Unemployment Md Tax Form

31621 - Maryland will be exempting all Unemployment Income issued by MD and reciprocal states using Form 502LU. For questions about the Unemployment Insurance Income Tax Subtraction please contact the Comptrollers Taxpayer Services Division at.

Professional Services Contract Template Awesome 50 Professional Service Agreement Templates C Contract Template Resignation Template Funeral Program Template

Professional Services Contract Template Awesome 50 Professional Service Agreement Templates C Contract Template Resignation Template Funeral Program Template

The state income tax filing deadline has been extended until July 15 2021.

Unemployment md tax form. Maryland usually taxes. The 2020 Publication 17 Your Federal Income Tax For Individuals was impacted by provisions in the American Rescue Plan Act of 2021 that was enacted on March 11 2021. Income Tax 1099G Information - Unemployment Insurance Form 1099-G Statement for Recipients of Certain Government Payments is issued to any individual who received Maryland Unemployment Insurance UI benefits for the prior calendar year.

Ley de Socorro de 2021. HOWEVER the Comptroller of MD tax division must first set up the rules for how the changes to the tax forms will be implemented and then will they tell the tax software companies how to change their software--both the original returns 502 505 as well as. 1099-Gs reflect Maryland UI benefit payment amounts issued within that calendar year.

The publication is not being revised at this time to reflect the new exclusion of up to 10200 of unemployment compensation. Division of Occupational and Professional Licensing. Sign up now -- only you will have access to your form online.

Other forms are offered as online applications that are completed online or e-mailed automatically. Besides the unavailability of Form 502LU the problem is that Federal AGI passes over to the MD 502. The information on the 1099-G tax form is provided as follows.

Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. What if I have more questions. Adjustments - This box includes cash payments and income tax refunds used to pay back overpaid benefits.

You may claim the subtraction on your 2020 and 2021 Maryland State Tax Return. While the total benefits are reported in Box 1 of the Form 1099-G you will only need to report a partial amount on your Schedule 1 of the Form 1040 tax return if you qualify for the new tax. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year.

If a taxpayer has already filed a MD return and it has been accepted they must amend their MD return to get the benefit of the change. Forms - Maryland Department of Labor. Form 1099-G information is used when preparing your federal tax return.

Tax Alert 03-11-2021 Extension of Time to File and Waiver of Interest and Penalty for Certain Filers. Forms will be found throughout the Maryland Department of Labor website under the heading for the DivisionOfficeBoardCommission responsible for the form. MD filing and payment deadlines have been extended to July 15 2021.

For more details please read our tax alert. Two distinct subtractions from income are available under the RELIEF Act for tax years 2020 and 2021. Division of Unemployment Insurance.

The American Rescue Plan a 19 trillion Covid relief bill waived. Sign up now to receive your 1099-G information online from our secure confidential web site. In order to claim these subtractions individuals must complete Maryland Form 502LU and file it along with their return.

MD filers that have already filed their MD will need to amend to subtract applicable Unemployment Income. Per the State of Maryland the tax forms will not be ready until sometime in March. So if there is 15000 in unemployment for example and 10200 is excluded from AGI for federal purposes that MAY have to be added back to Maryland income as an income adjustment - and then the entire 15000 backed out as a subtraction adjustment.

