What Percentage Of Income Does Unemployment Cover

But tax professionals said some people may. These workers are also the least likely to receive.

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

This means that those who receive.

What percentage of income does unemployment cover. For example if you applied for unemployment benefits on January 20 2020 your base year would include wages earned from October 1 2018 through September 30 2019. Unemployment benefits are often calculated as a percentage of the average of the claimants pay over a recent 52-week period. When people apply for unemployment benefits with their state they have the option to have 10 percent of each payment withheld for federal income taxes.

The Unemployment Insurance UI benefit calculator will provide you with an estimate of your weekly UI benefit amount which can range from 40 to 450 per week. If someone receives or is approved to receive unemployment benefits during 2021 their income will be treated as no higher than 133 percent of the FPL. As of January 1 2021 the maximum yearly insurable earnings amount is 56300.

If the option to have taxes withheld is available you will be notified when you sign up for unemployment. Ultimately the onus is on the state government to balance the checkbook so the state has to decide the benefits maximum amount duration and eligibility to receive the benefits. Compensation is usually paid by an unemployment check or via direct.

Some states withhold a percentage of your unemployment benefits to cover taxestypically 10. Be sure to report the withholding on the. For the 2020 tax year however the American Rescue Plan Act allows single taxpayers with modified adjusted gross income of less than 150000 to exclude up to 10200 in unemployment insurance from income.

But you may decide not. This calculator helps you estimate your benefits. This means that you can receive a maximum amount of 595 per week.

As of October 4 2020 the maximum weekly benefit amount is 855 per week. For further details refer unemployment benefits article. The unemployment rate soared from a 50-year low of 35 percent to 148 percent in April 2020 at the beginning of the COVID-19 pandemic and then fell faster than many forecasters anticipated to 6.

Unemployment insurance programs are governed by state governments and are funded by state federal and private companies that pay employment tax. Many American households only receive partial unemployment benefits. You will have to verify with your states unemployment office to see what the highest payout for your state is.

For most people the basic rate for calculating EI benefits is 55 of their average insurable weekly earnings up to a maximum amount. The unemployment compensation will be included in your federal adjusted gross income which is then brought over to Line 1 of the Connecticut income tax return. If you had any tax withheld by the Connecticut Department of Labor it will be reported to you as state tax withheld on Form UC-1099-G.

You can only request that 10 of each payment be withheld from your unemployment benefits for federal income taxes. Federal law allows recipients to choose a flat 10 withholding from these benefits to cover part or all their tax liability. Once you file your claim the EDD will verify your eligibility and wage information to determine your weekly benefit amount WBA.

These figures only reflect those receiving the maximum unemployment insurance benefits. You have to report that income on your 2020 federal tax return and state return if applicable. According to the Congressional Budget Office CBO about 17 of people in the bottom 20 of household income will receive benefits a larger share than in other earnings groups.

Lawmakers created PUA for gig workers and others not eligible for regular benefits as well as 100 percent federal funding for benefits for the long-term unemployed through Pandemic. Unemployment is computed and one half of what your weekly pay was at the time of the discharge up to your states maximum benefit. If you are eligible to receive Unemployment Insurance UI benefits you will receive a weekly benefit amount of approximately 50 of your average weekly wage up to the maximum set by law.

To do this recipients should complete Form W-4V Voluntary Withholding Request and give it to the agency paying their benefits. But eligible taxpayers must generally have at least 2500 in earned income unemployment income doesnt count to claim the refundable portion which is limited to 15 percent of earnings above. You could be eligible for an alternate base year claim if you do not have enough hours in that base year for a valid claim see below.

