What Is The Suta Rate For 2020 In Florida

This 7000 is known as the taxable wage base. 3 Oversee property tax administration involving 109.

Florida Extends Filing Deadline Waives Penalties For Businesses Impacted By Covid 19

Florida Extends Filing Deadline Waives Penalties For Businesses Impacted By Covid 19

The tax rate for new employers is 17.

What is the suta rate for 2020 in florida. SUTA tax rates will vary for each state. To read the full article log in. On the other hand self-employed individuals dont have an employer and must pay the entire percentage.

SUTA is also assessed quarterly and only applicable to the first 7000 of an employees gross wages. The FUTA tax applies to the first 7000 in wages you pay an employee throughout the calendar year. 52 rows State unemployment tax is a percentage of an employees wages.

Tax rates for the second quarter range from 01 to 17 for positive-rated employers and from 33 to 75 for negative-rated employers. An employer usually pays the other half of the self-employment tax which is why employees only pay roughly 7 for FICA tax. 1 2020 unemployment tax rates are to range from 01 to 54 unchanged from 2019.

The 2020 FUTA wage base of 7000 has remained unchanged since 1983 despite increases in the federal minimum wage and annual cost-of-living adjustments over the last 36 years. However it is set by the state that your business is domiciled in and it varies from state to state. The maximum tax rate allowed by law is 0540 54 except for employers participating in the Short Time Compensation Program.

Its worth noting that youll also need to pay SUTA taxes thanks to the State Unemployment Tax Act for your employees as well. Effective January 1 2021 unemployment tax rates are to range from 029 to 540. The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year.

Self-employed individuals must pay a whopping 153 also known as the self-employment tax. 52 rows The tax rates are updated periodically and might increase for businesses in certain industries that have higher rates of turnover. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

You will need to withhold 62 of each employees taxable wages up until they have reached a total earning of 142800 for that. Because the FUTA tax rate across all states is 6 we can determine that your FUTA tax liability is 42000 X 6 or 2520. FUTA Tax Rates and Taxable Wage Base Limit for 2021.

The 7000 is often referred to as the federal or FUTA wage base. If 2520 seems like a lot to pay in FUTA tax dont despair. Employers will receive an assessment or tax rate for which they have to pay.

See more information here. Each state has a range of SUTA tax rates ranging from 065 to 68. Employers should know about the SUTA tax wage base and state unemployment tax rates.

The Florida Department of Revenue announced that unemployment tax rates are set to increase for 2021. Social Security Tax. The list below details the localities in Florida with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Unemployment tax rates for 2020 ranged from 010 to 540. Your state wage base may be different based on the respective states rules.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. 2020 Florida State Sales Tax Rates. The 54 rate can be earned or it can be assigned to employers who have delinquencies greater than one year and to those employers who fail to produce all work records requested for an audit.

The FUTA tax rate protection for 2021 is 6 as per the IRS standards. The tax applies to the first 7000 you paid to each employee as wages during the year. The tax rate for new employers is to be 270 in 2021 unchanged from 2020.

New Hampshire has raised its unemployment tax rates for the second quarter of 2020. The FUTA tax rate is 60. FUTA tax rate.

For 2020 the FUTA tax rate is projected to be 6 per the IRS. Floridas unemployment-taxable wage base is to be 7000 in 2020 unchanged from 2019. The first 7000 for each employee will.

However given the COVID-19 pandemic and the mass unemployment crisis in Florida the Florida Chamber of Commerce has announced that the minimum unemployment tax rate will now be 29 effective Jan. Employers must pay SUTA tax in Florida if they pay wages of at least 1500 during a calendar quarter or employ at least one worker for some part of a day in 20 different. The State Unemployment Tax Act SUTA tax also called SUI state unemployment.

Some states are conservative in their approach to maintaining adequate SUI trust fund reserves. This means that employers who previously only needed to pay the minimum rate of 7 per employee will soon need to pay 2030 per employee. The tax rate for new employers is to be 27.

Companies often receive a FUTA tax credit for the unemployment contributions they pay to the state in which they do business. Florida has recently re-branded this as Re-Employment Tax and sets the rate for new business owners at 27.

