Unemployment Tax Rate Michigan 2021

Tax rates are computed annually and are mailed on the last business day of. Its great that Americans wont have to pay taxes on 10200 of unemployment income.

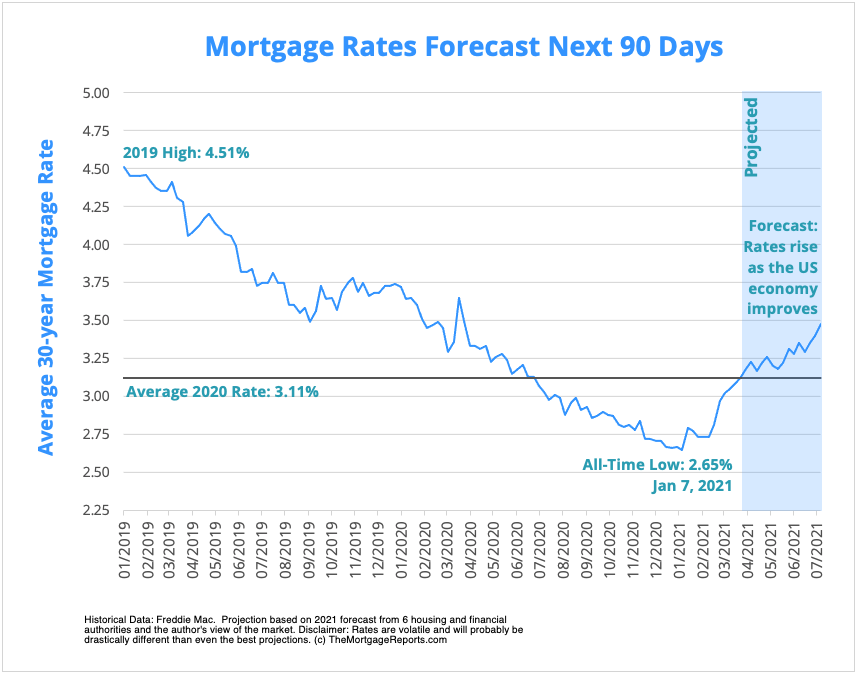

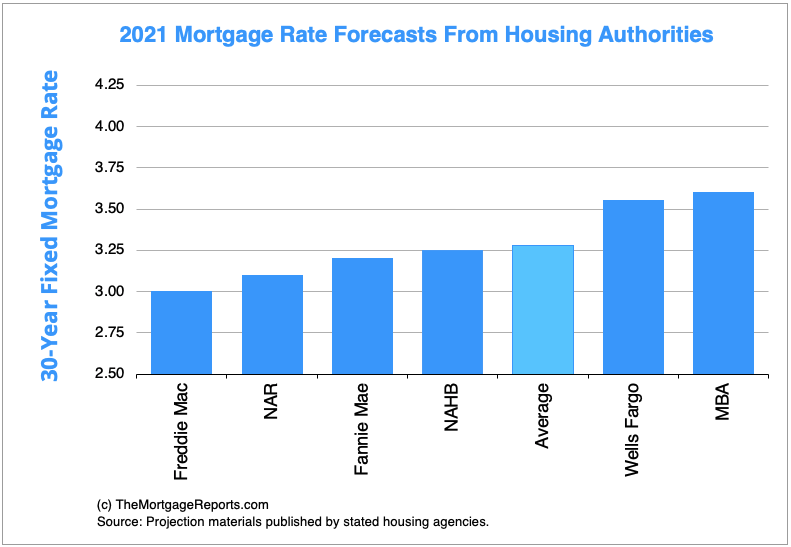

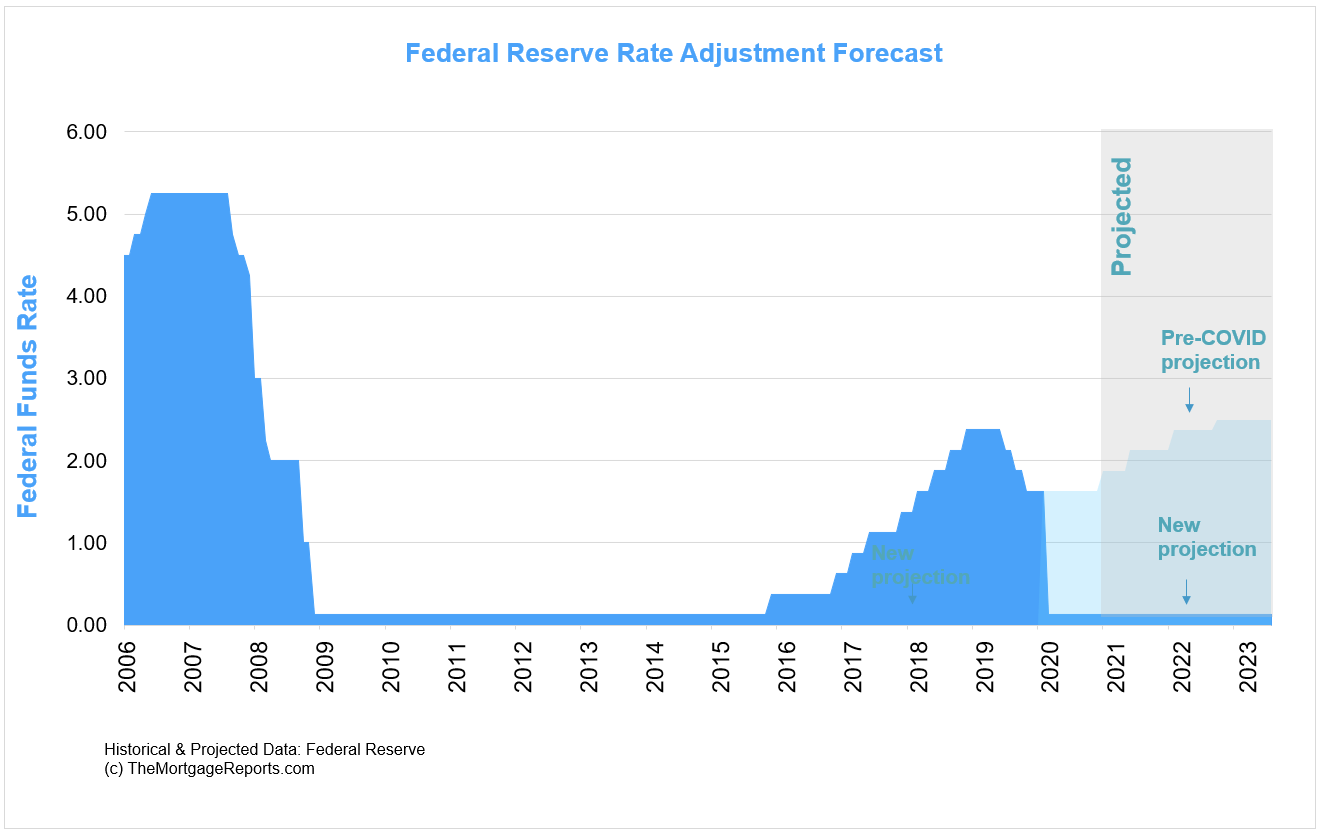

Mortgage Interest Rates Forecast Will Rates Go Down In April

Mortgage Interest Rates Forecast Will Rates Go Down In April

Contributing employers must pay taxes on the first 9500 of each employees wages in the 2021 calendar year.

Unemployment tax rate michigan 2021. 2 days agoPrinted tax forms were distributed and are available in limited quantities at public libraries some northern Michigan post offices Michigan Department of Health and Human Services county offices and Treasury Field Offices. Early each year the UI issues its Tax Rate Determination for Calendar Year 20__ Form UIA 1771. Business owners across Michigan are getting hit with a surprise tax increase in 2021 after a surge in unemployment claims during the COVID-19 pandemic depleted the states unemployment trust fund.