El Porcentaje De Desempleados Forced Labor Unemployment Rate Bar Chart

El Porcentaje De Desempleados Forced Labor Unemployment Rate Bar Chart

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

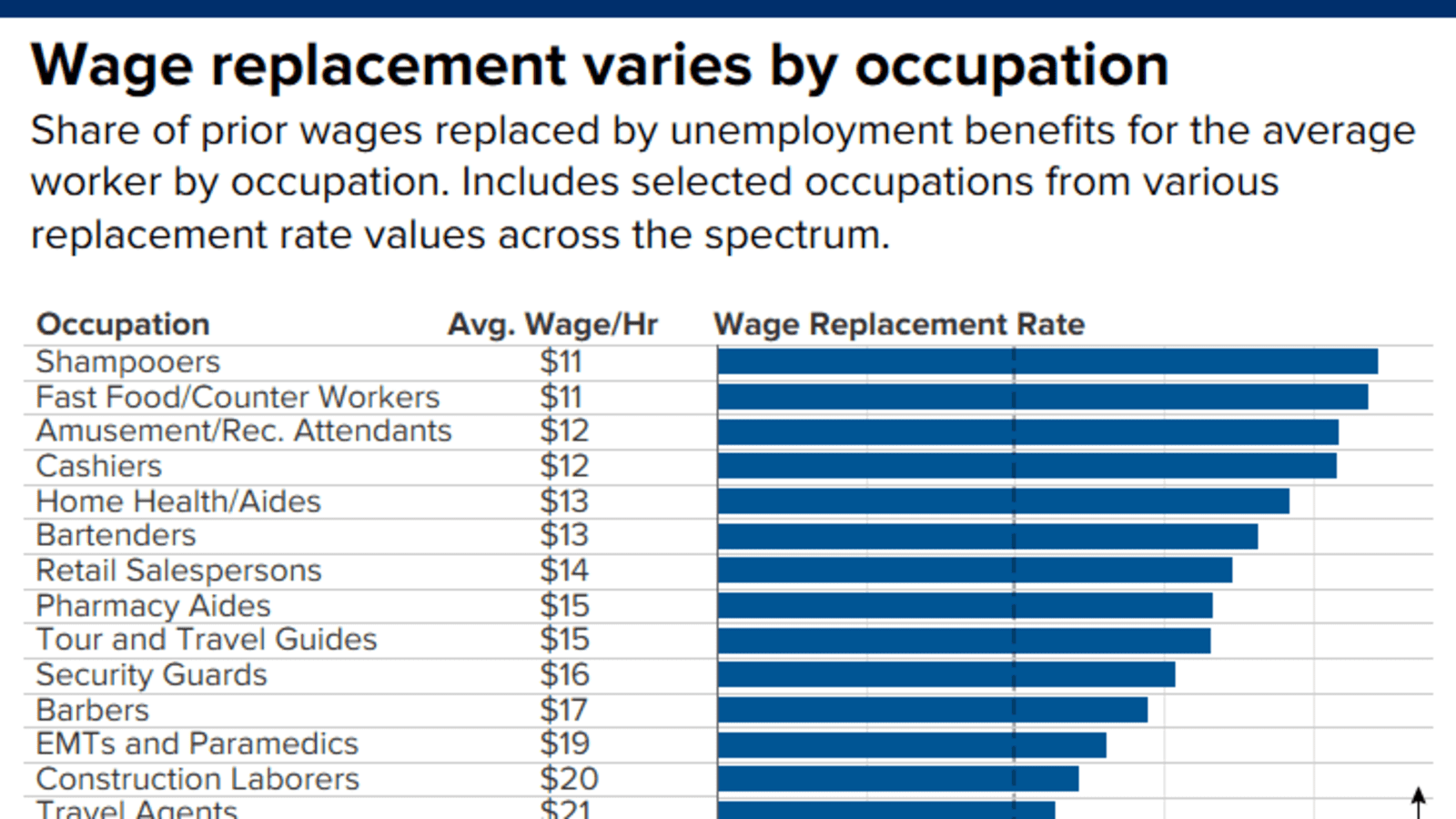

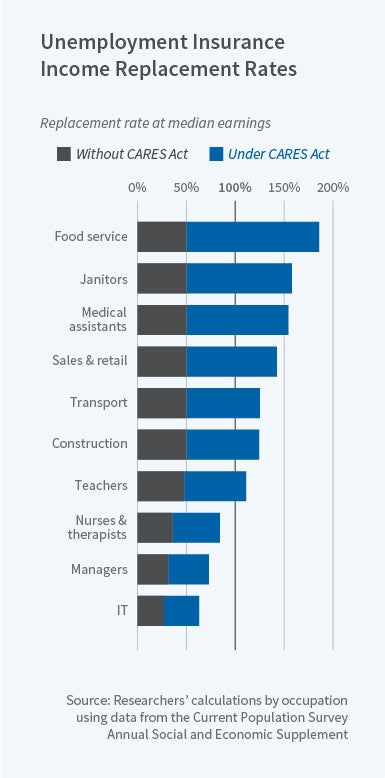

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

With The Unemployment Rate Still Hovering Around 8 Percent And Millions Out Of Work Many Have Started Design How To Stop Procrastinating College Application

With The Unemployment Rate Still Hovering Around 8 Percent And Millions Out Of Work Many Have Started Design How To Stop Procrastinating College Application

