Suta Tax Rate Pennsylvania

In recent years the employee withholding rate has been 07. The wage base recently has been at or above 9000 and in 2018 will hit 10000.

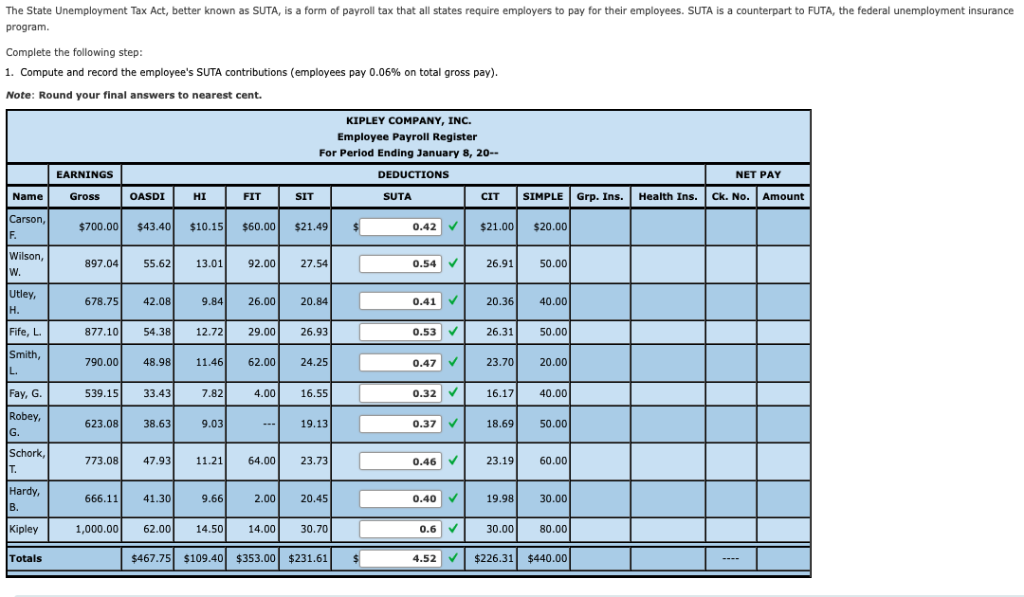

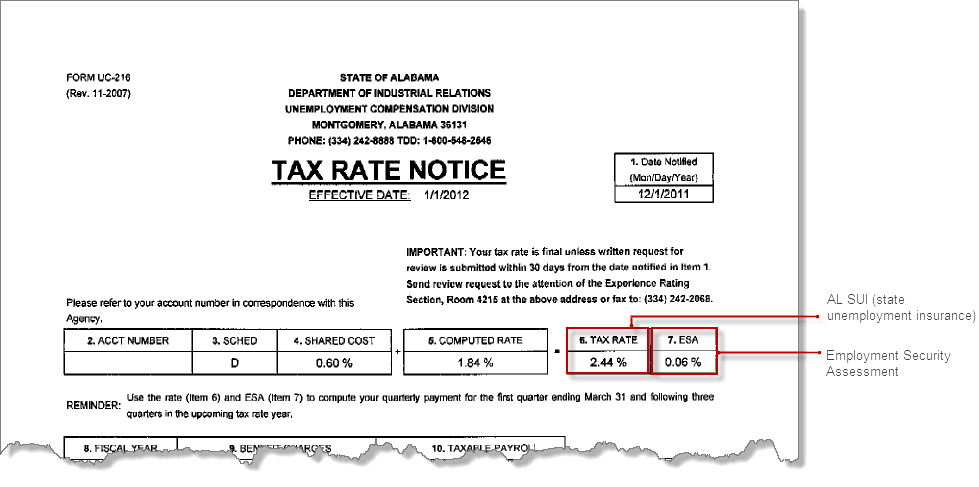

Employees are to be assessed an unemployment tax rate of 006 unchanged from 2020 with the tax deductible from wages.

Suta tax rate pennsylvania. If the Office of UC Tax Services issues a denial of a contribution rate appeal the employer has the right to file a second-level appeal with the UC Tax Review Office. The annual total SUI tax rate is based on a range of rates and several additional charges. However it isnt the only tax you need to take into consideration.

Employer UC tax services important information Pennsylvania Department of Labor Industry website November 2019 As a result the calendar year 2020 employer state unemployment insurance SUI experience tax rates will range from 12905 to 99333 down from 23905 to 110333 for 2019. Wages subject to unemployment contributions for employees are unlimited. Unlike other states Pennsylvanias UC tax requires withholding employee contributions along with direct payments by the employer.