20 rows 2021 STATE WAGE BASES Updated 122320 2020 STATE WAGE BASES 2019 STATE. The changes in EO 2020-10 were extended in subsequent orders including EOs 2020-24 2020-57 and 2020-76. HB 413 freezes the UI tax rate schedule at Schedule A for 2021.

What does this mean for my business. That would translate into incremental state taxes of 841 on 10200 in. How does the taxable wage base affect my organizations unemployment tax liability.

Beginning with the 2021 tax year the top rate will be 59 on taxable income over 210000 for single filers and over 315000 for joint filers. It shows an employers prior Actual Reserve benefits charged and contributions paid basis of the CBC and ABC components since the last annual determination and the employers new Actual Reserve. Michigan SUI taxable wage base expected to increase for 2021 due to COVID-19s depletion of UI trust fund.

But these cities charge an additional income tax ranging from 10 to 24 for Michigan residents. Claim it on your taxes. The new-employer tax rate will remain at 270 for 2021.

Whats Changing With Taxes in 2021. 2 days agoA good problem to fix. The sample shows how each of the three components that determines an employers tax rate is calculated.

Notification of State Unemployment Tax Rate. Here is a list of the non-construction new employer tax. Businesses to pay higher taxes in 2021 By.

Generally in the first two years of a businesss liability the tax rate is set by law at 27 except for employers in the construction industry whose rate in the first two years is that of the average employer in the construction industry which is announced by UIA early each year. In 2020 the Trust Fund balance fell below 25B therefore the 2021 taxable wage base is 9500. A decrease from the originally assigned Schedule E.

Due to this change tax rates will range from 030 to 900. Rates range from 006 to 103 of each employees income up to a wage base of 9500. If your business is new the unemployment tax rate is set at 27.

UIA Compensation Fund drops below 25B. Notification of Unemployment Tax Rate The UIA is required to notify each employer no later than 6 months after the computation date 0630 of their tax rate for the upcoming year. Michigan Payroll Taxes.

Ryan Cummings Posted at 437 PM Jan 05 2021. All individual income tax returns must be received by 1159 pm. Residents with 150000 in taxable income pay a marginal state tax rate of 825 percent.

Posted Apr 01 2021 The IRS will issue refunds to people who paid tax on 2020 unemployment. IRS will start sending refunds in May to many who paid tax on 2020 unemployment Updated Apr 01 2021. Form UIA 1771 Tax Rate Determination for Calendar Year 20__ gives you all the information you will need to calculate your unemployment tax rate.

This allows rates to return to 2020 levels providing relief to all experience-rated employers. 52 rows SUI tax rate by state. That tax break will put a lot of extra cash into peoples bank accounts.

On May 17 2021. Plus you also need to factor in Michigans state unemployment insurance SUI. This nonchargeable rate is capped at 10 for the unemployment insurance tax rate on the first 9000 of an employees wages instead of what could have been as high as 63.

Michigan employers should expect to see an increase in the state unemployment insurance SUI taxable wage base from the 9000 that has been in effect for the past several years to the 9500 currently only required to be used by delinquent employers. The third stimulus package makes up to 10200 of your unemployment benefits tax free. Your Michigan tax liability has the potential to increase.

Michigan has a single income tax rate of 425 for all residents. We have prepared a sample unemployment insurance tax rate calculation.

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Leading Index Spikes Showing 2020 Economic Growth Acceleration Theo Trade Index Economic Indicator Acceleration

Leading Index Spikes Showing 2020 Economic Growth Acceleration Theo Trade Index Economic Indicator Acceleration

