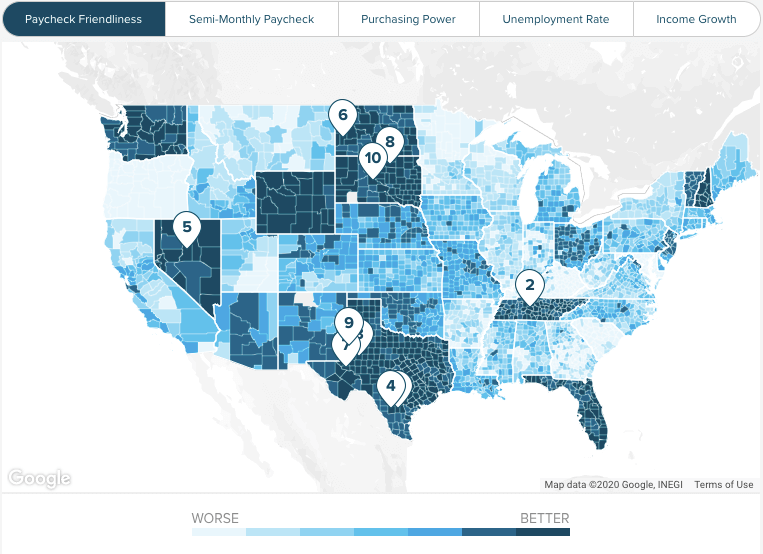

Oklahoma Paycheck Calculator Smartasset

Oklahoma Paycheck Calculator Smartasset

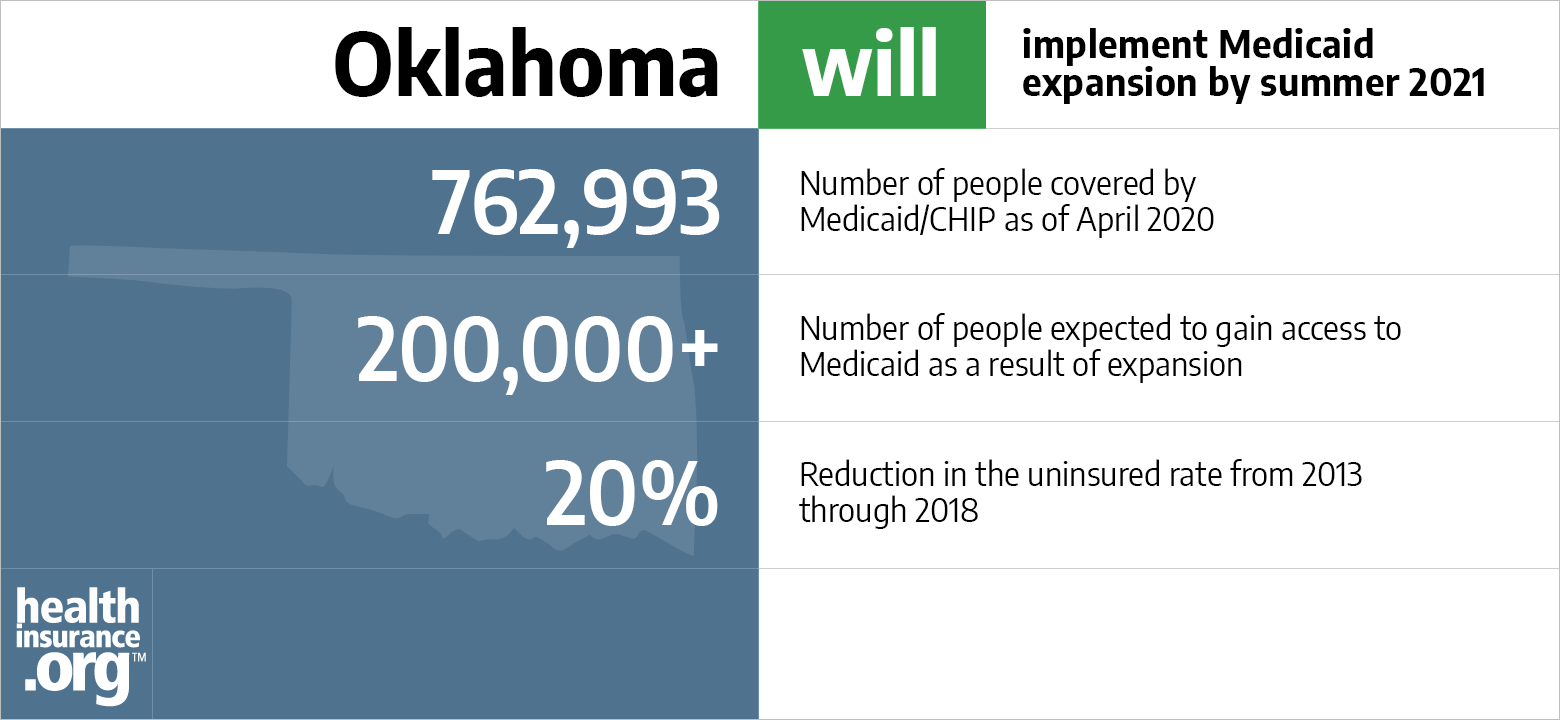

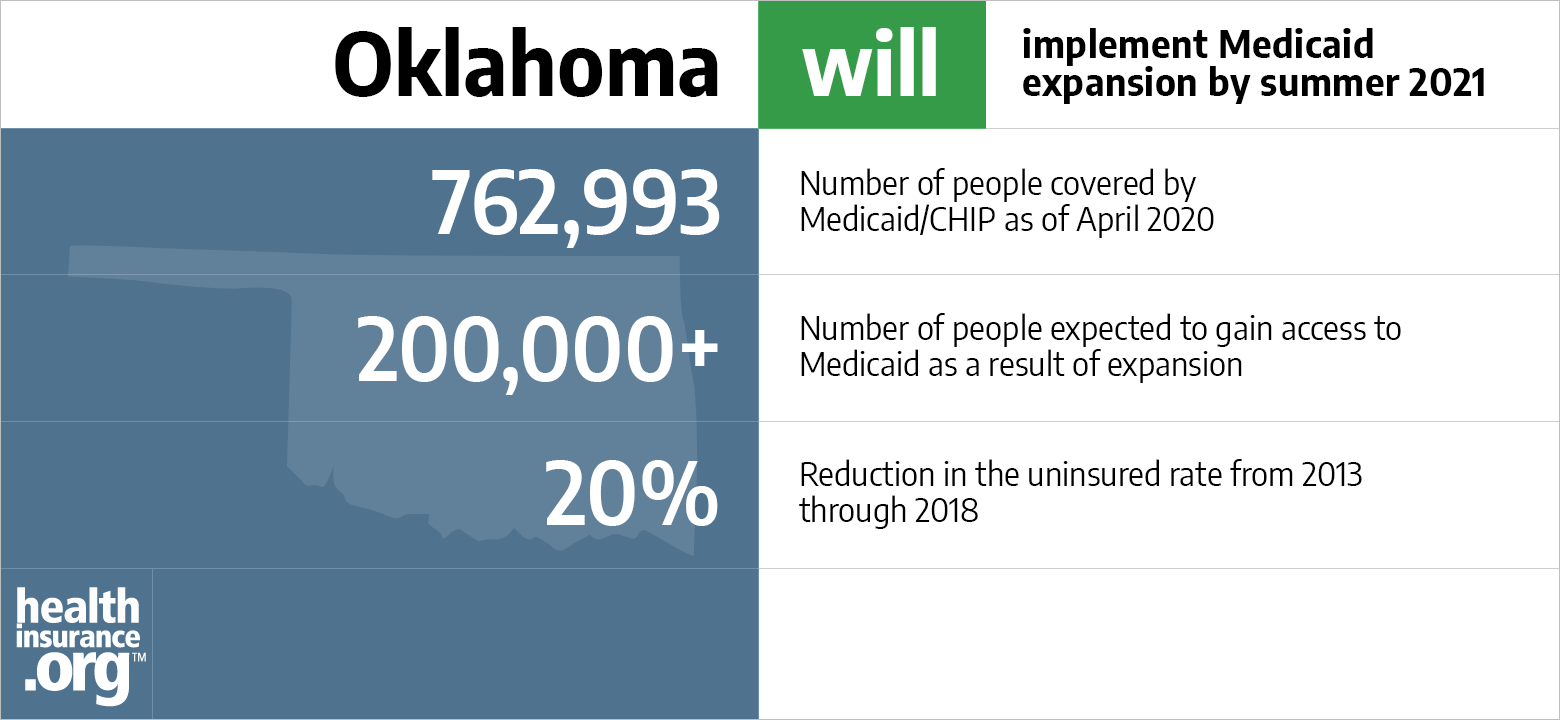

Oklahoma And The Aca S Medicaid Expansion Healthinsurance Org

Oklahoma And The Aca S Medicaid Expansion Healthinsurance Org

Oklahoma Unemployment Benefits Delay Possible

Oklahoma Unemployment Benefits Delay Possible

In The Know Archives Oklahoma Policy Institute

In The Know Archives Oklahoma Policy Institute

Oklahoma Unemployment Rate Continues To Decline Remains In Top Ten Oklahoma Department Of Commerce

Oklahoma Unemployment Rate Continues To Decline Remains In Top Ten Oklahoma Department Of Commerce

Unemployment Stateimpact Oklahoma

Oklahoma Employer Beware Fraudulent Unemployment Claims On The Rise Mcafee Taft

Oklahoma Employer Beware Fraudulent Unemployment Claims On The Rise Mcafee Taft

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Suta State Unemployment Taxable Wage Bases Aps Payroll

Suta State Unemployment Taxable Wage Bases Aps Payroll

Post a Comment for "Suta Tax Rate 2021 Oklahoma"