Contribution Rate Notices The Office of UC Tax Services plans to issue the Contribution Rate Notice for calendar year 2021 Form UC-657 no later than December 31 2020. 9000 taxable wage base x 27 tax rate x 6 employees 1458 SUTA taxes How does SUTA impact the FUTA tax. The maximum experience-based contribution tax rate is099333 this includes the 54 percent Surcharge.

There is also a local Earned Income Tax EIT that goes up to almost 4 depending on location. A 050 percent 0050 Additional Contributions. Employers and third-party administrators can file PA UC quarterly tax reports make payments and maintain important account information.

A 54 percent 054 Surcharge on employer contributions. Pennsylvania Unemployment Tax The employee rate for 2019 remains at 006. The minimum experience-based contribution tax rate is012905 this includes the 54 percent Surcharge and the 050 percent Additional Contributions tax.

See SUI Taxable Wages. The Pennsylvania anti-SUTA dumping law mirrors the. This change is effective for calendar year 2020.

The rates include a 540 solvency surcharge. The surcharge adjustment does not apply to reimbursable employers. Here is a list of the non-construction new employer tax.

Proudly founded in 1681 as a place of tolerance and freedom. The surcharge adjustment is computed by multiplying your basic rate by the 54 percent surcharge. Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27.

The result is added to the basic rate. 52 rows SUI tax rate by state. Pennsylvania Income Tax Rate The withholding rate for 2020 remains at 307.

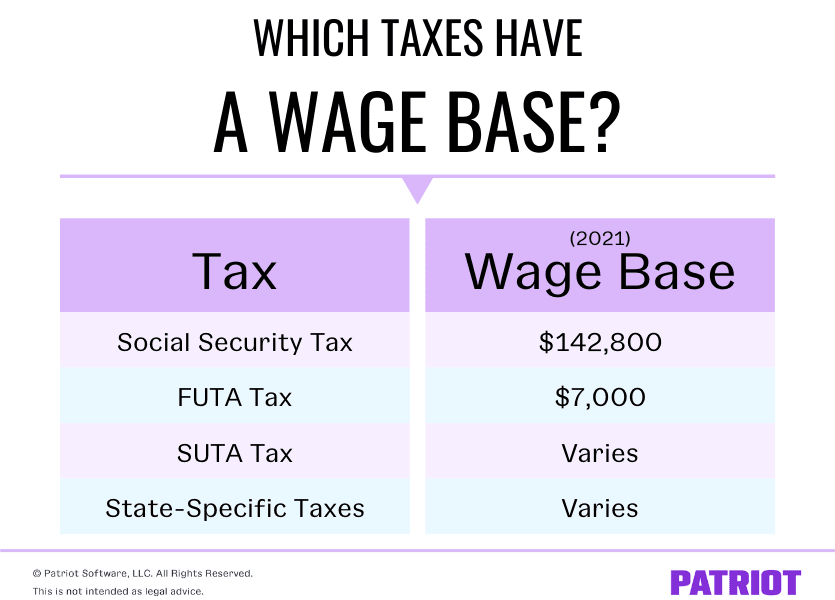

Employers and employees contribute into the unemployment system. 52 rows The tax rates are updated periodically and might increase for businesses. Pennsylvanias unemployment taxable wage base which is to be 10000 for 2021 does not apply with regard to unemployment tax assessed on employees.

However that amount is subject to change. Using the formula below you would be required to pay 1458 into your states unemployment fund. Pennsylvania state income taxes are relatively simple with a 307 flat income tax rate.

2019 legislation LB 428 increases the SUI taxable wage base to 24000 for employers assigned the maximum rate 54 for calendar year 2019. Wages subject to unemployment contributions for employers remains at 10000. The taxable wage base remains 9000 for all other employers.

4 rows Any amount your business pays in SUTA tax counts as a small business tax deduction.

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Solved The Federal Unemployment Tax Act Or Futa I R C Chegg Com

Solved The Federal Unemployment Tax Act Or Futa I R C Chegg Com

Suta Tax Rate Increase 2020 State By State Gusto

Suta Tax Rate Increase 2020 State By State Gusto

Suta Tax Your Questions Answered Bench Accounting

Suta Tax Your Questions Answered Bench Accounting

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

What Is A Wage Base Definition Taxes With Wage Bases More

What Is A Wage Base Definition Taxes With Wage Bases More

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

Https Www Cofcca Org Wp Content Uploads 2019 09 Cofcca 2011 Rfq4 Pdf

What Is The Futa Tax 2021 Tax Rates And Info Onpay

Suta State Unemployment Taxable Wage Bases Aps Payroll

Suta State Unemployment Taxable Wage Bases Aps Payroll

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax 2021 Tax Rates And Information

How Severely Will Covid 19 Impact Sui Tax Rates Managedpay

How Severely Will Covid 19 Impact Sui Tax Rates Managedpay

.jpg)

Post a Comment for "Suta Tax Rate Pennsylvania"