Compares 90 Years Of Income Disparity Between The Top 1 And Bottom 99 With Changes In Tax Rates Over The Same Period Tax Rate Unemployment Income

Compares 90 Years Of Income Disparity Between The Top 1 And Bottom 99 With Changes In Tax Rates Over The Same Period Tax Rate Unemployment Income

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

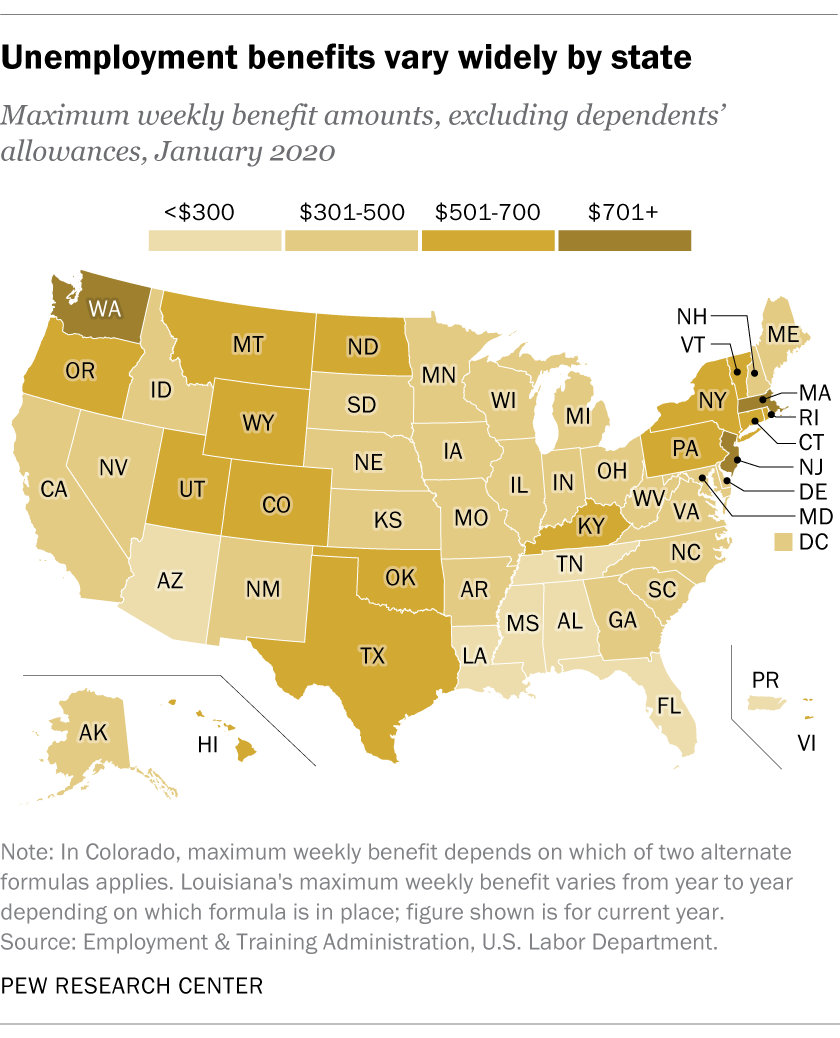

Recovering From Job Loss The Role Of Unemployment Insurance

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Recovering From Job Loss The Role Of Unemployment Insurance