Suta Tax Your Questions Answered Bench Accounting

Suta Tax Your Questions Answered Bench Accounting

Florida S New Unemployment Tax Rate Florida Political Review

Florida Chamber Business Groups Want To Cut Rising Unemployment Tax The Apopka Voice

Florida Chamber Business Groups Want To Cut Rising Unemployment Tax The Apopka Voice

Business Owners Optimistic Following Increased Unemployment Tax Rate Wuft News

Business Owners Optimistic Following Increased Unemployment Tax Rate Wuft News

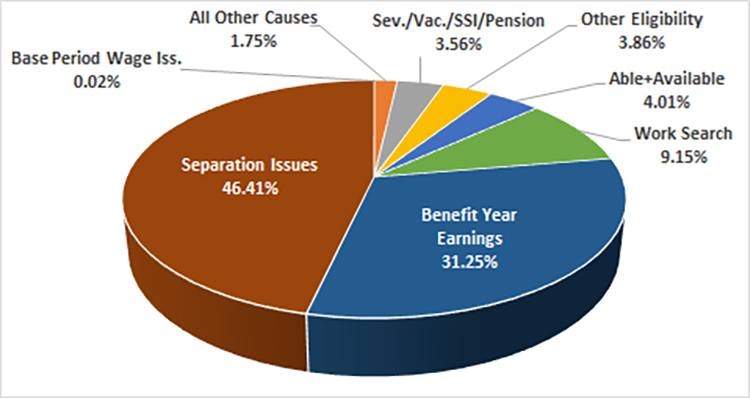

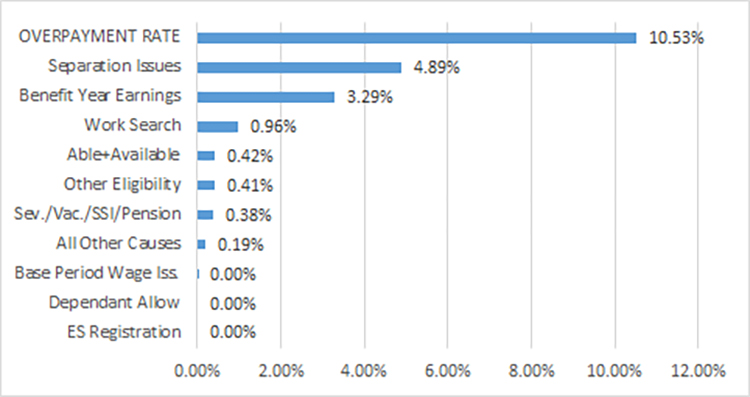

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Florida Lawmakers Consider Future Of State Unemployment System Connect In 2021 Youtube

Florida Lawmakers Consider Future Of State Unemployment System Connect In 2021 Youtube

Merlot New House Plan In Riverstone Naples Florida New House Plans New Homes Florida Home

Merlot New House Plan In Riverstone Naples Florida New House Plans New Homes Florida Home

Florida U S Department Of Labor

Florida U S Department Of Labor

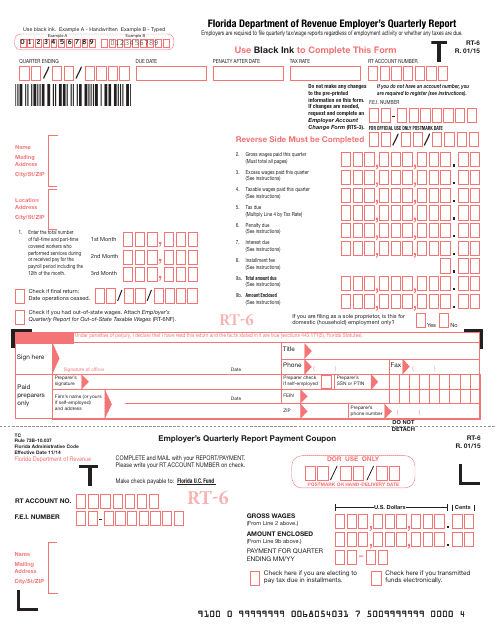

Form Rt 6 Download Printable Pdf Or Fill Online Employer S Quarterly Report Florida Templateroller

Form Rt 6 Download Printable Pdf Or Fill Online Employer S Quarterly Report Florida Templateroller

Florida Tax And Labor Law Summary Care Com Homepay

Florida Tax And Labor Law Summary Care Com Homepay

Florida S New Unemployment Tax Rate Florida Political Review

Florida U S Department Of Labor

Florida U S Department Of Labor

Https Floridajobs Org Docs Default Source Reemployment Assistance Center Employer Guides Employer Tax Charging One Pager Pdf Sfvrsn 1e4a4ab0 2

Florida Payroll Taxes What Is Futa Suta Smartcomp Solutions Inc

Florida Payroll Taxes What Is Futa Suta Smartcomp Solutions Inc

Florida Payroll Services And Regulations Gusto

Florida Payroll Services And Regulations Gusto

Florida Businesses To See 2021 Unemployment Tax Increase Workers Compensation Rate Cut Florida Thecentersquare Com

Florida Businesses To See 2021 Unemployment Tax Increase Workers Compensation Rate Cut Florida Thecentersquare Com

Suta State Unemployment Taxable Wage Bases Aps Payroll

Suta State Unemployment Taxable Wage Bases Aps Payroll

Florida Payroll Taxes What Is Futa Suta Smartcomp Solutions Inc

Florida Payroll Taxes What Is Futa Suta Smartcomp Solutions Inc

Post a Comment for "What Is The Suta Rate For 2020 In Florida"