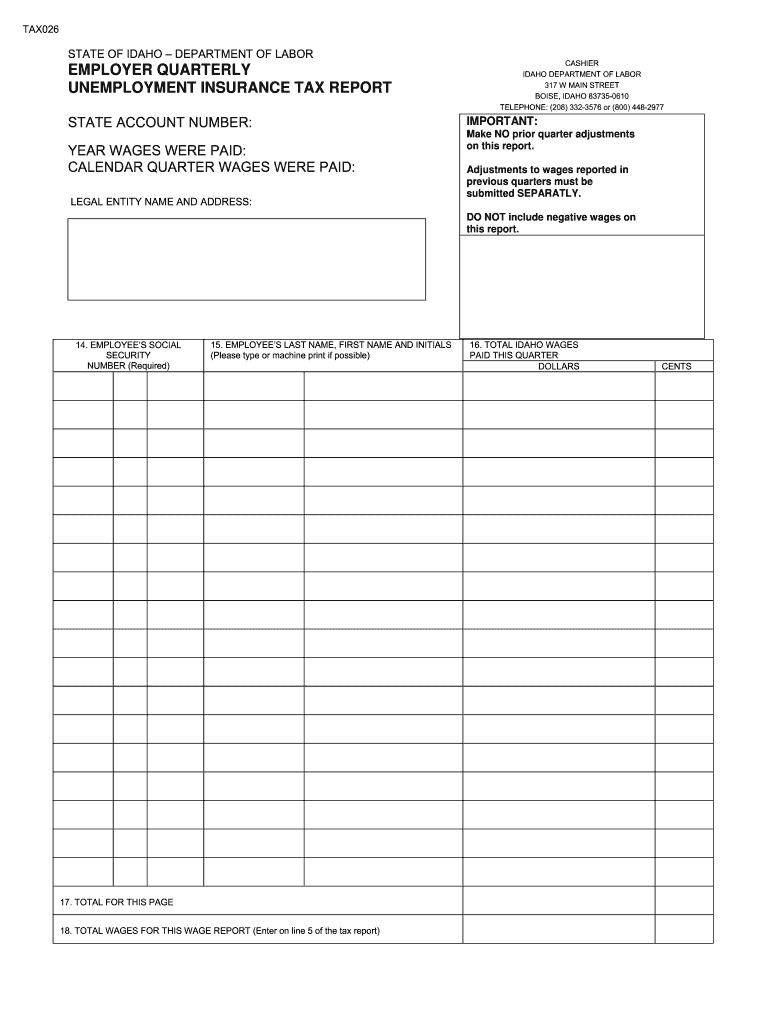

The Relief Act 2021. However any 2020 unemployment benefits excluded for federal tax purposes on Form 1040 Schedule 1 line 8 should be added back to your Idaho income tax return. Unemployment Compensation - This box includes the dollar amount paid in benefits to you during the calendar year.

Contact us if you find yourself in this situation as the corrected Maryland tax return forms were not ready and are still not available. To the extent included in. Income Tax 1099G Information - Unemployment Insurance Form 1099-G Statement for Recipients of Certain Government Payments is issued to any individual who received Maryland Unemployment Insurance UI benefits for the prior calendar year.

If you received unemployment incomebenefits in 2020 and have already filed your taxes you will most likely be due a refund. Schema to accept this form electronically expected by 3312021. Marylands Division of Unemployment Insurance has issued a 1099-G tax form to all claimants that received unemployment insurance benefits during the calendar year 2020 from January 1 2020 through December 31 2020 based on the delivery preference chosen in their BEACON portal.

For questions about the Unemployment Grants please contact the Maryland Department of Labor. RELIEF Act Tax Alert. Once the state updates the tax return TurboTax will be able to update the program and provide clear instructions on subtracting your unemployment compensation from your Maryland taxable income.

Alabama Tax Forms And Instructions For 2020 Form 40

Alabama Tax Forms And Instructions For 2020 Form 40

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg) Form 1040 Sr U S Tax Return For Seniors Definition

Form 1040 Sr U S Tax Return For Seniors Definition

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Rhode Island Tax Forms And Instructions For 2020 Form Ri 1040

Rhode Island Tax Forms And Instructions For 2020 Form Ri 1040

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg) Form 1040 Sr U S Tax Return For Seniors Definition

Form 1040 Sr U S Tax Return For Seniors Definition

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Connecticut Tax Forms And Instructions For 2020 Ct 1040

Connecticut Tax Forms And Instructions For 2020 Ct 1040

Free 7 Sample Tax Forms In Pdf

Free 7 Sample Tax Forms In Pdf

Unemployment Tax Form Fill Online Printable Fillable Blank Pdffiller

Unemployment Tax Form Fill Online Printable Fillable Blank Pdffiller

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Post a Comment for "Unemployment Md Tax Form"