Unemployment Benefit Replacement Rates During The Pandemic Nber

Unemployment Benefit Replacement Rates During The Pandemic Nber

Recovering From Job Loss The Role Of Unemployment Insurance

Household Budget Template 6 Budget Spreadsheet Template Household Budget Template Household Budget

Household Budget Template 6 Budget Spreadsheet Template Household Budget Template Household Budget

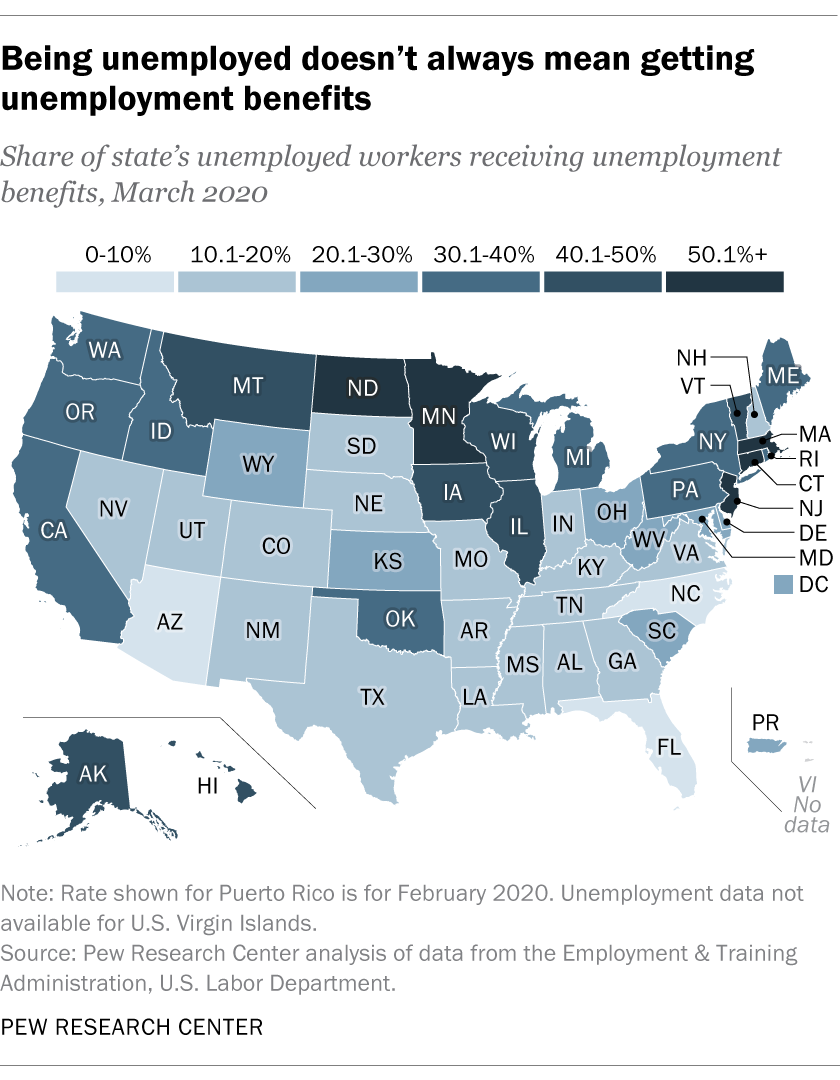

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

Unemployment In The Us Is Historically Low But Wage Growth Is Sluggish And No One Seems To Know Exactly Why Business Insider Corporate Profits Growth

Unemployment In The Us Is Historically Low But Wage Growth Is Sluggish And No One Seems To Know Exactly Why Business Insider Corporate Profits Growth

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Post a Comment for "What Percentage Of Income Does Unemployment Cover"