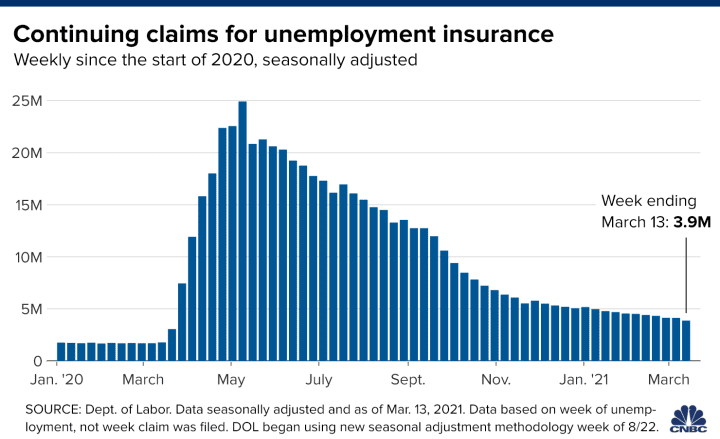

Covid 19 Market Insights 1 5 2021 Black Book

Covid 19 Market Insights 1 5 2021 Black Book

2021 Taxes A Comprehensive Guide To Filing Money

2021 Taxes A Comprehensive Guide To Filing Money

Mortgage Interest Rates Forecast Will Rates Go Down In April

Mortgage Interest Rates Forecast Will Rates Go Down In April

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

What Is The Futa Tax 2021 Tax Rates And Info Onpay

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Scraping By On 500k A Year Why It S So Hard To Escape The Rat Race

Scraping By On 500k A Year Why It S So Hard To Escape The Rat Race

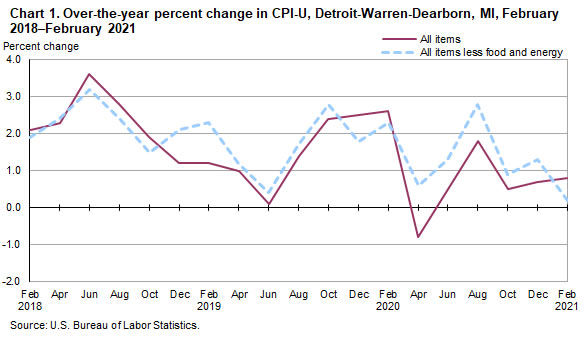

Consumer Price Index Detroit Warren Dearborn February 2021 Midwest Information Office U S Bureau Of Labor Statistics

Consumer Price Index Detroit Warren Dearborn February 2021 Midwest Information Office U S Bureau Of Labor Statistics

Florida Businesses To See 2021 Unemployment Tax Increase Workers Compensation Rate Cut Florida Thecentersquare Com

Florida Businesses To See 2021 Unemployment Tax Increase Workers Compensation Rate Cut Florida Thecentersquare Com

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Mortgage Interest Rates Forecast Will Rates Go Down In April

Mortgage Interest Rates Forecast Will Rates Go Down In April

Consumer Price Index Midwest Region February 2021 Mountain Plains Information Office U S Bureau Of Labor Statistics

Consumer Price Index Midwest Region February 2021 Mountain Plains Information Office U S Bureau Of Labor Statistics

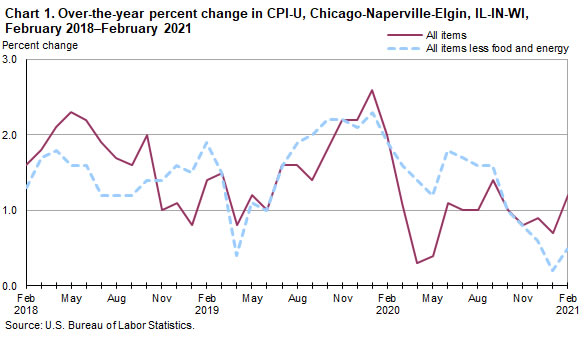

Consumer Price Index Chicago Naperville Elgin February 2021 Midwest Information Office U S Bureau Of Labor Statistics

Consumer Price Index Chicago Naperville Elgin February 2021 Midwest Information Office U S Bureau Of Labor Statistics

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

Medicaid Expansion Boosts Michigan S Economy And Will More Than Pay For Itself State Government Will End Up With More Than It Spen Medicaid Economy The Expanse

Medicaid Expansion Boosts Michigan S Economy And Will More Than Pay For Itself State Government Will End Up With More Than It Spen Medicaid Economy The Expanse

Post a Comment for "Unemployment Tax Rate Michigan 2021"